Welcome to the electrifying world of XRP, where the digital currency landscape is as thrilling as a roller-coaster ride on the blockchain highway. As the proud owner of XRPAuthority.com and a seasoned XRP investor since 2018, I can assure you that the current price outlook for XRP is nothing short of exhilarating. So, buckle up as we dive into why whales, ETFs, and rate cuts could catapult XRP to new heights.

Is it just me, or does it feel like every time I turn around, another “whale” is making waves in the XRP ocean? Recently, these crypto behemoths have gobbled up an astounding .5 billion in XRP, signaling an institutional appetite that rivals even my own at an all-you-can-eat crypto buffet. But why are these whales so hungry? Could it be the anticipation of upcoming XRP ETFs, or perhaps a strategic play in light of potential rate cuts? Let’s dig deeper.

The scent of opportunity is in the air, folks, and it’s as tantalizing as grandma’s homemade blockchain pie. Starting October 18, the SEC will begin ruling on seven XRP ETFs. Yes, you heard that right—seven! This could be the golden ticket that XRP needs to ascend the ranks of mainstream financial products. With approval hopes soaring higher than a bull on caffeine, the prospect of these ETFs is sparking interest from both seasoned investors and those new to the crypto game.

Now, let’s address the elephant—or should I say, the “whale”—in the room: the support level. XRP has not only held this crucial threshold but has broken above it with the grace of a digital ballerina. In a world where rate cuts and treasuries are fueling a bullish market sentiment, XRP stands poised to capitalize on these macroeconomic shifts. The mark isn’t just a number; it’s a fortress, a sign of resilience, and a beacon for what’s to come.

As we sail through October, XRP is entering this month with renewed vigor, much like a phoenix rising from the ashes, or more aptly, like a coin rising from the blockchain. This momentum has caught the attention of investors and traders alike, igniting discussions and debates that are as spirited as a blockchain conference after-party.

But what makes XRP so special in the vast universe of cryptocurrencies? Is it the technology, the community, or perhaps the potential for revolutionary financial applications? The answer is, of course, all of the above. XRP’s relevance in blockchain, finance, and trading is undeniable, offering fast transaction speeds, scalability, and a robust network that continues to evolve.

So, my fellow crypto enthusiasts, if you’re searching for insights that are as sharp as a blockchain ledger and as witty as a meme coin, look no further. XRP Authority isn’t just a name; it’s a promise—a promise to deliver the most insightful, engaging, and downright hilarious analyses in the crypto world. Whether you’re a savvy investor, a curious trader, or a fintech professional navigating the digital seas, XRP Authority is your lighthouse of knowledge.

In conclusion, as we navigate the thrilling waters of the XRP market, remember that XRP Authority is here to guide you with expertise, humor, and a dash of blockchain magic. Stay tuned for more insights, because when it comes to XRP, the only way is up—and we’re all aboard for the ride!

📌 Understanding XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring and Its Impact on XRP

