Are you ready to dive into the wildly intriguing world of XRPL Hooks, where smart contracts meet the relentless pace of XRP’s blockchain magic? Well, buckle up, because understanding the challenges and limitations of XRPL Hooks is like trying to explain blockchain to your grandma—complex, but incredibly rewarding when you get it right. XRPL Hooks, the smart contract functionality on the XRP Ledger (XRPL), is a bit like a Swiss Army knife with a few missing tools. It’s versatile, but not without its quirks. So, what’s holding back this shiny piece of tech from achieving its full potential?

Let’s start with scalability—every crypto enthusiast’s favorite buzzword. Imagine a blockchain that’s faster than a cheetah on roller skates. That’s the promise of XRPL, but even cheetahs have their limits. The XRPL Hooks face scalability challenges that can make executing complex smart contracts a bit like squeezing into your jeans after the holiday season—possible, but not without some effort. The current system is designed for lightweight operations, which means it’s not yet ready to handle the heavy-lifting that other smart contract platforms manage. Can you imagine trying to run a marathon with a paper-thin pair of sneakers? Exactly.

Then there’s the issue of resource constraints. Think of XRPL Hooks as a top chef working in a kitchen the size of a shoebox. The XRPL is designed to prioritize efficient transactions, but when it comes to executing more intricate smart contracts, there’s only so much room to maneuver. The ledger’s architecture, while robust and secure, limits the complexity and size of the Hooks, ensuring they remain resource-efficient but somewhat restricted. It’s like trying to paint the Mona Lisa with a box of crayons. Sure, you can create something beautiful, but you’re going to hit some snags.

Security is another hot potato. We all know the blockchain world can be as unpredictable as a cat on a Roomba. XRPL Hooks need to be bulletproof, but achieving this level of security without sacrificing performance is a tightrope walk. Developers are tasked with ensuring that Hooks are as safe as a vault while still being as nimble as a gymnast. It’s a delicate balance, akin to juggling flaming swords. The XRPL community is constantly innovating to reinforce security measures, but it’s an ongoing battle to stay ahead of potential vulnerabilities.

Let’s not forget interoperability. Ah, the dream of every blockchain developer: a world where blockchains talk to each other like lifelong pals. XRPL Hooks currently face limitations in interacting seamlessly with other blockchain networks. It’s a bit like trying to teach a dog to speak cat—possible, but challenging. For XRP to truly dominate the decentralized finance arena, enhancing interoperability is crucial. This challenge is, however, being actively addressed through community-driven projects aimed at bridging these gaps.

But it’s not all doom and gloom! The XRP Ledger’s community is nothing if not resilient. Developers and researchers are tirelessly working to enhance XRPL Hooks, much like a team of dedicated ants building the ultimate anthill. They’re exploring solutions that could make these Hooks more robust and versatile, without compromising the lightning-fast transaction speeds that make XRP the Usain Bolt of the crypto world. Through innovation and collaboration, the potential for XRPL Hooks to evolve is as vast as the crypto universe itself.

So, what does this mean for you, the savvy XRP investor or the curious crypto enthusiast? It means keeping a keen eye on the XRPL ecosystem, as these developments could significantly impact XRP’s utility and adoption in the blockchain, finance, and trading sectors. Imagine a world where XRPL Hooks unleash a wave of new applications, from decentralized finance to more intricate smart contracts. It’s not just a pipe dream—it’s a very real possibility.

In conclusion, while XRPL Hooks face their fair share of challenges and limitations, the ongoing efforts to overcome these hurdles are paving the way for a more dynamic and interconnected blockchain landscape. The journey to fully unlocking the potential of XRPL Hooks is like a thrilling roller-coaster ride—filled with ups, downs, and the occasional scream-inducing twist. But fear not, because XRP Authority is your go-to source for all things XRP and XRPL. Whether you’re an investor, trader, or fintech professional, we’ve got the insights you need to stay ahead in the ever-evolving world of crypto. Stick with us, and you’ll be navigating the blockchain cosmos like a pro.

