Are you ready to dive into the thrilling world of XRP trading in 2024? If you’re an investor, trader, or crypto enthusiast with a soft spot for Ripple’s avant-garde token, you’ve clicked on the right link! As the witty and insightful owner of XRPAuthority.com, I’ve been navigating the crypto waters since 2011 and riding the XRP wave since 2018. Today, we’re set to explore the crème de la crème of crypto exchanges where you can trade XRP with high liquidity. Buckle up, because this journey is as exciting as watching Bitcoin hit a new all-time high!

Now, you might be wondering, why is XRP still relevant in the ever-evolving blockchain landscape? Is it just another digital asset, or does it hold a secret power that makes it irresistible? Spoiler alert: it’s the latter. XRP is like the Swiss Army knife of cryptocurrencies, boasting ultra-fast transaction speeds and low fees, making it a darling in both finance and trading circles. Plus, with Ripple’s ambitious vision of revolutionizing cross-border payments, XRP’s potential is as vast as the universe itself—or at least as vast as Elon Musk’s aspirations for Mars colonization.

But let’s get to the meat of the matter: where should you trade XRP in 2024? Not all crypto exchanges are created equal, and when it comes to high liquidity, only a select few make the cut. Liquidity in trading is like having a reliable GPS in a bustling city; without it, you’re likely to lose your way—or in this case, your money. So, which exchanges are our top picks for ensuring your XRP trades are as smooth as a blockchain consensus algorithm?

Before we spill the beans, let’s sprinkle in a touch of humor and rhetorical insight. Have you ever tried trading on an exchange with low liquidity? It’s like trying to sell ice to an Eskimo or convincing your grandma that Bitcoin isn’t a Ponzi scheme. In other words, it’s a nightmare. High liquidity ensures that your trades are executed quickly and at the best possible price, sparing you the agony of watching your investments dwindle while waiting for a buyer.

It’s time to roll out our list of the best exchanges for XRP trading in 2024. These platforms not only offer high liquidity but also feature cutting-edge security measures and user-friendly interfaces. It’s like finding a unicorn in the crypto world: rare, magical, and incredibly valuable. Whether you’re a seasoned pro or a curious newbie, these exchanges provide the ideal environment to maximize your XRP trading potential.

As we navigate through this list, keep in mind that each exchange has its own unique perks and quirks. Some might charm you with their low fees, while others woo you with their advanced trading tools. It’s all about finding the right fit, like picking the perfect avocado at a grocery store—neither too ripe nor too firm, just the right amount of squishy. Remember, your trading experience can significantly impact your investment returns, so choose wisely!

In conclusion, XRP continues to be a formidable player in the crypto arena, and selecting the right exchange is pivotal to your trading success. Whether you’re drawn to XRP’s potential to reshape the global financial system or its allure as a high-speed, low-cost digital asset, knowing where to trade is half the battle. Our curated list of top exchanges will be your compass in the tumultuous seas of cryptocurrency trading.

And remember, XRP Authority is your trusted ally, providing insights that are as sharp as a satirical quip. With our finger on the pulse of the crypto world, we ensure that you have the knowledge and tools to make informed decisions. So, keep your eyes peeled on XRPAuthority.com for the latest updates and expert advice that will keep you ahead of the curve in the ever-changing world of XRP trading.

Understanding Best Exchanges to Trade XRP in 2024 and Its Impact on XRP

Top exchanges for trading XRP

Top Exchanges for Trading XRP

When it comes to trading XRP in 2024, choosing the right exchange can make a world of difference. With regulatory clarity improving and the demand for XRP surging, traders need platforms that offer high liquidity, advanced trading tools, and robust security features. Below is a list of the top cryptocurrency exchanges where XRP can be traded efficiently, ensuring seamless transactions and competitive fees.

