Welcome to the fascinating world of XRP and Cross-Chain DeFi, where the borders between blockchain ecosystems are as fluid as your favorite digital asset. Are you ready to explore how XRP is not just a cryptocurrency, but a pivotal player in the grand opera of decentralized finance? Grab your metaphorical popcorn as we dive into the intricacies of XRP’s interoperability and its role in the evolution of blockchain technology. Spoiler alert: XRP is not just another cog in the crypto machine; it’s the turbocharged engine powering cross-chain interactions.

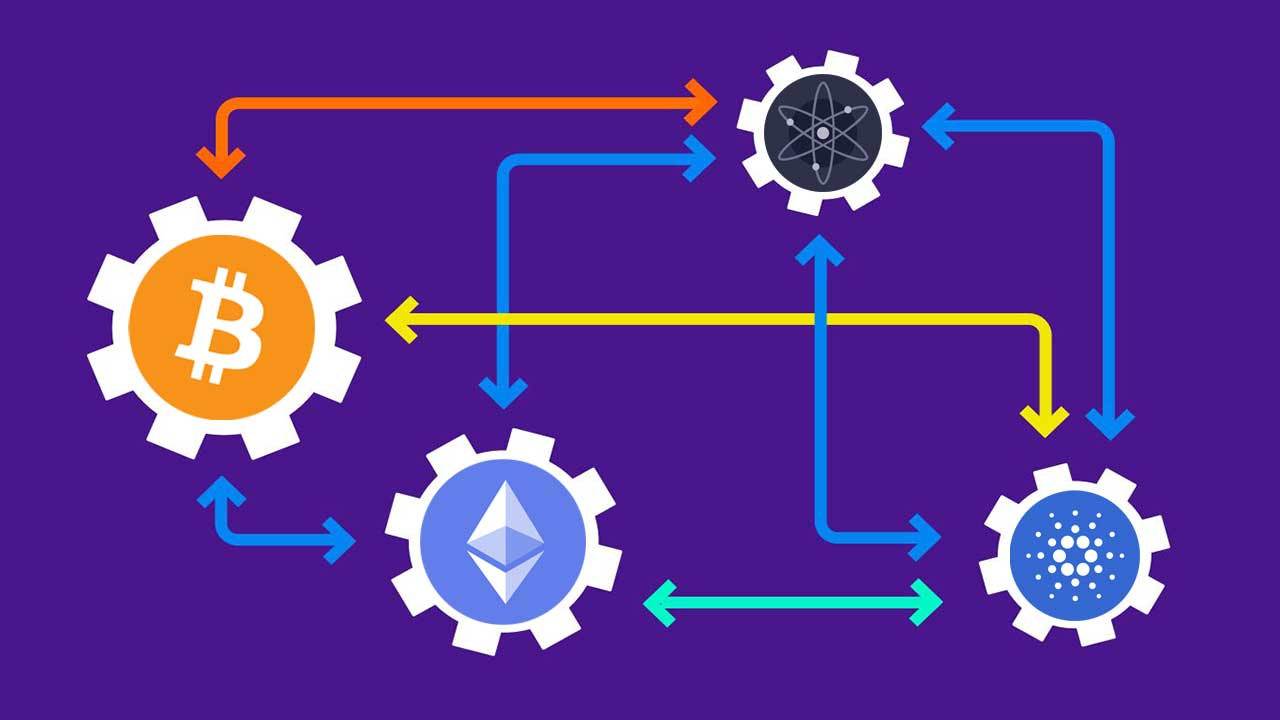

In the ever-expanding universe of blockchain, interoperability is the Holy Grail. Imagine a world where cryptocurrencies can seamlessly interact, like a universal translator for digital assets. That’s where XRP comes into play, bridging the gap between disparate blockchain networks. But how does it manage to pull off this magic trick? The answer lies in its robust architecture and a little help from its friends, like the Interledger Protocol. Who knew that a simple digital asset could moonlight as the UN ambassador of the crypto realm?

