Picture this: You’re sipping your morning coffee, scrolling through the latest crypto news, when you stumble upon the next big thing in decentralized finance (DeFi)—lending and borrowing on the XRP Ledger (XRPL). You might be thinking, “Is this another crypto rabbit hole, or does this actually make sense?” Strap in, because we’re diving headfirst into how the XRPL might just revolutionize lending and borrowing in DeFi. But fear not, dear reader, for this journey is less a tumble down the rabbit hole and more a strategic exploration of opportunity—all with a dash of humor and a sprinkle of insight.

The XRP Ledger, or XRPL to those of us who love acronyms almost as much as blockchain tech, is already known for its speed and efficiency. With transaction costs that make traditional banking fees look like a bad joke (seriously, have you ever tried wiring money internationally?), XRPL offers a robust platform for financial innovation. But can it really handle the complex world of lending and borrowing? Spoiler alert: yes, it can, and it does so with a flair that would make even the most seasoned banker raise an eyebrow.

Why XRP, you ask? Well, think of XRP as the Swiss Army knife of cryptocurrencies. It’s not just for cross-border payments anymore; it’s a versatile tool in the DeFi toolkit. Fast, scalable, and environmentally friendly, XRP provides a solid foundation for lending and borrowing protocols. And let’s face it, who doesn’t want to save the planet while turning a profit? As more developers unlock the potential of XRPL, we’re seeing a surge in interest from investors and crypto enthusiasts alike.

Now, let’s get technical for a moment. Lending and borrowing on XRPL leverages the ledger’s built-in decentralized exchange feature, which allows for seamless asset swaps and collateralization. This means that users can lend their XRP or other supported tokens in exchange for interest, while borrowers can secure the funds they need without jumping through traditional hoops. It’s like having a bank in your back pocket, minus the cumbersome paperwork and questionable interest rates.

But wait, there’s more! The transparency and security of blockchain technology mean that every transaction is verifiable and immutable. This adds a layer of trust that is often missing in traditional financial systems. No need to worry about shady backroom deals or disappearing funds. Instead, you can focus on what really matters: optimizing your returns and planning your next vacation (or moon mission, if you’re feeling ambitious).

Of course, like any great adventure, there are risks involved. Market volatility, regulatory changes, and protocol vulnerabilities can all impact the DeFi landscape. But fear not, intrepid investor! With careful research and strategic planning, the rewards can far outweigh the risks. Plus, with XRPL’s growing ecosystem, there are plenty of opportunities to diversify and hedge your bets.

So, where does XRP Authority fit into all of this? Consider us your trusty guide in the ever-evolving world of crypto and DeFi. With insights, analysis, and just the right amount of wit, we aim to keep you informed and entertained. Whether you’re a seasoned trader or a curious newcomer, XRP Authority is your go-to source for all things XRP and beyond.

In conclusion, as the realm of DeFi continues to expand, the integration of lending and borrowing on the XRP Ledger offers exciting possibilities. So why not dive in and see what the fuss is about? After all, fortune favors the informed—and a little humor never hurts either. Stay tuned to XRP Authority for the latest updates and insights; who knows, you might just discover your next great investment opportunity.

Understanding How XRPL Can Be Used for Lending and Borrowing in DeFi and Its Impact on XRP

Understanding XRPL and its core features

The XRP Ledger (XRPL) isn’t just another blockchain—it’s a high-performance, decentralized protocol that’s been quietly powering fast and efficient transactions since 2012. While it often flies under the radar compared to Ethereum or Solana, XRPL brings a unique set of features that make it a compelling foundation for decentralized finance (DeFi), especially in the realm of lending and borrowing. If you’re an investor or XRP enthusiast looking to understand why XRPL might be the next big thing in DeFi, buckle up. We’re diving deep into what makes XRPL tick.

