In the ever-evolving world of cryptocurrency, where price charts resemble roller coasters more than market trends, two digital titans often find themselves in the spotlight: XRP and Bitcoin. But how do these two crypto heavyweights stack up against each other when it comes to price trends? Are we looking at a tale of two blockchains, or is it more of a sibling rivalry where both have their unique strengths and quirks? Welcome to an in-depth comparative analysis of XRP vs. Bitcoin price trends, where we unravel the mysteries of these digital currencies with a dash of humor and a sprinkle of insight.

Bitcoin, often hailed as the granddaddy of cryptocurrencies, has been a beacon in the crypto universe since its inception in 2009. It’s the kind of currency that even your grandma has heard of. But what about XRP, the digital asset with a penchant for shaking things up in the financial world? While Bitcoin takes the spotlight as a store of value, XRP plays a crucial role in facilitating cross-border transactions, making it the Robin Hood of the financial sector. But why does this matter to you, the savvy investor or trader? Simply put, the way these two coins co-exist and compete can offer key insights into the broader crypto market dynamics.

Now, let’s dive into the numbers, shall we? Bitcoin’s price trends are often likened to a blockbuster movie—filled with drama, suspense, and the occasional plot twist. XRP, on the other hand, might remind you of an indie film—understated, yet profound in its impact. But don’t let its subtler movements fool you. XRP’s price trends can be just as exhilarating, especially when you consider its role in revolutionizing traditional finance. After all, who wouldn’t want a front-row seat to witness the transformation of global banking as we know it?

But what factors drive the price trends of these digital currencies? For Bitcoin, it’s a cocktail of supply constraints, market sentiment, and, sometimes, Elon Musk’s tweets. XRP, however, dances to a slightly different tune, influenced by regulatory news, adoption by financial institutions, and its utility in real-world applications. Ever wondered why XRP sometimes seems to zig when Bitcoin zags? The answer lies in their fundamentally different use cases and market drivers.

As we peel back the layers of crypto’s intricate price mechanics, it becomes evident that understanding the nuances between XRP and Bitcoin is not just about numbers. It’s about recognizing the narrative each currency tells and the potential it holds. While Bitcoin is often seen as digital gold, XRP is carving its niche as a financial bridge-builder, connecting disparate financial systems with the ease of a seasoned diplomat. So, where does that leave us as investors and enthusiasts?

For those of you who lose sleep over candlestick charts and dream of bull runs, recognizing these differences can be a game-changer. Investing in XRP or Bitcoin isn’t just about riding the next wave; it’s about strategically positioning yourself in a market that’s as unpredictable as your neighbor’s Wi-Fi signal. Are you prepared to navigate this thrilling landscape with the confidence of a seasoned crypto explorer?

In the grand tapestry of blockchain and finance, XRP holds a unique and indispensable place. Its ability to facilitate secure, instant, and low-cost international payments makes it a vital player in the global economy. Whether you’re a hardcore trader, a fintech professional, or just someone who likes to dabble in digital currencies, understanding XRP’s role in the ecosystem is crucial. After all, knowledge is power, especially in the dynamic realm of cryptocurrencies.

As we wrap up this comparative analysis, it’s clear that both XRP and Bitcoin offer distinct opportunities and challenges. And here at XRPAuthority.com, we pride ourselves on being your trusted guide in this exciting journey. With insights that are as sharp as a crypto crash and humor that keeps things light, we’re dedicated to providing you with the latest, most accurate information. So, whether you’re diving into XRP or diversifying with Bitcoin, remember: XRP Authority is your go-to source for all things crypto. Happy investing!

Understanding XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. and Its Impact on XRP

Historical performance of XRP and Bitcoin

Historical Performance of XRP and Bitcoin

Understanding the historical price movements of XRP and Bitcoin is crucial for identifying trends, potential investment opportunities, and market behaviors. While both cryptocurrencies have played significant roles in shaping the digital asset landscape, their price trajectories have been vastly different due to their unique use cases, adoption rates, and market perceptions.

Bitcoin: The Pioneer and Market Leader

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, is widely regarded as the first and most dominant cryptocurrency. Its price history is marked by cycles of exponential growth followed by sharp corrections, often influenced by macroeconomic events, regulatory developments, and overall market sentiment.

- In 2013, Bitcoin crossed the ,000 mark for the first time, signaling its potential as a store of value.

- The 2017 bull run saw Bitcoin reach an all-time high of nearly ,000, driven by increased retail adoption and media hype.

