Welcome to the digital Wild West, where cryptocurrency isn’t just a buzzword, but a way of life—and a potential gold mine. If you’ve been wandering the blockchain plains wondering how to make your XRP work for you, you’ve hit the jackpot. Lending XRP and earning interest is not just a possibility; it’s the financial equivalent of finding gold nuggets in your backyard. But how does one embark on this journey without falling into the traps of crypto bandits? Fear not, fellow crypto cowboys and cowgirls, for this guide is your trusty map to passive income paradise.

Why XRP, you ask? Well, picture this: a cryptocurrency that’s lightning-fast, with transaction fees so low they could make a penny pinch. XRP is not only a major player in the blockchain and finance realms but also a beloved companion for traders who crave speed and efficiency. So, why not harness its potential and lend it out for a handsome reward? Think of it as putting your digital dollars to work while you sip margaritas on a virtual beach.

Now, let’s dive into the nitty-gritty. Lending XRP is akin to becoming a bank in the digital world. You provide liquidity, and in return, you earn interest. Sounds simple, right? But wait—do you need a degree in rocket science to navigate this world of decentralized finance? Absolutely not! This guide will demystify the process, breaking down complex concepts into bite-sized nuggets of wisdom. After all, who doesn’t love a good crypto snack?

Ever wondered what platforms allow you to lend XRP? Well, you’re in for a treat. From decentralized behemoths to sleek, user-friendly apps, the options are plentiful. But which one to choose? Ah, the eternal dilemma—like picking the perfect avocado. We’ll explore the top contenders, weighing their pros and cons with the precision of a seasoned trader eyeing the market charts. Spoiler alert: there’s a platform out there with your name on it!

But wait, there’s more! What about the risks, you ask? Lending XRP isn’t just sunshine and rainbows. As with any investment, there are pitfalls to dodge and storms to weather. Fear not, for we will arm you with the knowledge to navigate these treacherous waters. From market volatility to security concerns, no stone will be left unturned. After all, who wants to be the crypto equivalent of a shipwrecked sailor?

Curious about how much interest you can earn? Let’s just say the numbers might surprise you. While traditional savings accounts offer interest rates that could make a snail seem fast, the crypto world operates on a different level. Imagine earning interest rates that actually make you smile—no, it’s not a fantasy, it’s the reality of lending XRP. We’ll crunch the numbers, so you don’t have to, showcasing potential returns that could turn skeptics into believers.

Of course, no journey is complete without a few cautionary tales. Ever heard of the legendary crypto tales where fortunes were made—and lost? With my years of experience, I’ll share stories that are equal parts educational and entertaining. Because let’s face it, learning from others’ mistakes is far less painful than making them yourself. Consider this guide your personal crypto oracle, ready to guide you to financial enlightenment.

Finally, as the proud owner of XRPAuthority.com, I’m here to assure you that you’re in capable hands. With a decade of crypto expertise and a deep-seated passion for XRP, this is more than just a guide—it’s a testament to the potential that lies within digital finance. So, ready to embark on your journey to passive income glory? Stick with XRPAuthority, where insights aren’t just shared—they’re minted.

Understanding How to Lend XRP and Earn Interest: Passive Income Guide A guide to earning interest by lending XRP on platforms. and Its Impact on XRP

Understanding XRP and crypto lending

Understanding XRP and Crypto Lending

To fully grasp how to earn passive income by lending XRP, it’s essential to start with a solid understanding of what XRP is and how crypto lending works. XRP, the native digital asset of the XRP Ledger, was developed by Ripple Labs to facilitate fast, low-cost international money transfers. Unlike Bitcoin, which is mined and operates on a proof-of-work model, XRP is pre-mined, with a total supply of 100 billion tokens. This unique structure gives XRP a distinct role in the crypto ecosystem, especially in cross-border payments and liquidity provisioning.