Whale activity signals growing confidence

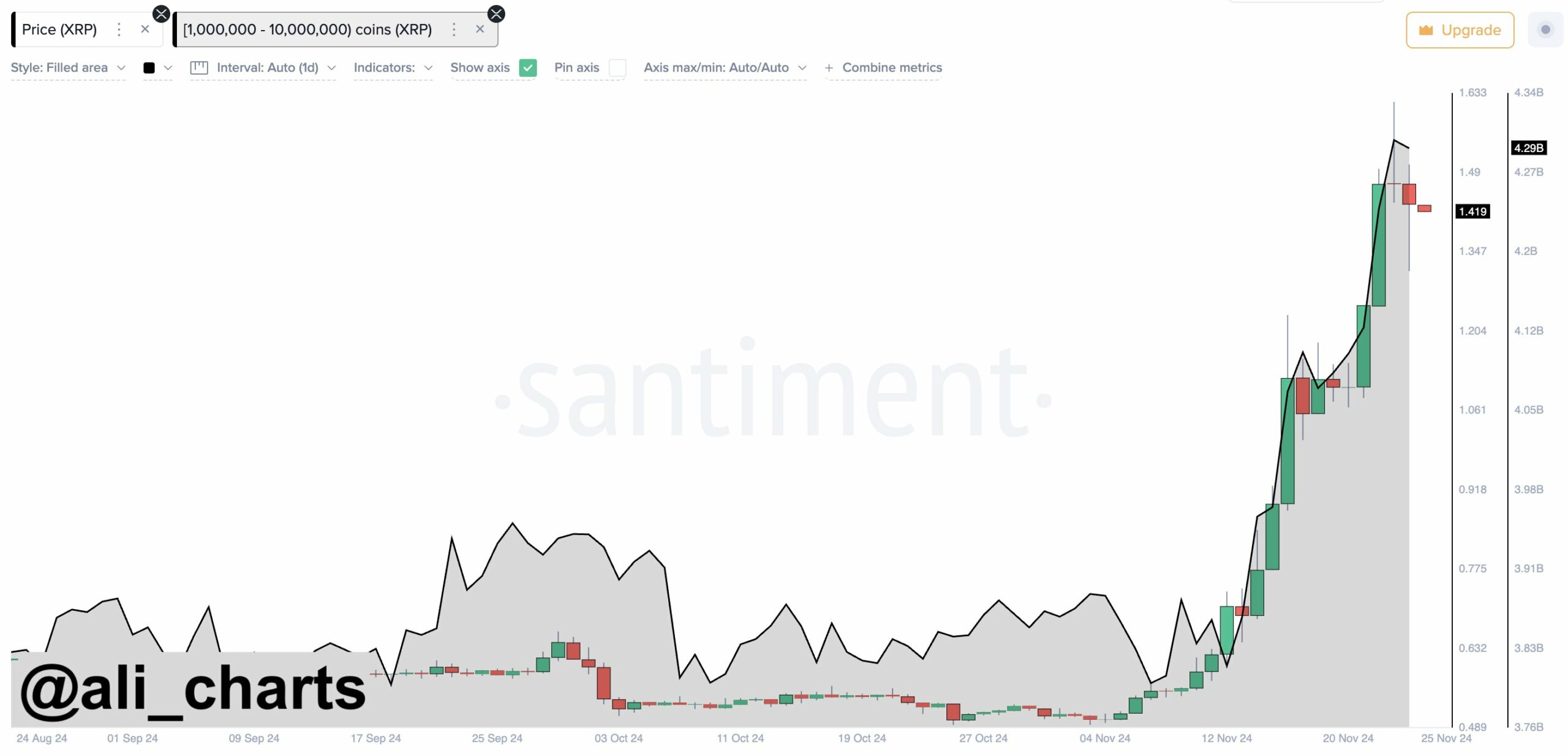

Whales—the deep-pocketed investors who can move markets with a single trade—are making waves in the XRP ecosystem. Over the past few weeks, on-chain data has revealed a significant uptick in large-scale XRP transactions, with whales collectively adding over .5 billion worth of XRP to their holdings. This surge in accumulation is more than just a bullish signal—it’s a vote of confidence in XRP’s long-term value proposition and its potential breakout trajectory.

Let’s break this down. Whale transactions often precede major price moves, as these investors typically operate with insider-level insights or long-term conviction. When you see this kind of capital flowing into a digital asset like XRP, it’s not just noise—it’s a strategic play. Analysts monitoring whale wallets have noted that these entities are not only buying but also transferring XRP off exchanges, a classic indicator of a “hodl” mindset. This behavior reduces immediate sell pressure and tightens supply, which can amplify price momentum during bullish cycles.

- Whales have added .5B in XRP, signalling strong institutional demand.

- Large addresses are moving XRP off exchanges, suggesting long-term holding strategies.

- This activity historically correlates with upcoming price surges and reduced volatility.

The timing of this whale activity is also telling. XRP has recently shown resilience in the face of broader market uncertainty, holding key support levels and even challenging new resistance zones. As we head into Q4 2024, this accumulation phase may serve as the foundation for a major breakout, especially if macroeconomic tailwinds (like rate cuts or ETF approvals) align favorably.

