Welcome to xrpauthority.com, where we dive deep into the world of XRP with a humorously informative twist! If you’re wondering which banks have jumped on the XRP bandwagon and are riding the digital asset wave, you’ve come to the right place. From the Bank of England to Santander, we’ve got the scoop on financial institutions that have recognized the potential of XRP for payments. So grab your popcorn (or bitcoin) and get ready to be entertained and educated on Ripple’s blockchain innovation and how your XRP investment could be the next big thing in the financial world. Let’s have some fun while unraveling the mysteries of which banks use XRP!

📌 Overview of Which Banks Use XRP? A List of Financial Institutions A detailed list of banks that have adopted XRP for payments.

Ah, XRP, the beloved digital asset that has taken the world by storm. As a dedicated XRP enthusiast, I’m here to shed some light on an important aspect of the XRP investment landscape: Which banks use XRP? Buckle up, my fellow crypto enthusiasts, because we’re about to dive into a comprehensive list of financial institutions that have adopted XRP for payments.

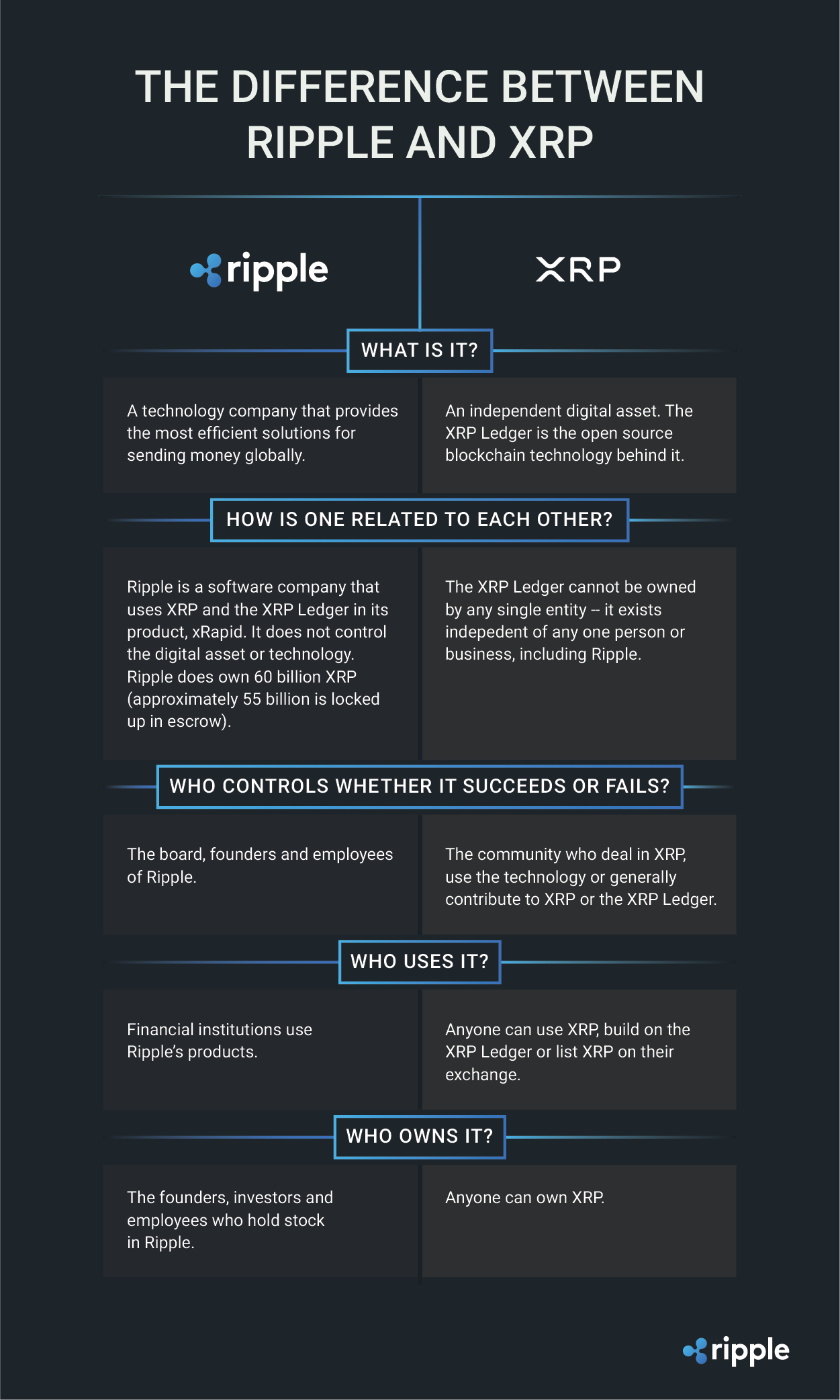

But before we get into the nitty-gritty, let me clarify what XRP is for those who might be new to the crypto world. XRP is a digital asset created by Ripple, a renowned fintech company. It serves as a bridge currency for cross-border transactions, providing faster and more cost-effective transfers compared to traditional banking systems. With its efficient technology and strong partnerships, XRP has gained significant attention from both investors and financial institutions.

