Are you tired of your crypto investments just sitting idly in your digital wallet, waiting for the next bull run? Ever wondered if XRP, the digital asset that you’ve been hodling since 2018, could be used to buy your morning coffee or that snazzy new pair of sneakers? Welcome to XRPAuthority.com, where we dive deep into the crypto waters to find out if XRP can break free from the confines of exchanges and make a splash in the world of everyday purchases. As someone who’s been navigating the crypto seas since 2011, I’m here to explore whether XRP can be your new best friend in the checkout line.

XRP, often hailed as the digital asset for payments, has its roots in facilitating cross-border transactions with lightning speed and minimal fees. But can it moonwalk its way into the realm of everyday consumer transactions? Or is it destined to remain the darling of the financial sector and trading desks? Before you start dreaming of paying for your pizza with XRP, let’s take a closer look at the current landscape of cryptocurrency acceptance.

Imagine walking into your local coffee shop and being met with a cashier who eagerly accepts your XRP. Sounds like a crypto enthusiast’s paradise, doesn’t it? However, as of now, most merchants still look at you like you’ve just asked to pay with Monopoly money. While Bitcoin and Ethereum are slowly making inroads into retail transactions, XRP’s presence is still akin to finding a unicorn at a petting zoo.

What makes XRP different, you ask? Unlike Bitcoin, which sometimes feels like it’s carrying a giant, clunky backpack full of transaction fees and confirmation delays, XRP is streamlined for speed and cost-efficiency. But, as we all know, being the fastest kid on the blockchain doesn’t always guarantee you a spot on the local store’s payment roster. So, why isn’t XRP more widely accepted for everyday purchases?

The answer lies in the adoption and integration of payment solutions. While Ripple, the company behind XRP, has been busy shaking hands with banks and financial institutions, the everyday retail world hasn’t fully caught the wave. Merchants are still warming up to the idea, often requiring third-party services to convert crypto to fiat instantly. So, unless you’re paying in a crypto-friendly coffee shop, your XRP might be better off in your digital wallet for now.

But don’t despair, fellow XRP enthusiasts! The tide is slowly turning. Payment platforms are beginning to embrace XRP, providing the necessary bridges to make everyday transactions a reality. Companies like BitPay and others are paving the way, and with the growing interest in blockchain solutions, it’s only a matter of time before XRP joins the ranks of commonly accepted digital currencies. Patience, as they say, is a virtue—especially in the world of crypto.

So, what’s the verdict? While XRP isn’t yet the go-to payment method for your grocery run, its potential in the financial sector and ease of use in cross-border transactions keep it relevant and promising. The future could very well see XRP accepted alongside Bitcoin and Ethereum, but for now, it remains a powerhouse in trading and global finance. As the landscape evolves, so too will the opportunities for XRP to step into the everyday limelight.

At XRPAuthority.com, we pride ourselves on being your trusty lighthouse amidst the crypto storm. Whether you’re an investor, trader, or fintech professional, we offer insights that cut through the noise and deliver the clarity you need. Stick with us for all the latest updates and analyses on XRP and beyond. After all, navigating the crypto world is a lot more fun when you have a witty and insightful guide by your side.

📌 Understanding Can You Use XRP for Everyday Purchases? Exploring whether XRP is widely accepted for goods and services. and Its Impact on XRP

