Alright, buckle up, crypto enthusiasts! If you’re ready to dive into the wild world of XRP investment and unlock the digital asset potential of Ripple’s blockchain innovation, then you’ve come to the right place. As the brains behind xrpauthority.com and a self-proclaimed XRP aficionado since 2018, I’m here to shed some light on how to read XRP charts like a pro. Whether you’re a seasoned investor looking to fine-tune your technical analysis skills or a newbie just dipping your toes into the blockchain waters, this guide is your ticket to decoding the mysteries of XRP charts with a dash of humor and a sprinkle of wit. So grab your favorite beverage, cozy up to your screen, and let’s unravel the secrets of XRP together!

📌 Overview of How to Read XRP Charts: Technical Analysis for Beginners

The Importance of XRP Charts

Hey there, fellow XRP enthusiasts! If you’re new to the world of cryptocurrency investing or just getting started with XRP, understanding how to read XRP charts is crucial. XRP charts provide valuable insights into the market trends, patterns, and potential future movements of XRP’s price. In this comprehensive guide, we will delve into the exciting world of technical analysis and help you navigate those colorful charts like a pro!

Technical Analysis for Beginners

Now, before we dive into the details of how to read XRP charts, let’s quickly cover the basics of technical analysis. Technical analysis is the art of predicting future price movements based on historical data and patterns. It involves studying charts, indicators, and other tools to identify trends and make informed investment decisions.

The Tools of the Trade

When it comes to analyzing XRP charts, there are several key tools and indicators you need to familiarize yourself with. These include:

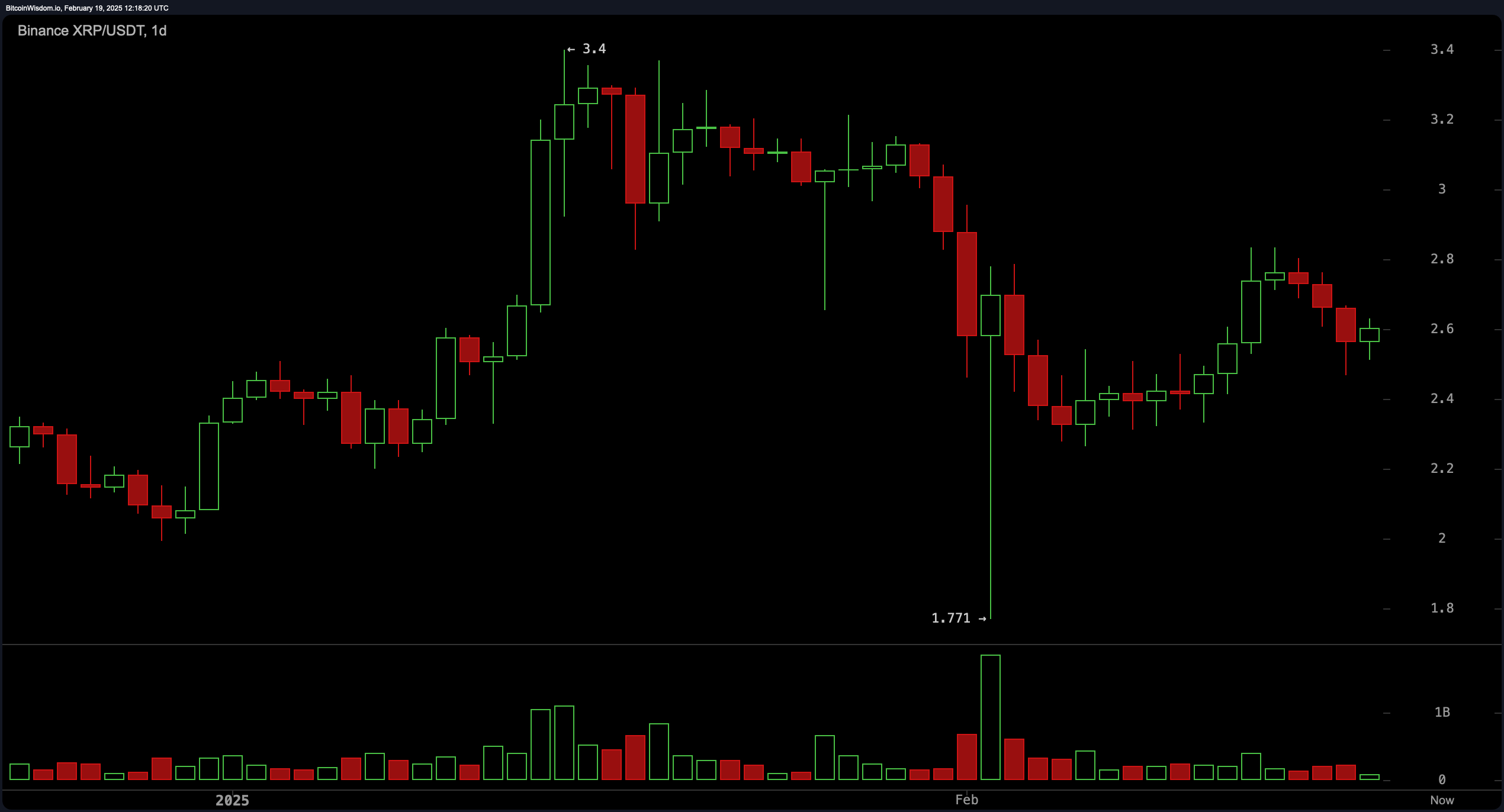

- Candlestick charts: Candlestick charts are the bread and butter of technical analysis. They provide a visual representation of price movements over a given period, using candle-shaped bars.