1. Binance – Best for Global Liquidity and Low Fees

Binance remains the go-to choice for XRP traders worldwide. With one of the deepest liquidity pools in the market, Binance ensures tight spreads and minimal slippage, making it ideal for both retail and institutional investors. The exchange offers a range of trading pairs, including XRP/USDT, XRP/BTC, and XRP/ETH, allowing traders to diversify their strategies.

- Trading Fees: Binance’s fee structure is among the lowest in the industry, starting at 0.1% per trade and reducing further with BNB fee discounts.

- Security: The platform employs advanced security protocols, including SAFU (Secure Asset Fund for Users) to protect traders’ funds.

- Liquidity: With billions in daily trading volume, Binance ensures XRP traders can execute large orders without significant price impact.

2. Coinbase – Best for U.S. Traders and Regulatory Compliance

For XRP traders in the U.S., Coinbase is a solid choice, thanks to its compliance with regulatory standards and user-friendly interface. While Coinbase initially delisted XRP due to the SEC lawsuit, it has since reinstated trading, offering secure and compliant access to the asset.

- Trading Fees: Coinbase fees are higher than Binance, typically ranging from 0.5% to 1.49% per trade, but the platform’s ease of use makes it worthwhile for beginners.

- Security: Industry-leading security measures, including FDIC insurance for USD balances and cold storage for crypto assets.

- Liquidity: While not as deep as Binance, Coinbase still provides strong liquidity for XRP trading, especially in USD pairs.

3. Kraken – Best for Security and Margin Trading

Kraken is a top-tier exchange for traders who prioritize security and advanced trading options. It offers XRP trading with leverage, making it an attractive choice for traders looking to maximize their capital.

- Trading Fees: Competitive fees, starting at 0.16% for makers and 0.26% for takers, with further reductions for high-volume traders.

- Security: Kraken is renowned for its robust security framework, with no major hacks reported since its inception.

- Liquidity: Deep order books for XRP/USD and XRP/EUR pairs, ensuring efficient trade execution.

4. KuCoin – Best for Altcoin Traders and Staking

KuCoin is a great option for traders looking to access a wide range of altcoins while also earning passive income. The exchange supports XRP staking and futures trading, adding extra utility for XRP holders.

- Trading Fees: Low fees starting at 0.1%, with additional discounts for KCS token holders.

- Security: Strong security features, including withdrawal whitelists and two-factor authentication.

- Liquidity: While not as deep as Binance, KuCoin still provides solid liquidity for XRP trading.

