Welcome to the fascinating world of XRP staking—a realm where digital assets not only reside in your wallet but also work for you, potentially earning XRP interest while you sip your morning coffee. As the witty and insightful owner of XRPAuthority.com, I’m here to peel back the layers of this intriguing aspect of the crypto universe. Are you tired of your XRP just sitting there, doing nothing but appreciating in value (hopefully)? What if I told you there’s a way to earn passive income simply by letting your XRP participate in the network? Yes, that’s right! Through mechanisms like validator rewards and crypto staking, your XRP can become a diligent little worker bee in the world of blockchain and finance.

Now, before you roll your eyes, thinking this is another too-good-to-be-true crypto promise, let’s delve into the mechanics of XRP staking. Unlike traditional staking models, XRP uses a unique consensus protocol that doesn’t require the typical “proof-of-stake” system. So, how does one earn XRP through staking if there’s no staking as we traditionally know it? Ah, that’s where the magic of validator rewards comes into play. Validators, the unsung heroes of the XRP Ledger, ensure transactions are processed smoothly, and they get their share of the pie for doing so.

But wait, you might be wondering, “Is becoming a validator the only way to earn XRP interest?” Not at all! While running a validator node can be as demanding as teaching a cat to fetch, there are other ways to engage with the network and earn passive income. Some platforms offer creative solutions that allow you to participate in XRP staking without the technical rigmarole. So whether you’re a tech-savvy enthusiast or someone who thinks ‘nodes’ are just bumps on a tree branch, there’s a place for you in the XRP staking ecosystem.

Why is XRP staking gaining traction in the crypto community, you ask? Beyond the allure of passive income, it underscores XRP’s pivotal role in the blockchain world. As a bridge currency designed for seamless cross-border transactions, XRP’s utility in finance and trading is unparalleled. With the ability to settle transactions in mere seconds and at a fraction of the cost of traditional methods, XRP is not just a digital asset; it’s a financial revolution in the making.

The beauty of XRP staking lies in its ability to democratize financial opportunities. Think of it as a financial buffet where everyone gets a taste of the rewards, not just the whales. By participating in the network, you’re not just earning XRP; you’re contributing to the security and efficiency of the entire ecosystem. It’s like being part of an exclusive club where you get paid to hang out and enjoy the benefits.

But let’s be real for a moment—like any investment, XRP staking comes with its risks. Market volatility, regulatory changes, and technical challenges can make the crypto waters a bit choppy. So, how does one navigate these treacherous seas without losing their ship (or sanity)? Knowledge, dear investor, is your compass. Understanding the ins and outs of XRP staking is crucial to maximizing your returns and minimizing risks.

At XRPAuthority.com, we pride ourselves on being your trusted navigator in this complex and ever-evolving landscape. With our finger on the pulse of the crypto world, we offer insights that are both deep and digestible, ensuring you stay ahead of the curve. So whether you’re an XRP aficionado or just dipping your toes into the crypto pool, our platform is your go-to source for all things XRP staking.

In conclusion, XRP staking is not just an investment strategy; it’s an invitation to be part of a financial revolution. As you contemplate your next move in the crypto space, let XRPAuthority.com be your guiding star. With humor, expertise, and a dash of wit, we equip you with the tools and insights needed to turn your XRP holdings into a thriving income stream. So why wait? Dive in and let your XRP start working for you today!

📌 Understanding XRP staking and Its Impact on XRP

XRP staking overview

XRP Staking Overview

In the ever-evolving landscape of crypto investing, staking has emerged as one of the most attractive methods for generating passive income. While coins like Ethereum and Cardano have long been associated with staking rewards, XRP — the native asset of the XRP Ledger — is making waves in the staking conversation as well. Although XRP does not natively support staking in the traditional proof-of-stake sense, innovative platforms and financial tools are enabling holders to earn XRP through mechanisms that resemble staking, offering a fresh avenue for generating yield in the digital asset space.

