Welcome to the thrilling world of XRP price prediction, where the only thing more exciting than the markets themselves is the chance to outsmart them. As cryptocurrency enthusiasts, we’ve all asked ourselves at some point: “Is XRP going to the moon, or am I just dreaming on a decentralized cloud?” Well, buckle up, because at XRPAuthority.com, we’ve been riding the crypto rollercoaster since 2011, and we’re here to explore XRP’s trajectory for 2025 and beyond with a blend of technical savvy and a dash of humor—because who said finance can’t be fun?

XRP, Ripple’s native token, isn’t just another digital asset; it’s the bridge currency that aims to revolutionize cross-border transactions. Imagine a world where international transfers happen as swiftly as sending a text message. Intrigued? You should be. But predicting its price isn’t as simple as wishing on a blockchain star. It involves a careful blend of market trends, technical analysis, and a sprinkle of expert insights, all of which we’ll dive into without needing a PhD in cryptography.

Now, you might be wondering, “Can’t I just ask my magic 8-ball for the future price of XRP?” Tempting as it may be, our approach involves a bit more substance. We’ll explore how market trends, such as increased adoption, regulatory developments, and technological advancements, play a pivotal role in shaping XRP’s future. After all, in the world of finance, knowledge is power—and we’re here to empower you.

Let’s not forget the technical analysis. If charts and graphs make you feel like you’re deciphering an alien language, fear not! We’ll break down complex patterns and indicators into digestible insights that even your grandma could appreciate. Understanding these can provide valuable clues about XRP’s potential movements, much like Sherlock Holmes deciphering a cryptic clue—minus the deerstalker hat.

Of course, no prediction would be complete without the insights of industry experts who live and breathe blockchain technology. With their crystal balls—erm, I mean, analytical prowess—they provide a unique perspective on XRP’s potential growth. Can they predict the future with absolute certainty? Not quite, but their insights are invaluable in painting a clearer picture of what’s to come.

In the grand tapestry of blockchain, finance, and trading, XRP stands out like a bold brushstroke. Its relevance transcends mere speculation, offering real-world utility that could reshape the financial landscape. Whether you’re a seasoned trader or a curious newcomer, understanding XRP’s potential is crucial for navigating the ever-evolving crypto seas.

So, where does XRPAuthority.com fit into all of this? As your trusted guide in the crypto wilderness, we’re committed to delivering not only accurate XRP price predictions but also the insights, humor, and expertise you need to make informed decisions. Think of us as the Gandalf of the crypto world, leading you to the treasures of Middle-earth—only with fewer orcs and more blockchain.

In conclusion, as XRP continues its journey through the intricate web of global finance, you can count on XRPAuthority.com to be your lighthouse in the storm. With a blend of technical depth and a touch of humor, we’re here to ensure you’re not just riding the crypto wave but surfing it with style. Whether you’re in it for the long haul or just enjoying the ride, our insights will keep you informed, engaged, and perhaps even entertained.

📌 Understanding XRP Price Prediction for 2025 and Beyond and Its Impact on XRP

Market trends influencing xrp’s future

Market Trends Influencing XRP’s Future

As we look ahead to XRP’s price trajectory in 2025 and beyond, it’s essential to analyze the key market trends shaping its future. XRP has long been a staple in the cryptocurrency world, known for its unique focus on fast, low-cost cross-border payments. However, its price movements are influenced by a mix of regulatory developments, institutional adoption, macroeconomic factors, and broader crypto market trends. Let’s break down the most critical elements that could impact XRP’s price in the coming years.

Regulatory Developments and Their Impact

Perhaps the most significant factor affecting XRP’s future is regulatory clarity. Ripple, the company behind XRP, has been embroiled in a legal battle with the U.S. Securities and Exchange Commission (SEC) over whether XRP should be classified as a security. Any favorable ruling or settlement in this case could trigger a bullish breakout for XRP, as it would remove a major source of uncertainty that has hindered institutional adoption.