Moreover, there’s growing chatter in institutional circles about XRP’s unique position in the payments and liquidity space. Unlike many other altcoins, XRP has a defined use case—cross-border settlements—and is partnered with major financial institutions through RippleNet. Whales aren’t just betting on speculation; they’re banking on utility, scalability, and regulatory clarity.

Adding fuel to the fire, XRP has entered October with renewed momentum, breaking above the mark and capturing the attention of both retail traders and institutional investors. This psychological milestone could mark the start of a new price discovery phase, especially as whale wallets continue to grow in size and influence.

In the crypto world, following the smart money isn’t just a cliché—it’s a strategy. And right now, the smart money seems to be swimming in XRP.

The post XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring appeared first on CoinJournal.

ETF prospects and institutional interest

XRP is inching closer to a potentially game-changing moment: the launch of a U.S.-approved exchange-traded fund (ETF). While Bitcoin and Ethereum have dominated ETF headlines, XRP is quietly positioning itself as the next major crypto asset to enter the institutional spotlight. Currently, seven XRP ETF applications are pending with the U.S. Securities and Exchange Commission (SEC), with initial rulings expected to begin on October 18. The anticipation alone has already created ripples in the market, and approval could send a tidal wave of institutional capital flowing into XRP.

Why does an ETF matter so much? For starters, ETFs make it significantly easier for traditional investors—think hedge funds, pension managers, and family offices—to gain exposure to XRP without directly handling crypto wallets or navigating crypto exchanges. This could unlock billions in sidelined capital that has been waiting for regulatory greenlights before jumping into the XRP ecosystem.

- Seven XRP ETFs await SEC decisions, with decisions starting in mid-October.

- ETFs provide a compliant, liquid, and familiar vehicle for traditional investors to access XRP.

- Approval could lead to a surge in demand, much like the Bitcoin ETF effect seen in early 2024.

Institutional interest in XRP is not just theoretical—it’s already happening under the radar. Asset managers are increasingly looking at XRP as a viable hedge in diversified crypto portfolios, especially given its unique role in real-world use cases like remittance and liquidity provisioning. Ripple’s partnerships with banks and payment providers mean XRP isn’t just a speculative asset—it’s a functional one. That’s a key differentiator that institutional players value in a maturing market.

Moreover, the ETF buzz is aligning with broader macro trends. As traditional finance continues its slow but steady march into the crypto sphere, regulatory clarity becomes the bridge that connects Wall Street to Web3. XRP, having already weathered much of the regulatory storm thanks to Ripple’s ongoing legal battles with the SEC, is now seen as a compliance-forward crypto asset. That perception could give it an edge over competitors when the ETF floodgates open.

Let’s not forget the psychological impact of ETF approval. If the SEC gives the green light, the news alone could trigger a media frenzy and FOMO-driven rally, pulling in both institutional and retail investors. We saw this happen with Bitcoin and Ethereum—there’s no reason XRP won’t follow a similar trajectory, especially with whales already laying the groundwork by loading up their bags.

In essence, the ETF narrative is more than just hype—it’s a structural shift in how XRP could be accessed, traded, and valued. With the clock ticking towards October 18, savvy investors are watching closely. If even one XRP ETF gets approved, it could catalyze a new era of legitimacy and liquidity for the asset, turning XRP into a core holding for both crypto-native and traditional portfolios alike.

As XRP continues to ride this wave of institutional curiosity and ETF anticipation, its price outlook becomes increasingly bullish. Momentum is building, and the stage is set for a potentially explosive move—especially if regulatory dominoes begin to fall in XRP’s favor.

The post XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring appeared first on CoinJournal.

Impact of potential interest rate cuts

Macroeconomic tailwinds are starting to blow in XRP’s favor, and one of the most powerful among them is the growing expectation of interest rate cuts by the Federal Reserve. After a prolonged period of tightening monetary policy to combat inflation, central banks are now signaling a shift toward easing. And for risk-on assets like cryptocurrencies—especially XRP—this could be a game changer.

So, why do rate cuts matter so much for XRP? Put simply, when interest rates go down, the opportunity cost of holding non-yielding assets like crypto decreases. Investors begin to move capital from low-yielding treasuries and savings accounts into higher-risk, higher-reward assets. Crypto, with its explosive upside potential, becomes a prime beneficiary of this capital rotation. XRP, in particular, stands to gain due to its established use case and renewed investor optimism.