Before diving into how XRP staking works, it’s essential to understand XRP’s unique position in the crypto ecosystem. Unlike many other cryptocurrencies, XRP is not mined or staked in the conventional sense. Instead, all 100 billion XRP tokens were pre-mined at inception, with a significant portion held by Ripple Labs. This design has led to XRP’s incredibly fast transaction speeds and minimal fees — two features that make it a favorite for real-world applications, especially in cross-border payments and liquidity provisioning.

So why is everyone talking about XRP staking now? The answer lies in market innovation. As decentralized finance (DeFi) continues to reshape the crypto economy, platforms are finding new ways to integrate XRP into yield-generating activities. These include delegating XRP to liquidity pools, lending protocols, or participating in synthetic staking models where users can lock up their XRP and receive returns in the form of interest or validator rewards.

This emerging trend is not just about technical feasibility — it’s about meeting investor demand. With XRP consistently ranking among the top cryptocurrencies by market cap, there’s a growing appetite among holders to make their assets work for them. Whether you’re a long-term HODLer or an active trader, the chance to earn XRP while you sleep is undeniably appealing.

- Passive Income: XRP staking offers a potential stream of income without requiring constant market monitoring.

- Crypto Staking Evolution: Even though XRP doesn’t use a traditional PoS model, staking-like mechanisms are evolving to include it.

- Market Demand: The growing interest in XRP interest-bearing products is pushing platforms to innovate.

- Real-World Utility: XRP’s speed and scalability make it a prime candidate for staking integrations in financial ecosystems.

In this new landscape, XRP staking is becoming more than just a buzzword — it’s a strategic play for investors looking to diversify their passive income streams while staying aligned with one of the most widely adopted digital assets in the world. With the right platform and a strong understanding of the mechanisms involved, XRP holders are now in a position to earn XRP in ways that were virtually impossible just a few years ago.

How XRP staking works

How XRP Staking Works

Unlike traditional proof-of-stake (PoS) networks like Ethereum or Tezos, XRP operates on a consensus algorithm known as the XRP Ledger Consensus Protocol. This means there are no validators competing for block rewards through staking in the conventional sense. So, when we talk about “XRP staking,” we’re really referring to a suite of creative, staking-like mechanisms that allow investors to earn XRP interest or validator rewards by locking up their tokens in yield-generating protocols.

Here’s how it all comes together. Rather than relying on a native staking mechanism, XRP staking typically involves third-party platforms or DeFi ecosystems that offer interest-bearing products. These platforms use your XRP to provide liquidity, facilitate lending, or engage in yield farming strategies, and in return, you receive a share of the profits—effectively mimicking the rewards of traditional crypto staking.

- Delegated Staking Models: Some platforms have introduced delegated staking-like systems where users lock their XRP into a smart contract or custodial pool. The platform then uses these pooled assets to support ecosystem functions, such as liquidity provision or validator operations on other chains, and distributes earnings proportionally.

- Lending Protocols: Through centralized or decentralized lending platforms, XRP holders can lend their tokens to borrowers. In return, lenders receive interest payments in XRP or stablecoins, creating a passive income stream without giving up ownership of their assets.

- Liquidity Pools: On DeFi platforms that support XRP or wrapped XRP (wXRP), users can contribute to liquidity pools. These pools enable trading pairs and, in return, liquidity providers earn a share of the transaction fees and potential yield farming incentives.

- Staking-as-a-Service: Some custodial exchanges and fintech platforms offer XRP staking as a packaged service. Behind the scenes, these providers often utilize lending, liquidity provisioning, or synthetic asset strategies to generate returns, passing a portion of the profits back to users as validator rewards or XRP interest.

This hybrid approach to staking means that XRP holders can tap into passive income opportunities without waiting for the XRP Ledger to implement a native staking protocol—something that’s not on the roadmap at this time. Instead, innovation comes from the outside, with fintech platforms and DeFi protocols bridging the gap between XRP’s unique architecture and the broader staking economy.