Beyond the SEC case, global regulatory frameworks are evolving. Countries such as the United Arab Emirates, Singapore, and Japan have taken a more welcoming stance toward Ripple’s technology, leading to increased adoption in cross-border payment solutions. If the U.S. and other major economies provide clearer guidelines supporting digital assets like XRP, this could lead to a surge in investor confidence and higher trading volumes.

Institutional Adoption and Utility

Unlike many cryptocurrencies that primarily serve as speculative assets, XRP has a strong use case in financial transactions. Ripple’s RippleNet and On-Demand Liquidity (ODL) solutions leverage XRP to facilitate instant international payments with minimal fees. Major financial institutions and payment providers, including Santander, SBI Holdings, and Tranglo, are already integrating Ripple’s technology into their operations.

As traditional finance continues to explore blockchain-based solutions, XRP could see increased adoption, leading to higher demand and upward price momentum. If more banks and financial institutions integrate XRP for cross-border payments, this could significantly impact its valuation, pushing it past key resistance levels.

Broader Crypto Market Trends

Like all cryptocurrencies, XRP is influenced by macro trends in the digital asset space. The overall market cycle—whether bullish or bearish—plays a crucial role in determining XRP’s price movement. Historically, XRP has surged during crypto market bull runs, often following Bitcoin’s lead.

Key trends to watch include:

- Bitcoin’s Performance: As the leading cryptocurrency, Bitcoin often dictates the overall market sentiment. A strong Bitcoin rally typically leads to capital flowing into altcoins like XRP.

- DeFi and CBDC Growth: The rise of decentralized finance (DeFi) and central bank digital currencies (CBDCs) could create new opportunities for XRP, given its focus on efficient payments.

- Stablecoin and Liquidity Partnerships: XRP’s liquidity solutions could benefit from the increasing use of stablecoins for international settlements, further solidifying its role in the crypto ecosystem.

Market Sentiment and Trading Signals

Another factor to consider is market sentiment, which is often driven by news, social media trends, and investor speculation. Positive developments, such as new partnerships, exchange listings, or successful regulatory outcomes, often lead to price surges. Conversely, negative news—such as legal setbacks or broader market downturns—can trigger sell-offs.

Technical indicators and trading signals also play a role in XRP’s price movements. Traders often watch for breakout patterns, resistance levels, and moving averages to determine potential entry and exit points. If XRP can break through key resistance levels and maintain strong support zones, it could attract more traders and investors, leading to sustained price growth.

Looking Ahead

With regulatory clarity on the horizon, increasing institutional adoption, and strong real-world utility, XRP is well-positioned to capitalize on the evolving crypto landscape. However, market volatility remains a constant factor, making it crucial for investors to stay informed and adapt to changing conditions.

Technical analysis and price projections

Technical Analysis and Price Projections

XRP’s price trajectory has historically been influenced by a mix of technical patterns, market sentiment, and macroeconomic factors. As we look toward 2025 and beyond, analyzing XRP’s historical price movements and current market structure can provide valuable insights into potential future price levels. Let’s dive into the key technical indicators, support and resistance levels, and expert price forecasts to understand where XRP might be headed.

Historical Price Patterns and Market Cycles

Historically, XRP has followed a cyclical pattern, closely mirroring Bitcoin’s market movements while also experiencing unique price surges driven by fundamental developments. Looking back at previous bull cycles, XRP has shown the ability to generate exponential gains when market conditions align favorably.

- 2017 Bull Run: XRP surged from under [gpt_article topic=XRP Price Prediction for 2025 and Beyond directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP Price Prediction for 2025 and Beyond for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use price forecast, crypto market, bullish breakout, trading signals, resistance levels and Forecasting XRP’s price based on market trends, technical analysis, and expert insights. to enrich the content.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].01 to an all-time high of around .84 in early 2018, largely driven by retail speculation and Ripple’s growing partnerships.

- 2021 Rally: XRP reached a high of approximately .96 amid the broader crypto market boom, despite regulatory challenges from the SEC lawsuit.

- Bear Market Resilience: Unlike some altcoins that faded into obscurity, XRP has maintained a strong presence in the top-ranked cryptocurrencies, suggesting continued investor confidence.

