Hey there, fellow crypto enthusiasts, blockchain buffs, and financial whizzes! If you’re wondering whether banks will finally hop on the XRP bandwagon for cross-border transactions, let me break it down for you with a dash of wit and wisdom. As someone who dove headfirst into the world of cryptocurrencies back in 2011 (yes, before it was cool), I’ve seen my fair share of digital asset potential. And let me tell you, XRP is like that quirky friend who always surprises you with their brilliance. With Ripple’s innovative blockchain technology paving the way, it’s not just a question of if, but when banks will realize the game-changing benefits of adopting XRP for their cross-border transactions. So, grab your popcorn (or should I say, your XRP stash?) and let’s explore the wild ride of XRP investment together!

📌 Overview of Will Banks Adopt XRP for Cross-Border Transactions?

They say money makes the world go round, but when it comes to cross-border transactions, it can feel more like the world is spinning out of control. The current banking system is notorious for its inefficiencies and high costs when it comes to moving money internationally. But fear not, fellow crypto enthusiasts, for there is a glimmer of hope on the horizon. The question on everyone’s mind is: Will banks adopt XRP for cross-border transactions?

XRP, the native cryptocurrency of the Ripple network, has been making waves in the financial industry since its inception. With its lightning-fast transaction speeds and low fees, XRP has positioned itself as a potential game-changer for cross-border transactions. But will banks be willing to embrace this digital disruptor? Let’s dive into the details and find out.

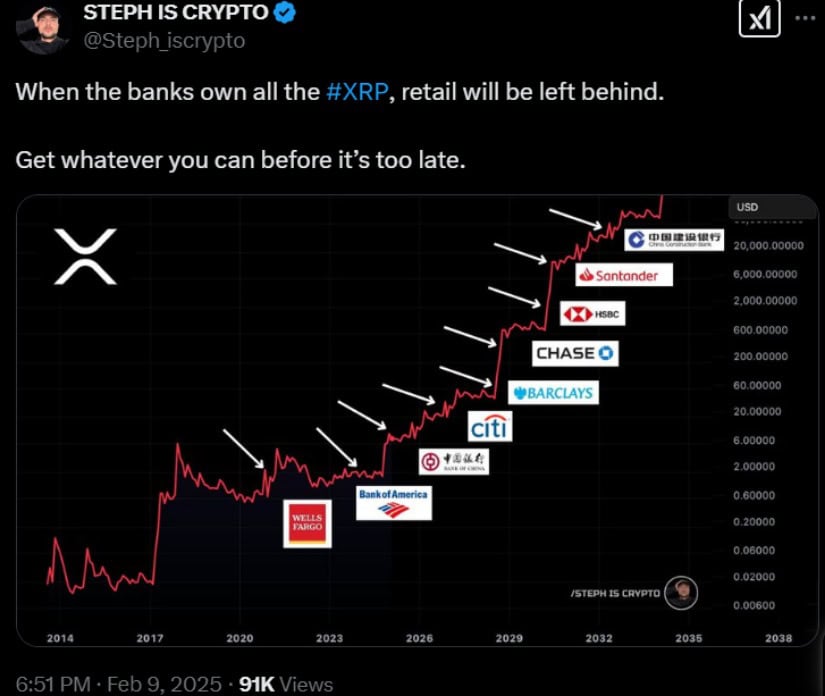

📈 How Will Banks Adopt XRP for Cross-Border Transactions? Impacts XRP’s Market Position and Potential Growth

The adoption of XRP by banks for cross-border transactions would have a profound impact on the market position and potential growth of this cryptocurrency. Here’s how:

1. Increased Liquidity: Banks are like vacuum cleaners when it comes to liquidity. They need a cryptocurrency that can handle large transaction volumes without causing price volatility. XRP’s high liquidity and low transaction costs make it an attractive option for banks looking to streamline their cross-border operations.

2. Market Validation: If banks start adopting XRP, it would be a resounding endorsement of its technology and utility. This validation would not only boost investor confidence but also attract more financial institutions to explore the benefits of XRP for cross-border transactions.

3. Mass Adoption: Banks have a vast network of customers who rely on their services for international money transfers. By incorporating XRP into their systems, banks can introduce this cryptocurrency to a wider audience, potentially leading to mass adoption and increased demand.

4. Price Stability: One of the main concerns with cryptocurrencies is their volatility. However, XRP’s unique design as a bridge currency helps maintain price stability during transactions. This feature makes it an appealing choice for banks as it reduces the risk associated with currency fluctuations.

🔍 Analysis of Current Market Trends Related to Will Banks Adopt XRP for Cross-Border Transactions?

To understand the potential adoption of XRP by banks for cross-border transactions, let’s take a closer look at the current market trends:

1. Regulatory Environment: The regulatory landscape plays a crucial role in the adoption of cryptocurrencies by banks. As governments around the world establish clear guidelines for digital assets, banks are becoming more confident in exploring the potential of cryptocurrencies like XRP.

