Welcome to the exhilarating world of cryptocurrency, where digital assets strive to revolutionize finance as we know it. Amidst this bustling landscape, two giants stand tall: Bitcoin (BTC) and XRP. Both boast fervent followings and transformative potential, yet they differ significantly in their approach to transactions. So, which one takes the crown in terms of speed, fees, and scalability? Let’s dive into the nitty-gritty details in this blockchain battle royale, brought to you by yours truly, Matt from XRPAuthority.com.

Imagine waiting for your Bitcoin transaction to confirm, twiddling your thumbs as you ponder life’s greatest mysteries. Is it faster to watch paint dry or to transfer BTC? That might be a rhetorical question, but it highlights one of Bitcoin’s biggest challenges: transaction speed. Enter XRP, the speedy hare to Bitcoin’s tortoise. XRP was designed with speed in mind, clocking in transaction times in mere seconds, compared to Bitcoin’s average of 10 minutes or more. But does speed alone make XRP the Usain Bolt of crypto transactions?

Let’s talk about fees—because who doesn’t love saving money? Bitcoin transactions often come with a hefty price tag, as miners need incentives to process transactions on its proof-of-work network. On the other hand, XRP operates on a consensus mechanism that doesn’t involve mining, resulting in nominal transaction fees. In an economy where every penny counts, XRP’s cost-effectiveness is a game-changer. So, is XRP the coupon-clipping hero of the crypto world, or is there more to the story?

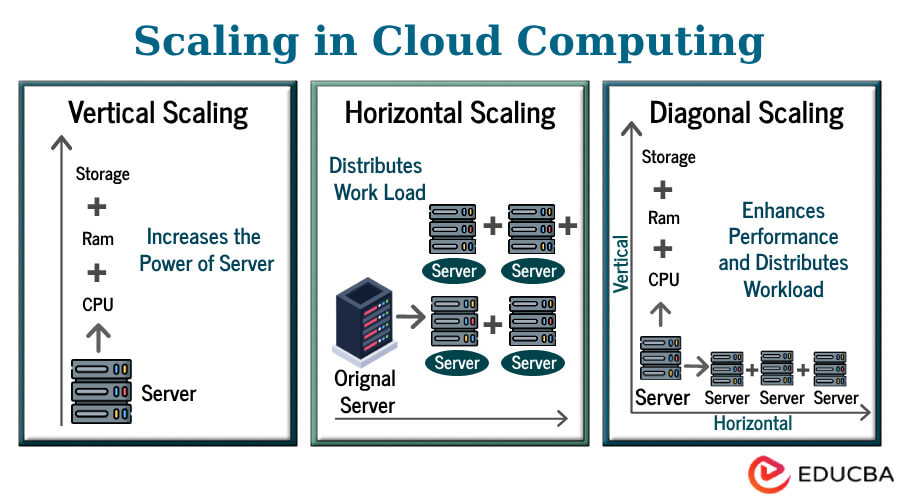

Scalability is where the plot thickens. Bitcoin, the pioneer cryptocurrency, has faced challenges in scaling its network to accommodate increasing demand. XRP, however, was built with scalability in mind, capable of handling 1,500 transactions per second. Compare that to Bitcoin’s handful of transactions per second, and XRP seems like the clear winner. But is scalability everything, or does the age-old adage “slow and steady wins the race” still hold water in the digital age?

Technicalities aside, both XRP and Bitcoin have etched their marks in the blockchain and finance sectors. Bitcoin is often heralded as digital gold, a store of value that has captured the imagination of investors worldwide. XRP, meanwhile, excels in facilitating cross-border payments and liquidity, positioning itself as a vital tool for global finance. Could it be that XRP is the Swiss Army knife of cryptocurrencies, or is its utility just one piece of the puzzle?

For traders, the choice between XRP and Bitcoin might feel like choosing between apples and oranges. Bitcoin’s volatility can be a siren song for those seeking high-risk, high-reward scenarios, while XRP’s relative stability and utility offer a more grounded approach. Are you a thrill-seeker or a pragmatic investor? Perhaps both? The answer might just lie in how you perceive these digital assets’ roles in your portfolio.

The debate over XRP vs. Bitcoin isn’t just a matter of personal preference; it’s a reflection of the evolving cryptocurrency landscape. As blockchain technology continues to innovate and grow, the conversation around transaction speed, cost, and scalability becomes increasingly relevant. Whether you’re a seasoned crypto investor or a curious onlooker, understanding these dynamics is crucial to navigating this brave new world of digital finance.

At XRPAuthority.com, we strive to be your trusted compass in the ever-changing seas of cryptocurrency. With insights honed since 2011 and a passion for XRP that’s burned bright since 2018, we’re here to guide you through the complexities of blockchain, finance, and trading. Whether you’re team XRP or Bitcoin, or just exploring your options, join us for expert analysis, wit, and a touch of humor as we unravel the mysteries of the crypto universe together.