Crypto lending, on the other hand, is a decentralized financial service that allows users to lend their digital assets to borrowers in exchange for interest. Think of it as the crypto version of a high-yield savings account, but instead of depositing fiat currency into a traditional bank, you’re parking your XRP on a lending platform. The borrower pays you interest, usually calculated in annual percentage yield (APY), and you can earn passive income while your XRP continues to work for you.

What makes XRP particularly attractive for lending is its utility and liquidity. Due to its widespread adoption by financial institutions and payment providers, XRP often maintains high trading volume and availability. This makes it a preferred asset for lending markets, where liquidity is critical. Additionally, because XRP transactions settle in just 3–5 seconds and cost a fraction of a cent, it’s extremely efficient for lending protocols that require fast collateral adjustments or margin calls.

Let’s break down why XRP stands out in the lending ecosystem:

- Speed and Efficiency: XRP transactions are nearly instantaneous, which is ideal for lending platforms that rely on quick settlements and rebalancing.

- Low Transaction Fees: With transaction costs often less than [gpt_article topic=How to Lend XRP and Earn Interest: Passive Income Guide A guide to earning interest by lending XRP on platforms. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Lend XRP and Earn Interest: Passive Income Guide A guide to earning interest by lending XRP on platforms. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].01, XRP is cost-effective for both lenders and borrowers.

- Strong Institutional Backing: Ripple’s partnerships with major banks and financial institutions lend credibility to XRP’s role in the financial sector, enhancing its perceived stability.

- High Liquidity: XRP is consistently ranked among the top cryptocurrencies by market capitalization and daily trading volume, ensuring there’s always a market for your lent assets.

In the crypto lending landscape, XRP can be lent in two primary ways: through centralized lending platforms like Nexo, Celsius (prior to its restructuring), or Binance Earn, and through decentralized finance (DeFi) protocols such as Kava or Flare Finance. Each method has its own risk-reward profile, but both allow you to earn interest on idle XRP holdings.

Here’s a quick example: Suppose you deposit 1,000 XRP into a lending platform offering a 6% APY. Over a year, you would earn 60 XRP in passive income, assuming the rate remains stable. That’s income generated without selling your XRP or actively trading—just by letting your assets sit and earn.

Given XRP’s role in enabling global liquidity and its integration in enterprise-grade financial systems, it holds long-term potential not just as a speculative asset, but as a functional part of next-gen finance. As the world increasingly leans into decentralized solutions and blockchain-based settlement layers, XRP’s relevance in lending markets is expected to grow. Combine this with the ability to generate passive income, and you’ve got a compelling use case for any crypto investor looking to optimize their portfolio.

Choosing a reliable lending platform

Choosing a Reliable Lending Platform

Now that you understand the power of XRP in the crypto lending ecosystem, the next step is selecting a lending platform that’s not only secure but also aligns with your financial goals. With dozens of platforms offering different rates, features, and risk profiles, making the right choice can feel like navigating a DeFi jungle. But don’t worry—we’re about to shine a flashlight on what really matters when choosing where to lend your XRP.

First and foremost, reliability is king. In crypto, trust is everything. You’re essentially handing over your assets to a third party, so the platform’s reputation, security protocols, and regulatory compliance are non-negotiables. Look for platforms that are transparent about how funds are handled, who the borrowers are, and how they manage risk. If a platform is vague about these details, that’s a red flag waving at full mast.

- Security Infrastructure: Ensure the platform uses industry-grade security measures like cold storage, multi-signature wallets, and two-factor authentication (2FA). Platforms such as Nexo and YouHodler, for example, boast robust insurance policies and custodianship through trusted partners like BitGo or Ledger Vault.

- Regulatory Compliance: Platforms operating under the oversight of financial regulators (e.g., SEC, FCA, or FINMA) are more likely to follow strict operational and security standards. While DeFi platforms may not fall under the same rules, centralized platforms should be transparent about their licensing status.

- Transparency and Audits: Look for platforms that undergo regular third-party audits and publish proof-of-reserves. This level of transparency gives confidence that your XRP isn’t being used recklessly or overleveraged.

