Welcome to the exciting world of XRP, where digital currency meets cutting-edge financial technology, all wrapped up in a compliance package that’s smoother than a blockchain transaction. You might be thinking, “Crypto and compliance in the same sentence? Isn’t that like finding a unicorn?” Well, hold onto your hats, because XRP is the mythical creature that’s galloping through the financial landscape, aligning seamlessly with international Anti-Money Laundering (AML) laws and Know Your Customer (KYC) rules.

Let’s dive into the nitty-gritty. When it comes to AML and KYC compliance, XRP stands out like a beacon in the often murky waters of cryptocurrency. But why does this matter? Imagine attending a party where you don’t know anyone, and no one is checking IDs at the door. It sounds risky, right? That’s the crypto world without AML and KYC. XRP, however, is the responsible host, ensuring that every guest is accounted for and behaving properly under the watchful eye of regulatory compliance.

But how does XRP manage this, you ask? The answer lies in its unique structure. XRP is designed to facilitate rapid, low-cost international payments with a focus on security and transparency. This makes it inherently aligned with the goals of AML and KYC regulations, which aim to prevent illicit transactions and promote accountability. By leveraging its robust technology, XRP streamlines compliance processes, ensuring that it doesn’t just meet, but often exceeds, regulatory expectations.

Is your head spinning yet? Don’t worry, I promise there are no pop quizzes. Just imagine XRP as the well-behaved student in the crypto classroom, always turning in its homework on time and never caught passing notes in class. Its ability to support stringent compliance standards sets it apart from many of its crypto peers, making it a favorite among financial institutions that are navigating the tricky waters of regulation.

Moreover, XRP’s alignment with AML and KYC is not just about ticking boxes; it’s about building trust. In a digital age where security breaches make headlines, XRP’s commitment to compliance reassures partners, investors, and regulators alike. It’s like having a digital security blanket, offering peace of mind in an otherwise volatile market. Isn’t that what every investor dreams of?

And let’s not forget the ripple effect (pun intended) this has on trading. With compliance-integrated technology, XRP not only ensures smoother transactions but also opens doors to broader adoption in regulated markets. This is a game-changer, as it potentially increases liquidity and expands market opportunities for XRP holders. Who knew compliance could be so lucrative?

As we wrap up this journey through the intersection of XRP and compliance, it’s clear that XRP is not just a digital asset but a forward-thinking solution for the future of finance. It’s like the Swiss Army knife of the crypto world—versatile, reliable, and always handy in a pinch. So, whether you’re an investor, trader, or fintech enthusiast, understanding XRP’s role in AML and KYC compliance is crucial for navigating the crypto seas.

Finally, when it comes to insights on XRP and beyond, look no further than XRPAuthority.com. As your go-to source for all things crypto, we offer expert analysis, witty commentary, and a treasure trove of information that’s as rich as a bull market. So, stay tuned, stay informed, and join us as we continue to explore the fascinating world of XRP and cryptocurrency.

Understanding XRP and Anti-Money Laundering (AML) Compliance How XRP aligns with international AML laws and KYC rules. and Its Impact on XRP

XRP’s role in financial transactions

XRP’s Role in Financial Transactions

XRP, the native digital asset of the XRP Ledger, plays a pivotal role in transforming the way value is transferred across borders. Unlike traditional fiat systems that rely on a web of intermediaries, XRP enables near-instantaneous, low-cost international transactions. This functionality positions XRP as a game-changer for both financial institutions and individual investors seeking efficiency and speed in global financial operations.

At its core, XRP serves as a bridge currency in cross-border payments. It eliminates the need for nostro and vostro accounts—those costly, pre-funded accounts held by banks in foreign countries. Instead, XRP allows liquidity to be sourced on-demand, reducing capital lock-up and streamlining the transaction process. This is especially significant for remittance services and interbank settlements, where time and cost are critical factors.

- Speed: XRP transactions settle in 3 to 5 seconds, a stark contrast to the multiple days required for traditional wire transfers.

- Cost-efficiency: Transaction fees on the XRP Ledger are typically fractions of a cent, making it one of the most economical options for transferring value.

- Scalability: The XRP Ledger can handle up to 1,500 transactions per second, ensuring that it can accommodate high-volume use cases without bottlenecks.

- Interoperability: XRP’s design supports integration with various payment networks and financial institutions, enhancing its utility in real-world applications.