- Following the 2018 bear market, Bitcoin rebounded in 2020-2021, hitting a new all-time high of around ,000 in November 2021.

- Despite periodic corrections, Bitcoin continues to be the benchmark for the entire crypto market, often influencing the price movements of altcoins, including XRP.

XRP: The Utility-Driven Digital Asset

XRP, created by Ripple Labs in 2012, was designed to facilitate fast and cost-efficient cross-border payments. Unlike Bitcoin, which primarily serves as a decentralized store of value, XRP’s price movements are closely tied to its adoption by financial institutions and regulatory developments.

- In early years, XRP remained relatively stable, with minor fluctuations between [gpt_article topic=XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].005 and [gpt_article topic=XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].01.

- The 2017 bull run propelled XRP to its all-time high of approximately .84 in January 2018, fueled by speculation around Ripple’s partnerships with banks.

- However, XRP’s price suffered a sharp decline in 2018, mirroring the broader crypto market downturn.

- The SEC lawsuit against Ripple in December 2020 triggered significant volatility, causing XRP to drop below [gpt_article topic=XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].20 before recovering as the case progressed.

- Despite legal uncertainties, XRP has remained resilient, often trading between [gpt_article topic=XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRP vs Bitcoin Price Trends: A Comparative Analysis Comparing XRP’s price trends with Bitcoin’s market movements. and for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].30 and .00, depending on market conditions.

Key Differences in Price Trends

While both Bitcoin and XRP have experienced periods of rapid growth and corrections, their price trends differ due to several key factors:

- Market Perception: Bitcoin is seen as “digital gold,” attracting long-term investors and institutional interest, whereas XRP is viewed as a utility token for financial transactions.

- Regulatory Impact: Bitcoin has largely avoided direct regulatory scrutiny, while XRP’s price has been heavily influenced by legal battles with the SEC.

- Supply Dynamics: Bitcoin’s limited supply of 21 million coins plays a role in its price appreciation, whereas XRP’s pre-mined supply and periodic token releases by Ripple create different market dynamics.

- Correlation with Market Trends: Bitcoin often dictates the broader crypto market trend, while XRP’s price movements are more independent, influenced by Ripple’s partnerships, legal developments, and adoption in the banking sector.

By analyzing historical performance, investors can gain insights into how each asset reacts to market cycles and external influences. While Bitcoin remains the dominant force in the crypto space, XRP offers a unique value proposition that continues to attract interest from financial institutions and investors alike.

Market factors influencing price trends

Both XRP and Bitcoin are subject to a variety of market forces that shape their price trends. While Bitcoin’s price movements are largely dictated by macroeconomic factors and investor sentiment, XRP’s valuation is influenced by regulatory decisions, adoption by financial institutions, and developments within the Ripple ecosystem. Understanding these key factors can help investors make informed decisions and anticipate potential price movements in both assets.

Regulatory Developments and Legal Challenges

One of the most significant factors affecting XRP’s price is regulatory scrutiny, particularly the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC). The lawsuit, which began in December 2020, accused Ripple of selling XRP as an unregistered security. This legal uncertainty initially caused XRP’s price to plummet, but as the case progressed, partial victories for Ripple have led to price recoveries.

- SEC Lawsuit Impact: Any updates regarding the case, whether positive or negative, have historically triggered sharp price movements in XRP.

- Global Regulatory Landscape: Unlike Bitcoin, which is widely accepted as a decentralized asset, XRP’s classification as a security or utility token varies across jurisdictions, impacting its adoption and price stability.

- Institutional Confidence: A favorable legal outcome for Ripple could pave the way for greater institutional adoption of XRP, driving its price higher.

Bitcoin, on the other hand, has largely avoided direct legal battles over its status as a security. However, regulatory developments regarding Bitcoin ETFs, taxation policies, and government interventions can significantly influence its price.

Adoption and Real-World Use Cases

Bitcoin’s primary use case as a store of value and digital gold has been a major driver of its price. Institutional adoption, such as companies adding Bitcoin to their balance sheets or Bitcoin ETFs gaining approval, has historically led to price surges.

- Institutional Investments: Companies like Tesla and MicroStrategy purchasing Bitcoin have contributed to significant price rallies.

- ETF Approvals: The introduction of Bitcoin ETFs has increased accessibility for traditional investors, further driving demand.

- Macroeconomic Trends: Inflation fears and economic uncertainty have led to Bitcoin being perceived as a hedge, similar to gold.