Current acceptance of XRP in retail

Current Acceptance of XRP in Retail

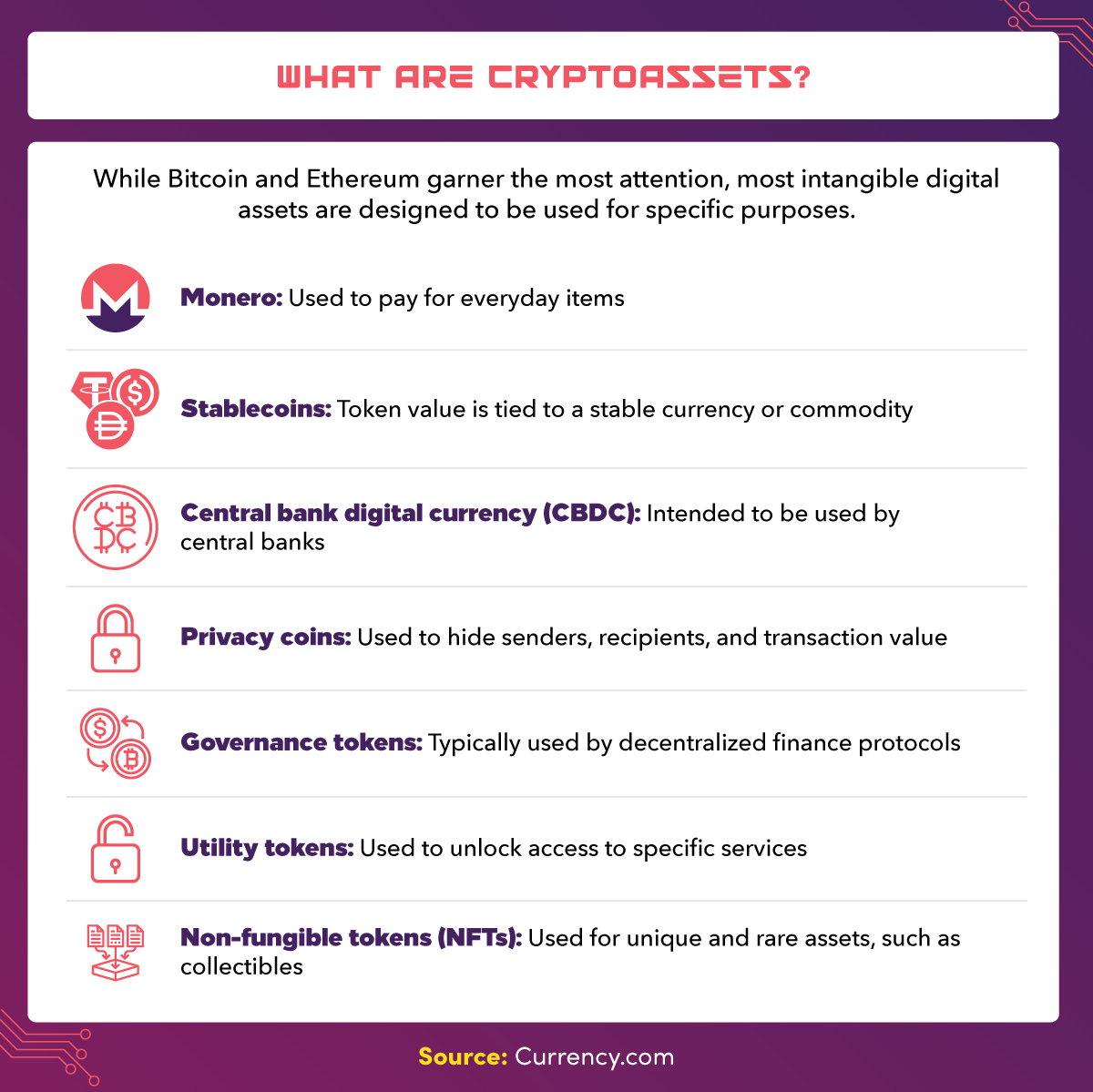

When it comes to spending XRP on everyday purchases, the reality is a mixed bag. While XRP is one of the largest cryptocurrencies by market capitalization and has a strong use case in cross-border payments, its adoption in retail transactions is still limited compared to Bitcoin (BTC) or even stablecoins like USDT. However, that doesn’t mean XRP is entirely absent from the retail space—far from it.

Several merchants and service providers have begun accepting XRP as a form of payment, particularly in the online space. Cryptocurrency-friendly retailers, e-commerce platforms, and even some travel and hospitality businesses have integrated XRP payments, allowing users to buy goods and services directly. However, mainstream brick-and-mortar stores remain cautious, primarily due to regulatory uncertainty and the volatility of cryptocurrencies.