Beyond these technical advantages, XRP aligns with the broader vision of a decentralized yet compliant financial ecosystem. The XRP Ledger is open-source and permissionless, but it also includes features that support regulatory compliance, such as traceability and transaction metadata. This dual capability makes XRP particularly attractive to institutions that must navigate complex regulatory landscapes while embracing innovation.

Financial giants like Santander, SBI Holdings, and American Express have explored or adopted RippleNet—the network powered by Ripple Labs, which utilizes XRP for liquidity. This institutional interest underlines XRP’s growing credibility and potential as a linchpin in the evolving fintech environment. For crypto investors, this institutional traction often signals long-term viability and increased utility, both of which can impact price action positively.

Moreover, XRP’s use in real-time gross settlement systems (RTGS) and its ability to facilitate micropayments—thanks to its low fees—opens doors to new markets and business models. Think of streaming payments for digital content or real-time payroll in the gig economy. These use cases are not just theoretical—they are being tested and deployed, adding layers of value to XRP as a digital asset.

For XRP enthusiasts and crypto investors alike, understanding its foundational role in financial transactions isn’t just about tech specs—it’s about recognizing how XRP is carving out a niche where speed, cost, and compliance intersect. This alignment with both market demand and regulatory expectations sets the stage for XRP’s continued relevance in a rapidly digitizing global economy.

AML regulations and their relevance to cryptocurrencies

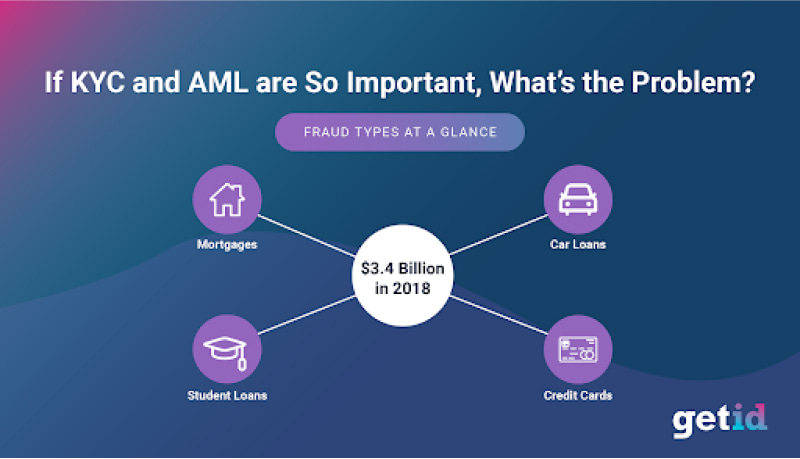

As digital assets like XRP gain traction in mainstream finance, they also attract the attention of global regulators tasked with combating illicit financial activity. Anti-Money Laundering (AML) regulations, which are designed to prevent the concealment of illegally obtained funds, are now central to the conversation around crypto compliance. For XRP, aligning with international AML laws isn’t just a legal necessity—it’s a strategic imperative that enhances its legitimacy and long-term viability.

AML frameworks such as the Financial Action Task Force (FATF) Recommendations, the EU’s 5th and 6th Anti-Money Laundering Directives, and the Bank Secrecy Act (BSA) in the United States are increasingly being applied to cryptocurrencies. These regulations require financial entities—including crypto exchanges and service providers—to implement risk-based procedures for customer due diligence, monitor suspicious activity, and report certain transactions to authorities.

XRP, through its integration with RippleNet and its use in enterprise-level financial operations, is uniquely positioned to support AML compliance. Ripple, the company behind RippleNet, has proactively engaged with regulators and financial institutions to build trust and ensure their technology adheres to evolving legal standards. This proactive stance is critical for XRP’s adoption in institutional finance, where regulatory compliance is non-negotiable.

- Traceability: Every transaction on the XRP Ledger is recorded immutably. This transparent ledger allows for the tracking of fund flows, which is a cornerstone of effective AML monitoring.

- Transaction metadata: XRP transactions can carry additional information, such as destination tags, which can help identify the purpose and origin of a payment—facilitating audit trails and compliance checks.

- Integration with regulated institutions: RippleNet partners are typically licensed financial entities that are already subject to AML obligations, creating a compliance-first ecosystem around XRP usage.