- Trend lines: Trend lines help identify the overall direction of the market. They connect the highs or lows of price movements, forming support and resistance levels.

- Indicators: Indicators are mathematical calculations applied to XRP charts to provide additional insights. Popular indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

📈 How How to Read XRP Charts: Technical Analysis for Beginners Impacts XRP’s Market Position and Potential Growth

The Power of Technical Analysis

Technical analysis plays a significant role in shaping XRP’s market position and potential growth. By understanding how to read XRP charts, investors can identify trends, patterns, and key levels of support and resistance. This knowledge empowers them to make informed trading decisions, whether it’s buying, selling, or holding their XRP assets.

Timing is Everything

One of the greatest benefits of technical analysis is its ability to help investors time their entries and exits. By analyzing XRP charts, you can identify potential entry points during price dips and exit points when the price reaches resistance levels. This strategic approach can maximize your profits and minimize your losses.

Market Sentiment and Psychology

Technical analysis also takes into account market sentiment and psychology. Patterns and trends on XRP charts reflect the collective behavior and emotions of market participants. By understanding these patterns, you can gauge market sentiment and make decisions based on the prevailing mood.

🔍 Analysis of Current Market Trends Related to How to Read XRP Charts: Technical Analysis for Beginners

The Bullish Trend

If you’ve been following the XRP market lately, you might have noticed the recent bullish trend. XRP charts have been displaying higher highs and higher lows, indicating a potential upward movement. Technical analysis can help confirm this trend and provide insights into potential price targets.

The Importance of Volume

Volume is an essential factor in technical analysis. It measures the number of shares or contracts traded within a specified period. When analyzing XRP charts, pay close attention to the volume accompanying price movements. High trading volume can validate the strength of a trend, while low volume may indicate a lack of conviction.

The Role of Support and Resistance

Support and resistance levels are key concepts in technical analysis. Support represents a price level where buying pressure is expected to outweigh selling pressure, preventing the price from falling further. Resistance, on the other hand, is a price level where selling pressure is expected to outweigh buying pressure, preventing the price from rising further. Identifying these levels on XRP charts can help you make important trading decisions.

✅ Key Benefits and ⚠️ Risks of Investing in XRP Related to How to Read XRP Charts: Technical Analysis for Beginners

The Benefits of XRP Investment

- High potential for growth and adoption in the financial industry.

- Backed by Ripple, a reputable company with numerous partnerships.

- Fast transaction speeds and low fees compared to traditional payment systems.

- Increasing institutional interest and adoption.

The Risks of XRP Investment

- Regulatory uncertainty surrounding cryptocurrencies.

- Market volatility and price fluctuations.

- Competition from other cryptocurrencies and digital payment solutions.

- Dependency on Ripple’s success and regulatory outcomes.

🚀 Ripple’s Strategic Developments or Innovations Relevant to How to Read XRP Charts: Technical Analysis for Beginners

Ripple’s Advancements

Ripple, the company behind XRP, has been making significant strides in the cryptocurrency and blockchain space. Their innovative solutions aim to revolutionize cross-border payments and improve financial inclusion. Ripple’s developments, including their partnerships with major financial institutions, can have a direct impact on XRP’s price and market dynamics. Keeping a close eye on Ripple’s strategic moves is crucial for XRP investors.

💡 Investor Insights: XRPAuthority’s Tips and Tricks for How to Read XRP Charts: Technical Analysis for Beginners

![]()

1. Start with the Basics

Don’t get overwhelmed by the complexity of XRP charts. Begin by understanding the basics of candlestick charts, trend lines, and support/resistance levels. Gradually, you’ll gain confidence and be ready to explore more advanced indicators and tools.

2. Practice Makes Perfect

Reading XRP charts is a skill that improves with practice. Take the time to analyze historical data, identify patterns, and make predictions. Over time, you’ll develop a better understanding of XRP’s market dynamics and improve your decision-making abilities.

3. Combine Technical and Fundamental Analysis

While technical analysis is essential, don’t forget to consider fundamental factors as well. Stay updated on XRP news, Ripple’s developments, and regulatory updates. Combining technical and fundamental analysis can provide a more comprehensive view of XRP’s potential.

4. Don’t Forget Risk Management

Investing in XRP or any cryptocurrency comes with risks. Set clear investment goals, diversify your portfolio, and establish stop-loss orders to limit potential losses. Risk management should be an integral part of your investment strategy.

5. Stay Humble and Open-Minded

Lastly, remember that even the most experienced investors can’t predict the future with certainty. Keep an open mind, be willing to adapt your strategies, and learn from both successes and failures. The cryptocurrency market is ever-evolving, so staying humble and flexible is key.

So there you have it, folks! A comprehensive guide to reading XRP charts for beginners. Armed with this knowledge, you’re now ready to navigate the exciting world of XRP investment. Happy charting and may your investments be as bullish as those XRP charts!