Welcome to XRPAuthority.com, your trusted beacon in the ever-evolving world of cryptocurrencies. If you’re wondering what the future holds for XRP, you’ve come to the right place. As we stand on the brink of a new decade, the question on every investor’s mind is, “What will the price of XRP be in 2030?” While we can’t offer a crystal ball, we can certainly provide a well-rounded forecast that combines technical expertise, market trends, and a sprinkle of humor to keep things lively.

Let’s face it: if Nostradamus were alive today, he’d probably be investing in crypto, or at least trying to decode the blockchain. XRP, often a contentious yet fascinating topic in the crypto world, holds a unique position. As one of the leading digital assets designed for cross-border payments, its potential for growth is not just a fantasy but a calculated possibility. But, how does one predict the unpredictable? Well, let’s dive into the data, shall we?

XRP’s role in revolutionizing finance is akin to that of email revolutionizing communication. Remember how we used to send letters that took days to arrive? XRP aims to do away with the financial equivalent of snail mail. With its ability to facilitate fast, cost-effective transactions, XRP has already made significant inroads in the realm of international banking and finance. But what does the next decade hold for this digital asset?

Can XRP maintain its momentum and continue to dodge the volatility that plagues many cryptocurrencies? While skeptics might raise an eyebrow, XRP has demonstrated a resilience that is hard to ignore. Its partnerships with major financial institutions and continued adoption are strong indicators that it’s not just another flash in the pan. So, could we be looking at a XRP in 2030? Or perhaps higher? The speculation is as exhilarating as a rollercoaster ride!

Technological advancements are another critical factor in XRP’s long-term price prediction. As blockchain technology evolves, XRP’s underlying infrastructure could see enhancements that propel it to new heights. Could XRP become the backbone of global financial transactions? It’s a thrilling possibility, one that could redefine the financial landscape as we know it.

For those new to the crypto scene, the concept of investing in digital currencies can feel like learning a new language. But fear not! At XRPAuthority.com, we break down complex jargon into bite-sized, digestible insights. Our goal is to make the world of XRP accessible and exciting, whether you’re a seasoned trader or a fintech novice.

As we delve deeper into XRP’s journey towards 2030, we’ll explore various scenarios, from optimistic to conservative, while keeping a close eye on regulatory developments, technological upgrades, and market dynamics. The road to 2030 is paved with uncertainties, but it’s also rich with opportunities for those willing to take the plunge.

In a world where crypto information can be as unreliable as weather forecasts, XRP Authority stands out as your go-to source for insightful analysis and expert predictions. With years of experience and a touch of humor, we’re committed to guiding you through the intricacies of XRP investing. After all, we’re not just predicting the future; we’re helping you shape it. So, buckle up and join us on this exciting journey to 2030!

Understanding XRP Price Predictions for 2030: Long-Term Outlook Evaluating XRP’s growth potential over the next decade. and Its Impact on XRP

Market trends shaping XRP’s future

Market Trends Shaping XRP’s Future

As we look toward 2030, XRP’s long-term price trajectory will be heavily influenced by emerging market trends in the cryptocurrency space. From institutional adoption to regulatory clarity, several key factors will shape XRP’s future. Understanding these trends is crucial for investors aiming to make informed decisions about XRP’s potential growth over the next decade.

Increased Institutional Adoption

One of the most significant trends impacting XRP’s future is the growing interest from financial institutions. XRP, developed by Ripple Labs, has already established itself as a leading digital asset for cross-border payments. With banks and payment providers continuously seeking faster and more cost-effective solutions, XRP’s utility as a bridge currency is expected to expand.

- Ripple’s partnerships with major financial institutions, such as Santander and SBI Holdings, position XRP as a key player in global remittances.

- As more central banks explore Central Bank Digital Currencies (CBDCs), XRP’s interoperability with these systems could drive further adoption.

- Institutional investment in crypto assets is increasing, and XRP’s role in enterprise-grade financial solutions may attract more capital inflows.

