Ah, inflation – the silent killer of fiat currencies, making your hard-earned cash worth less faster than a slice of pizza at a kids’ birthday party. But fear not, my fellow crypto enthusiasts, for XRP is here to save the day! As a seasoned veteran in the cryptocurrency world, I’ve seen it all – from Bitcoin’s meteoric rise to XRP’s game-changing potential. Let’s talk about how this digital asset powerhouse can not only hedge against the dreaded fiat devaluation but also make your investment portfolio look sexier than a slick Ripple transaction on the blockchain. So strap in, hold onto your hats (and your wallets), and let’s dive into how XRP and Ripple’s blockchain innovation are shaking up the financial world faster than you can say “moon lambo”.

📌 Overview of XRP and Inflation: How Crypto Can Hedge Against Fiat Devaluation

Hey there, crypto enthusiasts! Today, we’re diving into the world of XRP and inflation. If you’ve been wondering how this cryptocurrency can protect your hard-earned money from the sneaky claws of fiat devaluation, you’re in for a treat. Strap in and get ready for a wild ride through the exciting landscape of XRP!

Now, before we jump into the nitty-gritty details, let’s quickly cover the basics. XRP is a digital asset that was created by Ripple Labs in 2012. It’s an open-source platform that aims to enable fast and low-cost international money transfers. But what does XRP have to do with inflation and hedging against fiat devaluation? Well, my friend, that’s what we’re here to find out!

Understanding Inflation and Fiat Devaluation

To grasp the significance of XRP in hedging against fiat devaluation, we need to understand inflation and how it affects traditional currencies. Picture this: you go to the store and buy a bag of potato chips for . Now, fast forward a few years, and that same bag of chips costs . What happened? Inflation happened, my friend!

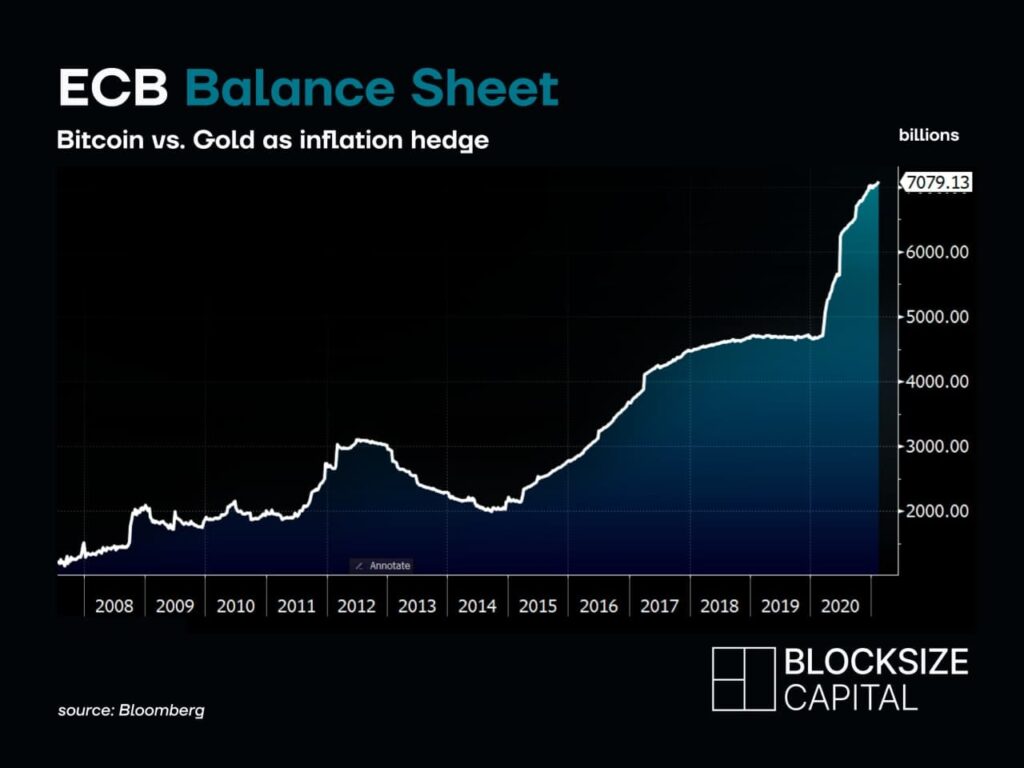

Inflation refers to the general increase in prices over time. It erodes the purchasing power of your hard-earned money, making everything more expensive. And that’s where fiat devaluation comes into play. Fiat currencies, like the US dollar or the Euro, can lose their value due to factors such as excessive money printing by central banks or economic instability. This devaluation can have a devastating impact on your savings and investments.

XRP: The Inflation-Proof Hero

Now, let’s talk about XRP and how it can save the day. One of the key features of XRP is its fixed supply. Unlike traditional fiat currencies that can be printed endlessly, XRP has a maximum supply of 100 billion coins. This limited supply acts as a shield against inflation, making XRP an attractive investment option for those looking to protect their wealth.

But how does XRP achieve this? Well, it’s all thanks to the innovative technology behind it. XRP operates on a decentralized blockchain network that allows for fast and secure transactions. This technology, combined with its limited supply, makes XRP a powerful tool for hedging against fiat devaluation.

📈 How XRP and Inflation: How Crypto Can Hedge Against Fiat Devaluation Impacts XRP’s Market Position and Potential Growth

Now that we understand the basics, let’s take a closer look at how XRP’s ability to hedge against fiat devaluation impacts its market position and potential for growth. Buckle up, because things are about to get interesting!