Next, consider the interest rates and terms. Not all lending platforms are created equal when it comes to yield. Some offer fixed APYs, while others have variable rates that change with market demand. For instance, a centralized platform might offer a flat 5% APY on XRP deposits, while a DeFi protocol might fluctuate between 4% and 10% depending on liquidity and borrower activity. Always read the fine print—some platforms require you to lock up your funds for a specific duration to earn the highest rates, while others offer flexible terms but lower returns.

Here are some popular platforms to consider for lending XRP:

- Nexo: A user-friendly centralized platform offering daily interest payouts on XRP with up to 6% APY. Nexo is regulated in multiple jurisdictions and provides 5 million in insurance on custodial assets.

- YouHodler: Offers competitive interest rates and supports XRP among other top-tier cryptocurrencies. It provides flexible lending terms and is known for its transparency.

- Binance Earn: Binance, as the world’s largest crypto exchange, offers XRP lending through its Earn platform. With both fixed and flexible savings options, it’s ideal for users who already use Binance for trading.

- Kava: A decentralized platform built on the Cosmos SDK that supports XRP lending through synthetic assets and collateralized debt positions. It’s perfect for DeFi-savvy users looking to stay on-chain.

- Flare Finance: A DeFi protocol native to the Flare Network, which is designed to unlock smart contract functionality for XRP. It introduces innovative lending pools and yield farming opportunities for XRP holders.

Another crucial factor is liquidity and withdrawal flexibility. You want to ensure that you can access your XRP when needed. Some platforms may impose withdrawal limits or delays, especially during periods of high network congestion or liquidity crunches. Always check the platform’s policy on withdrawals and whether there are any penalties for early redemption if you’re in a fixed-term lending contract.

For the more advanced investor, evaluating the platform’s risk management strategies is also key. Ask yourself: How does the platform vet borrowers? Do they require overcollateralization? Is there a liquidation mechanism in place to protect lenders from market volatility? Platforms like Compound or Aave (though not yet XRP-native) have set the standard in DeFi for automated risk controls, which are worth learning from even if you’re using a centralized service.

And finally, don’t underestimate user experience and customer support. A sleek interface and responsive support team can make a world of difference, especially if you’re new to crypto lending. Look for platforms with intuitive dashboards, mobile apps, and educational resources that help you track your earnings and manage your portfolio efficiently.

Here’s a quick checklist to guide your platform selection:

- 🔒 Is the platform secure and insured?

- 📜 Is it regulated or at least transparent about its operations?

- 📈 What APY does it offer on XRP, and are the terms flexible or fixed?

- 💸 Can you withdraw your XRP anytime, or are there lock-up periods?

- 🛡️ How does the platform manage borrower risk and market volatility?

- 🤝 Is the customer support responsive and helpful?

Choosing the right platform to lend your XRP isn’t just about chasing the highest yield—it’s about balancing return with risk, usability, and trust. As XRP continues to integrate into global financial infrastructure and as lending protocols evolve, the platforms that prioritize transparency, security, and innovation will stand out as the best places to grow your digital wealth.

Steps to lend XRP and start earning

Steps to Lend XRP and Start Earning

So, you’ve chosen a reliable platform and are ready to put your XRP to work—nice move! Lending XRP isn’t rocket science, but it does involve a few essential steps to ensure your assets are safe and your returns are optimized. Whether you’re going the centralized route or diving into the DeFi deep end, the process can be smooth and rewarding if you follow a clear roadmap. Let’s walk through the step-by-step process to lend XRP and start earning passive income like a pro.