Understanding Challenges and Limitations of XRPL Hooks and Its Impact on XRP

Technical constraints and resource limitations

XRPL Hooks are a powerful new addition to the XRP Ledger, enabling developers to embed lightweight smart contract logic directly into accounts. However, with great power comes a fair share of limitations. These aren’t just arbitrary restrictions—they’re carefully designed constraints to maintain the XRP Ledger’s signature speed, low-cost transactions, and reliability. For investors and developers alike, understanding these constraints is crucial to navigating the XRPL ecosystem effectively.

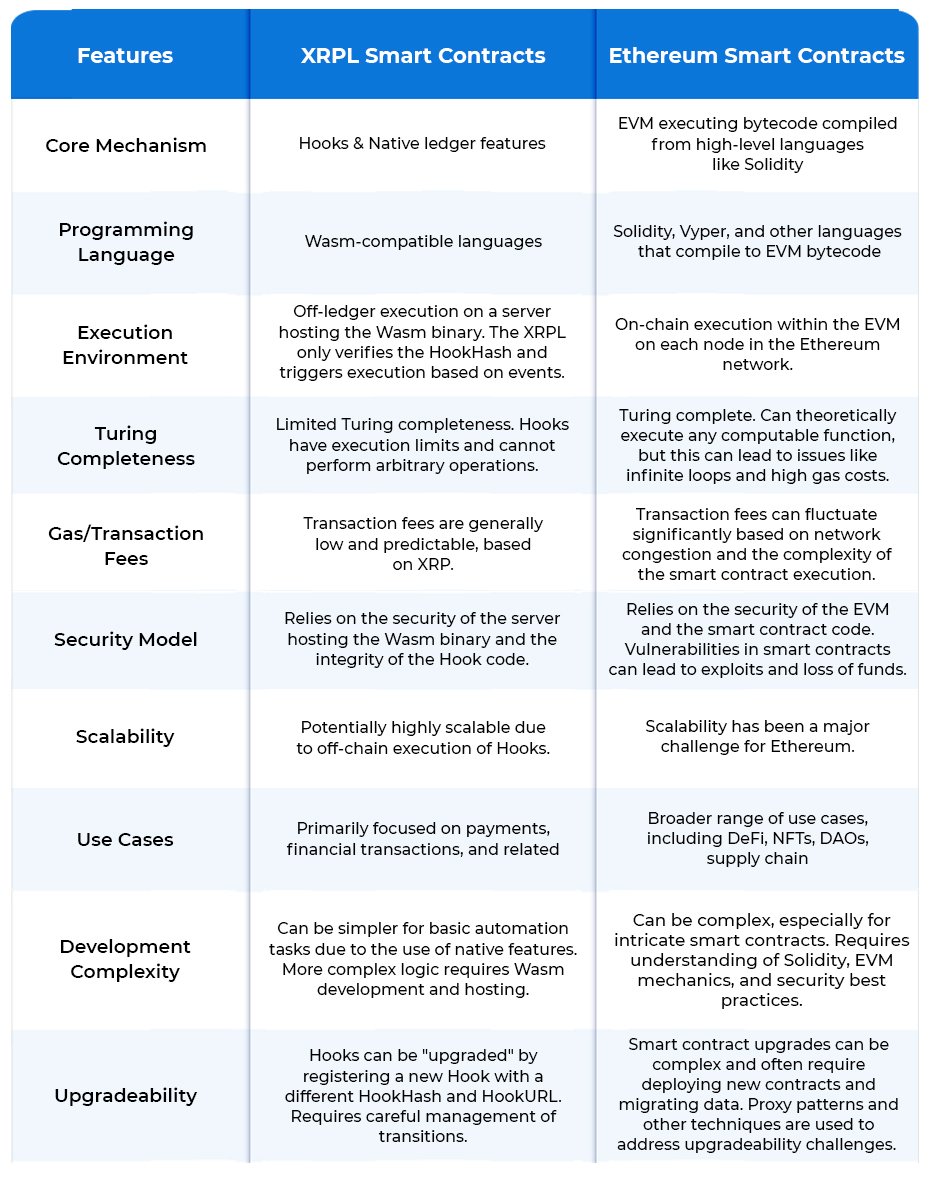

Unlike Ethereum or Solana, where smart contracts can be complex and resource-heavy, XRPL Hooks are purpose-built to be minimalistic. This design philosophy prioritizes ledger efficiency over computational flexibility. The goal is to avoid bloating the ledger and maintain XRPL’s blazing-fast transaction speed—often clocking in at 3 to 5 seconds per confirmation. But this comes at a cost.

