Are you ready to embrace the exhilarating world of shorting XRP, and potentially profit from price drops in the ever-volatile crypto market? Welcome to the rollercoaster ride that is margin trading with XRP—the digital asset that never ceases to spark debates, innovations, and a fair share of adrenaline rushes. Here at XRP Authority, your go-to source for everything XRP since 2018, we understand that navigating the tumultuous crypto seas requires not only a sturdy ship but also a seasoned captain. So, buckle up as we dive into the intricacies of shorting XRP, where each twist and turn can lead to substantial gains—or, if you’re not careful, a few unexpected splashes.

XRP, the digital currency primarily associated with Ripple, has long been at the forefront of blockchain technology and finance. It’s like the Swiss Army knife of the crypto world—versatile, efficient, and sometimes misunderstood. But what happens when the tide turns, and the price of XRP starts to dip? That’s where shorting comes into play. For those unfamiliar, shorting is a strategy used by savvy investors to profit from falling prices. Think of it as rooting for the underdog in a boxing match—only this time, the underdog is a digital asset, and your potential payday doesn’t require a physical bruising.

Why would anyone want to short XRP, you ask? Isn’t it better to simply buy low and sell high? Well, dear reader, what if I told you that shorting allows you to profit even when the market takes a nosedive? Yes, you heard that right. In the unpredictable world of crypto, where volatility has its own fan club, shorting can be your secret weapon—a way to turn market downturns into golden opportunities. And let’s face it, who doesn’t want to feel like a crypto superhero, wielding the power to profit no matter the market’s mood swings?

Now, let’s talk about margin trading, the trusty sidekick to shorting. Margin trading amplifies your buying power by allowing you to borrow funds to trade, turning your modest investment into a potential powerhouse. It’s like giving your trading account a shot of espresso—suddenly, everything is faster, bigger, and, well, riskier. But fear not, because with great risk comes the potential for great reward. And here at XRP Authority, we’re all about equipping you with the knowledge to navigate these high-stakes waters with confidence and finesse.

But, let’s not put all our eggs in one digital basket. While shorting and margin trading can be lucrative, they require a keen eye, sharp instincts, and a touch of humor to keep things in perspective. After all, if the market throws you a curveball, why not laugh in its face while strategically adjusting your positions? Remember, in the world of crypto, adaptability is your best friend, and being able to pivot with grace (and a grin) is key to long-term success.

Of course, it wouldn’t be a crash course on shorting XRP without acknowledging the risks. Margin calls, liquidations, and the potential for losses can turn a promising trade into a cautionary tale. But as the saying goes, “Fortune favors the bold.” So, arm yourself with knowledge, tread carefully, and remember that even in the face of adversity, there’s always a lesson to be learned and a strategy to be refined.

And why is XRP the perfect candidate for shorting? Its role in revolutionizing cross-border payments, its ongoing legal sagas, and its community of passionate supporters make it a digital asset like no other. Whether you’re a seasoned trader or a curious newbie, XRP’s dynamic nature offers endless possibilities for those willing to explore beyond the conventional buy-and-hold strategy.

Finally, as you embark on this thrilling journey of shorting XRP and mastering margin trading, know that you’re not alone. XRP Authority is here to guide you every step of the way, providing insights, strategies, and a touch of humor to make the ride as enjoyable as it is profitable. With over a decade of crypto expertise under our belt, we’re committed to being your trusted partner in navigating the ever-evolving landscape of digital assets. So, let’s set sail on this adventure together, and may your trading horizons be as limitless as the potential of XRP itself.

Understanding How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and Its Impact on XRP

Understanding XRP and market dynamics

Understanding XRP and Market Dynamics

Before diving into shorting XRP, it’s crucial to grasp what XRP is, how it fits into the broader crypto ecosystem, and what drives its price. XRP isn’t just another altcoin riding the crypto hype wave — it plays a unique role in digital finance and has a specific set of market influences that traders must understand to make informed decisions.

XRP is the native digital asset of the XRP Ledger, an open-source, decentralized blockchain technology designed for fast, low-cost international payments. Unlike Bitcoin or Ethereum, which rely on proof-of-work or proof-of-stake, the XRP Ledger uses a consensus protocol that’s faster and more energy-efficient. Its key use case? Bridging currencies for cross-border transactions, making it a favorite among financial institutions seeking to streamline global remittances.