For those of you who have been living under a rock (or perhaps just a very large ledger), XRP is the digital asset native to the XRP Ledger, a decentralized blockchain technology that boasts lightning-fast transactions and minimal fees. It’s like the Usain Bolt of cryptocurrencies, only it’s not just about speed. XRP’s ability to facilitate cross-chain DeFi interactions makes it a key player in the global financial ecosystem. Whether you’re a trader, an investor, or just someone who likes to stay ahead of the curve, understanding XRP’s role in interoperability is crucial.

Let’s get technical for a moment. XRP’s cross-chain capabilities are powered by its compatibility with other networks, thanks to innovations like sidechains and bridges. These technologies allow XRP to interact with multiple blockchain ecosystems, creating a seamless flow of assets across different platforms. It’s like a diplomatic passport for your digital assets, enabling them to travel freely without the usual bureaucratic red tape. Can your average altcoin do that? Didn’t think so.

But why should you, dear investor or trader, care about XRP’s interoperability prowess? Well, consider the potential for increased liquidity and access to a broader range of financial services. By enabling cross-chain interactions, XRP enhances the flexibility and functionality of decentralized finance. It’s like having a Swiss Army knife in your digital wallet—versatile, reliable, and always ready for action. Plus, who doesn’t love the idea of their investments working smarter, not harder?

Humor aside, XRP’s relevance in the blockchain and financial sectors cannot be overstated. As more institutions and individuals seek to leverage the benefits of blockchain technology, XRP’s ability to seamlessly connect different networks becomes increasingly valuable. It’s not just about being part of the crypto conversation; it’s about leading it. In a world where digital assets are constantly evolving, XRP stands out as a beacon of innovation and possibility.

Now, I know what you’re thinking: “Where can I get more of this insightful crypto wisdom?” Fear not, intrepid explorer of the digital frontier, for XRP Authority is here to quench your thirst for knowledge. As the go-to source for XRP insights, we pride ourselves on delivering the latest news, analysis, and expert commentary. Whether you’re a seasoned investor or a curious newcomer, our mission is to empower you with the information you need to navigate the dynamic world of cryptocurrency.

In conclusion, XRP’s role in cross-chain DeFi is a game-changer for the blockchain industry. Its ability to interact with multiple networks not only enhances its value but also positions it as a leader in the financial revolution. So, keep your eyes on XRP and let XRP Authority be your trusted guide in this exciting journey. Remember, in the world of crypto, knowledge is power—and a little humor never hurts.

Understanding XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. and Its Impact on XRP

XRP’s role in decentralized finance

XRP’s Role in Decentralized Finance

Decentralized finance (DeFi) has emerged as one of the most transformative innovations in the blockchain space, and while Ethereum has largely dominated the spotlight, XRP is quietly carving out a powerful role in this ecosystem. Known for its lightning-fast transactions and minimal fees, XRP is increasingly being recognized as a crucial liquidity and bridging asset within the DeFi landscape. But how exactly does XRP fit into a decentralized future that champions interoperability, permissionless access, and trustless protocols? Let’s unpack its growing influence.

First off, XRP’s foundational strength lies in the XRP Ledger (XRPL), a decentralized, open-source blockchain that’s been running since 2012 without downtime. Unlike many DeFi-native tokens that rely on proof-of-stake or proof-of-work consensus mechanisms, XRPL uses a unique consensus protocol that enables near-instant settlement—perfect for the real-time demands of DeFi platforms.

Here’s where XRP starts to shine from an investment and utility standpoint:

- Liquidity Provision: XRP is increasingly being used as a bridge asset for liquidity pools, especially in cross-border DeFi applications. Its ability to move value swiftly across networks makes it ideal for arbitrage, yield farming, and decentralized exchanges (DEXs).

- Transaction Efficiency: With average transaction costs hovering around fractions of a cent, XRP enables microtransactions and high-frequency trading strategies—something that’s often economically unfeasible on networks with high gas fees.