The process is generally straightforward for users. You choose a platform that supports XRP staking, deposit your tokens, and begin earning yield. Some platforms offer flexible terms with instant withdrawals, while others may lock your XRP for a fixed period to maximize returns. In either case, it’s essential to understand the underlying mechanism—whether it’s lending, liquidity provision, or a synthetic staking model—to evaluate the risk-reward profile effectively.

Security and trust are also critical components. Because XRP staking relies on third-party platforms, due diligence is non-negotiable. Look for platforms with transparent operations, robust security protocols, and a proven track record of managing user funds responsibly. While the potential to earn XRP passively is exciting, it’s important to balance enthusiasm with caution, especially in a rapidly evolving market.

With institutional interest in XRP growing and new staking-adjacent tools entering the market, the infrastructure for earning XRP through staking-like methods is becoming increasingly sophisticated. Whether you’re looking to earn XRP through lending platforms, liquidity pools, or synthetic staking models, the opportunities are expanding—offering a compelling way to grow your crypto portfolio without actively trading.

Ultimately, XRP staking represents a fusion of innovation and investor demand. It leverages XRP’s speed, scalability, and market liquidity to unlock new forms of passive income, making it an attractive option for crypto investors who want to earn XRP while staying ahead of the curve.

Benefits and risks of XRP staking

Benefits and Risks of XRP Staking

As XRP staking gains momentum among crypto investors, understanding the balance between its potential rewards and inherent risks is essential. Like any investment strategy, staking XRP can be a powerful tool for generating passive income, but it’s not without its caveats. Whether you’re seeking to earn XRP through interest-bearing protocols or exploring validator rewards via synthetic staking models, a well-informed approach is crucial to maximizing gains while managing exposure.

Key Benefits of Staking XRP

Let’s start with the good news—staking XRP can be an excellent way to make your crypto assets work for you, especially if you’re planning to hold your tokens long term. Here are the standout advantages:

- Passive Income Potential: One of the most appealing aspects of XRP staking is the ability to generate consistent, hands-off earnings. By locking your XRP into a staking-enabled platform, you can earn XRP interest over time without lifting a finger.

- High Liquidity and Fast Settlements: Thanks to XRP’s near-instant settlement times and low transaction fees, many staking platforms can offer flexible terms, including quick withdrawals and low slippage—ideal for investors who value liquidity.

- Portfolio Diversification: Including staking strategies in your investment mix provides a non-correlated income stream, which can help stabilize returns, especially during market downturns when price appreciation may be limited.

- Compounding Opportunities: Some platforms allow you to reinvest your staking rewards automatically, enabling compounding returns that can significantly enhance your yield over time.

- DeFi Integration: As more DeFi platforms incorporate XRP and wrapped XRP (wXRP), opportunities to earn validator rewards and participate in liquidity mining are expanding—bringing XRP staking closer to the functionality of native PoS assets.

Risks and Considerations

Of course, no reward comes without risk. While XRP staking offers many advantages, it’s vital to navigate the landscape with a clear understanding of what could go wrong. Here are the key risks to consider:

- Platform Risk: XRP staking typically involves third-party platforms, which means your funds are only as safe as the platform’s security infrastructure. Hacks, mismanagement, or insolvency could lead to partial or total loss of funds.

- Regulatory Uncertainty: XRP’s legal status has been under scrutiny, particularly in the U.S. While recent developments have been favorable for Ripple, regulatory shifts could impact the availability or legality of XRP staking services in certain jurisdictions.

- Lack of Native Support: Because XRP doesn’t have a built-in staking mechanism, all staking-like activities are essentially workarounds. This adds a layer of complexity and reliance on external systems that may not be as robust or transparent as native staking protocols.

- Token Lock-Up Periods: Some staking platforms require your XRP to be locked for a predetermined period. During this time, you may be unable to access your tokens, which can be risky in volatile market conditions.

- Yield Volatility: Unlike fixed-interest products, staking rewards can fluctuate based on market demand, protocol performance, and liquidity conditions. Your expected returns today might not hold tomorrow.

