Hey there, crypto cowboys and cowgirls! If you’re looking to lasso some serious gains in the wild world of digital assets, then saddle up and listen close, because XRP is the stallion you want to ride. As the proud owner of xrpauthority.com, I’ve seen it all when it comes to XRP investment, and let me tell you, this digital asset has more potential than a cowboy hat at a rodeo. With Ripple’s groundbreaking blockchain innovation leading the charge, XRP is galloping towards the forefront of institutional finance faster than you can say “yeehaw!” So, partner up with me as we wrangle in the details on why XRP and institutional finance are a match made in cryptocurrency heaven. Let’s ride! 🤠🚀 #XRP #ToTheMoon #CryptoCowboys

📌 Overview of XRP and Institutional Finance: A Growing Trend

In the world of cryptocurrency, there’s one digital asset that has been making waves in the financial industry – XRP. As an avid investor in cryptocurrencies since 2011 and a dedicated XRP enthusiast since 2018, I can confidently say that XRP is more than just another cryptocurrency. It represents a growing trend in institutional finance that has the potential to revolutionize the way we transact and move money.

XRP, created by Ripple Labs, is a digital asset that aims to facilitate fast and low-cost international money transfers. Unlike traditional banking systems that rely on slow and expensive intermediaries, XRP utilizes blockchain technology to enable seamless and efficient cross-border transactions. This has caught the attention of institutional investors who recognize the potential for XRP to disrupt the financial industry.

📈 How XRP and Institutional Finance: A Growing Trend Impacts XRP’s Market Position and Potential Growth

The growing trend of institutional finance embracing XRP has had a significant impact on its market position and potential growth. Here’s how:

1. Increased Adoption: Institutional investors bring credibility and legitimacy to the cryptocurrency market. As more institutions start to invest in XRP, its adoption and acceptance among the general public also increase.

2. Liquidity Boost: Institutional investors often trade large volumes of assets, which leads to increased liquidity in the XRP market. This liquidity provides stability and attracts more investors, further driving up the price of XRP.

3. Market Confidence: The involvement of institutional players in XRP instills confidence in the market. Their deep pockets and extensive research capabilities make them influential market participants, and their support for XRP sends a positive signal to other investors.

4. Regulatory Clarity: Institutional investors have a vested interest in advocating for regulatory clarity in the cryptocurrency industry. Their involvement can help shape regulations that are favorable to XRP and encourage wider adoption.

🔍 Analysis of Current Market Trends Related to XRP and Institutional Finance: A Growing Trend

To understand the significance of XRP and institutional finance, let’s take a closer look at the current market trends:

1. Institutional Investment: The entry of institutional investors into the cryptocurrency market has been on the rise. Major financial institutions and hedge funds are allocating a portion of their portfolios to cryptocurrencies, including XRP, as they recognize the potential for high returns.

2. Partnerships and Collaborations: Ripple, the company behind XRP, has been actively forming partnerships with banks and financial institutions around the world. These collaborations aim to leverage XRP’s technology to streamline cross-border payments and improve the efficiency of international transactions.

3. Regulatory Developments: Regulatory bodies are increasingly acknowledging the importance of cryptocurrencies in the financial landscape. They are working towards creating frameworks that allow institutional investors to participate in the cryptocurrency market while ensuring consumer protection and market stability.

4. Market Volatility: Like any other cryptocurrency, XRP is subject to market volatility. However, the involvement of institutional investors can help mitigate some of the price fluctuations by adding stability to the market.

✅ Key Benefits and ⚠️ Risks of Investing in XRP Related to XRP and Institutional Finance: A Growing Trend

Investing in XRP comes with its own set of benefits and risks, especially in relation to XRP and institutional finance. Let’s explore them:

Key Benefits:

– Fast and Low-Cost Transactions: XRP’s technology allows for near-instantaneous and cost-effective cross-border transactions, making it an attractive choice for institutional investors looking to streamline their payment processes.

– Liquidity and Market Depth: The involvement of institutional investors ensures a liquid market for XRP, allowing for easy buying and selling of the digital asset.

– Potential for High Returns: As institutional investors continue to allocate funds to XRP, the demand and price of the digital asset have the potential to increase significantly, leading to high returns for early investors.

Key Risks:

– Regulatory Uncertainty: The cryptocurrency market is still evolving, and regulations surrounding XRP and other digital assets are not fully established. Regulatory changes can impact the market and the value of XRP.

– Market Volatility: Cryptocurrencies are known for their price volatility, and XRP is no exception. Investors should be prepared for price fluctuations and potential losses.

– Competition: While XRP has carved out a niche in the cross-border payments market, it faces competition from other digital assets and traditional banking systems. The success of XRP depends on its ability to stay ahead of the competition.

