Welcome to the fascinating world of XRPL Hooks and their transformative potential in decentralized finance (DeFi). If you’ve ever wondered how this cutting-edge technology can revolutionize decentralized lending, staking, and liquidity automation, you’re in the right place. But let’s be honest, in the world of crypto, who hasn’t asked themselves, “What on earth is a hook, and can it catch anything other than a fish?” Fear not, fellow XRP enthusiasts, because we’re about to dive deep into the ocean of possibilities that XRPL Hooks present, with a splash of humor and a boatload of insights.

XRPL Hooks are akin to the secret sauce in your favorite dish—seemingly simple but absolutely essential. Think of them as programmable logic that empowers the XRP Ledger to execute complex operations automatically. Now, why should you care? Picture a world where your XRP investments aren’t just sitting pretty but actively working for you, optimizing returns in the DeFi universe. That’s where XRPL Hooks come into play, offering a new frontier of financial innovation that’s as exciting as a bull run on a Friday afternoon.

Decentralized lending is like the wild west of finance, but with XRPL Hooks, it becomes more like a well-oiled machine. Imagine collateralizing your crypto assets and earning interest without lifting a finger. Hooks can automate these processes, ensuring that your investments are as efficient as a blockchain transaction. And let’s face it, who doesn’t want their money to work harder than a caffeinated squirrel in a nut factory?

Staking, on the other hand, is the bread and butter of passive income in crypto. With XRPL Hooks, staking becomes a seamless process, effortlessly integrating with your existing assets. It’s like having a personal assistant for your crypto, ensuring your stakes are always optimized. Is it too much to ask for a feature that reminds you to hydrate while you’re at it? Maybe, but we can dream.

Liquidity automation might sound as thrilling as watching paint dry, but in the world of DeFi, it’s a game-changer. XRPL Hooks can automate liquidity provision, ensuring that your assets are always in the right place at the right time. Think of it as the ultimate chess player, always three moves ahead and never breaking a sweat. It’s like having a financial advisor who doesn’t charge an arm and a leg—or any limbs, for that matter.

Now, let’s talk about XRP’s role in this grand DeFi narrative. As a pioneer in blockchain and a cornerstone of digital finance, XRP stands at the forefront of innovation. With XRPL Hooks, XRP holders can maximize their investment potential, navigating the crypto seas with the precision of a laser-guided missile. In the ever-evolving landscape of finance, XRPL Hooks are the compass guiding XRP towards new horizons.

So, where does one go to stay ahead of the curve in this rapidly changing environment? Look no further than XRPAuthority.com. As your trusty guide in the crypto wilderness, we provide insights that are as sharp as a blockchain’s edge. Whether you’re a seasoned investor or a curious newcomer, our expertise ensures you’re never left in the dark, even when the market is as unpredictable as a cat on a hot tin roof.

In the end, XRPL Hooks are more than just technical jargon—they’re the key to unlocking the future of DeFi with XRP at the helm. And at XRP Authority, we’re committed to being your go-to resource for all things crypto. So buckle up, because with XRPL Hooks, the journey is just beginning, and it’s going to be one heck of a ride.

Understanding XRPL Hooks Use Cases in DeFi and Its Impact on XRP

Smart contract functionality with XRPL Hooks

Smart contracts have been the backbone of DeFi innovation, but until recently, the XRP Ledger (XRPL) lacked native smart contract capabilities. Enter XRPL Hooks — a groundbreaking feature that injects programmable logic directly into XRPL accounts. Think of Hooks as lightweight, event-driven scripts that execute automatically when specific ledger events occur, like sending or receiving a transaction. They’re essentially mini smart contracts tailored for the high-speed, low-cost XRPL environment.