For crypto enthusiasts who want to use XRP in daily life, the best options currently include:

- Online Retailers: Some e-commerce platforms and independent online stores accept XRP via crypto payment gateways. These businesses cater to tech-savvy consumers who prefer decentralized payment methods.

- Gift Card Platforms: Services like Bitrefill and Coinsbee allow users to purchase gift cards for major retailers using XRP, effectively enabling indirect spending at stores like Amazon, Walmart, and Starbucks.

- Travel and Hospitality: A few travel agencies and airlines accept XRP for booking flights, hotels, and vacation packages, often through third-party payment processors.

- Freelance and Digital Services: Some freelancers and digital agencies accept XRP as payment for services such as web development, graphic design, and content creation.

Despite these options, XRP is still not widely accepted in physical retail environments. Unlike Bitcoin, which has seen increasing adoption through services like the Lightning Network and major companies integrating BTC payments, XRP’s presence in everyday transactions remains niche. The primary reason for this is that XRP was designed with a focus on fast and cost-effective cross-border transactions rather than direct consumer spending.

That said, the landscape is evolving. As more businesses explore crypto payments and as regulatory clarity improves, XRP could see greater adoption in retail. Additionally, the emergence of crypto debit cards linked to XRP balances allows users to spend their holdings anywhere traditional credit cards are accepted, bridging the gap between crypto and conventional commerce.

While XRP is not yet a go-to payment method for everyday purchases, its utility in certain sectors and the growing acceptance of cryptocurrencies in general suggest that its role in retail could expand in the coming years.

Payment processors and XRP integration

Payment Processors and XRP Integration

One of the biggest hurdles for using XRP in everyday purchases is merchant adoption. While direct acceptance of XRP remains limited, payment processors have stepped in to bridge the gap between consumers who want to spend their crypto and businesses that prefer to receive fiat currency. These intermediaries facilitate seamless transactions, allowing XRP holders to use their assets without forcing merchants to deal with crypto volatility or regulatory complexities.

Several crypto payment gateways have integrated XRP into their systems, making it easier for businesses to accept the digital asset. Some of the most notable payment processors supporting XRP include:

- BitPay: A leading cryptocurrency payment service, BitPay enables merchants to accept XRP and settle in fiat currency if desired. This allows businesses to accept crypto payments without worrying about price fluctuations.

- CoinGate: This payment processor supports XRP among other cryptocurrencies, providing merchants with easy integration tools and plugins for e-commerce platforms like Shopify and WooCommerce.

- NOWPayments: A non-custodial crypto payment gateway that supports XRP, allowing businesses to accept payments directly in XRP or convert them to fiat.

- Uphold and Wirex: These platforms offer crypto debit cards that allow users to spend XRP anywhere that accepts traditional debit cards, effectively turning XRP into a spendable asset.

These payment processors play a crucial role in XRP’s usability for everyday purchases. By converting XRP into fiat at the point of sale, they eliminate the friction associated with crypto payments and make it more appealing for merchants to accept digital assets.

Additionally, some businesses have integrated XRP payments through these services, particularly in the online retail, travel, and digital services industries. For example, certain VPN providers, hosting services, and even charitable organizations now accept XRP donations or payments via crypto gateways. This demonstrates a slow but steady expansion of XRP’s real-world applications.

One of the key advantages XRP has over many other cryptocurrencies is its speed and low transaction fees. Transactions settle within seconds, making it an ideal candidate for payments. Unlike Bitcoin, which can experience delays and higher fees during peak congestion, XRP offers a more efficient alternative. This makes it particularly attractive for microtransactions and cross-border payments, where speed and cost are critical factors.

However, despite these advantages, XRP’s adoption via payment processors still lags behind major cryptocurrencies like Bitcoin and Ethereum. Many merchants remain hesitant due to regulatory concerns, price volatility, and the general lack of consumer demand for XRP payments. While payment gateways help mitigate some of these issues, widespread adoption will likely require further regulatory clarity and greater consumer interest in spending XRP rather than holding it as an investment asset.