Given these historical movements, XRP’s next major rally could be influenced by a combination of regulatory clarity, institutional demand, and broader market cycles.

Key Support and Resistance Levels

Technical traders closely monitor support and resistance levels to gauge potential breakout points for XRP. As of recent price action, the following levels are crucial:

- Support Levels: XRP has shown strong support around the [gpt_article topic=XRP Price Prediction for 2025 and Beyond directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP Price Prediction for 2025 and Beyond for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use price forecast, crypto market, bullish breakout, trading signals, resistance levels and Forecasting XRP’s price based on market trends, technical analysis, and expert insights. to enrich the content.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].40-[gpt_article topic=XRP Price Prediction for 2025 and Beyond directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP Price Prediction for 2025 and Beyond for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use price forecast, crypto market, bullish breakout, trading signals, resistance levels and Forecasting XRP’s price based on market trends, technical analysis, and expert insights. to enrich the content.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 range, which has historically acted as a buying zone for long-term investors.

- Resistance Levels: The [gpt_article topic=XRP Price Prediction for 2025 and Beyond directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP Price Prediction for 2025 and Beyond for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use price forecast, crypto market, bullish breakout, trading signals, resistance levels and Forecasting XRP’s price based on market trends, technical analysis, and expert insights. to enrich the content.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].85-.00 range remains a key resistance area. A breakout above this level could signal a new bullish trend.

- Psychological Barriers: The .00 and .00 marks are psychological resistance levels that could trigger FOMO-driven buying if surpassed.

If XRP can maintain strong support and break through these key resistance zones, it could set the stage for a significant price appreciation.

Technical Indicators and Trading Signals

Several technical indicators provide insights into XRP’s potential price direction:

- Moving Averages: The 50-day and 200-day moving averages are critical in determining whether XRP is in a bullish or bearish phase. A golden cross (when the 50-day MA crosses above the 200-day MA) would indicate a bullish breakout.

- Relative Strength Index (RSI): XRP’s RSI levels help gauge whether the asset is overbought or oversold. An RSI above 70 suggests overbought conditions, while below 30 indicates potential buying opportunities.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover could signal upward momentum, while a bearish crossover may indicate a pullback.

Traders and investors should watch for these signals closely to identify potential entry and exit points.

XRP Price Forecast for 2025 and Beyond

Predicting the exact price of XRP in the future is challenging, but various analysts and forecasting models provide insightful projections. Based on historical trends, adoption rates, and market sentiment, here are some potential price scenarios:

- Conservative Estimate: In a scenario where XRP maintains steady adoption but faces regulatory hurdles, a price range of .50-.50 by 2025 is plausible.

- Bullish Scenario: If Ripple secures favorable regulatory clarity and expands its financial partnerships, XRP could surpass its previous all-time high, reaching -.

- Ultra-Bullish Scenario: In the event of mass institutional adoption and a full-fledged crypto bull market, some analysts speculate XRP could reach or higher.

These projections depend on multiple factors, including market conditions, technological advancements, and macroeconomic trends.

Will XRP Experience a Bullish Breakout?

Given XRP’s strong fundamentals and increasing institutional adoption, the potential for a bullish breakout remains high. If XRP can break above the .00 resistance level and sustain momentum, it could trigger a rally toward higher price targets.

However, investors should remain cautious of external risks, including regulatory developments and broader market corrections. Staying informed and utilizing technical analysis tools can help traders make well-timed decisions.

While no price prediction is guaranteed, XRP’s historical resilience and growing real-world use cases suggest a promising future for the asset. For investors and traders alike, XRP remains a cryptocurrency worth watching as we move toward 2025 and beyond.

Expert opinions and industry insights

Expert Opinions and Industry Insights

When it comes to predicting XRP’s price trajectory for 2025 and beyond, expert opinions and industry insights play a crucial role. Leading analysts, institutional investors, and blockchain insiders provide valuable perspectives on XRP’s potential based on market trends, adoption rates, and regulatory clarity. By examining these viewpoints, we can gain a clearer understanding of XRP’s future price movements and investment prospects.

