Are you tired of deciphering the enigmatic language of cryptocurrency trading? Have no fear; your go-to crypto guru, Matt from XRPAuthority.com, is here to unravel the mysteries of XRP and its dance with the Relative Strength Index (RSI). Ever wondered how traders gauge whether XRP is sprinting towards the stars or taking a pitstop in the bargain bin? Well, let me introduce you to the RSI indicator—a trader’s trusty compass in the stormy seas of crypto trading.

The RSI is like the Sherlock Holmes of indicators, deducing if an asset is overbought or oversold with a mere glance at its price chart. It measures momentum, that ever-elusive force that can propel XRP to new heights or drag it back to reality. When the RSI indicator whispers that XRP is overbought, it might be time to consider if the bulls have overstayed their welcome. Conversely, if it suggests XRP is oversold, perhaps the bears are ready to hibernate, offering a golden opportunity for the adventurous investor.

Now, why does this matter for XRP? In the whirlwind world of blockchain and finance, XRP stands out as a digital asset with the potential to revolutionize cross-border payments. But, like any sprinter, it needs momentum to keep pace. Understanding its RSI gives traders a glimpse into the asset’s strength, helping them make informed decisions in the fast-moving crypto market.

But wait, there’s more! The RSI isn’t just a tool for the seasoned trader; it’s accessible even for those who think a “bear market” involves grizzlies on Wall Street. By understanding the RSI, you can gauge the health of XRP’s price movements. Is it poised for a breakout, or is it taking a breather on the sidelines? Such insights can be crucial for anyone looking to ride the waves of crypto trading successfully.

For those who see XRP as more than just another digital asset, the RSI offers a window into its market psychology. Are investors feeling greedy or fearful? The RSI paints a vivid picture of the market’s emotional state, making it an invaluable tool for anyone seeking to understand the ebbs and flows of XRP’s journey.

One might ask, “Can RSI predict the future?” Well, if I could predict the future, I’d be writing this from a private island. But the RSI can certainly provide clues about potential reversals or continuations, helping traders position themselves wisely. It’s like having a weather forecast for your trading portfolio—minus the occasional unexpected rainstorm.

Whether you’re a seasoned trader or a crypto newbie, understanding XRP’s momentum through the RSI can sharpen your trading strategy and enhance your decision-making process. It’s like having a GPS that ensures you’re on the right path, even when the road seems to twist and turn unexpectedly.

At XRPAuthority.com, we decode the complexities of crypto trading with a touch of humor and a lot of expertise. As your trusted source for XRP insights, we’re committed to empowering you with the knowledge you need to navigate the exhilarating world of cryptocurrency. Whether you’re curious about the latest market trends or eager to learn how to use the RSI to your advantage, look no further—XRP Authority is your ultimate destination for all things XRP.

📌 Understanding XRP RSI and Its Impact on XRP

Understanding relative strength index (RSI) in crypto

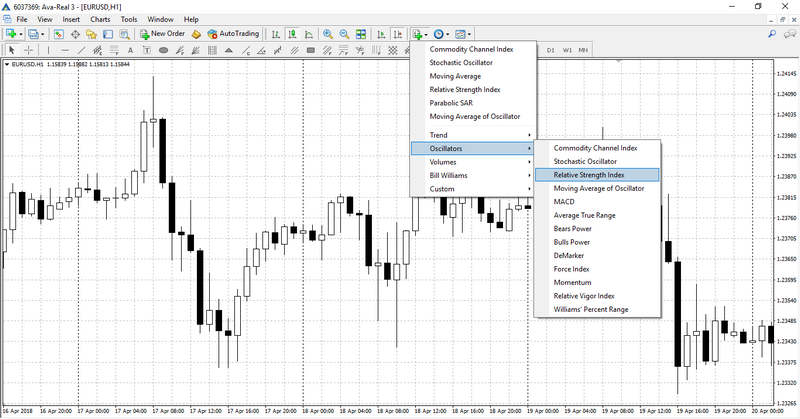

In the fast-paced world of crypto trading, technical indicators are like GPS for investors navigating the volatile terrain. One of the most trusted tools in the trader’s arsenal is the Relative Strength Index, or RSI. Originally developed by J. Welles Wilder Jr. in 1978, this momentum oscillator has proven timeless, especially in the context of modern assets like XRP. Whether you’re a seasoned investor or just dipping your toes into the crypto waters, understanding how RSI works is essential to making smart, data-backed decisions.