Investor Insights: Weighing the Trade-Offs

So, is XRP staking worth it? That depends on your investment goals, risk tolerance, and time horizon. For long-term holders, XRP staking offers a compelling way to earn XRP without selling the asset. It turns a dormant investment into a yield-generating tool—an enticing prospect in any market climate.

However, savvy investors know that not all staking platforms are created equal. Conducting due diligence—checking for platform transparency, smart contract audits, insurance coverage, and user reviews—can go a long way in mitigating risk. Tools like non-custodial staking solutions or platforms that offer flexible withdrawal options can also align better with risk-averse strategies.

It’s also worth considering the macro landscape. As XRP continues to gain traction in institutional finance and RippleNet expands its global footprint, the demand for XRP-based financial products—staking included—is expected to rise. This could lead to more competitive yields and broader platform support, further enhancing the attractiveness of XRP as a passive income vehicle.

Ultimately, XRP staking is a strategic tool in the modern crypto investor’s toolkit. By understanding both the upside and the downside, you can position yourself to seize the benefits while minimizing potential pitfalls—earning XRP and building wealth in a way that aligns with the future of decentralized finance.

Platforms supporting XRP staking

Platforms Supporting XRP Staking

As XRP staking continues to evolve from a niche concept to a viable investment strategy, several platforms have stepped up to offer mechanisms that allow XRP holders to earn passive income. These platforms vary in structure, risk profile, and reward potential, but they all aim to bridge the gap between XRP’s unique consensus model and the broader world of crypto staking. Whether you’re looking to earn XRP interest through lending, tap into validator rewards via synthetic models, or provide liquidity in DeFi ecosystems, choosing the right platform is crucial.

Below is a breakdown of some of the most prominent platforms currently supporting XRP staking-like services. Each comes with its own features, benefits, and considerations — and understanding these nuances can help you maximize your returns while managing risk effectively.

- Binance: As one of the largest and most trusted centralized exchanges in the world, Binance offers XRP holders the ability to earn yield through its Flexible Savings and Earn programs. While not staking in the traditional sense, these services allow users to deposit XRP and earn interest over time. The platform occasionally features promotional APRs, making it an attractive short-term passive income option for XRP holders.

- Nexo: Nexo is a leading crypto lending platform that allows users to earn XRP interest by depositing their tokens into interest-bearing accounts. The platform offers daily payouts and varying interest rates depending on whether you choose flexible or fixed-term options. With the added benefit of asset insurance and a user-friendly interface, Nexo is a popular choice for investors seeking passive income with low friction.

- Uphold: Known for its seamless fiat-to-crypto conversions and transparency, Uphold has ventured into staking-like offerings for XRP. While not a pure staking platform, Uphold allows users to earn rewards on XRP through its Earn program, which utilizes lending and liquidity provisioning strategies behind the scenes. It’s a solid option for users looking to earn XRP without diving deep into DeFi protocols.

- Gate.io: This exchange offers a variety of staking and yield farming products, including support for XRP via its HODL & Earn program. Users can lock their XRP for fixed terms and receive interest-based rewards. Gate.io also occasionally features XRP in its liquidity mining campaigns, which offer higher returns but come with increased risk.

- Bitrue Power Piggy: Bitrue has carved out a niche in the XRP ecosystem with its Power Piggy program. This feature allows users to earn daily interest on XRP deposits with no lock-up period, making it highly flexible. Bitrue is particularly XRP-friendly, often featuring XRP in promotions and offering higher-than-average yields for XRP holders.