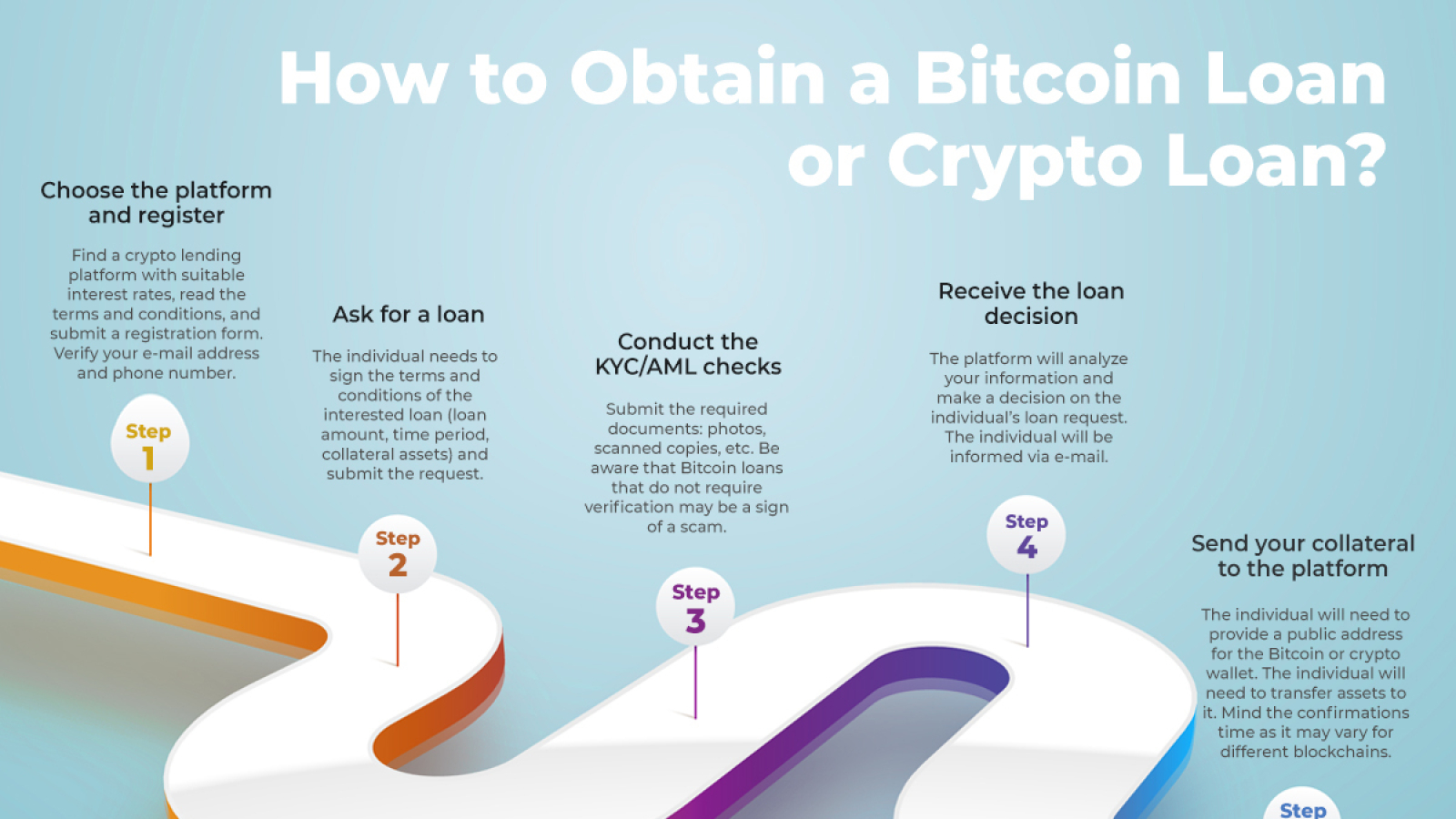

- Step 1: Create and Verify Your Account

Start by signing up on your chosen lending platform. For centralized platforms like Nexo or YouHodler, this means completing Know Your Customer (KYC) requirements. You’ll need to provide identification documents and possibly proof of address. This step ensures compliance with global regulations and adds a layer of security to the platform. - Step 2: Secure Your Wallet

