Have you ever wondered how a visionary concept transforms into a revolutionary force in the world of finance? Enter Chris Larsen, the co-founder of Ripple, whose journey in the blockchain universe is as riveting as a thriller novel with an unexpected twist. With the inception of Ripple, Larsen didn’t just hop onto the blockchain bandwagon; he helped build the road. The story of Ripple’s origin is a fascinating tale of innovation, ambition, and a sprinkle of serendipity. So, buckle up as we delve into how Larsen’s foresight and Ripple’s technology have reshaped the landscape of global finance.

In the early days of cryptocurrency, when Bitcoin was still a fledgling idea and Ethereum was merely a twinkle in Vitalik Buterin’s eye, Chris Larsen envisioned a world where money could move as seamlessly as information. Did he have a crystal ball, or was he just that ahead of the curve? Either way, his involvement in co-founding Ripple in 2012 set the stage for what would become a pivotal player in the financial ecosystem. Ripple, with its native digital asset XRP, wasn’t about to be just another cryptocurrency; it aimed to revolutionize cross-border payments and remittance services.

But what makes Ripple stand out in the crowded crypto marketplace, you ask? The answer lies in its unique consensus ledger and protocol, which promised to solve the inefficiencies plaguing traditional banking systems. Unlike Bitcoin’s proof-of-work and Ethereum’s proof-of-stake, Ripple’s consensus algorithm doesn’t require mining, making transactions faster and more energy-efficient. This innovative approach quickly caught the attention of banks and financial institutions worldwide. After all, who wouldn’t want to ditch the snail-mail pace of SWIFT for lightning-fast, cost-efficient transfers?

And here’s where Larsen’s genius truly shines. By strategically positioning Ripple as a bridge between the fiat and digital currency worlds, he didn’t just offer banks a technological upgrade; he provided them a lifeline in adapting to a digital future. The symbiotic relationship Ripple forged with the banking sector is akin to teaching an old dog new tricks – and getting the dog to love it. This was not just a tech upgrade; it was a paradigm shift.

Ripple’s XRP is not merely a digital token; it represents a cornerstone in the evolution of blockchain technology. While some cryptocurrencies focus solely on decentralization, Ripple strikes a balance between innovation and regulatory compliance. This dual focus has enabled XRP to gain traction in both the blockchain community and the institutional finance world. For investors, XRP isn’t just another asset to hold; it’s a ticket to the future of money. It’s like investing in the Internet in the ’90s but with the potential for even greater disruption.

So, what’s the secret sauce behind Ripple’s success and Larsen’s lasting impact? It’s the blend of visionary leadership, robust technology, and strategic industry partnerships. Larsen’s ability to navigate the choppy waters of regulation while pushing the envelope of what blockchain can achieve is a testament to his leadership and foresight. His influence remains palpable as Ripple continues to expand its reach, proving that sometimes the best way to predict the future is to create it.

For XRP investors and crypto enthusiasts, understanding Ripple’s origins and Larsen’s role provides valuable insights into the factors driving XRP’s market relevance. It’s not just about the price charts; it’s about grasping the underlying value proposition that Ripple and XRP offer. By examining the past, we gain a clearer perspective on the future potential of XRP in blockchain, finance, and trading. After all, knowledge is power, and in the world of crypto, it’s also profit.

As you navigate the dynamic world of cryptocurrencies, remember that XRP Authority is your go-to source for insights, analysis, and the latest updates on Ripple and XRP. Whether you’re a seasoned investor, a crypto newbie, or just someone with a thirst for fintech knowledge, XRP Authority is here to illuminate your path with wit, wisdom, and a touch of humor. Because, in this fast-paced digital era, staying informed isn’t just an advantage; it’s a necessity.

Understanding How Chris Larsen Co-Founded Ripple and Its Impact on XRP

Early ventures and entrepreneurial roots

Before Chris Larsen became a central figure in the world of blockchain and digital finance, he was already a seasoned entrepreneur with a sharp eye for disruption. Born in San Francisco in 1960, Larsen grew up with a deep appreciation for technology and innovation, thanks in part to his father’s work as an aircraft mechanic. This early exposure to complex systems laid the groundwork for his future ventures in the fintech space.