📌 Understanding XRP vs Bitcoin (BTC): Which is Better for Transactions? A detailed comparison of XRP and Bitcoin in terms of speed, fees, and scalability. and Its Impact on XRP

Transaction speed comparison

Transaction Speed Comparison

When it comes to speed, XRP leaves Bitcoin in the dust. While Bitcoin remains the king of cryptocurrencies in terms of market dominance and security, its transaction speed has long been a major pain point. XRP, on the other hand, was designed specifically to facilitate fast and efficient transactions, making it a strong contender for real-world payments.

Bitcoin transactions typically take anywhere from 10 minutes to an hour, depending on network congestion and miner fees. This is because Bitcoin relies on a proof-of-work (PoW) consensus mechanism, where miners must solve complex mathematical problems to validate transactions and add them to the blockchain. While this system ensures security and decentralization, it also creates bottlenecks, particularly during periods of high activity.

XRP, in contrast, operates on the Ripple Protocol Consensus Algorithm (RPCA), which doesn’t require mining. Instead, transactions are verified by a network of trusted validators, allowing for near-instant settlement. On average, an XRP transaction is confirmed in just 3-5 seconds. This speed advantage makes XRP an attractive option for financial institutions and businesses that require rapid cross-border payments.

- Bitcoin transaction speed: 10 minutes to an hour (or longer during high traffic)

- XRP transaction speed: 3-5 seconds on average

For users looking to send small transactions quickly—such as remittances, merchant payments, or intra-bank transfers—XRP is clearly the superior choice. Bitcoin’s slow confirmation times can make it impractical for everyday transactions, especially when compared to the near-instant finality of XRP.

Another factor affecting Bitcoin’s speed is the block size limit. Currently capped at 1MB, Bitcoin’s block size restricts the number of transactions that can be processed at any given time. While scaling solutions like the Lightning Network aim to address this limitation, widespread adoption is still in progress. XRP, on the other hand, doesn’t suffer from such constraints, as its consensus mechanism allows for significantly higher throughput.

In real-world applications, XRP’s speed advantage is a game-changer. Financial institutions using Ripple’s On-Demand Liquidity (ODL) solution leverage XRP to settle cross-border payments almost instantly, eliminating the need for pre-funded accounts. Bitcoin, while a valuable store of value, struggles in this area due to its slower confirmation times.

Ultimately, if transaction speed is a priority—whether for retail payments, remittances, or institutional transfers—XRP is the clear winner. Bitcoin may be the original cryptocurrency, but when it comes to real-time transactions, XRP’s efficiency is hard to beat.

Fee structure and cost efficiency

Fee Structure and Cost Efficiency

When it comes to transaction costs, XRP once again holds a significant advantage over Bitcoin. While Bitcoin’s high fees have been a point of concern for years, XRP was designed to facilitate low-cost transactions, making it a more practical choice for everyday payments and cross-border transfers.

Bitcoin transaction fees are determined by network congestion and the amount of data included in a transaction. Because Bitcoin operates on a proof-of-work (PoW) system, miners prioritize transactions with higher fees, which means users often have to pay more to ensure their transactions are processed quickly. During periods of high usage, Bitcoin transaction fees can skyrocket, sometimes reaching upwards of or more per transaction. This makes Bitcoin an expensive option for small payments or frequent transactions.

On the other hand, XRP’s fee structure is incredibly cost-efficient. Instead of a dynamic fee model based on congestion, XRP transactions incur a minimal, fixed cost. The average transaction fee for XRP is just a fraction of a cent—typically around 0.00001 XRP, which is practically negligible even when XRP’s price fluctuates. What’s more, XRP’s fees aren’t paid to miners but are instead burned, reducing the total supply of XRP over time. This deflationary mechanism adds an interesting economic incentive to the network.

- Bitcoin transaction fees: Can range from a few cents to over , depending on network congestion.

- XRP transaction fees: Typically around 0.00001 XRP (less than a fraction of a cent).

For businesses and financial institutions, the cost efficiency of XRP transactions is a major selling point. Cross-border payments, which often involve hefty fees with traditional banking systems, can be settled almost instantly and at a fraction of the cost using XRP. This is why many banks and payment providers have integrated Ripple’s technology into their operations—it significantly reduces the cost of moving money across borders.

Bitcoin, while still a preferred asset for long-term holding and large-value transfers, struggles with everyday usability due to its unpredictable and sometimes exorbitant fees. While second-layer solutions like the Lightning Network aim to make Bitcoin transactions faster and cheaper, adoption is still in progress, and it’s not yet a seamless experience for all users.