At its core, XRPL is designed for speed, low cost, and scalability. Unlike proof-of-work chains that consume massive amounts of energy and suffer from congestion, XRPL uses a consensus protocol that settles transactions in about 3–5 seconds with near-zero fees. This makes it ideal for high-frequency financial operations like collateralized loans, yield farming, and interest-bearing assets—all key pillars of DeFi lending and borrowing platforms.

- Transaction Speed: XRPL processes around 1,500 transactions per second (TPS), with the potential to scale even higher. That’s a game-changer for real-time lending and borrowing operations where latency can mean the difference between profit and loss.

- Low Fees: With transaction costs typically less than a fraction of a cent, XRPL makes micro-lending and high-volume borrowing economically viable. No more watching your gas fees eat into your APY.

- Decentralized Exchange (DEX): XRPL has a built-in DEX that allows users to trade assets directly on the ledger. This is critical for liquidity in DeFi lending pools and helps facilitate seamless collateral swaps.

- Issued Currencies: XRPL supports the creation of custom tokens—known as issued currencies—on-chain. These can represent anything from stablecoins to tokenized real-world assets, essential components in diversified DeFi lending protocols.

- Pathfinding Algorithm: The XRPL’s pathfinding algorithm enables optimized routing for liquidity, ensuring borrowers and lenders always get the most efficient trade path for their assets.

One of the most overlooked but powerful aspects of XRPL is its native support for multi-currency transactions. For instance, a user can send USD-pegged stablecoins while the recipient receives EUR-pegged tokens, all in one seamless transaction. This cross-currency functionality could revolutionize global DeFi lending platforms by removing the need for multiple bridges and reducing exposure to slippage or volatility during asset conversion.

From an investment perspective, the XRPL’s efficiency and longevity offer a stable foundation for DeFi applications. While speculative assets often grab headlines, XRPL has maintained a consistent uptime and proven reliability for over a decade. This kind of track record is invaluable when building lending and borrowing protocols that require trust and performance at scale.

Moreover, XRP—the native asset of XRPL—plays a vital role in liquidity provisioning and fee payments. As DeFi lending platforms on XRPL emerge, XRP could serve as a primary collateral asset, much like ETH does on Ethereum-based platforms. Given XRP’s deep liquidity, wide exchange support, and established market cap, its integration into DeFi lending pools could unlock new yield farming strategies and interest-bearing asset classes tailored for XRP holders.

In a market that often chases the latest shiny object, XRPL stands out by quietly offering the infrastructure that DeFi builders need: speed, cost-efficiency, and reliability. As we explore how smart contracts and lending mechanisms can be layered onto this robust foundation, it’s clear that XRPL is more than ready to enter the DeFi arena—not just as a participant, but as a potential leader.