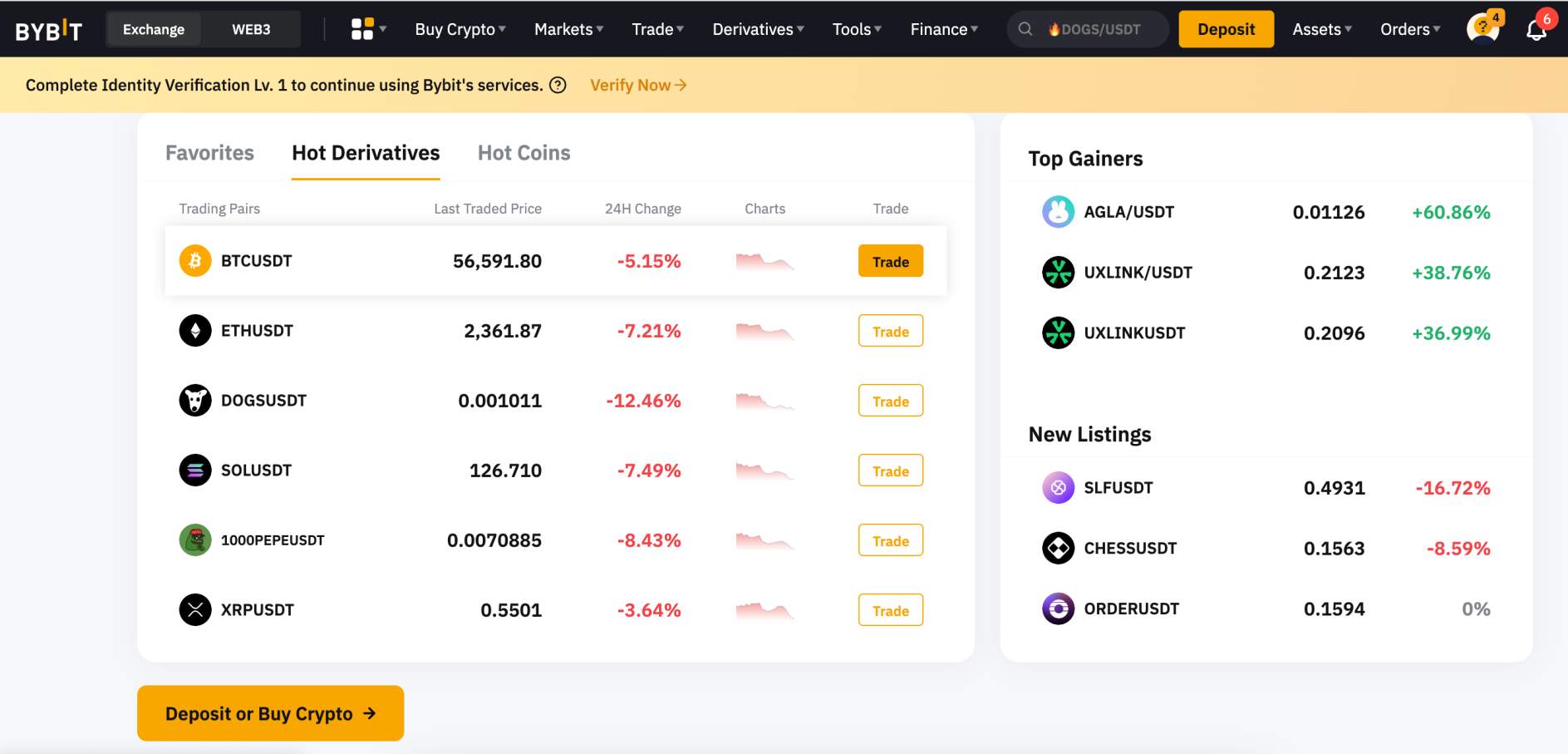

5. Bybit – Best for Derivatives and Leverage Trading

Bybit is an excellent choice for traders looking to engage in XRP futures and perpetual contracts. With up to 100x leverage, Bybit caters to high-risk, high-reward traders.

- Trading Fees: Maker fees at 0.01% and taker fees at 0.06%, making it one of the most competitive platforms for derivatives trading.

- Security: Multi-signature cold wallets and advanced risk management features.

- Liquidity: One of the highest XRP derivatives trading volumes in the market.

These exchanges provide the best environments for trading XRP, whether you’re a beginner looking for a simple interface or an advanced trader seeking deep liquidity and leverage options. With XRP’s growing adoption and institutional interest, choosing the right platform can maximize your trading efficiency and profitability.

Factors to consider when choosing an exchange

Factors to Consider When Choosing an Exchange

Selecting the right cryptocurrency exchange for trading XRP is crucial for ensuring a seamless and profitable experience. With numerous platforms available, each offering unique features, traders need to evaluate key factors before committing their funds. Here are the most important aspects to consider when choosing an exchange to trade XRP in 2024.

1. Liquidity and Market Depth

High liquidity ensures that traders can execute large XRP orders without experiencing significant price slippage. Exchanges with deep order books provide tighter bid-ask spreads, making trading more efficient and cost-effective.

- Why it matters: Low liquidity can lead to price manipulation and increased volatility, making it harder to enter or exit positions at desired price points.

- Best exchanges for liquidity: Binance, Coinbase, and Kraken are among the top platforms offering substantial XRP liquidity.