Looking ahead, as more payment processors integrate XRP and more businesses recognize its transactional benefits, adoption could accelerate. The increasing availability of crypto debit cards and point-of-sale solutions that support XRP may also contribute to making it a more viable option for everyday spending. For now, however, XRP remains primarily a tool for cross-border payments rather than a mainstream retail currency.

Challenges of using XRP for purchases

Challenges of Using XRP for Purchases

While XRP offers undeniable advantages in terms of speed and low transaction fees, several challenges hinder its widespread use for everyday purchases. From regulatory uncertainty to merchant hesitancy, these obstacles have kept XRP from becoming a mainstream payment option. Let’s explore some of the key barriers preventing XRP from achieving mass adoption in retail transactions.

Regulatory Uncertainty

One of the most significant hurdles facing XRP’s adoption as a payment method is the ongoing regulatory uncertainty surrounding the asset. Ripple, the company closely associated with XRP, has been embroiled in legal battles with the U.S. Securities and Exchange Commission (SEC), which has raised concerns about XRP’s classification as a security. Although Ripple has made progress in defending its case, the uncertainty has discouraged many businesses from accepting XRP as a form of payment.

Unlike Bitcoin and Ethereum, which have been given more regulatory clarity in several jurisdictions, XRP’s legal status remains a gray area in some regions. This lack of clarity makes merchants hesitant to integrate XRP payments, as they fear potential compliance issues or legal repercussions.

Limited Merchant Adoption

Another major challenge is the lack of widespread merchant adoption. While some online retailers and service providers accept XRP, the number of businesses that support it pales in comparison to Bitcoin or even stablecoins like USDC and USDT. Most merchants prefer to deal with fiat currency, and since cryptocurrencies are still viewed as a niche payment option, XRP has struggled to gain traction in the retail sector.

For merchants, integrating a new payment method involves costs and technical considerations. Many businesses are reluctant to go through the effort of accepting XRP when consumer demand for crypto payments remains relatively low. Additionally, the volatility of cryptocurrencies makes some merchants wary of accepting digital assets, even if payment processors offer automatic conversion to fiat.

Consumer Spending Habits

Even among crypto enthusiasts, XRP is often seen more as an investment asset than a spending currency. Many XRP holders prefer to hold onto their tokens in anticipation of price appreciation rather than use them for everyday purchases. This “HODL” mentality reduces the incentive for merchants to integrate XRP payments, as the demand from consumers simply isn’t high enough.

Moreover, with the rise of crypto debit cards that allow users to spend XRP without merchants directly accepting it, there’s even less pressure for businesses to integrate XRP payments. These cards convert XRP to fiat at the point of sale, making it easier for users to spend their holdings while bypassing the need for merchants to accept crypto directly.

Competition from Other Cryptocurrencies

XRP faces stiff competition from other cryptocurrencies that have gained more traction in the payments space. Bitcoin, despite its higher fees and slower transaction times, is widely accepted due to its first-mover advantage and strong brand recognition. Meanwhile, stablecoins like USDT and USDC have become popular for payments because they eliminate volatility concerns.

Additionally, networks like the Lightning Network for Bitcoin and Ethereum’s Layer 2 solutions have made these cryptocurrencies more efficient for transactions, further reducing XRP’s competitive edge in the retail payments sector. While XRP’s fast transactions and low fees make it an attractive option, merchants and consumers often opt for more established or stable alternatives.

Volatility Concerns

Although XRP boasts relatively lower volatility compared to some other cryptocurrencies, it is still subject to significant price fluctuations. This volatility can be a deterrent for both consumers and merchants. A transaction that seems reasonable at the time of purchase could become significantly more expensive (or less valuable) within hours or days, leading to uncertainty for both parties.

Stablecoins have gained favor in the payments industry precisely because they mitigate this issue. Since their value is pegged to fiat currencies, they provide a predictable and stable medium of exchange, something XRP currently lacks.