Integrating smart contracts for DeFi functionality

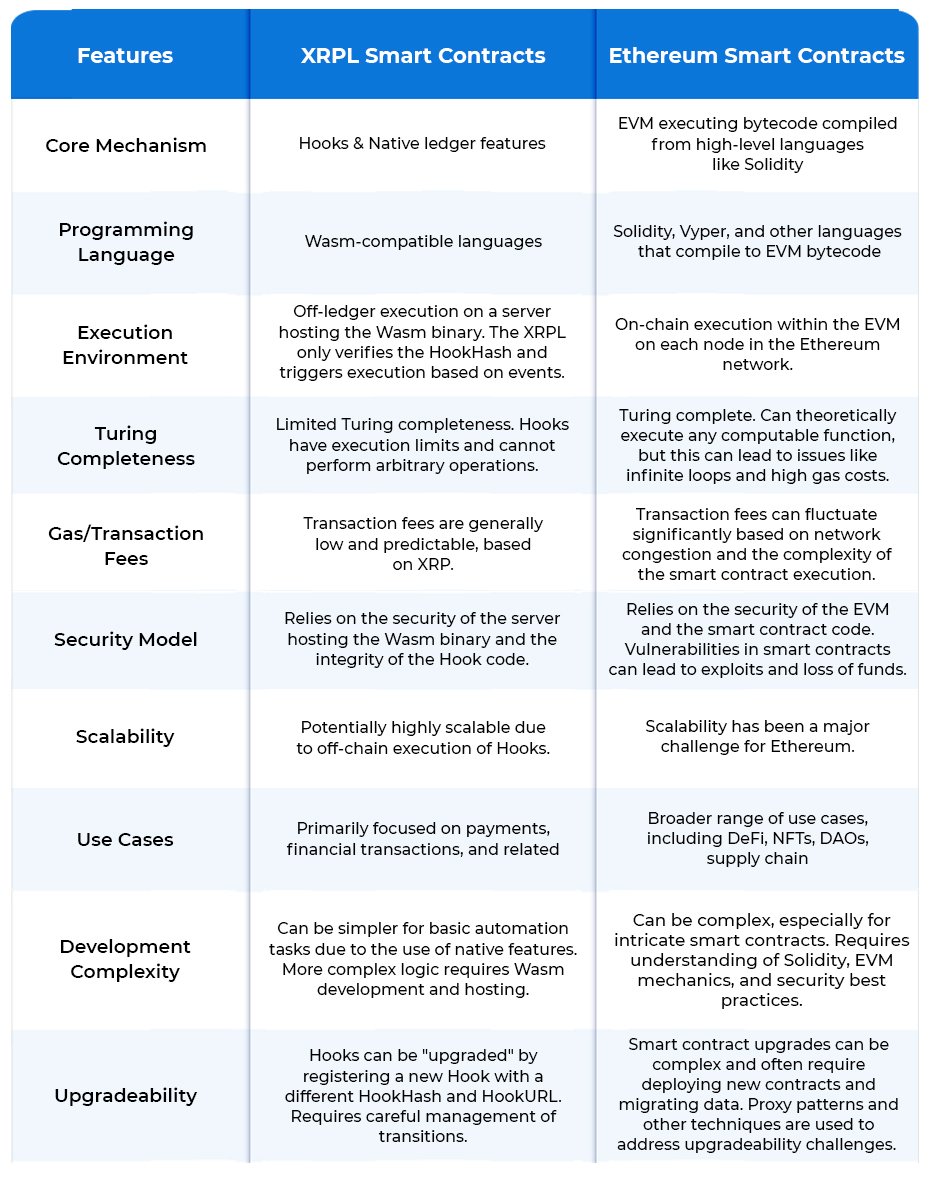

One of the key ingredients missing from XRPL’s original design was native smart contract support—a feature that has long been the backbone of DeFi ecosystems on platforms like Ethereum. However, the tides are turning. With the introduction of Hooks and the development of sidechains like the XLS-30d Automated Market Maker (AMM) and Evernode, XRPL is now on the cusp of becoming a smart contract powerhouse. This opens the doors for lending and borrowing protocols to flourish directly on the XRP Ledger.

Hooks are lightweight smart contract functionalities being developed as an amendment to XRPL. Think of them as programmable logic that can be attached to XRPL accounts, allowing developers to build custom behaviors into transactions. For DeFi, this means creating logic for lending pools, interest accrual, and even automated liquidations—all without bloating the ledger or compromising transaction speed.

In tandem, XRPL-compatible sidechains offer full smart contract capabilities without compromising the performance and consensus mechanisms of the mainnet. For instance, the sidechain developed by RippleX using Ethereum Virtual Machine (EVM) compatibility allows developers to port existing DeFi applications onto XRPL infrastructure. This means that protocols like Aave or Compound could, in theory, be replicated within the XRPL ecosystem, but with faster settlement times and lower operational costs.

- Collateralized Loans: Smart contracts can automate the issuance and repayment of loans using XRP or issued tokens as collateral. With real-time price feeds and oracles, the contract can enforce margin requirements and trigger automatic liquidations if the collateral value dips below a certain threshold.