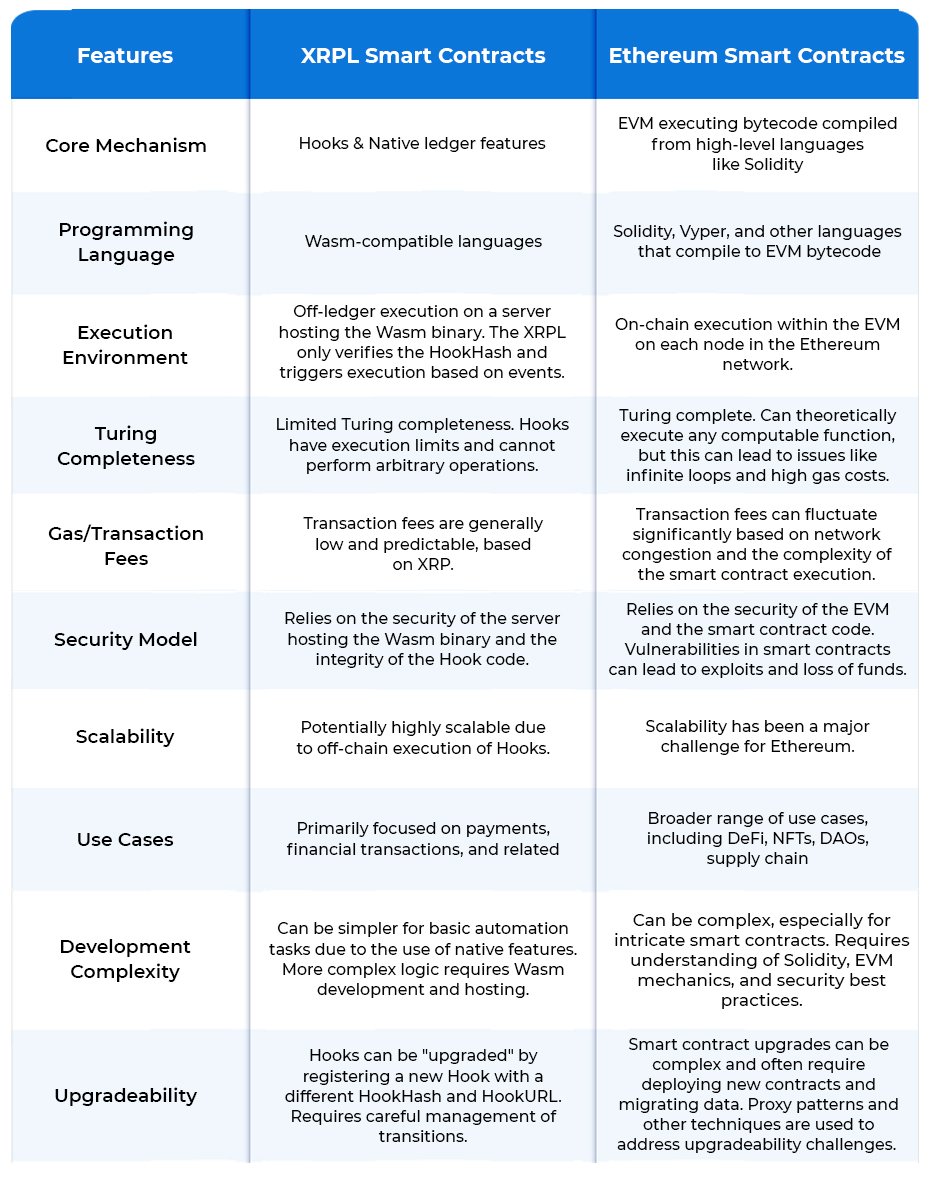

What makes XRPL Hooks particularly exciting is their ability to bring decentralized finance (DeFi) use cases to a ledger that’s already known for its blazing-fast transactions and near-zero fees. Unlike Ethereum’s full-blown Turing-complete smart contracts, Hooks are optimized for efficiency and security, written in WebAssembly (WASM) and executed deterministically. This makes them ideal for fine-tuned financial logic without the gas fee headaches.