Before transferring XRP, make sure your account is protected. Enable two-factor authentication (2FA), set up withdrawal whitelists, and use strong, unique passwords. For DeFi platforms like Kava or Flare Finance, connect a compatible crypto wallet (like MetaMask or Ledger via WalletConnect) and ensure your private keys are backed up and secure. Remember: in DeFi, you are your own bank—and that comes with responsibility. - Step 3: Deposit XRP into the Platform

Once your account is verified and secured, it’s time to fund it. Navigate to the wallet or deposit section of the platform and select XRP. You’ll be provided with a deposit address and possibly a destination tag (important for XRP transactions). Always double-check these details before initiating the transfer from your external wallet or exchange. A small mistake here can lead to lost funds. - Step 4: Choose Your Lending Terms

After your XRP hits your account, you’ll need to decide on the lending terms. Platforms often offer two main options:- Flexible Lending: Withdraw your funds anytime, but with slightly lower APY.

- Fixed Terms: Lock your XRP for a set period (e.g., 30, 60, or 90 days) for higher yield.

For example, Nexo may offer up to 6% APY on fixed-term XRP lending, while flexible accounts might yield around 4%. Make your choice based on your liquidity needs and market outlook.

- Step 5: Monitor Your Earnings

Once your XRP is lent out, you’ll start earning interest—usually paid out daily or weekly, depending on the platform. Use your dashboard to track your earnings, view current APY rates, and manage your lending positions. Many platforms also offer compounding options, allowing your earned interest to be automatically reinvested, further boosting your returns over time. - Step 6: Rebalance When Necessary

Crypto markets are dynamic, and lending rates can fluctuate. Keep an eye on APYs and platform updates. If another platform offers higher returns or better terms, consider reallocating your XRP. Just remember to weigh the risks and fees associated with moving assets around. - Step 7: Withdraw or Reinvest

At the end of your lending term—or anytime, if you’re using a flexible option—you can choose to withdraw your XRP or reinvest it. If prices are favorable or you need liquidity, withdrawing might make sense. But if you’re in it for the long haul and believe in XRP’s future (especially with Ripple’s growing institutional partnerships), reinvesting could supercharge your passive income strategy.

Let’s say you deposit 2,000 XRP into a platform offering 5% APY. That’s 100 XRP earned over a year—without lifting a finger. And if XRP’s market value increases during that time, your earnings could be even more impressive in fiat terms. That’s the double benefit of lending: you earn yield while maintaining exposure to potential price appreciation.

For DeFi users, the process is slightly more advanced. You’ll typically need to:

- Wrap your XRP into a compatible token (e.g., wXRP on Flare).

- Deposit it into a liquidity pool or lending vault.

- Interact with smart contracts to manage your loan positions.

The upside? Higher yields and greater control. The downside? Smart contract risk and a steeper learning curve. But for those comfortable with DeFi mechanics, platforms like Kava offer a decentralized way to earn interest while staying fully on-chain.

Pro tip: Always test with a small amount first. Whether you’re using a centralized or decentralized platform, sending a small test transaction helps confirm everything is working as expected before committing larger sums.

Also, keep an eye on XRP-specific developments. For instance, with the ongoing expansion of the Flare Network and Ripple’s push into central bank digital currencies (CBDCs), XRP’s DeFi capabilities are expected to grow. As more protocols integrate XRP, opportunities for lending and earning will likely multiply—so staying informed can help you stay ahead.

Lending XRP is about more than just APY percentages. It’s about maximizing the utility of your holdings, participating in the evolving crypto economy, and building a diversified income stream. With the right strategy and a bit of diligence, your XRP can go from idle in your wallet to earning interest 24/7—all while you sleep, sip coffee, or scroll through the latest crypto memes.

Risks and tips for safe lending

Risks and Tips for Safe Lending

Lending XRP can be a smart way to earn passive income, but like any investment strategy, it comes with a unique set of risks. Whether you’re staking your XRP on a centralized platform or experimenting with the latest DeFi protocol, understanding the potential pitfalls—and how to sidestep them—is crucial for protecting your capital and optimizing returns. Let’s unpack the key risks and share some battle-tested tips to keep your crypto lending journey smooth and secure.