XRP, in contrast, is primarily focused on facilitating cross-border payments and improving financial settlement efficiency. Its price is often influenced by adoption within the banking and financial sectors.

- Ripple’s Partnerships: Collaborations with financial institutions, such as banks and payment providers, can boost confidence in XRP’s utility and drive demand.

- On-Demand Liquidity (ODL): Ripple’s ODL solutions, which use XRP for instant cross-border transactions, continue to expand, increasing XRP’s real-world utility.

- CBDC Integration: Ripple’s involvement in central bank digital currency (CBDC) initiatives could further enhance XRP’s adoption and long-term value.

Market Sentiment and Investor Behavior

Both Bitcoin and XRP are heavily influenced by market sentiment, which can be driven by news, social media trends, and broader economic conditions.

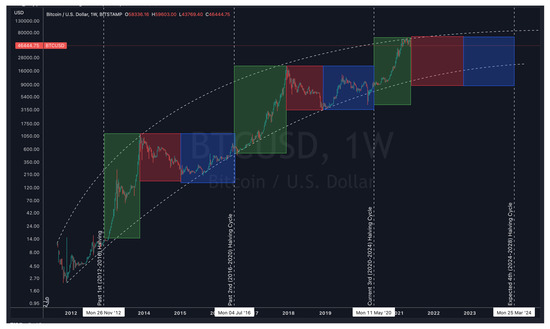

- Bitcoin’s Halving Cycles: Bitcoin undergoes a halving event approximately every four years, reducing the block reward for miners. Historically, this has led to price surges due to reduced supply.

- Fear and Greed Index: Crypto investors often rely on the Fear and Greed Index, which measures overall market sentiment. Extreme fear can lead to sell-offs, while extreme greed can fuel bullish trends.

- Whale Activity: Large holders of Bitcoin or XRP, known as “whales,” can influence price movements through significant buy or sell orders.

XRP’s price is also affected by social sentiment, particularly regarding Ripple’s legal battles and its ongoing partnerships. Positive news about regulatory clarity or new financial collaborations can lead to sudden price spikes.

Macroeconomic and Global Market Trends

Global economic conditions play a crucial role in the price trends of both Bitcoin and XRP. Factors such as inflation, interest rates, and geopolitical events can impact investor behavior.

- Inflation and Currency Devaluation: Bitcoin is often seen as a hedge against inflation, attracting investors during periods of economic uncertainty.

- Stock Market Correlation: Bitcoin has shown increasing correlation with traditional markets, meaning downturns in equities can sometimes lead to crypto sell-offs.

- Fiat Liquidity and Central Bank Policies: Loose monetary policies and stimulus measures can drive liquidity into risk assets like Bitcoin and XRP.

For XRP, macroeconomic trends also impact adoption, particularly in the financial sector. As banks and payment providers seek more efficient cross-border solutions, increased adoption of Ripple’s technology could bolster XRP’s long-term price growth.

By analyzing these market factors, investors can better understand the forces driving XRP and Bitcoin’s price movements. While Bitcoin remains a dominant force in the crypto market, XRP’s unique role in financial transactions and regulatory developments presents distinct opportunities and risks for investors.

Volatility comparison and investor sentiment

Volatility Comparison and Investor Sentiment

Volatility is a defining characteristic of the cryptocurrency market, and both XRP and Bitcoin exhibit distinct patterns in their price fluctuations. While Bitcoin is often seen as a high-risk, high-reward asset due to its dramatic price swings, XRP’s volatility is influenced by external factors such as regulatory developments and institutional adoption. Understanding how these two assets behave in different market conditions can help investors manage risk and identify opportunities.

Comparing Volatility in XRP and Bitcoin

Bitcoin has historically been one of the most volatile assets in the financial world, with price swings of 10% or more in a single day not being uncommon. This volatility is driven by factors such as market speculation, institutional buying or selling, and macroeconomic influences like inflation and interest rates.

- Bitcoin’s Volatility Index: The Bitcoin Volatility Index (BVOL) measures the asset’s price fluctuations over a given period. Historically, Bitcoin’s volatility has spiked during bull runs and major corrections.

- Market Liquidity: Bitcoin, being the most liquid cryptocurrency, often sees large trading volumes, which can amplify price swings when major buy or sell orders occur.

- Halving Events: Every four years, Bitcoin undergoes a halving event that reduces mining rewards, leading to supply shocks that can trigger extreme price movements.