- Rate cuts reduce yield on traditional assets, making crypto more attractive to investors seeking returns.

- Liquidity injection from central banks typically boosts risk assets, including digital currencies like XRP.

- XRP’s utility in cross-border payments positions it as more than just a speculative play in a low-rate environment.

Historically, lower interest rates have catalyzed bull runs in both traditional equities and digital assets. During the 2020-2021 cycle, the Fed’s ultra-loose monetary policy helped fuel a massive surge across the crypto market. While this time may not be a carbon copy, the parallels are hard to ignore. With inflation cooling and recession risks looming, the Fed is increasingly under pressure to pivot. If they do, XRP could be among the first to benefit.

Moreover, XRP has already shown signs of strength heading into this macroeconomic pivot. The asset has held the support level, even as other altcoins faltered under market pressure. This resilience suggests that investors view XRP as a fundamentally solid asset—one that can weather volatility and thrive in favorable conditions. Combine that with a dovish Fed, and you’ve got a recipe for a breakout.

Another factor to consider is the potential reallocation of institutional portfolios. With bond yields expected to drop, fund managers may look to diversify into alternative assets. Crypto-native and hybrid funds are already eyeing XRP as a candidate for portfolio expansion, particularly given its regulatory clarity post-Ripple’s partial legal victory and its real-world utility in cross-border finance.

Additionally, stable monetary policy and lower borrowing costs can stimulate startup and fintech growth, which indirectly benefits XRP. As more payment providers and financial institutions integrate RippleNet for cross-border settlements, the demand for XRP as a bridge currency grows. Rate cuts could act as an accelerant for these developments, unlocking new corridors and expanding XRP’s global footprint.

Let’s not underestimate the psychological aspect either. A dovish Fed typically signals “risk-on” to the market. That sentiment alone can ignite a wave of speculative interest, pushing traders and investors toward assets with high upside potential. XRP, with its combination of whale backing, ETF buzz, and real-world adoption, fits that mold perfectly.

As we look ahead to upcoming FOMC meetings and inflation data releases, crypto investors will be watching for any hint of monetary easing. Should the Fed pivot as expected, XRP is uniquely positioned to capitalize—not just because of macro trends, but because it’s already laying the groundwork for a breakout. The convergence of whale accumulation, ETF anticipation, and macroeconomic shifts paints a compelling picture for the months ahead.

The post XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring appeared first on CoinJournal.

Technical analysis and future price targets

XRP’s technical setup is flashing bullish signals, and investors are paying close attention. After months of consolidation and sideways movement, XRP has decisively broken above the critical psychological resistance at — a level not seen since its all-time highs in early 2018. This breakout is more than symbolic; it marks a potential shift in market structure that could pave the way for a sustained rally if key levels continue to hold.

Let’s dive into the charts. On the weekly timeframe, XRP has formed a classic cup-and-handle pattern, a bullish continuation structure that often precedes major upward price moves. The handle portion, which represented a period of consolidation between .50 and .00, has now resolved to the upside. Volume has also surged during the breakout, confirming the move with strong market participation — a key ingredient for trend continuation.

- Breakout above confirms bullish reversal pattern on higher timeframes.

- RSI remains in bullish territory, with room to run before overbought conditions set in.

- Next resistance zones: .50 (minor resistance), .10 (previous all-time high), and .00 (psychological milestone).

Momentum indicators also support the bullish thesis. The Relative Strength Index (RSI) on the daily and weekly charts remains in healthy territory, currently hovering around the 65–70 range. While this suggests strong bullish momentum, it hasn’t yet crossed into overbought territory, leaving room for further upside. Meanwhile, the MACD (Moving Average Convergence Divergence) has flipped positive, with the MACD line crossing above the signal line — another classic sign of bullish trend continuation.

From a Fibonacci retracement perspective, measuring the move from XRP’s 2021 high to its 2022 low, the asset has already cleared the 0.618 level, often considered the “golden ratio” and a key point of resistance. This unlocks the next Fibonacci extension targets, with .10 and .00 looking increasingly attainable if momentum continues. A break and close above .10 — the previous all-time high — would confirm a full recovery and likely attract additional retail and institutional interest.