After earning an MBA from Stanford University in the early 1990s, Larsen quickly immersed himself in the growing tech landscape of Silicon Valley. His first major entrepreneurial breakthrough came in 1996 when he co-founded E-Loan, one of the first online mortgage lenders in the U.S. At a time when most people still relied on brick-and-mortar banks for home loans, E-Loan offered something radical: a transparent, user-first experience that cut out the middleman. Under Larsen’s leadership as CEO, E-Loan became a pioneer in online lending, managing over billion in loans by the early 2000s.

This early success wasn’t just about capitalizing on internet trends—it was about challenging entrenched financial systems. Larsen’s experience at E-Loan taught him the value of decentralization and user empowerment, themes that would later become central to Ripple’s mission. Notably, Larsen made headlines for rejecting a lucrative acquisition offer from Intuit, opting instead to sell a minority stake to Yahoo! for a lower valuation. Why? Because the Yahoo! deal preserved E-Loan’s independence and aligned with Larsen’s vision of democratizing finance. This decision showcased his long-term mindset and commitment to principles over profit—a trait that would define his journey into blockchain.

Following E-Loan, Larsen didn’t take a break. In 2006, he launched Prosper Marketplace, a peer-to-peer lending platform that once again disrupted traditional banking models. Prosper was among the first platforms to directly connect borrowers and lenders, bypassing institutional intermediaries and enabling more competitive rates. It was during this time that Larsen started to focus more deeply on the inefficiencies of cross-border finance—a problem that would later become central to Ripple’s value proposition.

These early ventures weren’t just stepping stones; they were foundational building blocks for what would become Ripple. Larsen’s track record of innovation, combined with his deep understanding of financial systems, positioned him uniquely to identify the pain points in global payments and envision a blockchain-based solution. He wasn’t just another tech entrepreneur jumping on the crypto bandwagon—he was already a fintech veteran with a history of delivering real-world financial solutions.

- E-Loan: One of the first U.S. online mortgage lenders, emphasizing transparency and user empowerment.

- Prosper Marketplace: Pioneered peer-to-peer lending in the U.S., disrupting traditional loan structures.

- Fintech Focus: Consistently targeted inefficiencies in financial systems, laying the groundwork for Ripple’s mission.

- Long-Term Vision: Prioritized user-centric design, decentralization, and transparency—core values that Ripple would later adopt.

For crypto investors and XRP enthusiasts, understanding these early ventures is more than just a history lesson. Larsen’s entrepreneurial roots reveal a pattern of identifying systemic inefficiencies and building platforms that empower users and challenge the financial status quo. His journey through E-Loan and Prosper wasn’t just about launching startups—it was about reimagining finance altogether. This mindset would eventually fuel the creation of Ripple, a blockchain startup that aimed not only to disrupt but to redefine global payments for the digital age.

As the crypto space continues to mature, Larsen’s early work serves as a compelling case study in strategic foresight. His ability to scale fintech companies and attract early investors while staying true to a democratizing vision is a testament to the kind of leadership that has helped Ripple maintain its relevance—even amid regulatory hurdles and market volatility. And for investors tracking XRP’s performance, knowing the roots of its co-founder provides critical context for understanding the token’s resilience and long-term potential in the evolving digital economy.

The vision behind Ripple

Chris Larsen’s entrance into the blockchain space wasn’t driven by hype—it was fueled by a clear, calculated vision to fix a broken global financial system. While early crypto projects were focused on decentralization for decentralization’s sake, Larsen had a different goal: to build a bridge between the old world of finance and the new world of digital assets. His vision was grounded in practicality, not idealism. And that’s what ultimately set Ripple apart.