On the other hand, XRP’s volatility is influenced by different factors, primarily regulatory uncertainty and its adoption within the financial sector. While XRP has seen explosive price movements in the past, such as its meteoric rise to nearly .84 in 2018, its volatility is often event-driven rather than cyclical.

- SEC Lawsuit and Legal Developments: The ongoing legal battle between Ripple and the SEC has been a major source of volatility for XRP. Positive legal outcomes tend to drive price spikes, while setbacks can lead to sharp declines.

- Institutional Transactions: Since XRP is often used in cross-border payments and liquidity solutions, large institutional transactions can create temporary fluctuations in its price.

- Lower Market Liquidity Compared to Bitcoin: Although XRP is one of the largest cryptocurrencies by market cap, it has significantly lower liquidity than Bitcoin, making it more susceptible to price manipulation and sudden swings.

Investor Sentiment and Market Psychology

Investor sentiment plays a crucial role in the volatility of both assets. Bitcoin, often referred to as “digital gold,” is widely regarded as a long-term store of value, attracting both institutional and retail investors. XRP, however, is more closely tied to its utility in financial transactions, leading to different sentiment drivers.

Bitcoin: The Sentiment-Driven Market Leader

Bitcoin’s price is heavily influenced by investor sentiment, which is often shaped by news cycles, macroeconomic conditions, and institutional activity.

- Fear and Greed Index: A widely used indicator in the crypto space, the Fear and Greed Index measures market sentiment on a scale from extreme fear to extreme greed. Bitcoin’s price often moves in tandem with shifts in this index.

- Institutional Adoption: When major firms, such as Tesla or MicroStrategy, announce Bitcoin purchases, market sentiment turns bullish, leading to price surges.

- Macroeconomic Events: Bitcoin is increasingly seen as a hedge against inflation and economic uncertainty, meaning that financial instability can drive demand and push prices higher.

XRP: Sentiment Tied to Regulatory and Adoption News

Unlike Bitcoin, which is largely driven by macroeconomic trends and institutional interest, XRP’s price sentiment is closely linked to developments surrounding Ripple and its adoption in the financial sector.

- Regulatory Clarity: Positive news regarding Ripple’s legal battles, such as favorable court rulings, often lead to sudden XRP price spikes.

- Partnership Announcements: When Ripple secures partnerships with financial institutions or expands its On-Demand Liquidity (ODL) services, investor confidence in XRP increases.

- Community Engagement: XRP has a strong and vocal community that actively discusses the asset’s potential. Social media trends and discussions can sometimes influence short-term price movements.

Risk-Reward Profiles for Investors

Given their differing volatility patterns and sentiment drivers, Bitcoin and XRP present unique risk-reward profiles for investors.

- Bitcoin as a Long-Term Investment: Many investors see Bitcoin as a long-term asset with strong fundamentals. Despite its volatility, Bitcoin’s historical price trajectory has shown consistent growth over time.

- XRP as a High-Risk, High-Reward Asset: XRP’s price movements tend to be more event-driven, meaning that regulatory developments and adoption news can lead to rapid gains or losses. Investors willing to take on higher risk may find XRP appealing for short- to medium-term trading.

- Portfolio Diversification: Some investors allocate a portion of their portfolio to both Bitcoin and XRP, using Bitcoin as a stable long-term asset while leveraging XRP’s potential for short-term price surges.

Ultimately, understanding volatility and investor sentiment can help traders and investors make informed decisions about their crypto holdings. While Bitcoin continues to dominate the market as a store of value, XRP’s unique role in the financial sector presents distinct opportunities that may appeal to those looking for exposure to digital assets with real-world utility.

Future outlook and potential growth

Future Outlook and Potential Growth

The future of both XRP and Bitcoin remains a topic of intense debate among investors, analysts, and financial institutions. While Bitcoin continues to solidify its position as the leading cryptocurrency and a hedge against inflation, XRP’s future hinges on regulatory clarity, adoption by financial institutions, and the expansion of Ripple’s payment solutions. Examining the potential growth trajectories of both assets can help investors determine where opportunities may lie in the coming years.

Bitcoin’s Long-Term Growth Potential

Bitcoin’s future largely depends on macroeconomic trends, institutional adoption, and technological advancements. Historically, Bitcoin has followed a four-year cycle driven by halving events, which reduce the supply of new BTC entering the market and have historically led to price surges.