- Stability and Scalability: The XRPL can handle up to 1,500 transactions per second, making it one of the most scalable blockchains in the DeFi space. This positions XRP as a reliable backbone for DeFi protocols that require consistent throughput and low latency.

From a market perspective, XRP has shown resilience even during uncertain regulatory climates. Its utility-first approach has kept investor interest alive, especially among those looking for long-term plays in the DeFi sector. Analysts often point to XRP’s potential breakout past the [gpt_article topic=XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level as a signal of renewed bullish momentum, especially if institutional use cases continue to gain traction.

One of the most exciting developments is the rise of Wrapped XRP (wXRP), which allows XRP holders to participate in DeFi protocols on Ethereum and other blockchains. By wrapping XRP into an ERC-20 compatible token, users can stake, lend, and provide liquidity on popular platforms like Uniswap, Curve, and Aave. This not only enhances XRP’s utility but also embeds it deeper into the multi-chain DeFi ecosystem.

Moreover, Ripple’s recent efforts to support smart contract functionality via the introduction of Hooks and the upcoming integration of sidechains (like the Evernode project) are game-changers. These upgrades promise to unlock a wave of DeFi applications directly on the XRPL, reducing reliance on external platforms and bringing native DeFi to the XRP ecosystem.

For XRP enthusiasts and crypto investors watching the evolving DeFi landscape, the message is clear: XRP is no longer just a remittance token. It’s becoming a foundational layer for decentralized finance, with real-world applications spanning from cross-border liquidity to decentralized lending and yield generation. The convergence of speed, scalability, and interoperability makes XRP a formidable force in the next wave of DeFi evolution.

And with regulatory clarity on the horizon and growing institutional interest in blockchain-based financial services, XRP’s role in DeFi is poised to expand dramatically—both as a functional asset and as a high-potential investment vehicle.

Cross-chain interoperability technologies

As the decentralized finance ecosystem matures, one of the most pressing challenges is the fragmentation of liquidity and functionality across various blockchains. Ethereum, Binance Smart Chain, Avalanche, and others each have their own DeFi protocols, user bases, and token standards. Enter cross-chain interoperability technologies—solutions designed to bridge these isolated islands into a cohesive, multi-chain universe. For XRP, which thrives on speed and low transaction costs, integrating with these technologies is not just beneficial—it’s essential to maximizing its DeFi potential.

At the heart of cross-chain interoperability lies the ability to move assets and data between blockchain networks without relying on centralized intermediaries. XRP is leveraging several emerging technologies to achieve this, including wrapped assets, sidechains, and decentralized bridges. Let’s break down the key innovations making XRP a true cross-chain contender:

- Wrapped XRP (wXRP): One of the most impactful developments for XRP’s interoperability is the creation of Wrapped XRP—a tokenized version of XRP that lives on other blockchains, such as Ethereum or Binance Smart Chain. By wrapping XRP into a format compatible with ERC-20 or BEP-20 standards, holders can use their tokens in DeFi apps like Uniswap, SushiSwap, and PancakeSwap. This effectively brings XRP’s liquidity to networks that support smart contracts, without compromising its core speed and efficiency.

- Interledger Protocol (ILP): Originally developed by Ripple, the Interledger Protocol is a powerful tool for enabling value transfer across disparate ledgers. ILP abstracts the complexity of different blockchain architectures, allowing XRP to act as a universal settlement asset. Think of it as the TCP/IP of value transfer—ILP doesn’t care if you’re on Ethereum, Bitcoin, or XRPL; it just gets your value from point A to point B. For investors, this means XRP is positioned as a bridge currency in a truly interoperable financial web.