What Crypto Analysts Say About XRP’s Future

Crypto market analysts closely track XRP’s price movements, using both technical and fundamental analysis to forecast its future value. Many experts believe that XRP has strong upside potential, especially if Ripple secures more strategic partnerships and regulatory clarity.

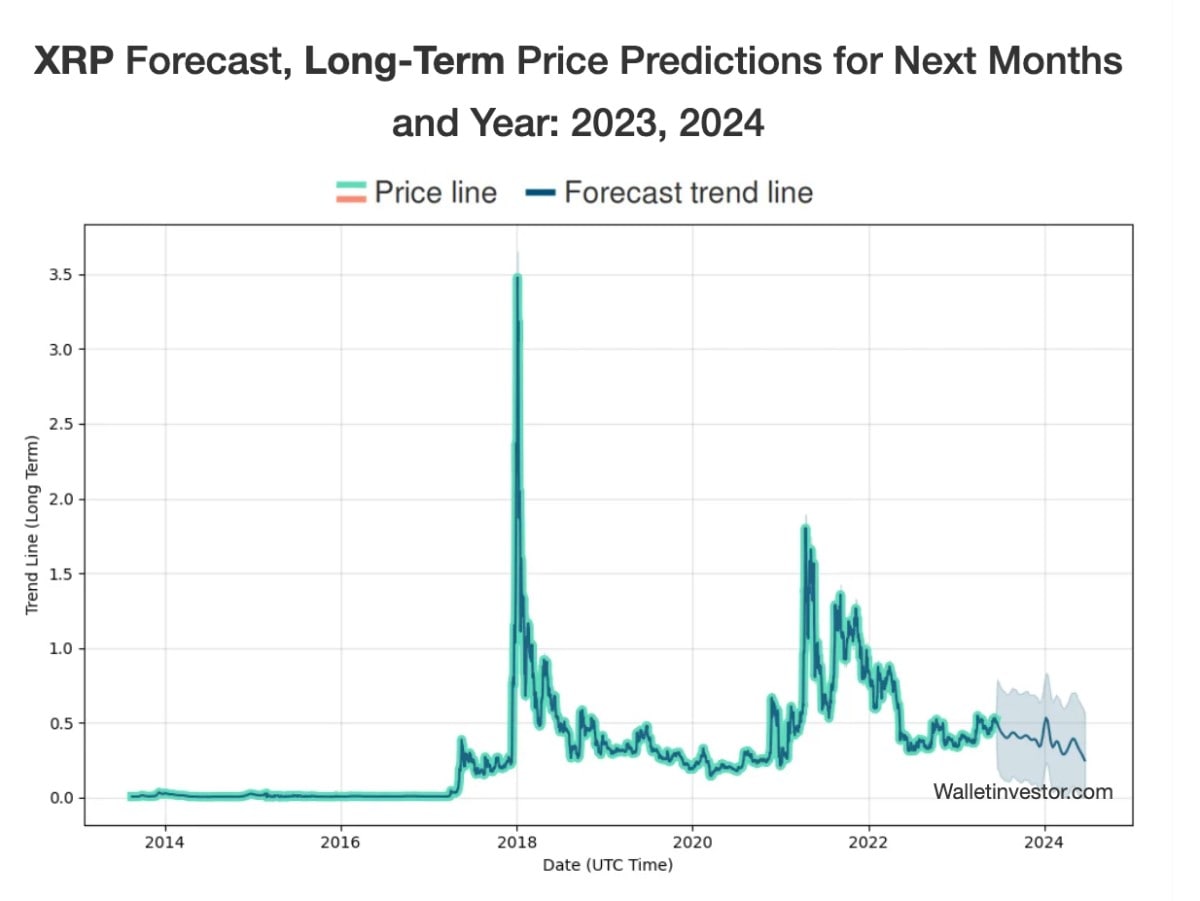

- WalletInvestor: This forecasting platform predicts that XRP could see moderate growth in the coming years, with a potential price range of .50 to .00 by 2025, assuming a steady adoption rate.