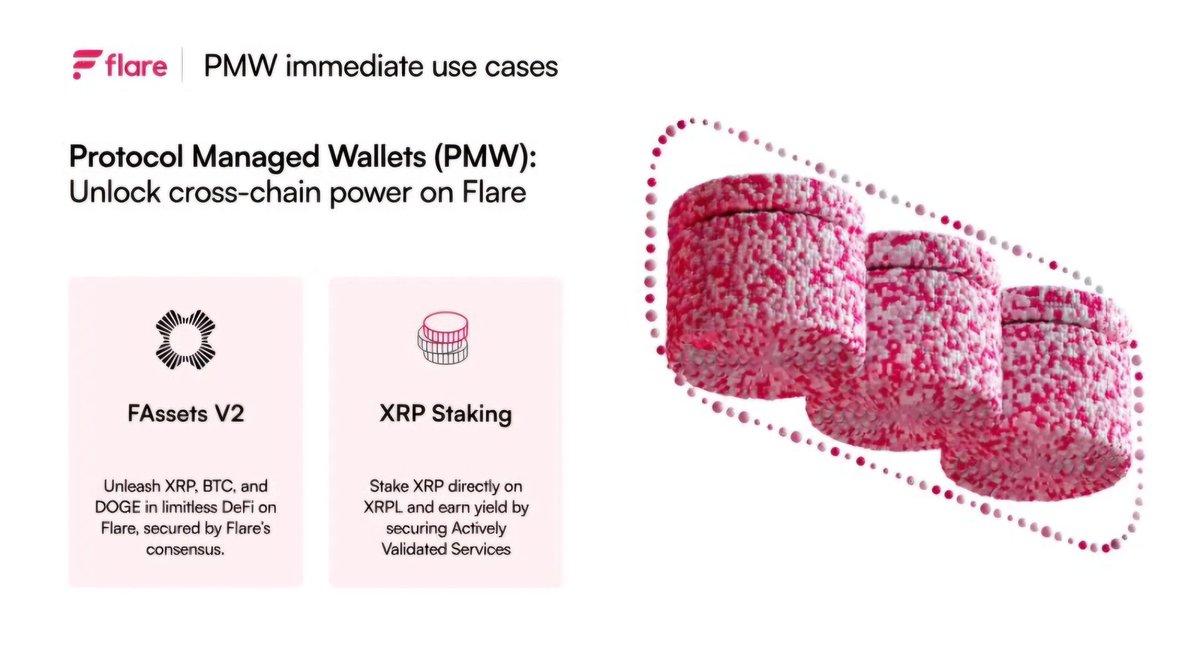

- Flare Network (via Wrapped XRP): For those willing to explore cross-chain opportunities, Flare Network offers a more DeFi-native approach. By wrapping XRP into FXRP or wXRP, users can participate in staking and yield farming on the Flare ecosystem. This opens up access to DeFi protocols such as liquidity pools, synthetic assets, and decentralized lending—all of which can generate validator rewards and XRP interest over time.

Each of these platforms offers a unique route to earning passive income with XRP, but they also come with their own sets of trade-offs. For example, centralized platforms like Binance and Nexo provide ease of use and customer support but may require users to relinquish custody of their assets. On the other hand, DeFi platforms like Flare Network offer greater control and higher yields, but they also demand a deeper understanding of smart contracts, token wrapping, and on-chain risk.

When choosing a platform, investors should consider several key factors:

- Yield Rates: Compare APRs across platforms, but remember that higher yields often come with higher risks.

- Custody and Control: Decide whether you’re comfortable with custodial platforms or prefer non-custodial options that let you retain control of your private keys.

- Security: Look for platforms with a strong security track record, insurance coverage, and transparent operations.

- Flexibility: Consider lock-up periods, withdrawal rules, and whether the platform allows compounding of earned XRP interest.

- Regulatory Compliance: Ensure the platform operates within your jurisdiction and complies with relevant laws to avoid future disruptions.

As institutional adoption of XRP continues to grow — particularly with Ripple’s expanding footprint in global payments — it’s likely that more platforms will begin offering XRP staking or staking-like services. This bodes well for long-term holders who are looking to diversify their crypto staking strategies and unlock new streams of passive income.

In this dynamic environment, staying informed is your best asset. Monitor platform updates, yield fluctuations, and emerging protocols that support XRP. The more agile and informed you are, the better positioned you’ll be to capitalize on the evolving landscape of XRP staking — and earn XRP while riding the next wave of crypto innovation.