- Execution Time Limits: Hooks are limited in how long they can run. Each hook has a strict execution time budget—measured in instructions, not seconds—to ensure that no single transaction can monopolize network resources. This constraint helps prevent denial-of-service attacks but limits the complexity of logic a developer can implement.

- Memory Usage Caps: Each hook operates within a tightly confined memory space. Developers have to be creative and ultra-efficient with their code, as there’s no room for bloated logic or inefficient algorithms. Think of it as coding in a tiny studio apartment—you can’t bring everything, so you bring only what matters.

- No External Data Calls: One of the most notable limitations is the absence of external data fetching. Hooks cannot pull data from or interact with off-chain APIs. This means that dynamic, real-time data (like price feeds or weather information) can’t be directly integrated unless it’s already available on-chain. This ensures network consistency but limits smart contract versatility.

- Deterministic Execution: All hooks must execute deterministically, meaning they must produce the same result every time they run with the same input. While this is great for ledger integrity, it restricts the use of randomization or any form of non-deterministic behavior, which is often needed in gaming or lottery applications.

These limitations are not bugs—they’re features. The XRP Ledger wasn’t designed to be a one-size-fits-all smart contract platform. Instead, it’s optimized for speed, scalability, and minimal energy consumption. By keeping Hooks lightweight, the XRPL avoids the pitfalls of high gas fees and network congestion that plague other blockchains during periods of high activity.

For crypto investors, this means XRPL remains a stable, low-cost environment for financial transactions. While you won’t see NFTs with embedded physics engines or decentralized casinos running on XRPL Hooks anytime soon, you will see streamlined, automated financial logic—like escrow triggers, compliance checks, or multi-signature routing—that can enhance XRPL’s role in real-world finance. This makes XRP a compelling asset for investors looking for utility-driven growth rather than speculative hype.

To address some of the current constraints, the XRPL community and developers at XRPL Labs are actively working on enhancements. For example, discussions are ongoing about enabling limited forms of inter-hook communication or on-ledger data sharing, which could expand the capabilities of Hooks without sacrificing performance. Meanwhile, developers are exploring creative coding patterns to work within the current constraints, such as chaining multiple small hooks together to perform complex logic over several transactions.

In the broader crypto ecosystem, XRPL’s smart contract approach stands out for its discipline. It’s not about doing everything—it’s about doing the right things well. And for investors who value speed, security, and sustainability, that’s a smart contract platform worth watching.

Security considerations and potential vulnerabilities

When it comes to blockchain innovation, speed and efficiency are great—but not at the expense of security. With XRPL Hooks introducing programmable logic directly into accounts, the XRP Ledger is stepping into a new frontier. But with this evolution comes a set of security dynamics that both developers and investors need to understand. After all, the last thing anyone wants is a rogue hook draining wallets or clogging the ledger.

XRPL Hooks are designed with a security-first philosophy. Their constrained environment isn’t just about maintaining ledger efficiency—it’s also a deliberate strategy to reduce the attack surface. By limiting complexity, XRPL inherently limits the risk of exploits. But that doesn’t mean it’s invulnerable. Let’s peel back the layers and look at how security is handled, and what vulnerabilities still lurk beneath the surface.

- Code Isolation: Each hook operates in a sandboxed environment, meaning it can’t interfere with other accounts or access arbitrary ledger data. This isolation ensures that even if a hook is compromised, its impact is contained. Think of it like having a firewall around every smart contract—malicious logic can’t spread beyond its boundaries.

- No External Dependencies: By design, Hooks can’t interact with external APIs or off-chain systems. While this limits functionality, it also eliminates a major vector for attacks—untrusted data sources. Without oracles or external feeds, you avoid the risk of manipulated market data leading to faulty contract execution, a common issue on Ethereum-based DeFi platforms.