- Decentralized Lending: Hooks can be used to automate lending protocols by embedding logic directly into user accounts. For instance, a Hook could enforce collateral requirements, trigger liquidation events, or monitor loan health ratios in real-time. This means users can borrow XRP or other issued tokens without needing a centralized intermediary.

- Staking Mechanisms: With Hooks, decentralized staking becomes a reality on XRPL. Validators or third-party staking platforms can deploy Hooks that track staking durations, calculate rewards, and auto-distribute yields. This opens the door for trustless staking where users retain control of their keys while earning passive income.

- Liquidity Automation: Hooks allow for real-time liquidity management. For example, a Hook could detect when an account balance drops below a defined threshold and automatically pull liquidity from a pool or rebalance assets. This kind of automation is crucial for maintaining healthy liquidity in decentralized exchanges and lending pools.

Hooks also offer a new level of granularity in DeFi automation. Developers can program conditions based on transaction metadata, account states, or even time-based triggers. Imagine a lending protocol that adjusts interest rates dynamically based on market conditions — all enforced through on-chain Hooks without needing external oracles or manual intervention.

For XRP investors, this evolution is more than a technical upgrade — it’s a strategic shift. XRPL is now positioning itself as a serious contender in the DeFi space, competing with Ethereum, Solana, and other smart contract platforms. The low transaction costs and high throughput of XRPL make it particularly attractive for micro-lending, high-frequency staking strategies, and yield farming operations that demand efficiency.

Moreover, as XRPL integrates with decentralized exchanges and cross-chain bridges, Hooks will play a central role in orchestrating complex DeFi workflows across ecosystems. Picture a future where your XRP is automatically staked, earns yield, and rebalances into stablecoins at the [gpt_article topic=XRPL Hooks Use Cases in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRPL Hooks Use Cases in DeFi and How Hooks can be used for decentralized lending, staking, and liquidity automation. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use DeFi automation, lending pools, yield farming, XRPL DeFi, decentralized staking and How Hooks can be used for decentralized lending, staking, and liquidity automation. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level — all through a series of Hooks, with no centralized party in sight.

In an industry where speed, cost, and trustless execution are paramount, XRPL Hooks offer a compelling toolkit for building the next generation of DeFi applications. Whether you’re a developer eager to deploy smart logic or an investor looking for yield-optimized strategies, Hooks are set to redefine what’s possible on the XRP Ledger.

Decentralized exchanges powered by XRPL

The XRP Ledger has long been praised for its built-in decentralized exchange (DEX) functionality, but with the introduction of XRPL Hooks, this native feature is evolving into something far more powerful. By embedding lightweight logic directly into accounts, Hooks can automate and enhance DEX operations, bringing smart contract-level sophistication to one of the fastest and most cost-effective blockchains in the game.

At its core, XRPL’s DEX allows for the seamless trading of issued assets without the need for third-party custodians or external liquidity aggregators. Now, with Hooks, developers can introduce programmable trading behaviors, dynamic liquidity provisioning, and conditional order execution — all on-chain and without bloating the network.

- Automated Market Makers (AMMs): While XRPL’s traditional DEX operates on an order book model, Hooks enable the creation of AMM-like functionality. For instance, Hooks can be programmed to adjust ask/bid spreads based on real-time trading volume or volatility, mimicking the behavior of Uniswap-style liquidity pools. This not only attracts liquidity providers but also enhances price discovery on the XRPL DEX.

- Slippage Protection: Traders can embed Hooks into their accounts that auto-cancel or modify trades if slippage exceeds a predefined threshold. This is particularly valuable during high market volatility or when trading illiquid pairs. Imagine setting a Hook that rejects any trade execution if the price deviates more than 2% from the expected rate — all without touching a single centralized API.

- Cross-Asset Swaps: Hooks can facilitate more complex trades, such as atomic swaps between XRP and issued tokens or even cross-chain swaps when integrated with bridges. These Hooks ensure that either both sides of a trade execute or neither does, removing counterparty risk and enabling seamless asset conversion.