With financial giants recognizing the efficiency of RippleNet and On-Demand Liquidity (ODL), XRP could see a surge in transaction volumes, directly influencing its price appreciation.

Regulatory Developments and Clarity

Regulation remains one of the most crucial factors affecting XRP’s long-term price outlook. The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has been a major roadblock for XRP’s growth. However, as global regulators refine their stance on digital assets, XRP could benefit from a more structured framework.

- Clearer regulatory guidelines could encourage institutional investors to enter the XRP market with confidence.

- Countries with crypto-friendly policies, such as the UAE and Singapore, may provide XRP with a favorable environment for expansion.

- A positive resolution in Ripple’s legal case could remove uncertainty, boosting investor sentiment and driving price appreciation.

As regulatory frameworks evolve, XRP’s compliance with financial laws will play a crucial role in determining its mainstream adoption and price stability.

Growing Demand for Cross-Border Payments

The global remittance market is projected to grow significantly by 2030, and XRP is well-positioned to capitalize on this trend. Traditional banking systems often involve high fees and slow transaction speeds, whereas XRP enables near-instant settlements at a fraction of the cost.

- Ripple’s ODL solution eliminates the need for pre-funded accounts, making cross-border transactions more efficient.

- Developing economies, where remittances are a major source of income, could see increased adoption of XRP-based payment solutions.

- Partnerships with payment providers like MoneyGram (in the past) showcase XRP’s potential to revolutionize international money transfers.

As financial institutions seek faster and cheaper alternatives for cross-border transactions, XRP’s role as a liquidity provider could drive significant price appreciation.

Technological Advancements and Network Upgrades

Another key factor shaping XRP’s future is the continuous development of Ripple’s technology and network upgrades. Innovations in blockchain scalability, security, and interoperability could enhance XRP’s utility, making it more attractive to both retail and institutional users.

- Ripple is actively working on improving the XRP Ledger (XRPL), enhancing its smart contract capabilities and transaction throughput.

- Integration with decentralized finance (DeFi) and non-fungible tokens (NFTs) could open new use cases for XRP.

- Advancements in interoperability with other blockchain networks could solidify XRP’s role in the broader digital asset ecosystem.

As the blockchain industry matures, XRP’s ability to adapt and innovate will be a key determinant of its long-term success.

Macroeconomic Trends and Crypto Market Cycles

Beyond XRP-specific developments, broader macroeconomic factors and crypto market cycles will also play a significant role in shaping its price trajectory. Historically, Bitcoin’s price movements have influenced the entire crypto market, including XRP.

- Institutional interest in cryptocurrencies as an inflation hedge could drive more capital into digital assets, benefiting XRP.

- Market-wide adoption of blockchain technology in finance, supply chain, and payments could increase XRP’s demand.

- Crypto bull and bear cycles will continue to impact XRP’s price, with potential parabolic growth during market uptrends.

Understanding these macroeconomic trends will help investors anticipate XRP’s long-term price movements and make well-informed investment decisions.

With these market trends in mind, XRP’s future looks promising, but a combination of regulatory clarity, institutional adoption, and technological advancements will ultimately determine its success in the coming decade.

Factors influencing XRP’s long-term value

Factors Influencing XRP’s Long-Term Value

Predicting XRP’s value in 2030 requires a deep understanding of the fundamental factors that will shape its price trajectory. While market trends provide a broad perspective, specific elements such as regulatory developments, adoption rates, technological advancements, and macroeconomic conditions will play a crucial role in determining XRP’s long-term valuation.

Regulatory Clarity and Legal Outcomes

One of the most significant factors influencing XRP’s future is regulatory clarity. The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has cast uncertainty over XRP’s status. A favorable resolution could act as a major catalyst for price appreciation, while an unfavorable outcome may hinder its growth.

- If XRP is officially classified as a non-security in the U.S., it could open the doors for institutional investment and exchange listings.

- Regulatory clarity in key markets, such as the European Union, Japan, and the United Kingdom, could further enhance XRP’s global adoption.