At the core of Ripple’s mission was a deceptively simple question: Why does it still take days and exorbitant fees to send money across borders? Larsen saw firsthand, through his work at Prosper Marketplace, how the legacy financial infrastructure was outdated, fragmented, and inefficient. The idea behind Ripple wasn’t to replace banks—it was to empower them with better tools. This was a bold departure from the Bitcoin ethos of cutting out intermediaries entirely. Instead, Larsen envisioned a blockchain-based system that could work with financial institutions to deliver faster, cheaper, and more transparent payments.

In 2012, this vision began to crystallize into what would become Ripple. Larsen co-founded OpenCoin, the original name for Ripple Labs, with the mission to develop a protocol that could enable instant, secure, and low-cost international payments. The idea was revolutionary: use a consensus ledger rather than proof-of-work to validate transactions, drastically reducing energy consumption and speeding up settlement times. This was the birth of the XRP Ledger—a decentralized, open-source protocol designed for high-speed financial transactions.

Unlike Bitcoin, which was designed to be a digital alternative to fiat currency, XRP was engineered as a bridge asset. It could facilitate liquidity between different fiat currencies, making it easier for banks and financial institutions to move money across borders. This utility-focused design was a game-changer for institutional adoption, and Larsen knew it. He wasn’t trying to create a replacement for the dollar—he was trying to create the internet of value.

- Bridge Currency: XRP was designed to serve as a neutral asset that could connect diverse fiat currencies in cross-border transactions.

- Institutional Focus: Ripple targeted banks and payment providers from the start, offering enterprise-grade blockchain solutions.

- Energy Efficiency: The XRP Ledger used a consensus mechanism that offered faster transactions with minimal environmental impact.

- Real-Time Settlement: Ripple’s technology enabled payments to settle in seconds, compared to the days required by traditional systems like SWIFT.

From an investment standpoint, this pragmatic approach gave Ripple and XRP a unique position in the crypto market. While other tokens were riding speculative waves, XRP was building real-world utility. That utility translated into partnerships with major financial players—think Santander, American Express, and SBI Holdings—who were eager to modernize their cross-border payment systems. These partnerships weren’t just PR stunts; they were proof that Larsen’s vision for Ripple was gaining traction where it mattered most: in the boardrooms of global finance.

Ripple’s early investor base reflected the credibility of its mission. Heavy-hitting venture capital firms like Andreessen Horowitz and IDG Capital Partners backed the company, betting on its potential to disrupt a multi-trillion-dollar global payments industry. For XRP holders, this institutional validation was more than symbolic—it suggested that Ripple had the strategic foundation and financial backing to weather market volatility and regulatory scrutiny.

Importantly, Larsen’s leadership style helped Ripple maintain a laser focus on its core mission. Rather than chasing trends or pivoting toward retail speculation, Ripple doubled down on enterprise adoption. The company built out its RippleNet network, a global payments platform that leverages the XRP Ledger to enable instant, trackable payments between financial institutions. This network quickly became one of the most robust blockchain infrastructures in the fintech ecosystem.

And the applications go far beyond theory. For example, in regions like Southeast Asia and Latin America, Ripple’s technology has enabled faster remittances and more inclusive financial services. These real-world use cases are not only socially impactful—they also strengthen XRP’s long-term value proposition by anchoring it in tangible utility.

Today, as blockchain startups continue to grapple with scalability, regulation, and adoption, Ripple stands as a case study in strategic clarity. Chris Larsen’s vision wasn’t just about creating another cryptocurrency—it was about building the rails for a new financial era. For investors, that vision translates into a compelling narrative of resilience, relevance, and real-world impact. And in a market often fueled by speculation, Ripple’s focus on utility might just be its most disruptive feature yet.