In contrast, XRP’s low fees make it ideal for microtransactions, remittances, and institutional transfers. Whether you’re sending money across the globe or making a small payment, XRP ensures that the cost remains minimal, making it a far more practical option than Bitcoin for frequent transactions.

Ultimately, in the battle of cost efficiency, XRP wins hands down. Bitcoin may be the gold standard for digital assets, but its fee structure makes it impractical for everyday payments. XRP’s near-zero transaction costs make it a highly efficient medium of exchange, especially for those looking to move money quickly and affordably.

Scalability and network capacity

Scalability and Network Capacity

Scalability is one of the most critical factors in determining a cryptocurrency’s long-term viability as a payment system. If a network can’t handle increased transaction volumes efficiently, it risks congestion, higher fees, and slower processing times—issues that Bitcoin has struggled with for years. XRP, by design, was built with scalability in mind, making it a formidable alternative for high-volume transactions.

Bitcoin’s scalability challenges stem from its proof-of-work (PoW) consensus mechanism and its 1MB block size limit. Since each block is created approximately every 10 minutes, Bitcoin can only process around 7 transactions per second (TPS). This limitation has led to network congestion during peak periods, causing significant delays and increased fees. While layer-2 solutions like the Lightning Network aim to improve Bitcoin’s scalability by enabling off-chain transactions, adoption remains in progress, and the technology is not yet seamless for all users.

In contrast, XRP’s consensus mechanism allows it to process transactions much more efficiently. The XRP Ledger (XRPL) can handle up to 1,500 TPS, far surpassing Bitcoin’s capacity. Additionally, XRP’s network does not experience the same congestion issues since transactions settle in just a few seconds. This high throughput makes XRP a far more scalable solution for global payments, particularly for financial institutions that require a reliable and fast network.

- Bitcoin network capacity: ~7 TPS, with scalability dependent on Lightning Network adoption.

- XRP network capacity: ~1,500 TPS, with built-in scalability.

Another key aspect of scalability is the ability to handle increasing demand without compromising security or efficiency. Bitcoin’s network becomes congested when transaction volumes rise, leading to higher fees as users compete for block space. XRP, however, maintains low fees and fast processing times even during periods of high activity, making it a more practical choice for large-scale adoption.

Moreover, Bitcoin’s reliance on miners for transaction validation introduces an additional scalability hurdle. As network usage grows, so does the energy consumption required to maintain the blockchain, raising concerns about sustainability. XRP, by using a consensus protocol that does not require mining, avoids these inefficiencies, making it a greener and more scalable option.

For businesses and financial institutions, scalability is not just a technical concern—it’s a fundamental requirement. Ripple’s On-Demand Liquidity (ODL) solution, which leverages XRP for cross-border payments, showcases the network’s ability to handle high transaction volumes without bottlenecks. This has led to partnerships with major financial players, reinforcing XRP’s position as a scalable payment solution.

While Bitcoin remains the dominant cryptocurrency for store-of-value purposes, its limited scalability makes it less practical for high-frequency transactions. XRP’s ability to process thousands of transactions per second with minimal fees and near-instant finality gives it a clear edge in terms of real-world usability.

Looking ahead, Bitcoin’s scalability challenges may improve with further Lightning Network adoption and potential protocol upgrades. However, XRP’s inherent scalability makes it a more immediate and reliable solution for users who need fast, efficient, and cost-effective transactions today.

Use cases and adoption

Use Cases and Adoption

Beyond technical specifications like speed, fees, and scalability, the real-world adoption of a cryptocurrency ultimately determines its success. While both Bitcoin and XRP serve unique purposes in the digital asset ecosystem, their use cases and adoption trends are vastly different. Bitcoin has cemented itself as the most recognizable and valuable cryptocurrency, often referred to as “digital gold,” whereas XRP thrives in the realm of payments and financial institutions.

Bitcoin’s primary use case revolves around being a store of value and a hedge against inflation. Many investors and institutions hold BTC as an asset similar to gold—something to preserve wealth over time rather than a medium for daily transactions. Due to its slow transaction times and high fees, spending Bitcoin for everyday purchases remains impractical, but its role as a long-term investment vehicle continues to grow. Major companies, such as Tesla and MicroStrategy, have added Bitcoin to their balance sheets, further legitimizing its status as a digital asset class.

However, Bitcoin’s adoption as a payment method has been slower. While some merchants accept BTC, the volatility and inefficiency of on-chain transactions make it less attractive for routine purchases. Efforts like the Lightning Network aim to improve Bitcoin’s usability for payments, but widespread adoption is still a work in progress.