Infrastructure and Awareness

Finally, the lack of infrastructure and general awareness about XRP as a payment method also presents challenges. While XRP has strong use cases in cross-border payments and institutional finance, its presence in the retail ecosystem remains minimal. Many merchants and consumers are simply unaware of how to use XRP for transactions, and without widespread education and marketing efforts, adoption is likely to remain slow.

Crypto payment processors have helped bridge the gap by enabling merchants to accept XRP, but further efforts are needed to make XRP as widely recognized and accepted as Bitcoin or stablecoins. More partnerships with major retailers, financial institutions, and e-commerce platforms could help push XRP into the mainstream payments arena.

Despite these challenges, XRP’s potential as a payment method remains strong. As regulatory clarity improves, merchant adoption increases, and new payment solutions emerge, XRP could become a more viable option for everyday purchases. However, overcoming these hurdles will require time, effort, and continued innovation in the cryptocurrency space.

Future prospects for XRP in everyday transactions

Future Prospects for XRP in Everyday Transactions

Despite the challenges XRP faces in becoming a widely used payment method, its future in everyday transactions holds significant potential. As regulatory clarity improves, technological advancements continue, and financial institutions explore blockchain-based payment solutions, XRP could see a surge in adoption for retail and day-to-day purchases. Let’s explore the key factors that could shape XRP’s future in the payments landscape.

Regulatory Clarity and Institutional Adoption

One of the most significant barriers to XRP’s widespread adoption has been regulatory uncertainty. However, as governments and financial regulators establish clearer guidelines for cryptocurrencies, XRP could benefit from increased institutional support. Ripple’s ongoing legal battles with the U.S. Securities and Exchange Commission (SEC) have created uncertainty, but a favorable resolution could open the floodgates for broader adoption.

With clearer regulations, banks and financial institutions may feel more comfortable integrating XRP into their payment systems. Ripple has already partnered with several financial entities worldwide through its RippleNet network, demonstrating its real-world utility in cross-border payments. If these institutions expand their use of XRP beyond remittances and into retail transactions, its adoption could accelerate significantly.

Integration with Payment Providers and Financial Services

As more payment processors incorporate XRP into their platforms, the ease of using XRP for everyday purchases will improve. Companies like BitPay, CoinGate, and NOWPayments have already integrated XRP, allowing businesses to accept the cryptocurrency seamlessly. If major payment providers such as PayPal, Visa, or Mastercard integrate XRP into their crypto offerings, it could become a more viable option for mainstream transactions.

Additionally, the rise of crypto debit cards linked to XRP balances could bridge the gap between digital assets and traditional finance. Platforms like Uphold and Wirex already offer such solutions, enabling users to spend XRP anywhere that accepts Visa or Mastercard. As these services expand and gain traction, they could drive greater consumer use of XRP for day-to-day expenses.

Advancements in Blockchain and Payment Technology

Blockchain technology continues to evolve, and XRP’s underlying ledger—the XRP Ledger (XRPL)—is well-positioned to support fast, low-cost transactions. Unlike Bitcoin, which relies on energy-intensive mining, XRP transactions settle in seconds with minimal fees, making it an attractive option for payments. As blockchain scalability solutions improve, XRP could become even more efficient for microtransactions and retail payments.

Furthermore, innovations such as decentralized finance (DeFi) and smart contract capabilities could enhance XRP’s utility. While XRP is not traditionally associated with DeFi, new developments—such as the introduction of smart contract functionality through sidechains—could expand its use cases. If XRP becomes a key player in DeFi ecosystems, it could drive broader adoption in both online and offline commerce.

Growing Consumer Demand for Crypto Payments

Consumer interest in cryptocurrency payments is rising, with more people looking for ways to spend their digital assets. According to surveys, a growing number of consumers are willing to use crypto for everyday purchases, provided there are convenient payment methods available. If this trend continues, merchants may feel increased pressure to accept XRP and other cryptocurrencies.

Additionally, younger generations—who are more digitally native—are driving the adoption of crypto payments. As Gen Z and Millennials gain more purchasing power, the demand for seamless crypto payment solutions could accelerate, pushing businesses to integrate XRP into their payment options.