Now, here’s where it gets interesting for traders: XRP’s price moves aren’t purely speculative. Yes, like all cryptocurrencies, it’s influenced by market sentiment and macroeconomic trends, but XRP also reacts to:

- Regulatory developments: XRP has been in the spotlight due to the ongoing SEC lawsuit against Ripple Labs. Legal clarity — or lack thereof — can cause sharp price swings.

- Adoption by financial institutions: Partnerships with banks and payment providers can boost investor confidence and drive price action.

- Ripple’s escrow releases: Ripple Labs holds a significant amount of XRP in escrow and releases a portion monthly. These predictable inflows can introduce downward pressure on price, especially when demand lags.

- General crypto market trends: XRP often follows broader market momentum. When Bitcoin rallies or crashes, altcoins like XRP typically echo the move — sometimes with amplified volatility.

Understanding these dynamics is essential for shorting XRP effectively. For example, if the SEC were to announce a favorable settlement with Ripple, XRP could surge past the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level, catching short-sellers off guard. On the flip side, negative legal news or delays in RippleNet adoption could send XRP spiraling downward, offering lucrative shorting opportunities.

Technical analysis also plays a pivotal role. Traders often watch key support and resistance levels, trend lines, and Fibonacci retracement zones to predict price movements. For instance, if XRP breaks below the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 support level and fails to recover at the 61.8% Fibonacci retracement, it could signal a strong bearish trend — ideal for initiating a short position.

But remember, shorting isn’t just about identifying falling prices. It’s about timing, sentiment, and understanding the catalysts that could trigger a reversal. The XRP market is known for sudden, high-volume moves, so traders need to be quick on the draw and constantly tuned into both technical charts and fundamental news.

Ultimately, mastering XRP’s market dynamics equips you with the insight to anticipate price movements, recognize shorting opportunities, and capitalize on volatility. In the ever-evolving world of crypto, knowledge isn’t just power — it’s profit.

Choosing a platform for shorting XRP

Choosing a Platform for Shorting XRP

When it comes to shorting XRP, not all crypto exchanges are created equal. Finding the right platform is like choosing the perfect surfboard before riding a wave — it can make or break your experience. You need a trading environment that’s fast, secure, and packed with the features necessary to execute profitable short positions. Whether you’re a seasoned trader or just dipping your toes into margin trading, selecting the right platform is your first strategic move.

Let’s break down what to look for when choosing a crypto exchange or brokerage to short XRP effectively:

- Support for XRP Shorting: First and foremost, the platform must allow short selling of XRP. This sounds obvious, but many exchanges, especially those operating in stricter regulatory environments, do not offer margin trading or derivative products for XRP due to its ongoing legal scrutiny. Always double-check that XRP is available for short positions.

- Margin and Derivatives Trading: Look for exchanges that offer margin trading accounts or futures contracts for XRP. Platforms like Binance, Kraken, Bybit, and BitMEX provide leveraged trading options with varying levels of exposure. For instance, Binance offers XRP/USDT perpetual contracts with up to 20x leverage, allowing traders to amplify potential gains (and risks).

- Liquidity and Order Book Depth: Shorting works best when there’s high liquidity — meaning lots of buyers and sellers. A deep order book reduces slippage and ensures you can enter and exit positions quickly, especially during volatile market conditions. Exchanges like Binance and Kraken typically have robust XRP trading volumes, making them ideal for short-term strategies.

- Security and Regulatory Compliance: Trust is non-negotiable. Choose platforms that have a proven track record of security, user fund protection, and compliance with local regulations. Features like two-factor authentication (2FA), cold storage for funds, and insurance against hacks are essential for protecting your capital.

- Fees and Funding Rates: Trading fees, withdrawal charges, and funding rates can eat into your profits. When shorting XRP using perpetual contracts, you may need to pay (or receive) a funding fee every 8 hours. These fees vary based on market imbalance — so make sure you understand the cost structure of your chosen platform.

- User Interface and Tools: A clean, intuitive interface with advanced charting tools, indicators, and real-time data feeds is a must. Platforms like TradingView-integrated exchanges or those with built-in TA tools can make spotting entry points — like breakdowns below the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 support level — a breeze.

- Customer Support and Community: Crypto never sleeps, and neither should your platform’s support team. Responsive customer service and an active user community can be lifesavers when you need quick answers or help resolving technical issues during high-stakes trades.

Here are a few standout platforms that crypto traders often turn to for shorting XRP:

- Binance: Offers XRP perpetual contracts with high liquidity and up to 20x leverage. Great for active traders who want access to a wide range of pairs and competitive fees.