- Compliance with financial regulations will be essential for XRP to maintain its role in cross-border payments and institutional finance.

Given that regulatory uncertainty has been a major roadblock for XRP’s growth, a clear legal framework could unlock immense potential, driving demand and price appreciation over the next decade.

Institutional and Enterprise Adoption

Institutional interest in blockchain technology is growing, and XRP is uniquely positioned as a bridge asset for financial institutions. Ripple’s partnerships with major banks and payment providers highlight the real-world utility of XRP in facilitating low-cost, high-speed transactions.

- Ripple’s On-Demand Liquidity (ODL) solution is already being used by financial giants, reducing reliance on traditional banking infrastructure.

- Integration with Central Bank Digital Currencies (CBDCs) could further solidify XRP’s role in global finance.

- Institutional investors seeking exposure to digital assets may view XRP as a viable long-term investment due to its real-world utility.

As financial institutions continue to explore blockchain-based solutions, XRP’s adoption could expand significantly, driving both demand and price growth.

Supply and Tokenomics

Unlike Bitcoin, which has a fixed supply of 21 million coins, XRP has a total supply of 100 billion tokens. However, Ripple has placed a significant portion of these tokens in escrow, releasing them periodically to maintain price stability and liquidity.

- Gradual token releases help prevent excessive inflation while ensuring sufficient liquidity for enterprise use.

- Burn mechanisms and transaction fees contribute to a slow reduction in circulating supply over time.

- Increased adoption and utility could lead to higher demand, offsetting concerns about XRP’s total supply.

Understanding XRP’s supply dynamics is crucial for investors, as controlled token distribution and increasing demand could positively impact its long-term value.

Technological Advancements and Network Upgrades

The evolution of the XRP Ledger (XRPL) will play a vital role in XRP’s long-term success. Ripple continues to enhance its technology to improve scalability, security, and interoperability with other blockchain networks.

- XRPL upgrades, such as the introduction of smart contract capabilities, could expand XRP’s use cases.

- Integration with decentralized finance (DeFi) ecosystems may attract new users and developers.

- Interoperability with other blockchain networks could increase XRP’s utility beyond cross-border payments.

As blockchain technology advances, XRP’s ability to adapt and innovate will be a key factor in sustaining its long-term value.

Macroeconomic Conditions and Market Sentiment

Broader economic trends and investor sentiment towards cryptocurrencies will also impact XRP’s price movement. As the global economy shifts towards digital assets, XRP could benefit from increased adoption and investment.

- Inflation concerns and fiat currency devaluation may drive investors toward alternative assets like XRP.

- Market cycles, including Bitcoin’s halving events, often influence the entire crypto market, including XRP.

- Institutional adoption of cryptocurrencies as part of diversified investment portfolios could boost XRP’s value.

By monitoring macroeconomic conditions and market sentiment, investors can better anticipate XRP’s price trends and long-term potential.

With these influencing factors in mind, XRP’s future remains highly promising. Its role in financial infrastructure, combined with regulatory clarity, institutional adoption, and technological advancements, could position it as a leading digital asset by 2030.