2. Security Measures

With the increasing number of exchange hacks and security breaches, it’s essential to choose a platform that prioritizes user protection. Robust security measures, such as two-factor authentication (2FA), cold storage for funds, and insurance policies, can safeguard your assets from cyber threats.

- Key security features to look for: Multi-signature wallets, withdrawal whitelists, and real-time monitoring for suspicious activities.

- Top secure exchanges: Kraken and Coinbase have a strong reputation for security, with industry-leading safety protocols and insurance coverage for digital assets.

3. Trading Fees and Costs

Trading fees can significantly impact profitability, especially for active traders. Most exchanges charge a combination of maker and taker fees, with discounts available for high-volume traders or those using native exchange tokens.

- Fee structures: Binance offers some of the lowest fees in the industry, starting at 0.1% per trade, with further reductions for users paying with BNB.

- Hidden costs: Some platforms impose withdrawal fees, deposit fees, or inactivity charges, so it’s essential to review the full fee schedule before signing up.

4. Regulatory Compliance and Availability

Regulatory compliance is becoming increasingly important as governments impose stricter rules on crypto exchanges. Traders should ensure the platform they choose is legally operational in their region and adheres to necessary compliance measures.

- Why compliance matters: Exchanges that comply with regulations are less likely to face sudden shutdowns or legal issues that could impact users’ funds.

- Best compliant exchanges: Coinbase and Kraken are known for their strong regulatory adherence, making them ideal for traders in jurisdictions with stringent crypto laws.

5. Trading Tools and Features

Advanced traders often require sophisticated tools such as margin trading, futures contracts, stop-loss orders, and technical analysis indicators. The availability of these features can enhance trading efficiency and strategy execution.

- Key trading features: Leverage trading, automated trading bots, and real-time charting tools.

- Best exchanges for advanced trading: Bybit and Binance offer extensive trading features, including derivatives and futures contracts for XRP.

6. User Experience and Customer Support

A user-friendly interface and responsive customer support can make a significant difference in the overall trading experience. Exchanges with intuitive dashboards, fast order execution, and 24/7 support provide a hassle-free environment for traders.

- Ease of use: Coinbase is known for its beginner-friendly interface, making it a great choice for new XRP traders.

- Customer support quality: Kraken and Binance offer 24/7 support via live chat and email, ensuring quick resolutions to user issues.

By carefully evaluating these factors, traders can select an exchange that aligns with their trading goals, security requirements, and budget. Whether you prioritize low fees, strong security, or advanced trading tools, the right platform can enhance your XRP trading experience and help you maximize profits.

Fees, security, and liquidity comparison

Fees, Security, and Liquidity Comparison

When trading XRP, understanding the differences in fees, security protocols, and liquidity across various exchanges is crucial. These factors can significantly impact your profitability, ease of trading, and overall experience. Below, we break down how top XRP exchanges compare in these key areas.

Trading Fees: Finding the Most Cost-Effective Exchange

Trading fees are one of the most important considerations when choosing an exchange. While some platforms offer competitive maker and taker fees, others charge higher rates or impose hidden costs such as withdrawal fees. Here’s how leading XRP exchanges compare:

- Binance: Known for its industry-low fees, Binance charges a standard 0.1% trading fee, which can be further reduced by using Binance Coin (BNB) for payments. High-volume traders can benefit from even lower rates.

- Coinbase: While user-friendly, Coinbase has relatively high fees, ranging from 0.5% to 1.49% per trade. Traders using Coinbase Pro can access a tiered fee structure starting at 0.4% for takers and 0.0% for makers at the highest volume levels.

- Kraken: Offers a competitive fee structure, with maker fees starting at 0.16% and taker fees at 0.26%. Fees decrease as trading volume increases.

- KuCoin: Charges a base fee of 0.1%, with further discounts available for KCS token holders. Futures trading fees are also among the lowest in the industry.

- Bybit: Primarily a derivatives exchange, Bybit offers ultra-low fees for perpetual contracts, with maker fees at 0.01% and taker fees at 0.06%.