- Lending Pools: Users can deposit assets into decentralized lending pools, earning passive income through interest. Smart contracts manage these pools, allocating funds to borrowers and calculating yields based on supply and demand—similar to how Aave and Compound function today.

- Interest-Bearing Assets: Depositors receive interest-bearing tokens representing their share in the lending pool. These tokens can then be used in other DeFi protocols, creating a layered financial ecosystem where yield can be compounded across platforms.

- Yield Farming: By incentivizing users to provide liquidity through reward tokens, DeFi platforms built on XRPL can encourage growth and liquidity. Smart contracts distribute these rewards automatically, based on staking duration and volume.

What makes this particularly exciting for XRP enthusiasts is the potential for XRP to become a default collateral asset in these lending protocols. Given its high liquidity and established market presence, XRP could fuel lending markets that rival Ethereum’s in scale—without the congestion or gas fee headaches. Imagine locking up XRP in a lending contract and earning interest in stablecoins, or leveraging XRP for margin trading without ever leaving the XRPL ecosystem.

Moreover, developers can integrate price oracles to feed real-time market data directly into smart contracts. This enables dynamic interest rates, flash loan protection, and liquidation thresholds that adjust based on market volatility—essential features for any robust DeFi lending platform.

From an investment perspective, these advancements significantly enhance the utility of XRP. As lending and borrowing protocols go live on XRPL, demand for XRP as a collateral and transactional asset could increase, potentially driving upward price pressure. If XRP begins to play a central role in DeFi, it could break through key technical levels—like the [gpt_article topic=How XRPL Can Be Used for Lending and Borrowing in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How XRPL Can Be Used for Lending and Borrowing in DeFi and A look at how XRP could be used in lending and borrowing protocols. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use collateralized loans, yield farming, lending pools, interest-bearing assets, DeFi lending platforms and A look at how XRP could be used in lending and borrowing protocols. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level—and establish new market narratives beyond cross-border payments.

Whether you’re a developer looking to build the next big DeFi dApp or an investor seeking yield-generating opportunities, the integration of smart contracts into XRPL is a game-changer. The infrastructure is maturing, the tools are being deployed, and the ecosystem is rallying behind a future where XRP is not just a remittance token, but a cornerstone of decentralized finance.

Lending and borrowing mechanisms on XRPL

Now that XRPL is evolving to support more complex logic through Hooks and EVM-compatible sidechains, the path to fully functional lending and borrowing protocols is wide open. But how would these mechanisms actually work on the XRP Ledger? Let’s break down the architecture, the user experience, and the economic incentives that could drive a thriving DeFi lending ecosystem powered by XRP.

At the heart of any lending and borrowing protocol is the concept of collateralized loans. Users deposit crypto assets—such as XRP or issued tokens—as collateral in exchange for a loan denominated in another asset, often a stablecoin. Thanks to XRPL’s native support for issued currencies, these stablecoins could be minted directly on-chain, representing USD, EUR, or even tokenized commodities. This flexibility makes XRPL a fertile ground for multi-asset lending platforms with global reach.

- Collateral Management: XRP can serve as a primary collateral asset due to its liquidity and established trading pairs. Borrowers would lock up XRP into smart contracts or Hooks-enabled accounts to mint stablecoins or access liquidity in other assets.

- Loan Issuance: Once collateral is locked, the protocol issues a loan at a value below the collateral’s market worth—typically based on an over-collateralization ratio to manage risk. For example, locking ,000 worth of XRP might allow borrowing 0 in stablecoins, maintaining a 60% loan-to-value ratio.

- Interest Mechanisms: Interest rates could be dynamically adjusted based on supply and demand within lending pools. These pools, managed by smart contracts, distribute interest to liquidity providers while collecting payments from borrowers.