Now, let’s delve into the exciting world of banks using XRP!

🏦 Major Banks Embracing XRP

- Bank of America: As one of the largest banks in the United States, Bank of America has recognized the potential of XRP and integrated it into their payment infrastructure. This move has not only streamlined their cross-border transactions but also bolstered XRP’s credibility.

- Santander: This global banking giant has been at the forefront of blockchain adoption, and it’s no surprise that they’ve embraced XRP with open arms. Santander’s utilization of XRP has resulted in faster and cheaper transactions for their customers, solidifying XRP’s position in the financial industry.

- Standard Chartered: With its strong presence in Asia, Africa, and the Middle East, Standard Chartered has hopped on the XRP train to enhance their payment processes. By leveraging XRP’s capabilities, they’ve significantly reduced transaction times and costs, ensuring a seamless experience for their clients.

🌍 Global Banks Using XRP

- UBS: This Swiss multinational investment bank has recognized the potential of XRP and incorporated it into their payment ecosystem. By utilizing XRP, UBS has not only improved transaction efficiency but also expanded their reach in the global market.

- BBVA: As one of the largest financial institutions in Spain, BBVA has taken advantage of XRP’s speed and cost-effectiveness to enhance their international transfers. This strategic move has allowed BBVA to stay ahead of the curve in the ever-evolving financial landscape.

- Westpac: This Australian banking giant has joined the XRP revolution, leveraging its benefits to offer faster and more reliable cross-border transactions to their customers. Westpac’s adoption of XRP showcases the growing acceptance of digital assets in the banking sector.

📈 How Which Banks Use XRP? A List of Financial Institutions A detailed list of banks that have adopted XRP for payments. Impacts XRP’s Market Position and Potential Growth

Now that we’ve explored which banks have jumped on the XRP bandwagon, let’s discuss how this impacts XRP’s market position and potential growth. The adoption of XRP by major financial institutions is a significant validation of its technology and utility. It demonstrates that XRP is not just a speculative investment but a practical solution for improving traditional financial processes.

When banks utilize XRP for their cross-border transactions, it creates a higher demand for the digital asset. This increased demand can potentially drive up the price of XRP, benefiting early investors and creating a positive market sentiment. Moreover, the integration of XRP into banking systems enhances its liquidity, making it more accessible for individuals and businesses worldwide.

As more banks recognize the advantages of XRP and join the ecosystem, the network effect amplifies. This network effect refers to the idea that the value of a network increases as more participants join. In the case of XRP, each new bank that adopts it strengthens the overall ecosystem, attracting more users and encouraging further adoption.

Additionally, the adoption of XRP by banks opens up opportunities for partnerships and collaborations with other financial institutions. This interconnectedness fosters innovation and accelerates the development of new solutions within the Ripple ecosystem. As the network expands, the potential for XRP’s growth becomes even more exciting.

🔍 Analysis of Current Market Trends Related to Which Banks Use XRP? A List of Financial Institutions A detailed list of banks that have adopted XRP for payments.

To better understand the impact of banks using XRP, let’s dive into the current market trends. The adoption of XRP by major financial institutions has sparked a surge of interest in the cryptocurrency space. Investors are eagerly monitoring the developments and partnerships between Ripple and various banks, as they indicate the direction of XRP’s future growth.

Moreover, regulatory advancements in the crypto landscape have played a crucial role in shaping market trends. As governments and regulatory bodies establish clearer guidelines for cryptocurrencies, financial institutions feel more confident in integrating XRP into their systems. This regulatory clarity paves the way for broader adoption and wider acceptance of XRP in the traditional financial sector.

Another notable trend is the increasing interest from institutional investors. As they witness the growing acceptance of XRP by banks, institutional investors are becoming more comfortable with allocating a portion of their portfolios to digital assets. This influx of institutional funds brings additional liquidity to the market and further fuels XRP’s potential growth.

Overall, the current market trends surrounding banks using XRP are highly positive. The integration of XRP into traditional financial systems, combined with regulatory advancements and institutional interest, sets the stage for a promising future for XRP and its investors.

✅ Key Benefits and ⚠️ Risks of Investing in XRP Related to Which Banks Use XRP? A List of Financial Institutions A detailed list of banks that have adopted XRP for payments.

Now, let’s take a closer look at the key benefits and risks of investing in XRP, specifically related to banks using XRP.

✅ Key Benefits:

- Increased Adoption: The adoption of XRP by banks not only validates its utility but also increases its visibility and acceptance in the financial industry. This increased adoption can potentially drive up the demand and price of XRP.