- Sidechains and Hooks: Ripple’s push for smart contract functionality is gaining traction through sidechains built on the XRPL. Projects like Evernode aim to enable decentralized applications (dApps) and custom smart contracts without bloating the main ledger. These sidechains can be bridged with other blockchains, allowing XRP and native XRPL tokens to flow freely between networks. Meanwhile, Hooks—small pieces of logic embedded in XRPL transactions—offer lightweight programmability for DeFi use cases like automated market makers (AMMs) and decentralized lending.

- Cross-chain Bridges: Decentralized bridge protocols such as Multichain (formerly Anyswap), Wanchain, and Flare Network are helping XRP jump across ecosystems. Flare, in particular, is noteworthy because it supports EVM-compatible smart contracts and aims to integrate XRP as a first-class asset. By using Flare’s F-Asset system, XRP can be represented on the Flare chain and interact with DeFi protocols natively. This opens up staking, lending, and even NFT functionalities for XRP holders.

These technologies are more than just technical novelties—they’re strategic enablers. For XRP investors, cross-chain interoperability means:

- Increased Utility: XRP isn’t limited to its home chain. With wrapped and bridged versions, it can participate in DeFi protocols across multiple chains, unlocking new yield opportunities and trading strategies.

- Diversified Exposure: By bridging into ecosystems like Ethereum, XRP holders gain access to a broader spectrum of DeFi products, from synthetic assets to algorithmic stablecoins.

- Liquidity Amplification: As XRP becomes more liquid across chains, it strengthens its position as a go-to bridge asset for cross-chain swaps and settlements.

From a market perspective, interoperability technologies could be the catalyst for XRP’s next major rally. As DeFi continues to evolve into a multi-chain environment, assets that can move freely and efficiently across networks are likely to see increased demand. Analysts are already eyeing the [gpt_article topic=XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level as a crucial breakout point, especially if XRP’s cross-chain integrations fuel a surge in on-chain activity and liquidity.

It’s also worth noting that institutional players are paying attention. With banks and fintech companies exploring blockchain for settlement and liquidity management, XRP’s role as a cross-chain bridge becomes even more compelling. The ability to seamlessly transfer value across permissioned and permissionless networks could turn XRP into the linchpin of a new, interoperable financial system.

In the grand vision of Web3, where users and assets flow freely across decentralized platforms, XRP’s adaptability through cross-chain technologies is not just a technical advantage—it’s a strategic necessity. As these technologies mature and become more integrated into DeFi infrastructure, XRP’s relevance and utility are poised to grow exponentially, making it a top contender in the race for cross-chain dominance.

Integrating XRP with major blockchain networks

One of the most exciting frontiers for XRP is its growing integration with major blockchain ecosystems—an essential step toward becoming a truly interoperable asset in the decentralized finance (DeFi) space. While XRP was originally designed for fast, low-cost cross-border payments, its evolution is now being shaped by partnerships, protocol upgrades, and cross-chain bridges that allow it to play a vital role in the broader multi-chain world. From Ethereum to Binance Smart Chain and beyond, XRP is crossing boundaries to unlock new opportunities for investors, developers, and institutions alike.

Let’s explore how XRP is weaving itself into the fabric of major blockchain networks:

- Ethereum Integration via Wrapped XRP (wXRP): Ethereum remains the undisputed king of DeFi, and XRP’s compatibility with this ecosystem is crucial. Wrapped XRP (wXRP), an ERC-20 token backed 1:1 with native XRP, allows users to interact with Ethereum-based protocols. Whether you’re providing liquidity on Uniswap, farming yields on Yearn Finance, or engaging in lending markets on Aave, wXRP brings XRP’s liquidity and speed to Ethereum’s vast DeFi playground. This not only boosts XRP’s visibility but also introduces new yield strategies for holders looking to maximize returns.

- Binance Smart Chain (BSC) Integration: With its low fees and high throughput, Binance Smart Chain has become a popular alternative to Ethereum. XRP’s presence on BSC—via BEP-20 wrapped tokens—mirrors its Ethereum strategy, offering seamless access to DeFi apps like PancakeSwap, Venus, and BakerySwap. The ability to swap, stake, and lend XRP on BSC opens the door for retail investors seeking faster, cheaper DeFi interactions, especially during periods of congestion on Ethereum.