- Liquidation Protocols: If the value of the collateral falls below a critical threshold—say, due to a drop in XRP price below the [gpt_article topic=How XRPL Can Be Used for Lending and Borrowing in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How XRPL Can Be Used for Lending and Borrowing in DeFi and A look at how XRP could be used in lending and borrowing protocols. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use collateralized loans, yield farming, lending pools, interest-bearing assets, DeFi lending platforms and A look at how XRP could be used in lending and borrowing protocols. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 support level—automated liquidation mechanisms kick in. This protects lenders by selling off collateral to repay the loan, using real-time oracle data to trigger actions.

The beauty of XRPL’s ultra-fast finality and low fees is that these mechanisms can operate with exceptional efficiency. Liquidations, interest payouts, and collateral adjustments happen in near real-time, reducing slippage and risk exposure. This makes the XRPL-based lending experience smoother and more accessible, especially for users who are accustomed to the slower, more expensive processes on other chains.

Another key component is the emergence of lending pools. These pools aggregate capital from users who wish to earn passive income. By depositing assets like XRP, issued stablecoins, or tokenized assets into these pools, users receive interest-bearing assets—essentially yield tokens that grow in value over time. These tokens can then be traded, staked, or used as collateral in other DeFi protocols, opening up advanced yield farming strategies and compounding opportunities.

Let’s say you deposit 10,000 XRP into a lending pool offering a 7% APY. You’d receive a corresponding amount of iXRP (interest-bearing XRP) which accrues value as interest is paid by borrowers. You could then use your iXRP as collateral in another borrowing protocol, effectively leveraging your position while still earning yield—a prime example of capital efficiency in action.

Yield farming, another pillar of DeFi, could also thrive on XRPL. Protocols may reward users who provide liquidity to lending pools or staking contracts with additional tokens—either governance tokens or utility tokens for reduced fees and enhanced features. For XRP holders, this means extra incentives to put their assets to work rather than letting them sit idle in cold storage.

Moreover, XRPL’s built-in decentralized exchange (DEX) plays a critical role in providing liquidity for these lending and borrowing protocols. Borrowers can instantly swap their loaned stablecoins for XRP or other assets, while lenders can liquidate interest-bearing tokens directly on-chain. The DEX ensures smooth asset flow and price discovery without relying on external exchanges—keeping everything within the XRPL ecosystem.

From an investment standpoint, XRP’s use as a collateral asset in DeFi lending protocols could significantly boost its utility and demand. As more users lock XRP into lending contracts, circulating supply decreases, potentially creating upward price pressure. If XRP begins to consistently hold above key levels like the [gpt_article topic=How XRPL Can Be Used for Lending and Borrowing in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How XRPL Can Be Used for Lending and Borrowing in DeFi and A look at how XRP could be used in lending and borrowing protocols. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use collateralized loans, yield farming, lending pools, interest-bearing assets, DeFi lending platforms and A look at how XRP could be used in lending and borrowing protocols. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level, it could signal market confidence in its role as a DeFi asset, not just a remittance tool.

And let’s not forget the institutional angle. With XRPL’s regulatory-friendly design and history of compliance-focused development, enterprise-grade lending protocols could find a home here. Imagine banks or fintech firms offering crypto-backed loans using XRP as collateral—all while leveraging XRPL’s transparent, auditable ledger and lightning-fast settlement times.

In the grander scheme, lending and borrowing on XRPL isn’t just about copying what Ethereum or Avalanche have done. It’s about leveraging the ledger’s unique strengths—speed, cost-efficiency, and built-in DEX—to create a new breed of DeFi protocols that are more accessible, more scalable, and more investor-friendly. Whether you’re a seasoned DeFi degenerate or a conservative yield-seeker, XRPL’s lending mechanisms offer a compelling new frontier for crypto finance.

Security and scalability considerations in XRPL DeFi

As lending and borrowing protocols begin to take root on the XRP Ledger, security and scalability become mission-critical. After all, no investor wants to wake up to a drained lending pool or a congested network that turns profitable trades into missed opportunities. Fortunately, XRPL is built with a foundation that naturally supports robust security and horizontal scalability—two pillars that can help DeFi applications thrive without compromising user trust or performance.