Expert predictions for XRP in 2030

Expert Predictions for XRP in 2030

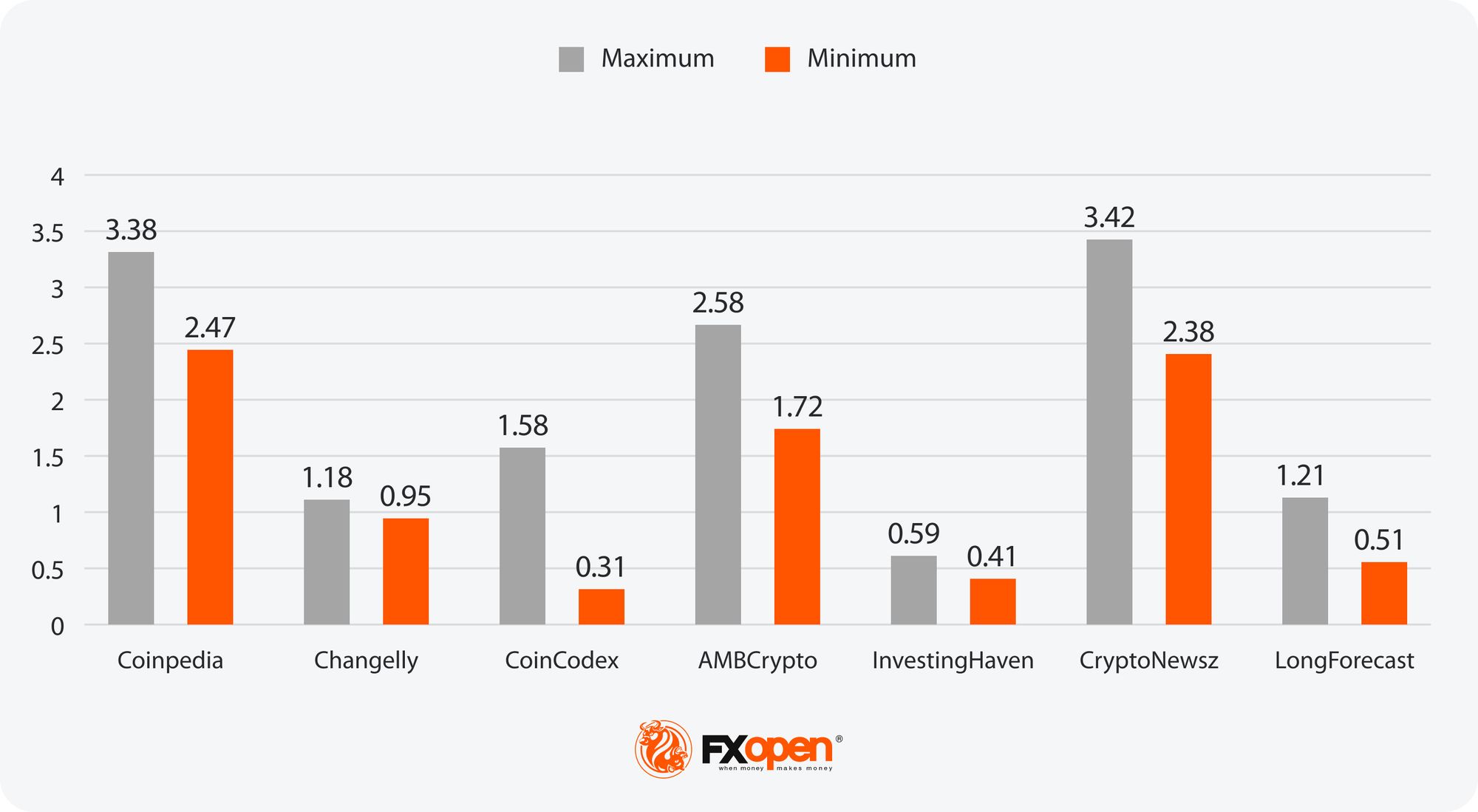

With a rapidly evolving cryptocurrency landscape, forecasting XRP’s price in 2030 requires analyzing expert opinions, historical trends, and potential market conditions. While no one can predict the future with absolute certainty, several prominent analysts and financial experts have shared their views on XRP’s long-term trajectory. These predictions take into account factors such as institutional adoption, regulatory developments, and technological advancements.

Optimistic Price Predictions

Many crypto analysts and XRP enthusiasts believe that by 2030, the digital asset could see significant price growth driven by mainstream adoption and increasing utility in global finance. Some of the most bullish projections suggest that XRP could reach double-digit price levels, fueled by its role as a bridge currency for cross-border payments.

- Institutional Adoption: As more banks and financial institutions integrate Ripple’s On-Demand Liquidity (ODL) solution, XRP’s transaction volume could skyrocket, leading to increased demand and price appreciation.