- Deterministic Logic Only: Hooks must execute deterministically, which means they always produce the same result with the same input. This predictability is a powerful defense mechanism against logic-based exploits. It prevents unexpected behavior that could be triggered by timing, randomness, or fluctuating external conditions.

- Transaction Rejection Mechanics: Hooks can be programmed to reject transactions that don’t meet specific criteria. This ability to enforce custom validation logic before a transaction is finalized adds an extra layer of defense. For example, a hook could block outbound payments unless a compliance check passes or a multi-signature threshold is met.

However, there are still potential vulnerabilities developers need to account for:

- Malicious Hook Deployment: A bad actor could theoretically deploy a hook that behaves correctly during testing but activates malicious logic under certain conditions. While the deterministic nature of hooks makes this harder, it doesn’t eliminate the possibility entirely—especially if the logic is obfuscated or conditionally triggered.

- Resource Exhaustion Attacks: Although XRPL enforces strict instruction and memory caps, a carefully crafted hook could still attempt to game the system by chaining transactions in a way that puts pressure on the ledger. These kinds of denial-of-service attempts are rare but not impossible, especially in high-volume scenarios.

- Logic Errors and Misconfigurations: The biggest threat often isn’t a hacker—it’s human error. A poorly written hook could lock funds, misroute payments, or create unintended behavior. And since XRPL Hooks are currently immutable once deployed, a bug in the logic can’t be patched on the fly. This puts immense pressure on developers to get it right the first time.

To safeguard against these risks, the XRPL community and XRPL Labs have implemented a robust review process for Hooks. There are testing environments, audit tools, and community-driven code reviews to help identify vulnerabilities before deployment. In the future, we may even see formal verification tools tailored for XRPL Hooks, allowing developers to mathematically prove the correctness of their code before it goes live.

For XRP investors, these security measures are more than just technical trivia—they’re critical to maintaining trust in the network. As Hooks become more widely adopted for use cases like decentralized compliance, automated escrow, and programmable payments, the integrity of the system becomes a financial imperative. A single high-profile exploit could shake confidence and impact the XRP price—potentially pushing it below key support levels like the [gpt_article topic=Challenges and Limitations of XRPL Hooks directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Challenges and Limitations of XRPL Hooks and What constraints exist in XRPL’s smart contract system and how they are being addressed. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use computational limits, security concerns, automation restrictions, ledger constraints, blockchain efficiency and What constraints exist in XRPL’s smart contract system and how they are being addressed. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 mark or delaying a breakout past the [gpt_article topic=Challenges and Limitations of XRPL Hooks directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Challenges and Limitations of XRPL Hooks and What constraints exist in XRPL’s smart contract system and how they are being addressed. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use computational limits, security concerns, automation restrictions, ledger constraints, blockchain efficiency and What constraints exist in XRPL’s smart contract system and how they are being addressed. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level.

But the good news? The XRPL community is taking a proactive stance. Security is baked into the architecture, and developers are encouraged to follow best practices from day one. By keeping Hooks lightweight, deterministic, and isolated, the XRPL continues to prioritize resilience over reckless innovation. This makes it a compelling platform for financial-grade applications—and a safer bet for investors looking to ride the next wave of blockchain utility without losing sleep over smart contract exploits.

As the ecosystem matures, expect to see more open-source libraries, security templates, and community-driven audits that help reduce the learning curve and minimize risk. Think of it as the XRPL equivalent of seatbelts and airbags—tools that let you go fast, but stay safe while doing it.

Integration challenges with existing XRPL infrastructure

While XRPL Hooks promise to bring a new layer of programmability to the XRP Ledger, they don’t exist in a vacuum. Integrating them into the existing XRPL infrastructure presents a unique set of challenges that developers, validators, and investors need to understand. After all, the XRPL wasn’t originally designed with smart contracts in mind—its architecture is fundamentally different from platforms like Ethereum or Cardano. This means that retrofitting Hooks into this high-speed, low-latency environment requires some serious engineering finesse.