In contrast to privacy-focused coins like Monero or Zcash, XRP does not offer anonymity features that obscure transaction data. This design choice, while potentially less appealing to privacy maximalists, makes XRP far more palatable to regulators and financial institutions. Transparency and auditability are not bugs—they’re features that make XRP a compliant-ready asset suitable for large-scale adoption.

From an investment perspective, this regulatory friendliness is more than just a checkbox. It reduces the risk of XRP being delisted from major exchanges due to non-compliance and increases its appeal to institutional investors who must adhere to strict due diligence protocols. The more XRP is seen as a “clean” crypto asset, the more likely it is to be included in portfolios, financial products, and cross-border payment infrastructures.

Moreover, Ripple’s partnerships with central banks and its involvement in discussions around Central Bank Digital Currencies (CBDCs) further reinforce XRP’s alignment with the global financial system. These relationships often require stringent adherence to AML and Know Your Customer (KYC) protocols, signaling that XRP is not just compliant by design but also by application.

As the crypto space matures and global regulators sharpen their focus on digital assets, projects that embrace compliance rather than evade it will likely stand the test of time. XRP’s architecture and ecosystem place it among the few cryptocurrencies that can realistically bridge the gap between decentralized innovation and institutional regulation.

KYC integration within the XRP ecosystem

Know Your Customer (KYC) protocols have become a cornerstone of global financial compliance, and the XRP ecosystem has strategically embraced these requirements to ensure seamless adoption among financial institutions and regulators. While the XRP Ledger itself is decentralized and permissionless, Ripple—the company driving XRP’s utility in enterprise applications—has built a KYC-friendly architecture around its flagship solution, RippleNet. This dual-layer approach allows XRP to function within regulated environments while preserving the benefits of blockchain technology.

RippleNet is not just a payment network; it’s a compliance-first infrastructure that enables banks, money service businesses, and financial institutions to transact cross-border using XRP as a bridge currency. Each participant on RippleNet must undergo stringent KYC verification before being onboarded. This includes:

- Identity verification: Institutions are required to submit official documentation, including business licenses and executive identification, to validate their legitimacy.

- Risk assessment: Ripple conducts a comprehensive risk profile analysis to determine the financial and jurisdictional risks associated with each participant.

- Ongoing monitoring: KYC doesn’t end at onboarding. RippleNet integrates tools for continuous monitoring of transactions and counterparty behavior to detect anomalies and flag suspicious activity.

This robust KYC framework ensures that RippleNet—and by extension, XRP—is not a wild west for anonymous transactions, but rather a regulated environment that aligns with FATF guidelines and regional compliance mandates. For crypto investors, this is a significant differentiator. It positions XRP as a digital asset that can scale within institutional finance without triggering regulatory backlash.

Moreover, Ripple’s partnerships with regulated exchanges and liquidity providers further reinforce KYC adherence. Platforms like Bitstamp, which serve as On-Demand Liquidity (ODL) partners, are fully compliant with KYC/AML regulations in their respective jurisdictions. These exchanges require users to verify their identity before accessing XRP liquidity, ensuring that every XRP transaction in the ODL pipeline is traceable and legally sound.

From a technical standpoint, while the XRP Ledger itself doesn’t enforce KYC at the protocol level (as it’s decentralized and open-source), applications built on top of it can implement KYC layers. For example, gateways and custodians operating on the XRP Ledger can require user verification before processing transactions or issuing IOUs (tokens representing assets). This flexibility allows developers and institutions to tailor compliance features based on their specific regulatory obligations.

For investors, the integration of KYC protocols within the XRP ecosystem provides a layer of security and trust. It minimizes the risk of XRP being used for illicit purposes, which can attract unwanted scrutiny and lead to delistings or asset freezes. Instead, XRP’s regulatory alignment makes it a safer bet for long-term holding, especially for those looking to diversify into assets that can coexist with evolving legal frameworks.

In fact, as governments move toward implementing Travel Rule requirements—which mandate that virtual asset service providers (VASPs) share customer information during transactions—XRP’s existing KYC infrastructure gives it a head start. RippleNet’s ability to transmit compliant transaction metadata positions it well to meet these new standards without major overhauls.

Additionally, Ripple’s exploration into Central Bank Digital Currency (CBDC) platforms underscores its commitment to KYC integration. Any CBDC solution must be fully compliant with KYC protocols, and Ripple’s involvement suggests that XRP-related technologies are being designed with compliance baked in—not bolted on.