- Kraken: Known for its compliance and security, Kraken supports margin trading for XRP and provides a user-friendly experience for both beginners and pros.

- Bybit: A derivatives-focused exchange that offers up to 50x leverage on XRP contracts. It’s ideal for traders who want speed and advanced order types.

- BitMEX: One of the pioneers in crypto derivatives. It supports XRP futures, though it’s more suitable for experienced users due to its complex interface.

When evaluating these platforms, align your choice with your trading style and risk tolerance. Are you a swing trader looking to capitalize on weekly trends? Or a day trader watching for intraday breakdowns below the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 level? Your platform should empower your strategy, not hinder it.

Also consider regional restrictions. Some platforms may not operate in your jurisdiction or may limit access to certain products like leveraged tokens or shorting features due to regulatory oversight. For example, U.S.-based traders often face limitations on margin trading and must use compliant platforms like Kraken or Coinbase Pro (though the latter doesn’t currently support XRP shorting).

Ultimately, choosing the right platform for shorting XRP is about balancing performance, safety, and flexibility. With XRP’s price often reacting sharply to legal updates, institutional partnerships, and macro crypto trends, you’ll want a platform that allows you to act swiftly and confidently when opportunity knocks. So, gear up, choose wisely, and get ready to ride those downward waves — profitably.

Using margin trading to amplify returns

Using Margin Trading to Amplify Returns

Margin trading is the high-octane fuel of the crypto world — and when it comes to shorting XRP, it can be the difference between a modest win and a game-changing profit. But with great power comes great responsibility. Leveraging your capital allows you to control larger positions than your actual account balance would permit, but it also magnifies losses if the market turns against you. So, before you go full throttle, let’s break down how margin trading works and how you can use it strategically to amplify returns when betting against XRP.