While Binance and KuCoin are the most cost-effective choices for spot trading XRP, Bybit stands out for derivatives traders due to its low fees. Coinbase, on the other hand, is better suited for beginners despite its higher costs.

Security: Protecting Your XRP Holdings

Security remains a top priority for crypto traders, especially given the history of exchange hacks and fraud cases. A secure exchange should have multi-layered protection, including cold storage, two-factor authentication (2FA), and robust withdrawal security. Here’s how leading exchanges compare in terms of security:

- Binance: Implements advanced security measures, including SAFU (Secure Asset Fund for Users), which acts as insurance against hacks. The platform also supports hardware wallet integration.

- Coinbase: One of the most secure platforms, Coinbase stores 98% of customer funds in cold storage and provides FDIC insurance for USD balances.

- Kraken: Has never suffered a major hack and employs stringent security protocols, including air-gapped cold storage and real-time monitoring for suspicious activity.

- KuCoin: Experienced a hack in 2020 but has since strengthened its security framework, including insurance-backed fund protection and withdrawal whitelisting.

- Bybit: Uses multi-signature cold wallets for all withdrawals and enforces strict security policies to prevent unauthorized access.

For traders prioritizing security, Coinbase and Kraken are the safest options due to their strong regulatory compliance and insurance-backed protections. Binance also offers robust security, but users should enable all available security features to maximize protection.

Liquidity: Ensuring Smooth Trade Execution

Liquidity is critical for XRP traders, as it determines how easily large orders can be executed without causing price slippage. An exchange with deep liquidity ensures that traders can buy and sell XRP at market prices without significant fluctuations. Here’s how the top exchanges compare in terms of liquidity:

- Binance: Offers the highest liquidity for XRP, with billions in daily trading volume. This makes it ideal for both retail and institutional traders.

- Coinbase: Provides strong liquidity for XRP/USD pairs, making it a great choice for U.S. traders.

- Kraken: Has deep liquidity for XRP trading pairs, particularly against USD and EUR.

- KuCoin: While not as liquid as Binance, KuCoin still offers decent market depth for XRP trading.

- Bybit: One of the top platforms for XRP derivatives trading, with high liquidity for perpetual contracts.

For traders looking for the highest liquidity, Binance is the best choice for spot trading, while Bybit dominates in the derivatives market. Coinbase and Kraken also offer solid liquidity, especially for fiat-based XRP trading pairs.

Final Thoughts on Choosing the Right Exchange

When selecting an exchange for trading XRP, it’s essential to balance fees, security, and liquidity based on your trading style and needs. If low fees and deep liquidity are your top priorities, Binance and KuCoin offer the best options. If security and regulatory compliance are crucial, Coinbase and Kraken are excellent choices. Meanwhile, Bybit is the go-to platform for derivatives traders seeking leverage and low transaction costs. By carefully weighing these factors, you can choose the best exchange to maximize your XRP trading efficiency and profitability.

How to get started with XRP trading

Getting started with XRP trading is a straightforward process, but it requires careful planning to ensure a smooth experience. Whether you’re a beginner or an experienced trader, following the right steps can help you navigate the market effectively. Below is a step-by-step guide to help you set up your trading account, fund it, and execute your first XRP trade.

Step 1: Choose the Right Exchange

Before you start trading XRP, the first step is selecting a reliable cryptocurrency exchange that supports XRP trading pairs. As discussed earlier, platforms like Binance, Coinbase, Kraken, KuCoin, and Bybit offer high liquidity, security, and competitive fees. Consider the following factors when making your choice:

- Regulatory Compliance: Ensure the exchange operates legally in your country and follows necessary regulations.

- Liquidity and Trading Volume: Higher liquidity means smoother trade execution with minimal slippage.

- Fees: Compare trading fees, withdrawal costs, and deposit charges to find the most cost-effective platform.