- Regulatory Clarity: A favorable regulatory environment, particularly in the U.S. and European markets, could remove barriers for institutional investors, driving capital inflows into XRP.

- Macro Trends: The growing shift towards digital assets and decentralized finance (DeFi) could position XRP as a key player in the evolving financial ecosystem.

Some optimistic projections place XRP’s potential price between and by 2030, assuming widespread adoption and continued technological improvements.

Moderate Predictions

While some experts remain highly bullish on XRP’s future, others take a more conservative approach, predicting steady but moderate growth over the next decade. These analysts argue that XRP’s price appreciation will depend on several variables, including competition from other payment-focused cryptocurrencies and the overall stability of the crypto market.

- Gradual Adoption: While Ripple has secured partnerships with major financial institutions, mainstream adoption may take longer than expected, leading to gradual price increases instead of sudden surges.

- Market Cycles: XRP, like other cryptocurrencies, is subject to market cycles, meaning its price could see periods of both growth and consolidation.

- Supply Dynamics: The controlled release of XRP from Ripple’s escrow accounts ensures liquidity, but it could also limit rapid price appreciation.

Moderate forecasts suggest XRP could trade between and by 2030, reflecting steady growth but acknowledging potential challenges.

Bearish Scenarios

While many analysts are optimistic about XRP’s long-term potential, some bearish scenarios could hinder its growth. Skeptics argue that regulatory roadblocks, competition, and market volatility could prevent XRP from reaching its full potential.

- Regulatory Setbacks: If regulatory challenges persist, particularly in key markets like the U.S., XRP’s adoption could be stifled, limiting its price appreciation.

- Competition from CBDCs: The rise of Central Bank Digital Currencies (CBDCs) could reduce the need for intermediary assets like XRP, affecting its demand.

- Market Volatility: The cryptocurrency market remains highly volatile, and external factors such as economic downturns or shifts in investor sentiment could impact XRP’s price.

In bearish scenarios, XRP’s price could remain below by 2030, particularly if adoption fails to accelerate or if regulatory challenges persist.

Key Takeaways from Expert Predictions

While expert opinions on XRP’s 2030 price vary, the general consensus is that its future will be shaped by regulatory clarity, institutional adoption, and technological advancements. Investors should consider the following insights when evaluating XRP’s long-term outlook:

- Adoption and Utility: The more financial institutions and payment providers use XRP, the higher its potential for price appreciation.

- Regulatory Developments: A favorable legal environment will be crucial for XRP’s growth, particularly in major financial markets.

- Market Trends: Broader crypto market cycles and macroeconomic conditions will influence XRP’s price trajectory.

Ultimately, while XRP’s future remains uncertain, its strong fundamentals and growing real-world use cases suggest that it could play a significant role in the financial ecosystem by 2030.

Potential risks and challenges ahead

Potential Risks and Challenges Ahead

While XRP has strong fundamentals and significant growth potential, it is not without its risks and challenges. As investors look toward 2030, understanding these potential hurdles is crucial for making informed investment decisions. From regulatory uncertainties to market competition, several factors could impact XRP’s long-term trajectory.

Regulatory Uncertainty and Legal Challenges

One of the most significant risks facing XRP is the ongoing regulatory scrutiny surrounding Ripple and its legal battles with the U.S. Securities and Exchange Commission (SEC). Although there have been developments in the case, regulatory uncertainty remains a major factor that could influence XRP’s price and adoption.

- SEC Lawsuit Outcome: A negative ruling in Ripple’s legal battle with the SEC could lead to further restrictions on XRP’s availability in the U.S., limiting its adoption and price potential.

- Global Regulatory Frameworks: Different countries have varying stances on cryptocurrencies, and stricter regulations in key markets like the European Union, Japan, or the U.S. could impact XRP’s growth.

- Compliance Challenges: As financial institutions integrate blockchain solutions, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations will be critical for XRP’s continued adoption.

Investors should closely monitor regulatory developments, as they will play a pivotal role in determining XRP’s long-term viability.