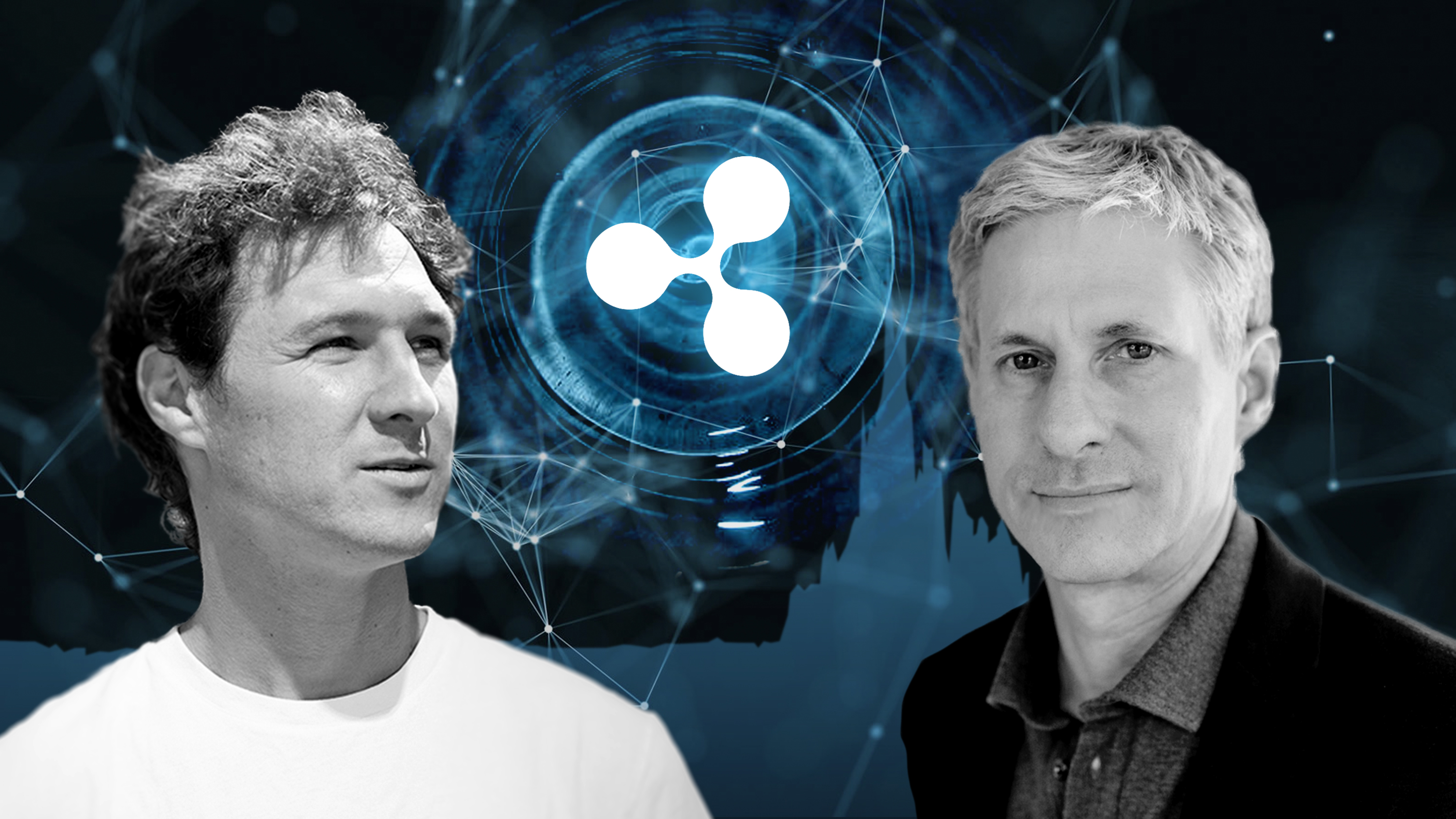

Partnering with Jed McCaleb

While Chris Larsen had the fintech chops and a clear vision for overhauling cross-border payments, the missing piece of the puzzle came in the form of Jed McCaleb—a serial entrepreneur with deep roots in the early cryptocurrency movement. McCaleb, best known at the time for creating the Mt. Gox Bitcoin exchange, brought a different kind of expertise to the table: a technical mastery of blockchain protocols and a passion for decentralized systems. The partnership between Larsen and McCaleb wasn’t just serendipitous—it was catalytic. It marked the genesis of what would become Ripple Labs, and ultimately, the XRP Ledger.