- Trading Tools: If you plan to use advanced strategies, look for platforms with margin trading, futures contracts, and technical analysis tools.

Once you’ve selected an exchange, proceed to create an account.

Step 2: Create and Verify Your Account

Most cryptocurrency exchanges require users to register an account before trading. Here’s how to do it:

- Visit the exchange’s official website and click on the “Sign Up” or “Register” button.

- Provide your email address, create a strong password, and complete any captcha verification.

- Check your email for a verification link and confirm your registration.

- Set up two-factor authentication (2FA) to enhance account security.

Many exchanges also require Know Your Customer (KYC) verification to comply with regulations. This process typically involves submitting an official ID (passport, driver’s license, or national ID) and proof of address (utility bill or bank statement). Completing KYC verification allows you to access higher withdrawal limits and additional trading features.

Step 3: Deposit Funds into Your Exchange Account

Once your account is set up and verified, the next step is funding it. Most exchanges offer multiple deposit methods, including:

- Bank Transfers: Available for fiat deposits (USD, EUR, GBP, etc.), though processing times may vary.

- Credit/Debit Cards: A fast way to buy XRP directly, but may come with higher fees.

- Cryptocurrency Deposits: If you already own crypto, you can transfer funds from another wallet to the exchange.

For those depositing fiat currency, ensure that the exchange supports your local currency and preferred payment method. If you’re depositing crypto, double-check the deposit address to avoid errors.

Step 4: Navigate the Trading Interface

After funding your account, it’s time to explore the trading interface. Most exchanges provide two types of trading platforms:

- Basic Trading: Ideal for beginners, with a simple interface for buying and selling XRP.

- Advanced Trading: Includes detailed price charts, order books, and technical analysis tools for experienced traders.

Familiarize yourself with key trading features such as market orders, limit orders, and stop-loss orders. Understanding these tools will help you execute trades efficiently and manage risk effectively.

Step 5: Place Your First XRP Trade

Now that you’re set up, it’s time to buy or sell XRP. Here’s how to place a trade:

- Go to the trading section of your chosen exchange.

- Select the XRP trading pair you want to trade (e.g., XRP/USDT, XRP/BTC, XRP/EUR).

- Choose your order type:

- Market Order: Executes immediately at the current market price.

- Limit Order: Sets a specific price at which you want to buy or sell XRP.

- Stop-Loss Order: Automatically sells XRP if the price drops to a predetermined level to limit losses.

- Enter the amount of XRP you want to trade.

- Review your order details and confirm the trade.

Once the trade is executed, your XRP balance will be updated accordingly.

Step 6: Secure Your XRP Holdings

After purchasing XRP, it’s crucial to store it securely. While leaving funds on an exchange is convenient for active traders, long-term holders should consider transferring XRP to a private wallet. Storage options include:

- Hardware Wallets: Devices like Ledger Nano X and Trezor provide offline storage for maximum security.

- Software Wallets: Mobile and desktop wallets like Trust Wallet and Exodus offer user-friendly access.

- Exchange Wallets: Suitable for short-term trading but riskier due to potential hacks.

Always enable security features like 2FA and withdrawal whitelisting to protect your funds from unauthorized access.

Step 7: Monitor Market Trends and Develop a Trading Strategy

To maximize profits and minimize risks, continuously monitor XRP market trends. Use tools like:

- Technical Analysis: Study price charts, support/resistance levels, and indicators like moving averages and RSI.

- Fundamental Analysis: Keep up with XRP news, regulatory developments, and adoption trends.

- Risk Management: Set stop-loss orders and diversify your portfolio to mitigate potential losses.

By staying informed and refining your strategy, you can improve your XRP trading performance over time.

Following these steps will help you confidently enter the XRP market and make the most of your trading experience. Whether you’re looking to capitalize on short-term price movements or invest in XRP for the long haul, choosing the right exchange, securing your assets, and developing a solid strategy are key to success.