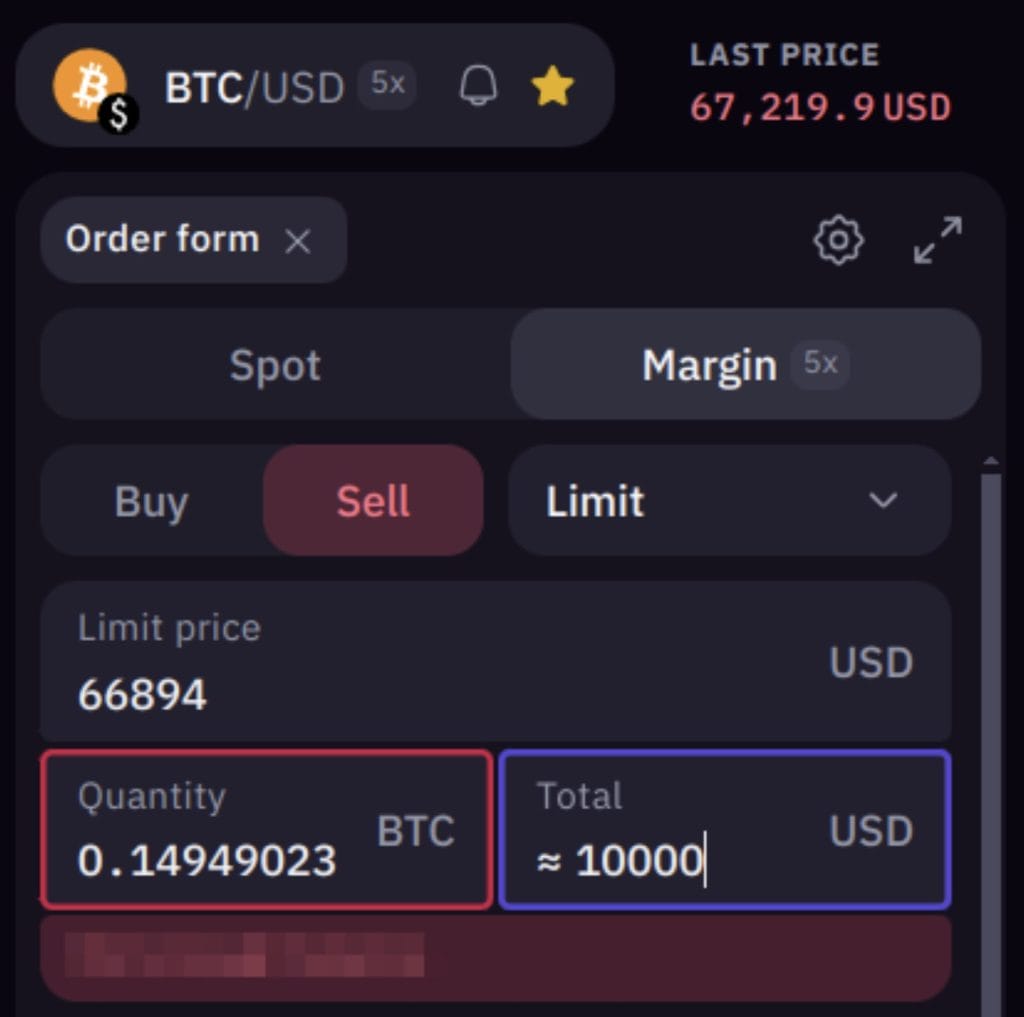

In essence, margin trading allows you to borrow funds from your exchange or broker to open a larger trade than your capital alone would allow. For example, with 5x leverage, a ,000 margin can control a ,000 position. If XRP drops by 10%, your short position would yield a 50% return on your initial margin — not too shabby. But if XRP moves up 10% instead, your ,000 could be wiped out just as quickly. That’s why understanding the mechanics is crucial before you dive in.

Here’s how margin trading works when shorting XRP:

- Open a Margin Account: Most exchanges require you to enable margin trading and meet certain criteria before you can borrow funds. You’ll need to deposit collateral — usually in USDT, BTC, or another supported asset — to open leveraged positions.

- Borrow and Sell XRP: To short XRP, you borrow XRP from the exchange and sell it at the current market price. If the price drops, you buy it back at a lower price, return the borrowed XRP, and pocket the difference as profit.

- Leverage Settings: Platforms typically offer adjustable leverage — anywhere from 2x to 100x — though most traders stick to the 3x to 10x range for a balance of risk and reward. For instance, if you believe XRP will break below the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 support level, a 5x short position could be a calculated bet with significant upside.

- Margin Requirements and Liquidation: Exchanges require you to maintain a certain margin level. If your position goes against you and your equity falls below the maintenance margin, the platform will liquidate your position to prevent further losses. This is where risk management becomes your best friend (more on that in the next section).

Now, let’s talk strategy. Timing is everything when shorting XRP with leverage. Here are a few scenarios where margin trading can supercharge your returns:

- Technical Breakdown: If XRP fails to hold the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].55 support level and breaks downward with high volume, it could signal a bearish continuation. Opening a leveraged short at that moment allows you to ride the wave down to the next support — say, the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].45 level — with multiplied gains.

- News-Driven Selloffs: XRP is highly sensitive to regulatory announcements. A negative update in the Ripple vs. SEC case could trigger a sharp selloff. Leveraged short positions entered early in such events can capture the bulk of the move before the market stabilizes.

- Bearish Divergences: Using technical indicators like RSI and MACD, traders can spot divergence between price action and momentum. If XRP is making higher highs while RSI is making lower highs, it could be a sign of weakening momentum — a prime setup for a leveraged short.

But margin trading isn’t just about jumping into the deep end. Smart traders use tools like trailing stop-losses, limit orders, and take-profit targets to manage trades effectively. Platforms like Bybit and Binance offer these features, allowing you to automate your exit strategy and protect your profits — or at least minimize losses — if the trade doesn’t go your way.

Another consideration is funding rates. When holding leveraged positions on perpetual contracts, you may incur funding fees — small payments exchanged between long and short traders every few hours. If the majority of traders are shorting XRP and the funding rate turns negative, you may actually earn passive income while holding your short. On the flip side, if the market flips bullish and you’re short, you might have to pay that fee, adding to your cost of holding the position.

Lastly, keep an eye on your margin level and available balance. Most platforms provide real-time updates on your margin ratio and liquidation price. If XRP starts creeping up toward the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].70 resistance level and your short position is over-leveraged, you could be at risk of a margin call. In such cases, adding funds to your account or reducing leverage can help you stay in the trade longer and avoid forced liquidation.

Margin trading, when used wisely, can be a powerful tool in your XRP shorting arsenal. It’s not about being reckless — it’s about being strategic. By combining solid technical analysis, market awareness, and tight risk management, you can turn small market moves into meaningful profits. Just remember: leverage is like a chainsaw — incredibly effective when handled correctly, but dangerous in the wrong hands.