- CryptoBull: A well-known crypto analyst, CryptoBull, has suggested that XRP could rally past its previous all-time high of .84 if it breaks through key resistance levels and gains further institutional adoption.

- TradingView Analysts: Many traders on TradingView highlight XRP’s strong support zones and potential for a breakout. If XRP can close above the .00-.20 range, they anticipate a bullish trend that could drive its price toward .00.

While these predictions vary, most experts agree that XRP’s price largely depends on regulatory outcomes, broader crypto market trends, and increased adoption in the financial sector.

Institutional Interest and Adoption

One of XRP’s biggest advantages is its growing adoption among financial institutions. Unlike many cryptocurrencies that primarily serve as speculative assets, XRP has a clear use case in facilitating cross-border payments and improving liquidity.

- Ripple’s Expanding Partnerships: Ripple has already partnered with major financial institutions, including Santander, SBI Holdings, and Tranglo. These collaborations strengthen XRP’s utility and increase its demand.

- Central Bank Digital Currencies (CBDCs): Ripple has been actively working with central banks on digital currency initiatives. If XRP plays a role in CBDC interoperability, it could see a surge in institutional adoption.

- On-Demand Liquidity (ODL): Ripple’s ODL solution, which uses XRP to facilitate instant cross-border transactions, continues to gain traction. More banks and payment providers integrating ODL could drive XRP’s price higher.

With financial institutions increasingly embracing blockchain-based solutions, XRP is well-positioned to benefit from this trend, potentially leading to a sustained price increase.

Regulatory Clarity and Its Impact

Perhaps the most significant factor influencing XRP’s future is regulatory clarity. Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has been a major source of uncertainty. However, recent developments suggest that a resolution could be on the horizon.

- SEC Lawsuit Resolution: If Ripple secures a favorable ruling, it could remove a major barrier to XRP’s adoption in the U.S. market, leading to increased investor confidence and a potential price surge.

- Global Regulations: Outside the U.S., XRP has received regulatory approval in countries like Japan and the UAE. If more jurisdictions provide clear guidelines for XRP’s use, it could enhance its adoption and market value.

- Institutional Confidence: Many institutional investors have been hesitant to engage with XRP due to regulatory concerns. A positive legal outcome could attract significant institutional capital, driving XRP’s price higher.

Regulatory clarity remains a key catalyst for XRP’s future growth, and investors should closely monitor developments in this area.

Industry Leaders’ Perspectives on XRP

Beyond analysts and traders, prominent figures in the blockchain and financial sectors have weighed in on XRP’s potential.

- Brad Garlinghouse (Ripple CEO): Garlinghouse has consistently emphasized Ripple’s commitment to revolutionizing cross-border payments. He believes that XRP’s utility will drive long-term value and adoption.

- David Schwartz (Ripple CTO): Schwartz has highlighted XRP’s efficiency and scalability, noting that its ledger is designed for high-speed, low-cost transactions—making it an ideal asset for financial institutions.

- Michael Arrington (TechCrunch Founder): Arrington, who launched a 0 million XRP-based hedge fund, has expressed confidence in XRP’s ability to transform global finance.

These endorsements from industry leaders reinforce XRP’s potential as a leading digital asset with real-world utility.

Potential Catalysts for a Bullish Breakout

Several factors could trigger a significant price breakout for XRP in the coming years:

- Successful SEC Settlement: A favorable legal outcome could remove regulatory barriers, allowing XRP to be relisted on major exchanges and attracting institutional investors.

- New Banking Partnerships: If Ripple secures additional partnerships with major banks and payment providers, it could drive demand for XRP and push its price higher.

- Crypto Market Boom: A broader crypto bull market, led by Bitcoin and Ethereum, could create favorable conditions for XRP to rally past key resistance levels.

- Increased Utility in DeFi and CBDCs: XRP’s integration into decentralized finance (DeFi) platforms and central bank digital currency (CBDC) projects could further enhance its value proposition.

While XRP’s price movements are subject to market volatility, these catalysts indicate strong growth potential in the coming years.