2. Partnerships: Ripple, the company behind XRP, has been actively forming partnerships with financial institutions globally. These collaborations help build trust and create a strong network of banks that are open to adopting XRP for cross-border transactions.

3. Proof of Concept: Several banks have already conducted successful pilot projects using XRP for cross-border transactions. These proof-of-concept initiatives have shown promising results, further encouraging banks to consider the adoption of XRP on a larger scale.

4. Competitive Advantage: Banks are always on the lookout for ways to stay ahead of the competition. By integrating XRP into their systems, banks can offer faster, cheaper, and more efficient cross-border payment solutions, giving them a competitive edge in the market.

✅ Key Benefits and ⚠️ Risks of Investing in XRP Related to Will Banks Adopt XRP for Cross-Border Transactions?

As an investor, it’s essential to weigh the benefits and risks of investing in XRP, especially in relation to the potential adoption of XRP by banks for cross-border transactions. Let’s take a closer look:

Key Benefits:

– Faster Transactions: XRP’s transaction speeds are lightning-fast, allowing for near-instant cross-border transfers. This speed would greatly benefit banks and their customers, reducing settlement times and improving overall efficiency.

– Lower Costs: Traditional cross-border transactions can be expensive, with fees ranging from a few percentages to exorbitant amounts. XRP’s low transaction fees would significantly reduce costs for banks and their customers, making it an attractive alternative.

– Enhanced Security: XRP’s blockchain technology provides robust security measures, ensuring the integrity and privacy of transactions. This added layer of security would give banks and their customers peace of mind when conducting cross-border transfers.

– Global Accessibility: XRP operates on a decentralized network, making it accessible to anyone with an internet connection. Banks adopting XRP would enable their customers to send and receive funds globally, without the need for intermediaries or cumbersome processes.

⚠️ Risks:

– Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. Changes in regulations could impact the adoption of XRP by banks, potentially affecting its market performance.

– Volatility: Although XRP has demonstrated stability during transactions, it is still subject to market volatility. Investors should be aware of the inherent risks associated with investing in cryptocurrencies and be prepared for price fluctuations.

– Competition: While XRP has made significant strides in the cross-border payments market, it faces competition from other cryptocurrencies and traditional financial institutions. The success of XRP’s adoption by banks will depend on its ability to stay ahead of the competition.

🚀 Ripple’s Strategic Developments or Innovations Relevant to Will Banks Adopt XRP for Cross-Border Transactions?

Ripple, the driving force behind XRP, has been actively working on strategic developments and innovations to encourage the adoption of XRP by banks for cross-border transactions. Here are a few noteworthy initiatives:

1. RippleNet: Ripple’s global payments network, RippleNet, connects banks, payment providers, and digital asset exchanges, facilitating seamless cross-border transactions. This network provides a solid foundation for banks to integrate XRP into their existing infrastructure.

2. On-Demand Liquidity (ODL): Ripple’s On-Demand Liquidity solution enables real-time, low-cost cross-border payments using XRP as a bridge currency. ODL has already gained traction with several financial institutions and holds great potential for widespread adoption.

3. Central Bank Digital Currencies (CBDCs): Ripple has been actively exploring partnerships with central banks to leverage XRP in the issuance of CBDCs. This innovative approach could revolutionize the concept of digital currencies and further accelerate the adoption of XRP by banks.

4. Interoperability: Ripple is focused on creating interoperability between different blockchains, allowing for seamless transfers of value across networks. This cross-chain compatibility would make XRP an even more attractive option for banks looking to streamline their cross-border operations.

💡 Investor Insights: XRPAuthority’s Tips and Tricks for Will Banks Adopt XRP for Cross-Border Transactions?

As a seasoned cryptocurrency investor and dedicated XRP enthusiast, I have a few insights and tips to share regarding the potential adoption of XRP by banks for cross-border transactions:

1. Stay Informed: Keep yourself updated with the latest news and developments in the world of cryptocurrencies, particularly those related to XRP and its adoption by banks. This will help you make informed investment decisions.

2. Diversify Your Portfolio: While XRP shows great potential, it’s crucial to diversify your cryptocurrency portfolio to mitigate risks. Consider investing in other promising cryptocurrencies and traditional assets to balance your investments.

3. Understand the Risks: Investing in cryptocurrencies, including XRP, comes with inherent risks. Familiarize yourself with these risks, such as market volatility and regulatory uncertainties, and only invest what you can afford to lose.

4. Long-Term Perspective: The adoption of XRP by banks for cross-border transactions may not happen overnight. Take a long-term perspective with your investments and be patient. Rome wasn’t built in a day, and neither will the future of XRP.

In conclusion, the potential adoption of XRP by banks for cross-border transactions holds immense significance within the XRP investment landscape. With its numerous benefits, strategic developments by Ripple, and evolving market trends, XRP has the potential to revolutionize the way we move money across borders. So, buckle up and keep an eye on the horizon, because the future of XRP looks bright, and banks may just be ready to hop on the XRP train.