Managing risk and setting stop-loss orders

Managing Risk and Setting Stop-Loss Orders

Shorting XRP can be thrilling, especially when you catch a price drop just right — but let’s be real, the crypto market is a beast that doesn’t always play nice. That’s why managing risk and setting smart stop-loss orders isn’t just a good idea; it’s your financial seatbelt. You wouldn’t drive a race car without brakes, right? The same logic applies here. Whether you’re using 5x leverage or going full degen with 20x, protecting your capital is the name of the game.

In the world of shorting, especially with volatile assets like XRP, risk management is what separates long-term winners from flash-in-the-pan traders. XRP’s price can swing wildly due to regulatory news, whale movements, or even a tweet from a prominent crypto influencer. So, how do you ride the wave without wiping out? Let’s break it down.

- Set a Stop-Loss Before You Enter the Trade: Professional traders don’t just wing it — they define their risk upfront. When shorting XRP, this means setting a stop-loss order above a key resistance level. For example, if you open a short at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60, placing a stop-loss at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].64 (just above the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].63 resistance zone) can protect you from a sudden breakout reversal.

- Use Technical Analysis to Define Risk Zones: Look at historical price action and identify zones where XRP tends to reverse. These are your guideposts. The 61.8% Fibonacci retracement level or a previously rejected resistance at the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 mark can signal where the bulls might regain control. Place your stop-loss just outside these zones to avoid premature liquidation due to market noise.

- Adjust for Volatility: XRP isn’t shy when it comes to intraday volatility. Use the Average True Range (ATR) indicator to gauge how much the asset typically moves within a timeframe. This helps you avoid setting a stop-loss that’s too tight. If XRP is swinging [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].03 in a day, placing a stop just [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].01 above your entry is basically asking to get stopped out.

- Risk-Reward Ratio Matters: Every trade should have a favorable risk-reward ratio — ideally 1:2 or better. This means if you’re risking 0, your potential reward should be at least 0. For a short on XRP, that might look like entering at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].58, setting a stop-loss at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].62, and targeting a take-profit level around [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50. This way, even if you lose a few trades, your winners can more than make up for them.

- Use Trailing Stop-Losses to Lock in Profits: Once your short starts moving in the right direction, don’t just sit there and hope. Activate a trailing stop-loss — a dynamic order that adjusts as the market moves in your favor. For instance, if XRP drops from [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 to [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].52, a trailing stop set [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].02 above the lowest price would lock in profits if the price bounces back to [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].54.

- Position Sizing is Key: Never risk more than 1%–2% of your portfolio on a single trade. If you’re trading with a ,000 account, your stop-loss should limit your loss to 0–0. This way, even a string of bad trades won’t wipe you out. Combine this with leverage cautiously — just because you can use 10x leverage doesn’t mean you should.

Let’s bring it to life with a quick example. Suppose XRP is testing the [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 level and showing signs of weakness after rejecting a move past [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].63. You decide to short at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 with a stop-loss at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].64 and a take-profit at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50. That’s a [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].04 risk for a [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].10 reward — a solid 1:2.5 risk-reward setup. You enter the trade with ,000 on 5x leverage, giving you a ,000 position. If the trade hits your take-profit, you’ve made roughly 3 before fees. If it hits your stop-loss, you lose 3. The math works — as long as you respect the plan.

And what happens if XRP suddenly spikes due to a Ripple legal win or a surprise exchange listing? That’s where your stop-loss saves the day. It exits you from the trade automatically, preventing an emotional decision or a catastrophic loss. You live to trade another day — and that’s the real win.

Some platforms also offer isolated margin versus cross margin. Isolated margin confines your risk to one position, while cross margin uses your entire account to maintain margin levels. For shorting XRP, isolated margin is usually the safer bet — it limits your exposure and keeps a bad trade from dragging down your whole portfolio.

Finally, don’t underestimate the power of mental discipline. Setting a stop-loss is one thing — sticking to it is another. Avoid the temptation to “give it a little more room” when the price moves against you. That’s how small losses become big ones. Stick to your strategy, trust your analysis, and let the numbers do the talking.

In short (pun intended), managing risk is the cornerstone of successful XRP short trading. With stop-loss orders, smart position sizing, and technical awareness, you can navigate XRP’s wild price swings like a pro — minimizing losses and maximizing your staying power in the market. Because in crypto, survival is profitability’s best friend.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- Set a Stop-Loss Before You Enter the Trade: Professional traders don’t just wing it — they define their risk upfront. When shorting XRP, this means setting a stop-loss order above a key resistance level. For example, if you open a short at [gpt_article topic=How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How to Short XRP: Profiting from Price Drops A guide to shorting XRP and using margin trading. and for embedding into a WordPress post.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.