One of the biggest hurdles is compatibility. The XRPL has a well-established transaction model that emphasizes simplicity, speed, and determinism. Introducing programmable logic into this architecture—without compromising those core features—is like adding turbochargers to a finely-tuned race car. You want more power, but not at the expense of balance or control.

- Legacy Codebase Constraints: The XRP Ledger has been live since 2012, and its codebase is battle-tested but conservative. Hooks must integrate seamlessly with this existing framework, which means developers are limited in how much they can modify core components. Every change must be carefully evaluated to avoid introducing bugs or latency spikes that could ripple across the entire network.

- Validator Coordination: For Hooks to be fully supported, XRPL validators must update their software to a version that includes Hook functionality. This introduces a degree of network coordination that can be slow and politically sensitive. Not every validator may be eager to adopt the changes immediately, which can lead to fragmentation or delays in widespread support.

- Tooling and API Support: The XRPL ecosystem is rich with tools like the XRP Ledger API, rippled server, and various SDKs. However, most of these tools were built before Hooks existed. Developers now face the task of updating or extending these tools to support Hook deployment, testing, and monitoring. Until these updates are widespread, building Hook-enabled applications can feel like assembling IKEA furniture without the manual.

- Client-Side Awareness: Wallets and client applications also need to be updated to recognize and safely interact with Hooks. This includes displaying Hook-triggered transaction rejections, showing hook metadata, and providing user-friendly warnings when hooks are present on an account. Without proper UX support, users may be confused or even alarmed by behavior they don’t expect.

Another integration challenge lies in the deterministic nature of Hooks. Since they must execute the same way across all nodes, any integration with existing functionality—like payment channels, escrows, or trust lines—must be airtight. There’s no room for ambiguity. This requires exhaustive testing and simulation to ensure that Hooks don’t inadvertently interfere with existing XRPL features or introduce edge cases that could lead to inconsistent ledger states.

For investors, these integration challenges are more than just developer headaches—they have real implications for adoption and utility. Until Hooks are fully integrated and supported across the ecosystem, their use cases remain somewhat limited. That means slower rollout of the kinds of financial automation that could drive demand for XRP and push the price beyond key psychological thresholds like the .00 mark or the 61.8% Fibonacci retracement from its all-time high.

However, the community is already taking steps to smooth the path forward. XRPL Labs has released a testnet environment (Hooks Testnet) that allows developers to experiment with real Hook logic in a sandboxed ledger. This environment mimics mainnet conditions while allowing for rapid iteration and debugging. Additionally, there’s growing momentum around developer education, with tutorials, webinars, and open-source starter kits emerging to make it easier to build and deploy Hooks.

There’s also movement toward modularizing Hooks deployment. Some developers are exploring the idea of pre-built Hook libraries—standardized, audited snippets of logic that can be plugged into accounts without starting from scratch. Think of them like smart contract Legos: reusable, composable, and much easier to integrate into existing systems. This could significantly speed up adoption and reduce the risk of bugs or misconfigurations.

From a market perspective, the successful integration of Hooks into the XRPL infrastructure could be a game-changer. It would enable native, low-cost automation for payment flows, decentralized compliance, and token issuance—all without leaving the XRPL ecosystem. This positions XRP as more than just a bridge currency; it becomes a programmable asset with real-world financial logic baked in. For savvy investors, this opens up new narratives for XRP’s value proposition, particularly in institutional finance and cross-border settlements.

Of course, we’re still in the early innings. But as the tooling matures and validator support widens, expect to see a steady uptick in Hook-enabled applications. Whether it’s programmable multi-signature wallets, decentralized royalty payments, or automated tax compliance, the possibilities are expanding. And with each successful integration, the XRPL edges closer to fulfilling its promise as a next-generation financial protocol—fast, secure, and now, programmable too.

Future outlook and community feedback

As XRPL Hooks move from experimental playgrounds into real-world deployment, the future outlook for this technology is both promising and pragmatic. While their minimalistic design presents certain limitations, it also opens up a new paradigm in blockchain automation—one that’s tailored for speed, security, and sustainability. The XRPL community, known for its strong developer base and forward-thinking ethos, has already begun to shape the roadmap through active feedback, testing, and innovation.