For liquidity providers, XRPL Hooks open up new revenue streams and risk management tools. A Hook could, for example, monitor pool utilization and dynamically adjust yield incentives to attract or repel liquidity. This kind of logic-driven liquidity automation ensures that pools remain balanced and responsive to market conditions, which is essential in maintaining a healthy DeFi ecosystem.

Staking and yield farming mechanics can also be integrated into DEX operations. Users could stake their LP (liquidity provider) tokens, and a Hook could track staking duration, auto-compound rewards, and even reallocate assets based on predefined yield strategies. Think of it as DeFi autopilot — once configured, your tokens work for you while you sleep, with every move governed by Hooks and executed in real-time.

Institutional-grade traders and retail investors alike stand to benefit. With the ability to automate complex trading strategies, set conditional triggers, and manage liquidity exposure — all without relying on external smart contract platforms — XRPL becomes a serious contender in the DeFi exchange arena. The near-zero fees and sub-second finality are just the icing on the cake.

And let’s not forget compliance. Hooks can be configured to enforce regulatory conditions, such as KYC verification or jurisdictional restrictions, directly at the account level. This could pave the way for compliant DEXs operating on XRPL, bridging the gap between decentralized innovation and traditional finance requirements.

As XRP continues to hover around critical price levels — like the [gpt_article topic=XRPL Hooks Use Cases in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRPL Hooks Use Cases in DeFi and How Hooks can be used for decentralized lending, staking, and liquidity automation. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use DeFi automation, lending pools, yield farming, XRPL DeFi, decentralized staking and How Hooks can be used for decentralized lending, staking, and liquidity automation. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level — the demand for high-performance, low-cost trading infrastructure will only grow. XRPL’s DEX, supercharged with Hooks, offers a scalable, programmable, and trustless solution that could attract a new wave of users, developers, and liquidity providers into the XRP ecosystem.

In a world where DeFi is increasingly dominated by networks plagued with high gas fees and congestion, XRPL’s Hook-enabled DEX offers a refreshing alternative: fast, affordable, and smart. It’s not just about trading anymore — it’s about creating an intelligent, automated financial layer where your assets interact with the market on your behalf, all thanks to the magic of XRPL Hooks.

Lending and borrowing protocols on XRPL

Decentralized lending and borrowing have become cornerstones of the DeFi ecosystem, offering users the ability to earn yield or access liquidity without relying on traditional financial intermediaries. With XRPL Hooks, the XRP Ledger is stepping into this realm with its own unique advantages — namely, ultra-low fees, lightning-fast settlement, and now, programmable logic baked directly into accounts. This opens the door for lending and borrowing protocols that are not just efficient but also fully autonomous and trustless.

Imagine a lending pool built natively on XRPL where Hooks monitor collateralization ratios, calculate interest in real time, and automatically trigger liquidations when needed — all without a central authority overseeing the process. That’s no longer just a concept; with Hooks, it’s a potential reality. These micro-smart contracts can enforce lending logic at the protocol level, ensuring that borrowers remain within safe parameters and lenders are protected from downside risk.

- Collateralized Lending: Hooks can be designed to validate whether a user has deposited enough collateral before allowing a loan transaction to proceed. If conditions aren’t met — for example, if the loan-to-value (LTV) ratio exceeds 75% — the Hook can reject the transaction or require additional collateral. This on-chain enforcement reduces the risk of under-collateralized loans and maintains the integrity of the lending pool.

- Dynamic Interest Rates: One of the most exciting use cases is interest rate automation. Hooks can dynamically adjust borrowing rates based on pool utilization. For instance, if a lending pool is over 90% utilized, a Hook could programmatically increase interest rates to incentivize more deposits and discourage borrowing, maintaining liquidity balance.