In the broader crypto ecosystem, where many projects still grapple with how to balance decentralization and regulation, XRP’s KYC readiness is a clear competitive advantage. It not only opens doors for institutional adoption but also provides peace of mind for investors wary of regulatory shakeups. As the global financial system continues to digitize, assets like XRP that prioritize compliance while delivering on performance are likely to find themselves on the right side of history—and regulation.

Challenges and future outlook for XRP compliance

While XRP has made significant strides in aligning with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, the road to full compliance and widespread institutional adoption is not without its hurdles. The evolving nature of global regulatory frameworks, geopolitical nuances, and the decentralized architecture of the XRP Ledger all present unique challenges that could shape the asset’s future trajectory.

One of the most pressing challenges is regulatory uncertainty, particularly in the United States. The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has cast a long shadow over XRP’s regulatory status. The SEC’s argument that XRP may be classified as a security has led to delistings from several major exchanges and has created hesitation among institutional investors. While recent court rulings have provided some clarity, the final outcome remains crucial for XRP’s long-term compliance outlook and market positioning.

Globally, regulatory fragmentation adds another layer of complexity. While jurisdictions like the European Union are moving toward comprehensive frameworks such as MiCA (Markets in Crypto-Assets), others lag behind or take a more punitive approach. This inconsistency can make it difficult for Ripple and XRP-integrated platforms to implement a unified compliance strategy. Cross-border payments—XRP’s core use case—require a harmonized regulatory environment to function at scale efficiently, and the current patchwork of rules undermines that potential.

Another challenge lies in the decentralized nature of the XRP Ledger. Unlike RippleNet, which is a controlled network with built-in compliance layers, the XRP Ledger is open-source and permissionless. This means that anyone can build applications or conduct transactions on the ledger without undergoing KYC or AML checks. While this decentralization is a feature, not a flaw, it can create friction with regulators who prefer tighter control over financial systems. The key will be for Ripple and its partners to continue developing tools and protocols that enable optional compliance features without compromising decentralization.

- Interoperability vs. compliance: As XRP aims to integrate with diverse payment systems and financial platforms, ensuring that each integration meets local compliance standards is a logistical and legal challenge.

- Technology adoption curve: While XRP is technologically advanced, not all financial institutions are ready to adopt blockchain-based solutions. Bridging this gap requires not just education but also robust compliance assurances.

- Data privacy laws: Compliance with AML and KYC often requires collecting and storing sensitive user data. Aligning these requirements with data privacy regulations like the GDPR can be a tightrope walk for service providers using XRP.

Despite these challenges, the future outlook for XRP compliance is promising, particularly as the global regulatory landscape begins to mature. Ripple has demonstrated a proactive approach by engaging with policymakers, participating in pilot programs with central banks, and investing in compliance infrastructure. These moves not only enhance XRP’s credibility but also position it as a bridge between traditional finance and the digital asset economy.

Looking ahead, the development of programmable compliance features could be a game-changer. Imagine smart contracts on the XRP Ledger that automatically enforce KYC protocols or restrict transactions based on jurisdictional rules. These innovations could make XRP even more attractive to regulated entities while preserving the efficiencies of blockchain technology.

Furthermore, the expanding use of Ripple’s On-Demand Liquidity (ODL) solution is a strong signal of market confidence. As more financial institutions leverage ODL to facilitate cross-border payments, the demand for compliant XRP infrastructure will naturally grow. This creates a positive feedback loop: greater adoption leads to more scrutiny, which in turn drives stronger compliance measures, enhancing institutional trust.

From an investor’s perspective, XRP’s commitment to compliance is a long-term value proposition. As regulators increasingly favor digital assets that are transparent, auditable, and secure, XRP is well-positioned to thrive. Its ability to operate within legal frameworks without sacrificing performance makes it a rare asset in a space often plagued by regulatory risk.

In the near term, key developments to watch include final rulings in the Ripple-SEC case, the rollout of global AML guidelines tailored to crypto, and the expansion of Ripple’s partnerships with regulated entities. Each of these milestones could significantly impact XRP’s compliance narrative and, by extension, its market valuation. For savvy investors, staying informed on these fronts isn’t just due diligence—it’s a strategic advantage.

Ultimately, the convergence of compliance and innovation will define the next chapter of XRP’s evolution. As the digital asset ecosystem matures, those projects that can navigate the regulatory labyrinth without losing their technical edge will lead the charge. XRP, with its dual commitment to performance and regulation, is poised to be one of those frontrunners.