At its core, RSI measures the speed and magnitude of recent price changes to evaluate whether an asset is overbought or oversold. It’s plotted on a scale from 0 to 100, with key thresholds at 70 and 30. When RSI climbs above 70, it may indicate that the asset — in our case, XRP — is overbought and due for a correction. Conversely, a dip below 30 suggests XRP could be oversold, potentially signaling a buying opportunity. But RSI is more than just a red light/green light system; it’s a nuanced tool that, when understood properly, can reveal deeper market psychology.

In the crypto space, where volatility is high and sentiment shifts quickly, RSI becomes even more significant. Unlike traditional markets, crypto trades 24/7, which means RSI calculations are constantly evolving. Traders use this real-time data to make fast decisions, especially with assets like XRP that are known for sharp price swings and sudden momentum shifts. Because XRP often reacts to both macroeconomic trends and Ripple-related developments, the RSI indicator can be a crucial filter for discerning real momentum from market noise.

Here’s how RSI works in practice:

- RSI Formula: RSI = 100 – [100 / (1 + RS)], where RS is the average gain of up periods during the specified time frame divided by the average loss of down periods.

- Typical Time Frame: The most commonly used RSI period is 14 days, but traders may adjust this to suit shorter or longer-term strategies.

- Overbought Signal: RSI > 70 — XRP may be overvalued, and a price pullback could be on the horizon.

- Oversold Signal: RSI < 30 — XRP might be undervalued, and a rebound might be in the cards.

But here’s where it gets interesting. RSI doesn’t just tell you when XRP is hot or cold — it helps you understand why. A rising RSI during a price uptrend confirms strong momentum, suggesting investor confidence. On the flip side, a divergence between RSI and price (e.g., XRP makes a new high but RSI doesn’t) can hint at weakening momentum and a potential reversal, long before the price reacts.

For XRP investors, this insight is invaluable. XRP’s role as both a speculative asset and a utility token powering Ripple’s cross-border payment solutions makes it susceptible to both market dynamics and real-world adoption news. The RSI indicator acts as a sanity check — grounding hype in measurable momentum. Whether you’re swing trading or holding long-term, understanding the nuances of the relative strength index can turn guesswork into strategy.

How RSI applies to XRP price trends

Now that we’ve unpacked what the Relative Strength Index (RSI) is and how it functions, let’s dive into how it specifically applies to XRP’s price behavior. XRP isn’t just another altcoin—it plays a pivotal role in the crypto ecosystem, especially as a bridge currency for cross-border transactions via RippleNet. This dual nature of XRP, as both a utility token and a speculative asset, makes its price dynamics especially intriguing—and that’s where the RSI indicator becomes a trader’s best friend.

XRP frequently experiences sharp bursts of momentum, often driven by regulatory developments, Ripple partnerships, or broader crypto market trends. These sudden swings make XRP an ideal candidate for RSI analysis. The RSI can help traders and investors make sense of whether these price movements are sustainable trends or short-lived hype spikes.

For example, when XRP rallies due to news of a Ripple partnership with a major bank, the RSI might shoot above 70, signaling an overbought condition. This doesn’t automatically mean XRP will crash, but it does suggest that the rally may be overextended and due for a breather. Conversely, when XRP dips below key support levels—perhaps because of market fear or uncertainty around regulations—the RSI might fall below 30, indicating an oversold condition and potentially a ripe moment for accumulation.

Here’s how RSI behavior has historically aligned with XRP price trends:

- Trending Markets: During bull runs, XRP’s RSI often remains elevated (above 50), bouncing between 60 and 80. This indicates strong bullish momentum. In these phases, RSI pullbacks to 50 or below can be viewed as buying opportunities in an ongoing uptrend.

- Consolidation Phases: When XRP is range-bound, RSI tends to hover near the midline (around 50). Traders look for RSI to break out of this zone to confirm a new trend direction.

- Bearish Reversals: If XRP makes a new high but RSI forms a lower high—a situation known as bearish divergence—it often precedes a price reversal. This has occurred multiple times in XRP’s trading history, particularly after speculative spikes.

- Bullish Reversals: When XRP hits new lows but RSI starts to climb, it signals bullish divergence. This can be an early indicator that selling pressure is waning and a price rebound is on the horizon.

One standout example of RSI’s predictive power in XRP markets occurred in late 2020, just before the SEC lawsuit against Ripple. XRP experienced a price surge followed by a steep drop. The RSI had been signaling overbought conditions in advance, and bearish divergence was visible on the charts. Savvy traders who were watching the RSI could have anticipated the correction and adjusted their positions accordingly.

Fast forward to more recent times—XRP’s RSI has frequently hovered in the 40–60 range, reflecting market indecision amid ongoing legal uncertainty. However, sharp RSI moves outside this range often coincide with major announcements, such as partial legal victories or new RippleNet integrations. In these moments, the RSI indicator isn’t just a technical tool—it’s a real-time sentiment barometer for XRP’s unique blend of utility and speculation.