The two met in 2012, a time when Bitcoin was still in its infancy and blockchain was barely a buzzword. McCaleb had been working on a new consensus protocol that didn’t require mining, making it far more energy-efficient than Bitcoin’s proof-of-work model. This protocol aimed to solve Bitcoin’s scalability and energy issues—two major obstacles for mainstream adoption. For Larsen, this aligned perfectly with his vision of building financial infrastructure that could be trusted and adopted by major institutions. Together, they co-founded OpenCoin, the precursor to Ripple Labs, and began developing what would become one of the most unique and scalable blockchain platforms in the world.

The synergy between McCaleb’s technical innovation and Larsen’s strategic vision was immediately evident. While McCaleb and the engineering team focused on building the XRP Ledger—a decentralized, open-source blockchain optimized for speed and cost—Larsen worked on positioning the company within the broader fintech landscape. He spearheaded outreach to banks, payment providers, and early investors, laying the business foundation for Ripple’s enterprise-first approach.

- Technical Foundation: McCaleb’s consensus protocol offered fast, low-cost transactions without the need for energy-intensive mining.

- Strategic Alignment: Larsen saw the potential to leverage the protocol as a financial-grade infrastructure for cross-border payments.

- Founding Ripple Labs: The duo co-founded OpenCoin in 2012, which was rebranded as Ripple Labs in 2013 to better reflect the company’s mission.

- XRP Ledger Launch: Together, they launched the XRP Ledger, designed to serve as the backbone for RippleNet and XRP’s role as a bridge asset.

From the outset, Ripple diverged from the prevailing crypto ethos of the time. While most projects were focused on decentralization for ideological reasons, Ripple took a more pragmatic route. Larsen and McCaleb believed that real-world adoption would require working with regulators and financial institutions—not against them. This philosophy shaped Ripple’s corporate structure, compliance strategy, and product offerings. It also influenced the design of XRP itself, which was pre-mined with a fixed supply of 100 billion tokens. This decision stirred controversy in crypto circles but made XRP more predictable and appealing to institutional users wary of the volatility and unpredictability of mined tokens.

OpenCoin quickly attracted attention from the venture capital world. Andreessen Horowitz, Lightspeed Venture Partners, and IDG Capital were among the early investors who saw the disruptive potential of Ripple’s technology. Their backing gave Ripple not just capital, but credibility—especially important in a space often plagued by fly-by-night operations and vaporware. This early investor confidence also signaled to the market that Ripple was playing the long game, building infrastructure that could stand the test of time and regulation.

However, no partnership is without friction. By 2013, ideological and strategic differences between Larsen and McCaleb began to surface. McCaleb favored a more open, decentralized approach, while Larsen remained focused on building a scalable, enterprise-oriented platform. Eventually, McCaleb departed Ripple to start Stellar, another blockchain project aimed at cross-border payments, albeit with a more decentralized ethos. Despite this split, the foundational work the two had done together left Ripple with a robust technical architecture and a clear business direction.

For XRP investors, this early phase of Ripple’s development is crucial to understanding the token’s unique market position. Unlike many other cryptocurrencies born from idealistic manifestos, XRP was engineered with institutional utility in mind. The partnership between Larsen and McCaleb fused ideology with execution, creating a blockchain startup that could speak both to crypto purists and Wall Street traditionalists. XRP’s role as a bridge currency—facilitating liquidity between fiat currencies—was baked into its DNA from the very beginning.

Today, XRP continues to serve as a cornerstone of RippleNet, enabling real-time, cross-border settlements at a fraction of the cost of traditional systems like SWIFT. The early collaboration between Larsen and McCaleb laid the groundwork for this success, combining technical innovation with business acumen to build a platform that has attracted over 300 financial institutions globally. From Santander to SBI Holdings, Ripple’s growing list of partners underscores the staying power of that original vision.