One of the most exciting developments is the growing alignment between XRPL Hooks and real-world financial use cases. From automated compliance checks to conditional asset transfers, the Hooks framework is being fine-tuned to address the specific needs of enterprise-grade finance. This is particularly relevant for XRP investors who are focused on utility-driven growth. With programmable logic now embedded at the account level, the XRPL is evolving from a fast payment rail into a fully programmable financial layer—without sacrificing its core performance metrics.

Community input has played a pivotal role in shaping the direction of XRPL Hooks. Developers on the Hooks Testnet have provided invaluable insights into what works, what doesn’t, and what could be improved. For instance, one common request has been the ability to enable limited inter-hook communication—essentially allowing hooks to share state or trigger each other in a controlled manner. While this introduces complexity, it also unlocks more sophisticated workflows, such as cascading approvals or multi-step transaction validation.

Another area of active discussion is the potential for on-ledger data storage. Currently, hooks have minimal access to persistent data, which limits their ability to track state across transactions. The community is exploring solutions like lightweight data slots or structured metadata fields that could store state information without bloating the ledger. This would enable more advanced applications, such as recurring payments, on-chain subscriptions, or even decentralized identity checks—all within XRPL’s native environment.

From a governance perspective, the XRPL Foundation and XRPL Labs have been proactive in engaging the community through open forums, GitHub discussions, and AMAs. This transparency has fostered a collaborative culture where developers feel empowered to contribute ideas and report issues. It’s a virtuous cycle: as more developers build with Hooks, the feedback loop strengthens, leading to faster iteration and more robust features.

On the investment front, the expanding use cases for XRPL Hooks are beginning to influence sentiment around XRP. As programmable automation becomes more feasible, XRP’s role in financial ecosystems could shift from a transactional token to a programmable asset used in smart compliance, escrow automation, and cross-chain asset management. This evolution could support price momentum, particularly if enterprise adoption accelerates. Investors watching for a breakout above the [gpt_article topic=Challenges and Limitations of XRPL Hooks directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Challenges and Limitations of XRPL Hooks and What constraints exist in XRPL’s smart contract system and how they are being addressed. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use computational limits, security concerns, automation restrictions, ledger constraints, blockchain efficiency and What constraints exist in XRPL’s smart contract system and how they are being addressed. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level or a reclaim of the 61.8% Fibonacci retracement zone from previous highs may find renewed confidence in the asset’s long-term trajectory.

But it’s not just about price action—it’s about ecosystem resilience. Feedback from early adopters has highlighted the importance of better developer tooling, improved documentation, and more intuitive debugging environments. In response, initiatives like Hook-specific SDKs, pre-audited code libraries, and real-time simulation environments are gaining traction. These tools lower the barrier to entry for new developers and help ensure that deployed hooks are secure, efficient, and fit-for-purpose.

Looking ahead, we can expect a phased approach to Hook adoption. In the short term, more projects will likely emerge on the Hooks Testnet, testing everything from automated royalties to decentralized tipping mechanisms. Mid-term, we may see enterprise pilots that integrate Hooks into treasury operations, compliance workflows, or cross-border payment logic. Long-term, Hooks could become a foundational component of decentralized finance on XRPL—enabling trustless automation without the gas fee volatility or latency issues seen on other chains.

The XRPL community’s cautious optimism is well-founded. By balancing innovation with discipline, Hooks are carving out a niche that aligns with the Ledger’s original mission: to be a high-performance, low-friction platform for financial transactions. As feedback continues to shape development and real-world use cases begin to emerge, Hooks are poised to unlock a new chapter in the XRPL story—one where speed meets logic, and utility meets programmability.

For XRP holders and crypto investors, this is more than a technical upgrade—it’s a strategic evolution. As the Hooks ecosystem matures, expect to see increased developer activity, deeper enterprise interest, and a stronger narrative around XRP’s real-world utility. And in the fast-moving world of crypto, that kind of narrative is often the difference between stagnation and breakout.

- for key points.