On-chain metrics are also aligning with the bullish technical outlook. Exchange balances of XRP continue to decline as coins are moved into cold storage — a signal that long-term holders are not looking to sell anytime soon. Network activity is rising, with transaction volumes growing steadily, especially in corridors tied to RippleNet partners. This increase in utility-driven demand could act as a tailwind, reinforcing price stability even during pullbacks.

Short-term traders may want to watch the .25–.30 zone for potential retracements or consolidation. This area could act as new support if XRP retests its breakout level. A successful retest would offer a high-reward low-risk entry point for swing traders eyeing the next leg up. Conversely, failure to hold above could lead to a drop toward the .75 support zone, though current sentiment and volume suggest this is unlikely unless broader market conditions deteriorate.

Looking ahead, price targets for XRP vary depending on the methodology used, but several converging models point toward a bullish roadmap:

- Conservative target: .10 (retest of 2018 high)

- Moderate target: .00 (psychological round number and Fibonacci extension)

- Aggressive target: .50–.00 (projected based on breakout from macro consolidation pattern)

Of course, no technical outlook is complete without acknowledging the role of market sentiment and macroeconomic catalysts. The combination of whale accumulation, ETF anticipation, and potential rate cuts provides the perfect storm for a breakout rally, and the technicals are now echoing that narrative. Traders and investors alike should keep an eye on volume trends, breakout confirmations, and broader crypto market health as XRP navigates this new bullish territory.

In summary, XRP’s charts are painting a compelling picture of strength and breakout potential. As long as the asset maintains momentum above the level and avoids major macroeconomic shocks, the path of least resistance appears to be upward. With technicals, fundamentals, and sentiment aligning, XRP may be on the cusp of its most significant rally in years.

The post XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring appeared first on CoinJournal.

💡 Frequently Asked Questions (FAQs) About XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring

Frequently Asked Questions About XRP Price Outlook

XRP has shown significant potential in the crypto market, especially with recent developments involving whales, ETFs, and economic factors. Here are some key questions and answers to help you understand the current XRP price outlook.

-

Why is the addition of .5 billion in XRP by whales significant?

The accumulation of .5 billion in XRP by whales indicates strong institutional demand. Whales, or large investors, typically have access to comprehensive market analysis and insights, and their investment is often seen as a vote of confidence in the asset’s future prospects. This influx of capital suggests that significant players expect XRP’s value to rise, potentially driving price appreciation.

-

How could the approval of XRP ETFs impact its price?

The approval of XRP exchange-traded funds (ETFs) could significantly boost its price by increasing accessibility for traditional investors. ETFs make it easier for institutional and retail investors to gain exposure to XRP without directly purchasing the cryptocurrency. This increase in demand could lead to higher liquidity and potentially drive up the price as new capital flows into the market.

-

What role do rate cuts and treasuries play in XRP’s bullish outlook?

Rate cuts and favorable treasury conditions can create a conducive environment for riskier assets like cryptocurrencies to flourish. Lower interest rates reduce the appeal of traditional savings and bonds, potentially redirecting investment towards higher-yielding assets such as XRP. This macroeconomic backdrop may encourage more investors to consider cryptocurrencies as part of their portfolio, contributing to XRP’s bullish outlook.

-

Why is maintaining the support level crucial for XRP?

Maintaining the support level is crucial as it demonstrates XRP’s resilience and investor confidence. A strong support level suggests that buyers are willing to step in and purchase the asset whenever its price dips to this point. This psychological price barrier can act as a foundation for future growth, making it a key parameter for traders and investors assessing XRP’s price potential.

-

What are some potential use cases for XRP that could drive its long-term value?

XRP is primarily used for cross-border payments and remittances, offering fast and cost-effective transactions. Its utility in the financial sector could expand as more institutions adopt Ripple’s technology for international settlements. Additionally, XRP’s low transaction fees and quick processing times make it an attractive option for micropayments and e-commerce, which could further enhance its adoption and long-term value.