- Platform Risk: This is the big one. When you lend XRP through a centralized platform, you’re essentially trusting a third party to safeguard your funds and honor their payout terms. If the platform gets hacked, mismanages funds, or goes insolvent (hello, Celsius flashbacks), your XRP could be at risk. Even if the platform claims to have insurance, read the fine print—coverage might not extend to all scenarios.

- Smart Contract Risk: For DeFi users, the risk shifts from centralized mismanagement to code vulnerabilities. Smart contracts are only as good as the developers who write them. Bugs, exploits, or malicious backdoors can result in funds being drained from a protocol in seconds. Even battle-tested platforms like Compound and Aave have seen security incidents in the past, so due diligence is a must.

- Market Volatility: XRP is no stranger to price swings. If the market tanks and borrowers can’t maintain their collateral, your lent XRP could be at risk—especially on under-collateralized platforms. Some DeFi platforms rely on liquidation mechanisms to protect lenders, but in fast-moving markets, slippage can still cause losses.

- Regulatory Risk: The regulatory landscape around crypto lending is evolving rapidly. Governments and financial watchdogs are increasingly scrutinizing platforms that offer interest-bearing crypto accounts. Changes in laws could impact your ability to lend XRP or withdraw funds, especially if platforms are forced to cease operations or comply with new licensing requirements.

- Liquidity Risk: Not all platforms offer instant withdrawals. If you need to access your XRP during a market crunch or emergency, you may face delays or unfavorable terms. Fixed-term lending contracts are particularly restrictive, so always weigh the trade-off between yield and flexibility.

Now that the risks are on the table, let’s flip the coin and explore smart strategies to lend XRP safely and effectively:

- Diversify Your Lending: Don’t go all in on one platform or protocol. Spread your XRP across multiple trusted platforms to reduce exposure to any single point of failure. This applies to both CeFi and DeFi options. Think of it as not putting all your eggs—or tokens—in one basket.

- Stick with Reputable Platforms: Choose platforms with a proven track record, transparent operations, and solid security practices. Look for regular audits, proof-of-reserves, and clear communication channels. If a platform is offering unusually high APYs (think 20%+ on XRP), it’s probably too good to be true.

- Use Hardware Wallets for DeFi: If you’re venturing into DeFi, use a hardware wallet like Ledger or Trezor to interact with protocols. This adds a layer of security that hot wallets or browser extensions can’t match. Also, avoid clicking on suspicious links or signing unknown transactions—phishing attacks are common in the DeFi space.

- Start Small and Scale Up: Before committing large sums, test the platform with a small XRP deposit. Monitor how interest is paid, how withdrawals work, and how responsive the support team is. Once you’re comfortable, gradually increase your lending position.

- Stay Updated on XRP Developments: XRP’s integration into DeFi is still evolving. Protocols like Flare and Kava are building new use cases, and staying informed about these developments can help you identify safer and more lucrative opportunities. Follow official project updates, join community forums, and subscribe to trusted crypto newsletters.

- Understand the Terms: Always read the fine print before lending. Know the lock-up period, how interest is calculated, and what happens if the platform experiences liquidity issues. For example, some platforms may offer a 6% APY but require a 90-day lock-up—make sure that aligns with your investment timeline.

- Monitor Your Lending Positions: Set calendar reminders to check your lending accounts weekly. Watch for changes in APY, new platform announcements, or any red flags. If something feels off—like sudden changes in terms or delayed interest payments—it might be time to withdraw and reassess.

One final note: consider the tax implications of earning interest on XRP. In many jurisdictions, crypto interest is considered income and may be taxable. Keep detailed records of your deposits, withdrawals, and earnings, and consult with a crypto-savvy tax professional to stay compliant.

Lending XRP is a powerful tool in the passive income toolbox, but it’s not a “set it and forget it” strategy. By understanding the risks and following these safety tips, you can navigate the lending landscape with confidence and make your XRP work smarter—not harder—for your financial future.

- for key points.