On the other hand, XRP was built specifically for efficient global transactions. Unlike Bitcoin, which was designed as a decentralized alternative to traditional financial systems, XRP works within the existing financial infrastructure. Ripple, the company behind XRP, has developed solutions like On-Demand Liquidity (ODL) to enable seamless cross-border payments. This has led to partnerships with major banks, payment providers, and remittance services worldwide.

- Bitcoin adoption: Primarily used as a store of value, investment asset, and hedge against inflation.

- XRP adoption: Focused on cross-border payments, institutional transactions, and financial system integration.

A key advantage of XRP in the payments sector is its ability to settle transactions almost instantly. Traditional cross-border payments through the banking system can take days and involve multiple intermediaries, leading to high costs. With XRP, financial institutions can move money across borders in seconds, reducing costs and eliminating the need for pre-funded accounts in different currencies.

This efficiency has made XRP a popular choice for remittance companies like MoneyGram (which previously partnered with Ripple) and other financial institutions seeking to modernize their payment infrastructure. While Bitcoin’s adoption in finance is largely centered around investment and speculation, XRP is actively being used to facilitate real-world transactions.

Another area where XRP is seeing increased adoption is in central bank digital currencies (CBDCs) and financial settlements. Ripple has been working with governments and financial institutions to explore how blockchain can improve monetary systems. The XRP Ledger’s ability to handle high transaction volumes with low fees makes it an attractive option for central banks looking to digitize their currencies.

Meanwhile, Bitcoin’s role in institutional finance continues to evolve. Major financial firms like Fidelity, BlackRock, and PayPal have integrated Bitcoin into their services, allowing customers to buy, sell, and hold BTC. Additionally, Bitcoin ETFs have gained traction, making it easier for traditional investors to gain exposure to the asset. However, Bitcoin’s use as a transactional currency remains limited compared to its role as a speculative investment.

Ultimately, the adoption of Bitcoin and XRP reflects their fundamental differences in purpose. Bitcoin dominates as a long-term investment, a hedge against economic uncertainty, and a decentralized asset resistant to government control. XRP, in contrast, excels in practical financial applications, offering a solution for real-time payments, cross-border transfers, and institutional finance.

Looking ahead, both Bitcoin and XRP will likely continue to see adoption in their respective niches. Bitcoin’s role as “digital gold” is unlikely to change, while XRP’s position as a payment-focused digital asset will strengthen as more financial institutions integrate blockchain technology into their operations. For those looking for a cryptocurrency optimized for transactions, XRP remains the superior choice due to its speed, cost-efficiency, and growing adoption in the payments industry.

💡 Frequently Asked Questions (FAQs) About XRP vs Bitcoin (BTC): Which is Better for Transactions? A detailed comparison of XRP and Bitcoin in terms of speed, fees, and scalability.

XRP vs Bitcoin (BTC): Which is Better for Transactions?

Explore the key differences between XRP and Bitcoin (BTC) in terms of transaction speed, fees, and scalability to determine which is more suitable for your transactional needs.

1. What are the transaction speeds of XRP and Bitcoin?

XRP is renowned for its rapid transaction processing, typically completing transactions in about 3-5 seconds. This speed is due to its consensus algorithm, which does not require mining. In contrast, Bitcoin transactions can take anywhere from 10 minutes to an hour, depending on network congestion, as it relies on a proof-of-work system.

2. How do transaction fees compare between XRP and Bitcoin?

Transaction fees on the XRP network are generally low, often costing only a fraction of a cent. This makes XRP appealing for frequent, low-cost transactions. Bitcoin’s fees, however, can fluctuate significantly, particularly during periods of high demand, making it potentially more expensive for smaller transactions.

3. What about the scalability of XRP and Bitcoin?

XRP is designed to handle a high volume of transactions, capable of processing around 1,500 transactions per second (tps). Its scalability is a major advantage for enterprise-level use cases. Bitcoin, on the other hand, processes approximately 7 tps, which can lead to bottlenecks during peak times, affecting its scalability for large-scale applications.

4. Which is more suitable for cross-border transactions, XRP or Bitcoin?

XRP is specifically optimized for cross-border transactions, with financial institutions utilizing its platform to facilitate international money transfers efficiently. Its speed and low cost make it a preferred choice for remittances and interbank settlements. Bitcoin, while being a popular store of value, is less efficient for such use cases due to higher fees and longer transaction times.

5. Are there any specific investment insights for XRP and Bitcoin?

Investors often view Bitcoin as a “digital gold,” serving as a hedge against inflation and a store of value. Its limited supply of 21 million coins adds to its appeal as an investment. XRP, meanwhile, is valued for its utility in the financial industry, especially for those looking to invest in technology that enhances global payment systems. Both assets carry their own risks and potential rewards, making diversification a common strategy among crypto investors.