🚀 Ripple’s Strategic Developments or Innovations Relevant to XRP and Institutional Finance: A Growing Trend

Ripple, the company behind XRP, has been at the forefront of strategic developments and innovations that are highly relevant to XRP and institutional finance. Some notable ones include:

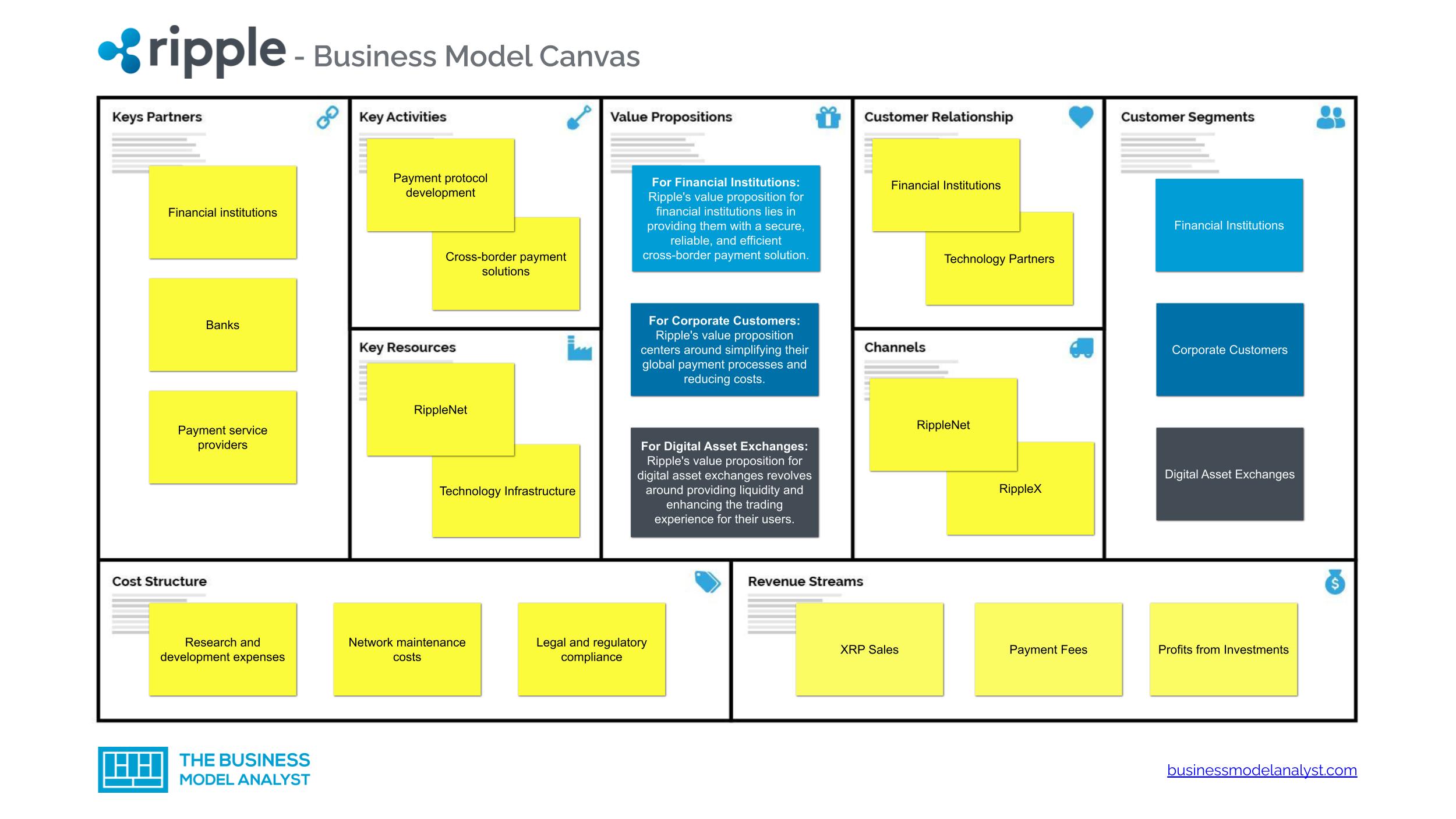

1. RippleNet: Ripple has developed RippleNet, a global payments network that connects banks and financial institutions. This network allows for fast and secure cross-border transactions using XRP as a bridge currency, eliminating the need for multiple intermediaries.

2. On-Demand Liquidity (ODL): Ripple’s ODL solution enables financial institutions to use XRP as a real-time bridge currency for cross-border transfers. This innovation reduces liquidity costs and settlement times, making it an attractive option for institutional investors.

3. Central Bank Digital Currencies (CBDCs): Ripple has been actively exploring partnerships with central banks to pilot and develop CBDCs. These digital currencies, backed by national governments, have the potential to further integrate XRP into the global financial system.

4. Interoperability: Ripple is working on interoperability solutions that allow different blockchain networks to communicate and transact with each other. This development is crucial for the widespread adoption of XRP and institutional finance.

💡 Investor Insights: XRPAuthority’s Tips and Tricks for XRP and Institutional Finance: A Growing Trend

As an experienced cryptocurrency investor and dedicated XRP enthusiast, here are some tips and tricks for navigating the XRP and institutional finance landscape:

1. Research, Research, Research: Stay informed about the latest developments in both XRP and institutional finance. Read news articles, follow industry experts, and join online communities to gather insights and make informed investment decisions.

2. Diversify Your Portfolio: While XRP shows great potential, it’s always wise to diversify your cryptocurrency portfolio. Allocate funds to other digital assets, such as Bitcoin and Ethereum, to spread out your risk.

3. Understand Regulatory Environment: Keep a close eye on regulatory developments and how they may impact XRP. Stay compliant with regulations in your jurisdiction to avoid any legal issues.

4. Long-Term Perspective: Investing in XRP, or any cryptocurrency for that matter, requires a long-term perspective. Don’t get swayed by short-term price fluctuations and focus on the potential growth of XRP and institutional finance over time.

In conclusion, XRP and institutional finance represent a growing trend that has the potential to reshape the financial industry. With increased adoption, market trends favoring institutional investment, and Ripple’s strategic developments, XRP is poised for significant growth. However, it’s important to consider the benefits and risks of investing in XRP, stay informed about market developments, and approach investments with a long-term perspective. Happy investing!