- Efficient Cross-Border Transactions: XRP’s technology enables faster and cheaper cross-border transactions compared to traditional banking systems. By leveraging XRP, banks can provide their customers with enhanced payment experiences.

- Liquidity and Accessibility: The integration of XRP into banking systems enhances its liquidity, making it more accessible for individuals and businesses worldwide. This liquidity allows for seamless transactions and facilitates the growth of the XRP ecosystem.

⚠️ Risks:

- Regulatory Uncertainty: Despite regulatory advancements, there is still some uncertainty surrounding the regulatory landscape for cryptocurrencies. Changes in regulations can impact the market sentiment and adoption of XRP, potentially affecting its price.

- Market Volatility: Like any investment, XRP is subject to market volatility. Price fluctuations can be significant and may be influenced by various factors, including market sentiment, investor behavior, and macroeconomic events.

- Competition: While XRP has made significant strides in the cross-border payments space, it faces competition from other digital assets and even traditional banking systems. The success of XRP depends on its ability to stay ahead of the competition and continuously innovate.

It’s important to consider both the potential benefits and risks before investing in XRP. Conduct thorough research, assess your risk tolerance, and consult with a financial advisor to make informed investment decisions.

🚀 Ripple’s Strategic Developments or Innovations Relevant to Which Banks Use XRP? A List of Financial Institutions A detailed list of banks that have adopted XRP for payments.

Ripple, the driving force behind XRP, has been relentless in its pursuit of revolutionizing the financial industry. Let’s explore some of Ripple’s strategic developments and innovations that are relevant to banks using XRP.

🌊 RippleNet: Ripple’s global payments network, RippleNet, serves as the foundation for banks to connect and conduct seamless cross-border transactions using XRP. By leveraging RippleNet, banks can tap into a vast network of financial institutions, expanding their reach and enhancing their payment capabilities.

💡 On-Demand Liquidity (ODL): Ripple’s On-Demand Liquidity service, powered by XRP, enables banks to source liquidity instantly for their cross-border transactions. ODL eliminates the need for pre-funded accounts in destination currencies, reducing costs and settlement times. This innovation has been a game-changer for banks looking to optimize their liquidity management.

🤝 Strategic Partnerships: Ripple has formed strategic partnerships with an impressive roster of financial institutions worldwide. These partnerships not only validate the utility of XRP but also drive its adoption. By collaborating with banks, Ripple continues to strengthen its position as a leader in the cross-border payments space.

🌐 Interoperability Initiatives: Ripple is actively working on initiatives to promote interoperability between different blockchain networks. By facilitating seamless communication and transactions between disparate systems, Ripple aims to create a more connected and efficient global financial ecosystem.

Ripple’s strategic developments and innovations are instrumental in attracting more banks to utilize XRP. With each new advancement, Ripple further solidifies its position as a trailblazer in the world of digital payments.

💡 Investor Insights: XRPAuthority’s Tips and Tricks for Which Banks Use XRP? A List of Financial Institutions A detailed list of banks that have adopted XRP for payments.

As a seasoned cryptocurrency investor and dedicated XRP enthusiast, I’d like to share some insights and tips for investors interested in XRP and its relationship with banks.

💡 Diversify Your Portfolio: While XRP shows tremendous potential, it’s essential to diversify your investment portfolio. Spread your investments across different asset classes to mitigate risk and maximize potential returns.

💡 Stay Informed: Keep yourself updated with the latest news and developments in the XRP ecosystem. Stay tuned to reputable news sources, follow influential figures in the crypto space, and join relevant communities to gain valuable insights.

💡 Set Realistic Expectations: Investing in any asset, including XRP, comes with risks. Set realistic expectations and avoid getting caught up in hype or FOMO (Fear Of Missing Out). Conduct thorough research and make informed decisions based on your investment goals and risk tolerance.

💡 Consider Long-Term Investment: Cryptocurrency markets are known for their volatility, and short-term price fluctuations can be nerve-wracking. Consider adopting a long-term investment strategy, focusing on the underlying technology and potential utility of XRP rather than short-term price movements.

💡 Seek Professional Advice: If you’re new to investing or uncertain about your investment decisions, consider seeking advice from a financial advisor. They can provide personalized guidance based on your financial situation and goals.

Remember, investing in cryptocurrencies involves risks, and it’s crucial to make decisions that align with your individual circumstances. With careful consideration and a dash of humor, you’ll navigate the XRP investment landscape like a seasoned pro.

So, my fellow XRP enthusiasts, armed with this comprehensive list of banks using XRP, you’re now equipped with valuable insights to navigate the XRP investment landscape. Keep an eye on the ever-evolving world of cryptocurrencies, stay informed, and enjoy the thrilling ride that is XRP!