- Flare Network: A Native Smart Contract Layer for XRP: Perhaps the most ambitious integration to date is with the Flare Network. Designed to bring smart contract capabilities to non-Turing complete assets like XRP, Flare’s F-Asset system allows XRP to be wrapped and used directly within the Flare ecosystem. What makes this unique is that Flare supports Ethereum Virtual Machine (EVM), meaning XRP can interact with Solidity-based smart contracts without needing to leave its ecosystem. For XRP investors, this means access to staking, governance, and even decentralized insurance protocols—all while retaining exposure to their core asset.

- Polkadot and Avalanche Bridges: As the blockchain world becomes increasingly modular, networks like Polkadot and Avalanche offer scalable frameworks for cross-chain interoperability. Projects are actively working on bridges that enable XRP to flow into these ecosystems. For example, Avalanche’s Avalanche Bridge (AB) and Polkadot’s parachain architecture can host wrapped XRP, providing users access to high-speed, low-cost DeFi protocols like Trader Joe and Acala. These integrations give XRP holders more options for yield farming, derivatives trading, and synthetic asset creation.

- Cosmos and the Inter-Blockchain Communication Protocol (IBC): Cosmos is another interoperability-focused network that is making strides in DeFi. While direct integration with XRP is still in development, projects like Sifchain are exploring ways to connect XRPL with Cosmos hubs via the IBC protocol. This would allow XRP to become a liquidity source within Cosmos’ rapidly expanding DeFi ecosystem, enabling cross-chain swaps and staking opportunities.

From an investment perspective, these integrations are more than just technical milestones—they’re strategic inflection points. As XRP becomes interoperable with the top blockchain networks, it gains access to their user bases, liquidity pools, and DeFi infrastructure. This not only strengthens XRP’s utility but also enhances its price discovery mechanisms across chains. Analysts are watching these developments closely, especially as XRP inches closer to breaking the [gpt_article topic=XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level—a move that could be catalyzed by rising on-chain activity across multiple ecosystems.

What’s particularly compelling is how these integrations are democratizing access to XRP-powered DeFi. No longer confined to the XRP Ledger, XRP is now a multi-chain asset capable of participating in global decentralized finance. For developers, this means building cross-chain dApps that leverage XRP’s speed and cost-efficiency. For institutions, it means tapping into XRP’s liquidity for settlement and treasury management across permissionless and permissioned networks.

Moreover, these integrations are laying the groundwork for more advanced financial products. Imagine a synthetic stablecoin backed by XRP on Avalanche, or a decentralized options market using XRP as collateral on Ethereum. These are no longer hypothetical scenarios—they’re within reach, thanks to the evolving interoperability landscape.

In a world where blockchain ecosystems are becoming increasingly interconnected, XRP’s seamless integration with major networks positions it as a cornerstone asset for the next generation of DeFi. Whether you’re a long-term investor eyeing multi-chain exposure, a developer seeking fast and scalable infrastructure, or an institution exploring blockchain-based settlement, XRP’s cross-network capabilities offer a compelling value proposition that goes far beyond remittances.

Future potential and ecosystem growth

As XRP continues to embed itself deeper into the multi-chain decentralized finance (DeFi) landscape, its future potential is not just promising—it’s transformative. The convergence of smart contract capabilities, cross-chain interoperability, and institutional adoption is setting the stage for XRP to become a linchpin of the next-generation financial ecosystem. With each integration and protocol enhancement, XRP is moving from a niche remittance solution to a foundational element of Web3 infrastructure.

One of the most compelling indicators of XRP’s future trajectory is the expansion of the XRP Ledger (XRPL) ecosystem. Developers are increasingly building DeFi protocols, non-fungible token (NFT) marketplaces, and decentralized applications (dApps) directly on XRPL, thanks to innovations like Hooks, sidechains, and the upcoming Automated Market Maker (AMM) integration. These features will allow for native DeFi functionality—without the need to port XRP to other chains—making the ledger more self-sustaining and attractive to both developers and liquidity providers.