Let’s start with security. Unlike proof-of-work blockchains that rely on mining and are vulnerable to 51% attacks, XRPL uses a unique consensus protocol that’s fast, deterministic, and resistant to manipulation. Validators—chosen based on a Unique Node List (UNL)—must agree on the state of the ledger before any transaction is finalized. This design eliminates the risk of chain reorganizations and double-spending, which are critical concerns for lending and borrowing protocols dealing with real-time asset flows and liquidations.

For DeFi protocols, this means that loan issuance, collateral locking, and interest distribution can be executed with near-instant finality. No more waiting for 12 block confirmations or worrying about a transaction being reversed. Once it’s done on XRPL, it’s done for good. This level of transactional integrity is a huge win for developers building interest-bearing assets, lending pools, and automated liquidations—security that’s baked into the protocol, not bolted on as an afterthought.

Furthermore, the upcoming integration of Hooks and smart contract sidechains doesn’t compromise this security model. Hooks are intentionally lightweight and designed to run efficiently without clogging the network or introducing systemic vulnerabilities. Meanwhile, sidechains like the XRPL EVM chain are being developed with interoperability and security in mind, enabling smart contract execution while keeping the main ledger streamlined and stable.

- Isolation of Risk: By leveraging sidechains for smart contract execution, XRPL ensures that issues in one protocol or dApp don’t compromise the entire network. This modular approach is ideal for DeFi, where bugs in lending contracts can have cascading effects.

- Validator Diversity: XRPL’s validator set includes a mix of independent operators, institutions, and community nodes, reducing centralization risks and increasing ledger resilience.

- Auditable Ledger: Every transaction on XRPL is publicly verifiable, making it easier for DeFi platforms to maintain transparency and undergo third-party audits. This is especially important for protocols managing billions in collateralized loans and yield farming rewards.

Scalability is equally important. As more users flock to XRPL for its fast transactions and low fees, the network needs to maintain performance without bottlenecks. Luckily, XRPL’s architecture is inherently scalable. With a current capacity of around 1,500 transactions per second—and the capability to scale even higher with optimization—XRPL can handle the volume required by real-time lending and borrowing platforms.

Consider a scenario where thousands of users are depositing XRP into lending pools, minting interest-bearing tokens, and engaging in cross-asset swaps on the DEX. On Ethereum, such activity would likely trigger gas wars and slow confirmation times. On XRPL, it’s just another Tuesday. The network’s low latency and high throughput ensure that all these actions can be executed smoothly, even during periods of high demand.

From an investor’s perspective, this translates into a better user experience and fewer hidden costs. The ability to move collateral quickly, claim interest without delay, and avoid slippage during liquidations makes XRPL-based DeFi protocols more attractive—especially for institutional players who demand both performance and predictability.

In terms of real-world applications, imagine a micro-lending platform built on XRPL that services users in emerging markets. With XRPL’s scalability and near-zero fees, such a platform could process thousands of transactions daily without breaking the bank. Or consider an institutional-grade lending protocol that requires sub-second settlement and high auditability—XRPL’s security model and transparent ledger make it an ideal fit.

And let’s not overlook compliance. As regulators begin to scrutinize DeFi more closely, XRPL’s transparent and immutable ledger provides a strong foundation for KYC- and AML-compliant protocols. Developers can build lending platforms that are not only secure and scalable but also align with emerging regulatory frameworks—an important consideration for long-term sustainability and mass adoption.

Ultimately, the synergy between XRPL’s consensus model, smart contract extensions, and high-performance infrastructure positions it as a formidable player in the DeFi lending space. As more protocols begin to experiment with XRP as a collateral asset and deploy lending pools and yield-generating mechanisms, the network’s security and scalability will be the bedrock upon which these innovations are built. For XRP holders and crypto investors alike, this evolution adds a compelling layer of utility that goes far beyond speculative trading—it’s about building a financial future that’s fast, fair, and fundamentally secure.

- for key points.