Final Thoughts from Experts

Despite ongoing regulatory challenges, most experts agree that XRP has significant upside potential due to its strong fundamentals and real-world use cases. If Ripple continues expanding its financial partnerships and regulatory clarity improves, XRP could see substantial price appreciation in the next few years.

For investors looking to capitalize on XRP’s potential, staying informed about regulatory developments, institutional adoption, and market trends is crucial. While risks remain, XRP’s unique position in the financial ecosystem makes it a digital asset worth watching in 2025 and beyond.

Risks and opportunities for investors

Risks and Opportunities for Investors

Investing in XRP, like any cryptocurrency, comes with its fair share of risks and opportunities. While XRP’s strong fundamentals, institutional adoption, and real-world use cases position it as a promising digital asset, market volatility, regulatory challenges, and competition could impact its growth. Let’s explore the key risks and opportunities that investors should consider when evaluating XRP’s potential for 2025 and beyond.

Potential Risks Associated with XRP Investment

Despite its advantages, XRP is not without risks. Investors need to be aware of the following factors that could influence its price and adoption:

- Regulatory Uncertainty: One of the biggest risks XRP faces is ongoing regulatory scrutiny. The legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has created uncertainty. While a favorable resolution could boost XRP’s price, an unfavorable outcome may lead to delistings, reduced institutional interest, and price declines.

- Market Volatility: Like all cryptocurrencies, XRP is subject to significant price swings. Crypto markets are highly speculative, and sudden changes in investor sentiment, global economic conditions, or macroeconomic factors can lead to sharp price fluctuations.

- Competition from Other Payment Solutions: XRP’s primary use case revolves around cross-border payments, but it faces competition from other blockchain-based solutions such as Stellar (XLM), traditional payment networks like SWIFT, and emerging central bank digital currencies (CBDCs). If Ripple fails to maintain its competitive edge, XRP’s adoption could be affected.

- Dependence on Ripple’s Success: While XRP operates on a decentralized ledger, its adoption is closely tied to Ripple’s success. If Ripple faces financial difficulties, legal challenges, or strategic setbacks, it could negatively impact XRP’s price and market perception.

- Liquidity and Exchange Risks: XRP’s availability on exchanges has been affected by regulatory concerns, with some platforms delisting it following the SEC lawsuit. If major exchanges continue to limit XRP trading, it could reduce liquidity and hinder price growth.

Opportunities for XRP Investors

Despite these risks, XRP presents significant opportunities that could drive long-term value appreciation. Here are some key factors that could contribute to XRP’s growth:

- Regulatory Clarity and Institutional Adoption: If Ripple secures a favorable regulatory outcome, it could pave the way for greater institutional adoption. Banks, remittance companies, and financial institutions may be more willing to integrate XRP into their payment systems, driving demand and price appreciation.

- Expansion of On-Demand Liquidity (ODL): Ripple’s On-Demand Liquidity (ODL) solution, which utilizes XRP for cross-border payments, is already being used by several financial institutions. As more companies adopt ODL, XRP’s utility will increase, potentially leading to higher demand and price growth.

- Potential for a Bullish Breakout: XRP has historically experienced strong price surges during crypto bull markets. If Bitcoin and the broader crypto market enter another bullish phase, XRP could follow suit, breaking through key resistance levels and reaching new highs.

- Partnerships with Financial Institutions: Ripple continues to form partnerships with banks and payment providers worldwide. If more prominent financial players integrate XRP into their operations, it could significantly boost its credibility and market value.

- Integration with CBDCs and DeFi: As central banks explore digital currencies, Ripple’s technology could play a role in CBDC interoperability. Additionally, XRP’s integration into decentralized finance (DeFi) platforms could open new use cases and increase adoption.

Key Considerations for XRP Investors

For investors looking to capitalize on XRP’s potential, it’s essential to adopt a strategic approach. Here are some practical tips:

- Stay Informed on Regulatory Developments: The outcome of Ripple’s legal battles will have a significant impact on XRP’s price. Keeping track of regulatory news and developments can help investors make informed decisions.