Moreover, Ripple’s push for regulatory clarity and enterprise adoption is accelerating institutional interest. Financial institutions exploring blockchain-based settlement solutions are eyeing XRP not just for its speed and cost-efficiency, but also for its growing interoperability. With the potential for compliance-friendly DeFi products built on XRPL, XRP is well-positioned to serve both retail and institutional markets in parallel—a rare feat in today’s fragmented crypto landscape.

Looking ahead, several catalysts could significantly boost XRP’s ecosystem growth:

- Smart Contract Maturity: As projects like Evernode and Hooks reach full deployment, expect a wave of DeFi protocols to launch natively on XRPL. This will reduce dependency on wrapping XRP for use on other chains and unlock a new era of XRP-based DeFi products.

- Cross-Chain Liquidity Aggregation: With XRP already integrated into Ethereum, Binance Smart Chain, Flare, and others, the next step is seamless liquidity aggregation across these platforms. Protocols that can route trades and yield strategies across multiple chains using XRP as a bridge asset will dramatically enhance its utility and trading volume.

- Ecosystem Incentives and Grants: Ripple’s commitment to boosting the XRPL developer community through funding and grants is bearing fruit. Expect more startups and DeFi projects to emerge, creating a positive feedback loop of innovation and liquidity inflow into the XRP ecosystem.

- Institutional DeFi (DeFi 2.0): With regulatory frameworks slowly taking shape, institutions are beginning to explore compliant DeFi solutions. XRP, with its history of enterprise engagement and emerging DeFi capabilities, is a prime candidate for powering institutional-grade DeFi applications, including tokenized assets, real-world asset collateralization, and blockchain-based treasury management.

From a market perspective, this ecosystem expansion positions XRP as more than just a speculative asset. It’s becoming a yield-generating, utility-rich token with real-world applications. As wrapped XRP gains traction across DeFi platforms and native XRPL-based apps come online, the demand for XRP could rise significantly—especially during bull cycles where investors seek multi-chain exposure and high-performance assets. Analysts are increasingly viewing the [gpt_article topic=XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP and Cross-Chain DeFi: Interoperability with Other Networks How XRP can interact with multiple blockchain ecosystems. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level not just as a technical barrier, but as a psychological gateway to broader market acceptance and a potential breakout fueled by ecosystem growth.

Another key growth vector is tokenization of real-world assets (RWAs). As enterprises and governments explore blockchain for issuing tokenized bonds, carbon credits, and supply chain assets, XRP’s speed and low cost make it a natural settlement layer. Combined with smart contract functionality and cross-chain connectivity, XRP could serve as a backbone for this emerging asset class, opening up trillions in potential market capitalization.

And let’s not forget the growing importance of green blockchain initiatives. As sustainability becomes a core concern for both investors and regulators, XRP’s energy-efficient consensus protocol gives it a competitive edge over proof-of-work chains. This could attract ESG-conscious investors and institutions looking to align with eco-friendly blockchain solutions without compromising on performance or scalability.

In the broader context of Web3 and decentralized infrastructure, XRP’s evolution reflects the market’s shift from siloed networks to interconnected ecosystems. With its expanding toolkit, strategic partnerships, and growing developer activity, XRP is not just keeping pace with the DeFi revolution—it’s helping to define it.

For crypto investors and XRP enthusiasts, the message is clear: the XRP ecosystem is entering a high-growth phase. Whether you’re staking wXRP on Ethereum, farming yield on BSC, or building dApps on the XRPL, the opportunities are multiplying. As the infrastructure matures and cross-chain liquidity deepens, XRP’s role as a multi-chain, high-utility asset is set to become one of the defining narratives of the next crypto bull cycle.