Partnerships with Major Retailers and E-Commerce Platforms

For XRP to become a mainstream payment method, partnerships with major retailers and e-commerce platforms will be crucial. Companies like Tesla, Microsoft, and Overstock have experimented with accepting cryptocurrencies in the past, and as crypto payments become more normalized, XRP could be included in these initiatives.

One way to accelerate adoption is through collaborations with payment giants like Shopify, Amazon, or eBay. If XRP becomes an accepted payment method on these platforms, it could open up a vast new market for crypto transactions. Additionally, expanding the availability of XRP-backed gift cards for major retailers could indirectly increase its usability in everyday commerce.

The Role of Central Bank Digital Currencies (CBDCs)

Another factor that could shape XRP’s future in payments is the rise of central bank digital currencies (CBDCs). Many governments are exploring the launch of digital versions of their national currencies, and Ripple has positioned itself as a key player in this space. The company has been working with central banks to develop CBDC solutions using its blockchain technology.

If Ripple successfully integrates XRP into CBDC infrastructure, it could strengthen its role in global payments. While XRP may not replace fiat currencies, it could serve as a bridge asset for seamless conversions between digital currencies, further increasing its adoption in financial transactions.

Potential Challenges Ahead

Despite these promising developments, XRP still faces some hurdles in becoming a mainstream payment method. Regulatory concerns, competition from stablecoins, and merchant reluctance could slow down adoption. Additionally, consumer habits—where many prefer to hold XRP as an investment rather than spend it—remain a challenge.

However, as crypto-friendly regulations emerge, more businesses integrate XRP payments, and technological advancements improve transaction efficiency, the potential for XRP to be used in everyday purchases will continue to grow. The key will be overcoming these barriers through strategic partnerships, improved infrastructure, and increased consumer awareness.

Ultimately, while XRP may not yet be a dominant force in retail payments, its future prospects remain bright. As the global financial landscape evolves, XRP’s unique advantages—speed, low fees, and institutional backing—position it as a strong contender for broader adoption in everyday transactions.

💡 Frequently Asked Questions (FAQs) About Can You Use XRP for Everyday Purchases? Exploring whether XRP is widely accepted for goods and services.

FAQ: Can You Use XRP for Everyday Purchases?

Exploring whether XRP is widely accepted for goods and services.

-

Is XRP accepted by many retailers for everyday purchases?

While XRP is primarily known for its role in facilitating cross-border transactions, its acceptance for everyday purchases is limited. Unlike Bitcoin or Ethereum, XRP is not as widely accepted by merchants for direct payment. However, some online platforms and crypto payment gateways are starting to support XRP, allowing users to spend it at select retailers.

-

How can I use XRP for purchasing goods and services?

To use XRP for purchases, you can convert it to a more widely accepted cryptocurrency like Bitcoin or Ethereum. Alternatively, some crypto debit cards allow you to spend XRP by converting it to fiat currency at the point of sale. Always ensure the platform or card you’re using supports XRP transactions.

-

Are there any risks associated with using XRP for everyday purchases?

Using XRP for daily transactions involves certain risks, including price volatility and limited merchant acceptance. Additionally, transaction fees and exchange rates can impact the effective use of XRP. It’s crucial to stay informed about market conditions and choose reliable platforms for conversions and payments.

-

What are the benefits of using XRP for payments?

Using XRP offers benefits such as fast transaction times and low fees, making it an attractive option for cross-border payments. Its efficient network can facilitate quick transfers compared to traditional banking systems. However, these benefits are more relevant for large transactions rather than everyday purchases due to current merchant acceptance levels.

-

What is the future outlook for XRP as a payment method?

As the cryptocurrency ecosystem evolves, the acceptance of XRP for everyday purchases could improve. Partnerships with financial institutions and advancements in crypto payment technologies may enhance its usability. It’s crucial for potential users to monitor industry developments and regulatory changes that could influence XRP’s adoption for retail transactions.