Competition from Other Cryptocurrencies and CBDCs

XRP was designed to facilitate fast and cost-efficient cross-border payments, but it is not the only project targeting this use case. Competition from both private-sector cryptocurrencies and government-backed digital currencies could pose a challenge to XRP’s market dominance.

- Stablecoins and Payment Networks: Stablecoins like USDC and USDT are widely used for international transactions, offering a potential alternative to XRP’s utility.

- Central Bank Digital Currencies (CBDCs): Many central banks are developing their own digital currencies, which could reduce the demand for third-party bridge assets like XRP.

- Other Blockchain Solutions: Competing blockchain networks, such as Stellar (XLM) and Algorand (ALGO), offer similar functionalities and could capture market share from XRP.

For XRP to maintain its relevance, it must continue developing innovative solutions, forming strategic partnerships, and ensuring seamless integration with evolving financial systems.

Market Volatility and Investor Sentiment

Like all cryptocurrencies, XRP is subject to significant market volatility, which can lead to sharp price fluctuations. Investor sentiment, influenced by macroeconomic conditions and broader crypto market trends, will play a crucial role in determining XRP’s price movements.

- Crypto Market Cycles: Historically, the crypto market has experienced boom-and-bust cycles, with periods of rapid growth followed by sharp corrections.

- Macroeconomic Factors: Economic downturns, interest rate hikes, and inflation concerns can impact investor appetite for digital assets, including XRP.

- Institutional Participation: While institutional adoption is a bullish factor, sudden shifts in regulatory policies or institutional sentiment could lead to large sell-offs, affecting XRP’s price stability.

Investors should be prepared for price fluctuations and consider long-term holding strategies to mitigate short-term volatility risks.

Ripple’s Control Over XRP Supply

Unlike Bitcoin, which has a fixed supply and decentralized mining process, XRP’s supply is controlled in part by Ripple Labs. While Ripple has placed a significant amount of XRP in escrow to ensure gradual token release, concerns about centralization and token distribution remain.

- Escrow Releases: Ripple periodically releases XRP from escrow, which can impact price stability if not managed effectively.

- Market Manipulation Concerns: Some critics argue that Ripple’s control over a large portion of XRP’s supply could lead to price manipulation or excessive influence over the asset’s future.

- Community Perception: Decentralization is a key principle in the crypto space, and any perception of centralization could deter some investors from holding XRP.

To address these concerns, Ripple continues to emphasize transparency in its escrow management and works to decentralize the XRP Ledger further.

Technological and Security Risks

As a blockchain-based asset, XRP is dependent on the security and efficiency of the XRP Ledger (XRPL). While XRPL has proven to be a robust and scalable network, technological risks remain.

- Network Vulnerabilities: Any potential security flaws or exploits in the XRP Ledger could undermine trust in the network.

- Scalability Challenges: As transaction volumes grow, the XRP Ledger must continue to scale efficiently to handle increased demand.

- Adoption of New Technologies: The blockchain industry is rapidly evolving, and XRP must stay competitive by integrating new innovations such as smart contracts and interoperability solutions.

Continuous development and upgrades to the XRP Ledger will be essential in maintaining its competitive edge in the digital asset space.

Geopolitical and Economic Uncertainties

Global economic and geopolitical factors can also impact XRP’s long-term prospects. As digital assets become more integrated into the financial system, they may face new challenges related to government policies, economic stability, and international trade.

- Government Crackdowns: Some countries may impose stricter regulations on cryptocurrencies, limiting XRP’s accessibility and adoption.

- Economic Instability: Financial crises or inflationary pressures could either drive demand for digital assets or lead to stricter government interventions.

- Cross-Border Trade Policies: As XRP is primarily used for cross-border payments, changes in international trade agreements or restrictions could impact its utility.

Investors should consider these macroeconomic factors when assessing XRP’s long-term growth potential.

While XRP has a promising future, it is essential to be aware of these risks and challenges. By staying informed and monitoring key developments, investors can make strategic decisions to navigate the evolving cryptocurrency landscape.