- Bitcoin Halving in 2024: The next Bitcoin halving is set to occur in 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. If past trends hold, this event could trigger another bull run, potentially pushing Bitcoin to new all-time highs.

- Institutional and Corporate Adoption: Increasing adoption by companies, hedge funds, and governments could further cement Bitcoin’s status as a legitimate asset class. The approval of more Bitcoin ETFs and sovereign wealth fund investments could drive additional demand.

- Regulatory Clarity: While Bitcoin has largely avoided direct regulatory scrutiny, clearer guidelines from governments and financial regulators could provide a more stable investment environment, attracting further institutional interest.

- Layer 2 Scaling Solutions: The development of the Lightning Network and other Layer 2 solutions aims to improve Bitcoin’s transaction speed and scalability, making it more viable for everyday transactions.

Given these factors, long-term Bitcoin holders remain optimistic about BTC’s ability to surpass its previous all-time highs, with some analysts predicting a six-figure valuation in the coming years.

XRP’s Growth Prospects Amid Regulatory and Adoption Trends

Unlike Bitcoin, XRP’s growth potential is heavily tied to regulatory developments and institutional adoption. Ripple’s ongoing legal battle with the SEC has been a major source of uncertainty, but a favorable outcome could open the floodgates for new investment and partnerships.

- SEC Lawsuit Resolution: If Ripple secures a favorable ruling in its case against the SEC, it could provide much-needed regulatory clarity for XRP, leading to increased adoption and a potential price surge.

- Expansion of Ripple’s On-Demand Liquidity (ODL): Ripple’s ODL service, which utilizes XRP for instant cross-border payments, has been expanding globally. More financial institutions integrating ODL could drive demand for XRP.

- CBDC Integration: Ripple has been actively involved in discussions with central banks regarding central bank digital currencies (CBDCs). If XRP becomes a bridge asset for CBDC transactions, its value proposition would significantly increase.

- Increased Utility in Banking and Payments: As traditional financial institutions seek faster and more cost-efficient payment solutions, XRP’s role as a liquidity provider could see greater adoption, positively impacting its price.

- Global Regulatory Developments: Beyond the U.S., regulatory clarity in regions like Europe and Asia could lead to increased exchange listings and adoption by financial institutions.

If these factors align favorably, XRP could experience a breakout from its long-term trading range and challenge its previous all-time highs.

Comparative Growth Potential: Bitcoin vs. XRP

While both Bitcoin and XRP have significant growth potential, their trajectories will likely be shaped by different catalysts. Bitcoin’s price movements are primarily influenced by macroeconomic factors and institutional interest, whereas XRP’s valuation is closely tied to its adoption in the financial sector and regulatory developments.

- Bitcoin as a Store of Value: If Bitcoin continues to be adopted as “digital gold,” its long-term price trajectory remains bullish, with projections ranging from 0,000 to 0,000 per BTC in the next decade.

- XRP as a Utility Token: If Ripple successfully expands its payment solutions and gains regulatory clarity, XRP could see exponential growth, particularly if it becomes a key player in cross-border transactions and CBDC interoperability.

- Risk vs. Reward: Bitcoin is generally seen as a safer long-term investment due to its widespread adoption and decentralized nature, while XRP offers higher potential gains but comes with regulatory risks.

For investors, diversification between both assets may be a strategic approach, allowing exposure to Bitcoin’s long-term appreciation potential and XRP’s potential for explosive growth in the payments sector.

Key Factors to Watch Moving Forward

As the crypto market evolves, several key factors will play a crucial role in determining the future of Bitcoin and XRP:

- Regulatory Developments: Ongoing discussions around cryptocurrency regulations will impact both Bitcoin and XRP. Clearer guidelines could unlock institutional capital and drive mainstream adoption.

- Institutional Involvement: Continued investment from major financial institutions, hedge funds, and governments will shape the trajectory of both assets.

- Technological Advancements: Improvements in blockchain scalability, security, and interoperability will enhance the usability of both Bitcoin and XRP.

- Macroeconomic Conditions: Inflation rates, interest rate policies, and economic stability will influence investor sentiment and capital flows into cryptocurrencies.

Both Bitcoin and XRP have promising futures, but their paths to growth will depend on different factors. While Bitcoin is positioned as a long-term investment and store of value, XRP’s success hinges on regulatory clarity and its adoption in the global financial system. Investors should stay informed about key developments and market trends to make informed decisions about their crypto portfolios.

- for key points.

- for key points.

- for key points.

- for key points.