- Auto-Liquidation: If a borrower’s collateral falls below a critical threshold — say, during a market dip where XRP drops below the [gpt_article topic=XRPL Hooks Use Cases in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRPL Hooks Use Cases in DeFi and How Hooks can be used for decentralized lending, staking, and liquidity automation. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use DeFi automation, lending pools, yield farming, XRPL DeFi, decentralized staking and How Hooks can be used for decentralized lending, staking, and liquidity automation. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 support level — a Hook can automatically trigger a liquidation. This ensures that lenders are repaid and the system remains solvent, all without manual intervention or third-party execution.

What makes XRPL especially attractive for decentralized lending is its high throughput and minimal transaction costs. Unlike Ethereum, where interacting with a lending protocol could cost upwards of in gas fees, XRPL transactions cost fractions of a cent. This enables micro-lending and borrowing — imagine taking out a loan for a short-term liquidity need, something unfeasible on most other chains but entirely viable on XRPL thanks to Hooks.

For XRP holders, this means their assets can now be put to work in ways that were previously impossible on the native ledger. By depositing XRP into a lending protocol powered by Hooks, users can earn interest while maintaining full custody of their funds. The logic embedded in Hooks ensures that the terms of lending agreements are enforced without needing to trust a central counterparty.

On the flip side, borrowers gain access to instant liquidity without the friction of credit checks or KYC — unless, of course, a Hook is programmed to enforce compliance for regulated use cases. This flexibility allows developers to tailor lending protocols for both decentralized anarchists and regulation-friendly institutions, all within the same infrastructure.

And let’s not overlook cross-chain lending. With the rise of interoperability protocols and bridges, Hooks can be integrated with wrapped assets or synthetic tokens. This means you could deposit wrapped BTC or ETH on XRPL, borrow XRP against it, and manage your position via Hooks — all with sub-second finality and near-zero fees. This kind of multi-chain DeFi experience is the holy grail for advanced investors looking to optimize yield, hedge positions, or access capital without selling core holdings.

For yield farmers and DeFi strategists, the implications are enormous. Hooks can be used to automatically reinvest interest earnings, rebalance loan portfolios based on market movements, or even migrate assets between lending pools to chase the best APYs. Picture a Hook that monitors the 61.8% Fibonacci retracement level on XRP, and when price action confirms support, it reallocates funds into higher-risk, higher-yield pools. That’s not just smart investing — that’s programmable alpha.

Ultimately, XRPL Hooks are transforming the XRP Ledger into a fertile ground for DeFi lending innovation. Whether you’re a lender seeking passive income, a borrower needing quick capital, or a developer building the next big protocol, Hooks provide the tools to create robust, trustless lending ecosystems. The combination of speed, cost-efficiency, and programmable automation makes XRPL a serious player in the DeFi lending arena — and a compelling option for anyone looking to ride the next wave of decentralized finance.

Automated yield farming strategies using Hooks

Yield farming has become the bread and butter of DeFi — a way for crypto holders to put idle assets to work and earn passive income in the form of interest, fees, and token rewards. But here’s the catch: traditional yield farming often requires constant monitoring, manual reallocation, and gas-guzzling transactions. Enter XRPL Hooks — the secret weapon for turning yield farming into a fully automated, cost-effective, and intelligent strategy on the XRP Ledger.

Hooks bring a new level of automation and precision to yield farming by embedding programmable logic directly into XRPL accounts. These lightweight scripts can listen for specific events — like incoming rewards, price fluctuations, or liquidity pool metrics — and trigger predefined actions without any need for third-party smart contract platforms. That means no more staying up at night wondering if it’s time to harvest or rebalance. Your Hooks do the heavy lifting while you focus on strategy — or sleep.

- Auto-Compounding Rewards: One of the most popular yield farming strategies is compounding — reinvesting rewards to maximize returns. On XRPL, Hooks can detect when rewards hit your wallet and automatically reinvest them into the same or different pools. This recursive logic ensures your capital grows exponentially over time, with zero manual intervention and near-zero fees.

- Dynamic Pool Hopping: Yield optimization is all about chasing the best APYs. Hooks can be programmed to monitor multiple liquidity pools and move funds when a better yield opportunity arises. For example, if Pool A drops below a 10% APY and Pool B exceeds 15%, a Hook can automatically reallocate your assets — maximizing returns and minimizing opportunity cost.