- Monitor Technical Indicators: Watching key trading signals, such as moving averages, resistance levels, and RSI (Relative Strength Index), can help investors identify potential entry and exit points.

- Diversify Your Portfolio: While XRP has strong potential, diversification is key to managing risk. Investing in a mix of cryptocurrencies and traditional assets can help mitigate potential losses.

- Adopt a Long-Term Perspective: Given XRP’s volatility, short-term price swings are inevitable. Investors who believe in its long-term potential should consider a holding strategy rather than reacting to market fluctuations.

- Use Risk Management Strategies: Setting stop-loss orders and allocating only a portion of your portfolio to XRP can help minimize risk exposure.

Final Thoughts on XRP’s Investment Potential

XRP remains one of the most intriguing digital assets in the cryptocurrency space, offering both risks and opportunities for investors. While regulatory challenges and market volatility pose hurdles, XRP’s strong utility in cross-border payments, expanding institutional adoption, and potential bullish breakout make it a compelling investment option.

As we approach 2025 and beyond, XRP’s future will largely depend on regulatory clarity, broader market trends, and its ability to maintain a competitive edge in the financial industry. Investors who stay informed, manage risks effectively, and adopt a long-term perspective may find significant opportunities in XRP’s evolving landscape.

💡 Frequently Asked Questions (FAQs) About XRP Price Prediction for 2025 and Beyond

Frequently Asked Questions about XRP Price Prediction for 2025 and Beyond

XRP’s future price is a topic of much speculation and interest. Below, we answer some common questions related to XRP’s price prediction based on market trends, technical analysis, and expert insights.

1. What factors influence XRP’s price predictions for 2025 and beyond?

XRP’s price is influenced by multiple factors, including:

- Market Trends: Broader cryptocurrency market trends, including Bitcoin’s price movements and regulatory developments, can impact XRP’s price.

- Technical Analysis: Chart patterns, trading volumes, and historical price data are used to predict future price movements.

- Regulatory Environment: Regulatory clarity and developments, especially regarding Ripple Labs’ ongoing legal battles, are crucial.

- Adoption and Use Cases: Increased adoption of Ripple’s technology for cross-border payments can boost XRP’s value.

2. How does technical analysis help in predicting XRP’s future price?

Technical analysis involves studying price charts and trading volumes to identify trends and potential price movements. Key tools include:

- Moving Averages: Identifying trends by smoothing out price data over time.

- Relative Strength Index (RSI): Measuring momentum to assess whether an asset is overbought or oversold.

- Support and Resistance Levels: Key price levels where XRP is likely to encounter buying or selling pressure.

3. What do experts predict for XRP’s price by 2025?

Expert predictions for XRP’s price by 2025 vary, but several analysts suggest potential growth due to:

- Increased Adoption: Ripple’s efforts to expand its payment solutions could enhance XRP’s utility and demand.

- Partnerships: Collaborations with financial institutions may bolster XRP’s credibility and use.

- Market Recovery: A bullish crypto market could positively impact XRP’s price trajectory.

4. How might XRP’s use cases affect its price in the future?

XRP’s use cases, particularly in the realm of cross-border payments, could significantly influence its price. Key points include:

- Cost Efficiency: XRP offers fast and low-cost transactions, which can drive adoption among financial institutions.

- Liquidity Solutions: XRP is used in Ripple’s On-Demand Liquidity (ODL) service, potentially increasing demand as ODL gains traction.

- Innovation: Ongoing development and integration into new financial systems could enhance XRP’s value proposition.

5. What risks should investors consider when predicting XRP’s future price?

Investors should be aware of several risks, including:

- Regulatory Uncertainty: Ongoing legal issues with the SEC could impact XRP’s price and market perception.

- Market Volatility: Cryptocurrency markets are highly volatile, and XRP is no exception.

- Competitive Landscape: Competition from other cryptocurrencies and payment solutions may affect adoption and price.

Investors should conduct thorough research and possibly consult financial advisors before making investment decisions related to XRP.

- for key points.

- for key points.

- for key points.

- for key points.