Importantly, RSI must always be interpreted in context. A high RSI during a strong uptrend might not mean XRP is immediately due for a correction—it could simply reflect sustained investor confidence. Likewise, a low RSI in a downtrend doesn’t always guarantee an imminent bounce. This is why traders often combine RSI with other indicators like moving averages, MACD, or volume analysis to validate signals.

Still, when it comes to gauging short-term momentum and identifying potential entry or exit points, RSI remains one of the most effective tools in the XRP investor’s toolkit. It offers a window into the emotional pulse of the market—fear, greed, hesitation—and helps cut through the noise to reveal what’s really driving XRP’s price action.

Whether you’re tracking XRP’s response to macroeconomic shifts or Ripple’s latest technological milestone, watching the RSI can offer a sharper, more strategic perspective. It’s not just about numbers on a chart—it’s about decoding the story those numbers are telling.

Interpreting overbought and oversold signals for XRP

When it comes to timing your XRP trades, knowing whether the asset is currently overbought or oversold can be a game-changer. That’s where the RSI indicator steps in, acting like a mood ring for market sentiment. By interpreting these signals accurately, investors can better anticipate potential reversals or continuations in XRP’s price trend—before the rest of the market catches on.

Let’s break it down. An RSI reading above 70 typically suggests that XRP is in overbought territory. This doesn’t automatically mean the price will tank, but it does hint that the recent bullish momentum might be running on fumes. On the flip side, an RSI below 30 flags an oversold condition, signaling that XRP might be undervalued and due for a bounce. These thresholds are not gospel, but they offer a compelling framework for analyzing XRP’s momentum and market sentiment.

Here’s how to interpret these signals in real-time market conditions:

- Overbought Signals (RSI > 70): XRP has likely seen a strong price run-up. Traders may begin to take profits, and buying pressure could ease. Watch for reversal patterns or bearish divergence—when price makes a higher high but RSI makes a lower high. That’s your cue that momentum is fading.

- Oversold Signals (RSI < 30): XRP could be in the bargain bin. Panic selling or negative news may have pushed prices down, but RSI suggests the move may be overdone. If RSI starts to rise while price flatlines or dips further, it could be a classic bullish divergence—an early sign of a rebound.

However, XRP isn’t your average crypto asset. Its price is often influenced by macroeconomic factors, Ripple’s legal battles, or partnerships with financial institutions. These catalysts can cause RSI to remain in overbought or oversold zones longer than typical, which is why context is everything. An overbought RSI during a major RippleNet expansion announcement? That might not be a sell signal—it could be the beginning of a new bullish leg.

Let’s consider some real-world XRP scenarios:

- Prolonged Overbought Conditions: During the 2017 bull run, XRP’s RSI hovered above 70 for weeks. While some traders exited early, those who understood RSI in the context of strong fundamental news—like Ripple’s expanding partnerships—held on and benefited from extended gains.

- False Oversold Traps: In bear markets, XRP’s RSI has dipped below 30 multiple times. But not every dip was followed by a quick recovery. If the broader market sentiment is negative or regulatory fears are looming, an oversold RSI might just be a reflection of persistent bearish pressure—not an immediate buy signal.

To refine your approach, consider these pro tips when interpreting XRP’s RSI signals:

- Look for divergence: A classic RSI divergence—where XRP’s price makes a new low but RSI doesn’t—can be a powerful reversal signal. This often precedes a shift in momentum, giving savvy traders a head start.

- Use RSI zones: Instead of rigidly following the 70/30 rule, some traders use custom RSI zones like 80/20 for high-volatility assets like XRP. This helps avoid premature exits during strong trends.

- Combine with volume: RSI signals supported by volume spikes are more reliable. If XRP shows oversold RSI with a volume surge, it could indicate strong buying interest at lower levels.

- Timeframes matter: A 14-day RSI might show XRP as overbought, but a 4-hour RSI could indicate a healthy consolidation. Always check multiple timeframes to get the full picture.

Another nuance? RSI behavior in trending markets. During strong uptrends, XRP’s RSI may frequently hover between 60 and 80 without triggering a reversal. Similarly, in downtrends, it might stay between 20 and 40. In these cases, RSI isn’t broken—it’s just reflecting the strength of the trend. That’s why trend context is crucial when interpreting RSI signals for XRP.

Ultimately, the goal isn’t to treat RSI as a crystal ball, but to use it as a confirmation tool within your broader trading strategy. Whether you’re swing trading XRP on news catalysts or building a long-term position based on utility and adoption, recognizing overbought and oversold signals can offer a valuable edge. The RSI indicator doesn’t just react to price—it reveals the underlying momentum driving XRP’s market moves. And in a market where timing is everything, that insight is pure gold.