- Time-Based Strategies: Some farmers prefer to lock in gains at specific intervals or during favorable market conditions. Hooks can execute yield harvesting or rebalancing at predefined times or block intervals. Imagine a strategy where your XRP holdings are automatically staked every Monday, and rewards are harvested and converted into stablecoins if XRP breaks the [gpt_article topic=XRPL Hooks Use Cases in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRPL Hooks Use Cases in DeFi and How Hooks can be used for decentralized lending, staking, and liquidity automation. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use DeFi automation, lending pools, yield farming, XRPL DeFi, decentralized staking and How Hooks can be used for decentralized lending, staking, and liquidity automation. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level — all without lifting a finger.

This kind of intelligent automation is a game-changer for yield farmers who want to avoid the high fees and congestion of Ethereum-based DeFi. On XRPL, even complex farming strategies can be executed at the speed of light and for a fraction of a cent, making micro-yield farming not only feasible but profitable. Whether you’re farming with 0 or 0,000, Hooks level the playing field.

But it gets even better for power users and institutional-grade DeFi strategists. Hooks can integrate logic based on technical indicators and market data. For instance, a Hook could monitor the 61.8% Fibonacci retracement level on XRP’s price chart and trigger a shift from high-risk yield pools into stablecoin farms when volatility spikes. That’s not just automation — that’s algorithmic investing, XRPL-style.

And let’s talk about liquidity layering — a strategy where funds are distributed across multiple pools to balance risk and reward. Hooks can be programmed to allocate percentages of your portfolio based on real-time metrics. For example:

- 50% in a low-risk XRP-USDC pool

- 30% in a mid-risk XRP-ETH pool

- 20% in a high-risk yield-maximizing farm

If market conditions shift — say, XRP breaks above the [gpt_article topic=XRPL Hooks Use Cases in DeFi directives=”Generate a long-form, well-structured, SEO-optimized article on the topic XRPL Hooks Use Cases in DeFi and How Hooks can be used for decentralized lending, staking, and liquidity automation. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use DeFi automation, lending pools, yield farming, XRPL DeFi, decentralized staking and How Hooks can be used for decentralized lending, staking, and liquidity automation. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level and enters a bullish trend — the Hook can dynamically increase exposure to higher-yield pools. Conversely, during bearish periods, it can pull back into safer, stablecoin-based farms. This kind of responsive farming strategy is typically reserved for hedge funds with algorithmic trading desks, but with XRPL Hooks, it’s available to anyone with a wallet and a plan.

For developers, this opens the door to building sophisticated yield farming platforms directly on XRPL. Imagine a dashboard where users can select predefined automated strategies — conservative, balanced, or aggressive — and the underlying Hooks handle everything from staking to rebalancing. No MetaMask pop-ups, no gas fee estimations, just pure DeFi performance on autopilot.

And for the XRP ecosystem as a whole, the implications are massive. By enabling intelligent, low-cost, and decentralized yield farming, XRPL becomes an attractive home for liquidity providers and yield seekers alike. This draws more capital into the network, deepens liquidity pools, and increases demand for XRP and issued tokens — all of which support price appreciation and ecosystem growth.

In a world where DeFi users are constantly searching for better yields with lower friction, XRPL Hooks provide a unique edge. They bring the automation of smart contracts without the drag of high fees or slow confirmation times. Whether you’re deploying capital into lending pools, staking protocols, or high-yield farms, Hooks ensure your funds are always working for you — intelligently, efficiently, and autonomously.

So, if you’re serious about yield farming and tired of babysitting your DeFi portfolio, it might be time to let XRPL Hooks take the wheel. With the right logic and a little creativity, you can turn your XRP into a self-sustaining income engine — all on a ledger that’s fast, cheap, and now, smarter than ever.

- for key points.

- for key points.