XRP’s Market Position

XRP has established itself as one of the top cryptocurrencies in the market. With its focus on cross-border transactions and partnerships with major financial institutions, XRP has carved out a unique niche for itself. Its ability to hedge against inflation and fiat devaluation adds another layer of attractiveness to its market position. Investors looking for a safe haven in times of economic uncertainty are turning to XRP, driving up its demand and value.

Potential for Growth

When it comes to potential growth, XRP is like a Jack-in-the-box waiting to pop. As more people become aware of the benefits of hedging against fiat devaluation with cryptocurrencies, XRP’s demand is expected to skyrocket. Additionally, Ripple Labs’ continuous efforts to improve the efficiency and scalability of the XRP network position the cryptocurrency for long-term success. So, if you’re looking for a crypto investment with significant growth potential, XRP might just be your golden ticket.

🔍 Analysis of Current Market Trends Related to XRP and Inflation: How Crypto Can Hedge Against Fiat Devaluation

Now, let’s put on our detective hats and analyze the current market trends related to XRP and inflation. We’re about to uncover some fascinating insights, so get ready to have your mind blown!

The Rise of Crypto as an Inflation Hedge

In recent years, cryptocurrencies have gained significant popularity as a hedge against inflation. With central banks around the world pumping trillions of dollars into their economies, investors are seeking alternative assets to protect their wealth. And guess who’s stealing the spotlight? That’s right, our beloved XRP!

XRP’s fixed supply and its ability to facilitate fast and low-cost transactions make it an ideal choice for investors looking to hedge against fiat devaluation. As more people recognize the benefits of cryptocurrencies in uncertain economic times, the demand for XRP is expected to soar.

The Ripple Effect

Speaking of demand, let’s talk about Ripple Labs and their strategic moves in the crypto world. Ripple Labs, the creator of XRP, has been making waves with its partnerships and innovative solutions. By collaborating with financial institutions and introducing revolutionary products like RippleNet, Ripple Labs is paving the way for XRP’s widespread adoption.

These strategic developments not only boost XRP’s market position but also solidify its role as a hedge against fiat devaluation. With Ripple Labs leading the charge, XRP is poised for success in the ever-evolving world of cryptocurrencies.

✅ Key Benefits and ⚠️ Risks of Investing in XRP Related to XRP and Inflation: How Crypto Can Hedge Against Fiat Devaluation

Now, let’s weigh the pros and cons of investing in XRP as it relates to hedging against fiat devaluation. After all, it’s crucial to consider both sides of the coin before diving headfirst into the world of cryptocurrency.

Key Benefits of Investing in XRP

- Hedging against fiat devaluation: As we’ve discussed, XRP’s limited supply and decentralized nature make it an excellent hedge against inflation and fiat devaluation.

- Fast and low-cost transactions: XRP’s blockchain technology enables quick and affordable cross-border transactions, making it an attractive choice for global commerce.

- Partnerships with financial institutions: Ripple Labs’ partnerships with major financial players give XRP a solid foundation and increase its potential for widespread adoption.

Potential Risks of Investing in XRP

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations could impact XRP’s value and usage.

- Market volatility: Like any investment, XRP is subject to market fluctuations. Its value can rise or fall rapidly, so it’s essential to stay informed and be prepared for potential volatility.

- Competition from other cryptocurrencies: While XRP has established itself as a major player, it faces competition from other cryptocurrencies that offer similar features and benefits.

🚀 Ripple’s Strategic Developments or Innovations Relevant to XRP and Inflation: How Crypto Can Hedge Against Fiat Devaluation

Ripple Labs has been on a mission to revolutionize the financial industry and enhance XRP’s role as a hedge against fiat devaluation. Let’s take a look at some of their strategic developments and innovations that are shaping the future of XRP.

RippleNet: Connecting the World

RippleNet is Ripple Labs’ flagship product that aims to connect financial institutions and enable seamless cross-border transactions. By utilizing XRP as a bridge currency, RippleNet reduces the costs and delays associated with traditional money transfers. This innovation not only enhances XRP’s utility but also strengthens its position as a hedge against fiat devaluation.

xRapid: Liquidity on Demand

xRapid is another game-changing solution offered by Ripple Labs. It leverages XRP’s speed and liquidity to provide real-time settlements for financial institutions. By eliminating the need for pre-funded nostro accounts, xRapid reduces costs and enhances liquidity. This innovation opens up new avenues for XRP’s usage and further solidifies its position as a hedge against fiat devaluation.

💡 Investor Insights: XRPAuthority’s Tips and Tricks for XRP and Inflation: How Crypto Can Hedge Against Fiat Devaluation

As a seasoned cryptocurrency investor and dedicated XRP enthusiast, I’ve gathered some valuable insights and tips to help you navigate the world of XRP and inflation. So, grab your notepad and get ready to learn from the best!

Do Your Research

Before diving into any investment, it’s essential to do your due diligence. Educate yourself about the fundamentals of XRP, its technology, and its market position. Stay informed about the latest developments and market trends to make well-informed investment decisions.

Diversify Your Portfolio

While XRP offers excellent potential as a hedge against fiat devaluation, it’s always wise to diversify your investment portfolio. Allocate your funds across different cryptocurrencies and traditional assets to mitigate risks and maximize potential returns.

Stay Calm and HODL

Cryptocurrency markets can be volatile, and it’s easy to get caught up in the hype. Remember to stay calm and avoid making impulsive decisions based on short-term price fluctuations. Take a long-term approach and HODL (hold on for dear life) your XRP investment, keeping in mind its potential as a hedge against fiat devaluation.

And there you have it, my fellow crypto enthusiasts! We’ve explored the exciting world of XRP and how it can hedge against fiat devaluation. From understanding inflation and fiat devaluation to analyzing market trends and investor insights, we’ve covered it all. So, go forth and conquer the crypto world with your newfound knowledge of XRP and inflation!