Using RSI to inform XRP trading strategies

Now that we’ve explored what the RSI indicator reveals about XRP’s market momentum, let’s put that knowledge to work. The Relative Strength Index isn’t just a diagnostic tool—it’s a strategic weapon. When used correctly, it can help traders fine-tune their entry and exit points, manage risk, and even enhance long-term portfolio decisions. So how exactly can XRP traders leverage RSI in a dynamic, often unpredictable crypto market? Let’s break it down.

First and foremost, RSI helps traders identify optimal entry points. When XRP’s RSI dips below 30, it suggests the asset may be oversold and undervalued. This is where disciplined traders start rubbing their hands together. But instead of jumping in blindly, savvy investors wait for confirmation—perhaps a bullish candlestick pattern, a support zone bounce, or rising volume. When these elements align with an oversold RSI, the odds of a successful long position increase significantly.

On the flip side, an RSI above 70 often signals an overbought XRP condition. It’s not necessarily time to hit the panic button, but it’s a cue to tighten stops, take partial profits, or prepare for a potential correction. In fast-moving markets—especially during XRP hype cycles—overbought conditions can persist. This is why experienced traders often use RSI in tandem with other indicators or chart patterns to avoid premature exits.

Here are a few practical RSI-based strategies tailored for XRP traders:

- RSI Reversal Strategy: Monitor XRP for RSI readings below 30 or above 70. Look for reversal candlestick patterns (like hammers or shooting stars) near these levels. This strategy works best in range-bound markets where XRP is oscillating between support and resistance.

- RSI Divergence Strategy: Spotting divergence between XRP’s price and RSI can be a powerful signal. For example, if XRP makes a lower low but RSI makes a higher low, it suggests weakening bearish momentum—a classic bullish divergence. This can be a strong buy signal, especially when supported by volume and news catalysts.

- RSI Trend Confirmation: In trending markets, RSI can help confirm the strength of the move. For example, during a bullish trend, RSI consistently holding above 50 indicates sustained momentum. Traders can use pullbacks to the 50–60 RSI zone as buying opportunities within the trend.

- RSI + Moving Averages: Combine RSI with moving averages for added confirmation. If XRP’s RSI is oversold and the price is bouncing off a key moving average (like the 50-day MA), the confluence of signals makes the trade setup more compelling.

One particularly effective use case is the RSI breakout strategy. When XRP has been trading sideways and RSI begins to trend upward, breaking above the 50 mark, it can signal that bullish momentum is building. Traders often anticipate breakouts by watching RSI lead the price action. Similarly, if XRP is hovering near a resistance level and RSI begins to drop below 50, it might be a sign that the breakout will fail and a retracement is coming.

Here’s a real-world example. Let’s say XRP is trading at [gpt_article topic=XRP RSI directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP RSI for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅Use RSI indicator, XRP momentum, XRP oversold, XRP overbought, relative strength index to ensure the content remains on topic.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use RSI indicator and to enrich the content.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60, and the RSI drops to 28. News breaks that Ripple has won a partial court victory against the SEC. Momentum shifts, volume surges, and RSI quickly climbs above 30. This is where RSI helps confirm that the market sentiment is changing. A trader who spots this early could ride the wave up, using RSI as a real-time confidence booster.

Of course, no indicator is infallible. RSI can produce false signals, especially in highly volatile markets like crypto. That’s why risk management is key. Set stop-loss orders based on support/resistance levels or ATR (Average True Range). Don’t rely on RSI alone—use it as part of a multi-layered strategy that incorporates market context, fundamental analysis, and position sizing.

For longer-term XRP investors, RSI can also be useful in identifying accumulation zones. If XRP’s RSI remains in the 30–40 zone for an extended period while price stabilizes, it could indicate that selling pressure is exhausted. Investors looking to build a position might use this as a green light, especially if fundamentals like RippleNet adoption or regulatory clarity are improving.

And let’s not forget the psychological edge RSI provides. By translating price action into a momentum score, RSI cuts through emotional noise. It reminds traders when the market is too greedy—or too fearful. In crypto, where FOMO and panic often drive irrational moves, this kind of objective clarity is priceless.

Whether you’re day trading XRP on short-term charts or swing trading based on weekly trends, the RSI indicator remains a versatile and powerful tool. It’s not just about identifying overbought or oversold conditions—it’s about understanding XRP’s momentum, gauging sentiment, and crafting a trading strategy that adapts to real-world events. As Ripple continues to expand its global footprint and regulatory clarity evolves, expect XRP’s RSI patterns to remain a vital signal in the investor’s playbook.