In a crypto market often dominated by hype and speculation, the story of how Larsen and McCaleb co-founded Ripple offers a refreshing reminder of what can happen when visionary leadership meets technical brilliance. For investors, it reinforces the idea that XRP isn’t just another altcoin—it’s the product of a deliberate, well-funded, and strategically executed plan to modernize global finance. And with Ripple continuing to expand its global footprint, that original partnership remains one of the most consequential in blockchain history.

Overcoming challenges and scaling Ripple

As Ripple began gaining traction, Chris Larsen found himself navigating a landscape that was equal parts opportunity and obstacle course. Scaling a blockchain startup with ambitions to revolutionize global payments meant confronting skepticism from legacy financial institutions, navigating murky regulatory waters, and competing in a rapidly evolving crypto ecosystem. Yet, Larsen’s leadership and Ripple’s focused mission helped the company not only survive but thrive, turning challenges into catalysts for innovation and growth.

One of the earliest and most persistent hurdles Ripple faced was regulatory uncertainty. Unlike many crypto projects that operated in legal gray zones or chose to remain decentralized and anonymous, Ripple took a bold, transparent approach. Under Larsen’s guidance, Ripple engaged directly with regulators, advocating for clear, forward-looking frameworks that could support innovation while protecting consumers. This proactive stance helped Ripple build credibility with institutional partners and positioned it as a compliant player in an industry often viewed with suspicion by governments and central banks.

However, regulatory scrutiny eventually culminated in a high-profile legal battle with the U.S. Securities and Exchange Commission (SEC), which filed a lawsuit in 2020 alleging that XRP was an unregistered security. While Larsen had already stepped down as CEO by then, his foundational role and Ripple’s early decisions were central to the case. Rather than retreat, Ripple mounted a robust defense, arguing that XRP should be classified as a digital currency, not a security. This legal saga became a defining moment for Ripple—and for crypto at large—highlighting the need for regulatory clarity and setting precedents for how digital assets are treated in the U.S.

Even amid legal headwinds, Ripple continued to expand its global footprint. Under Larsen’s leadership and strategic groundwork, the company doubled down on international markets, particularly in Asia and the Middle East, where regulatory environments were often more favorable. RippleNet, the company’s enterprise blockchain network, grew to include over 300 financial institutions, including heavyweights like Santander, PNC Bank, and SBI Holdings. These partnerships weren’t just symbolic—they were instrumental in proving Ripple’s real-world utility and scalability.

To support this growth, Ripple invested heavily in infrastructure and talent. The company expanded its engineering teams, opened new offices around the world, and launched initiatives like the University Blockchain Research Initiative (UBRI) to foster academic research in blockchain technology. These moves helped Ripple stay ahead of the curve, ensuring that its solutions could meet the needs of both emerging fintech startups and established banking giants.

- Regulatory Strategy: Ripple took a proactive approach to compliance, engaging with governments and regulators globally to shape fair digital asset policies.

- Global Expansion: RippleNet scaled rapidly, onboarding hundreds of financial institutions and extending Ripple’s reach into over 40 countries.

- Legal Resilience: Despite the SEC lawsuit, Ripple maintained operations and continued to grow, reinforcing investor confidence in XRP’s long-term viability.

- Infrastructure Investment: Ripple built a robust backend to support high-volume transactions, ensuring scalability and reliability for enterprise clients.

From an investor’s perspective, Ripple’s ability to navigate adversity is a testament to its resilience and long-term potential. While many blockchain startups falter under pressure, Ripple has demonstrated time and again that it can adapt, innovate, and grow—regardless of external challenges. The company’s focus on real-world applications, rather than speculative hype, has made XRP one of the few digital assets with a clear use case and institutional adoption.

Moreover, Ripple’s battle-tested infrastructure and strong leadership have positioned it as a key player in the future of global finance. As central banks explore digital currencies and financial institutions seek faster, cheaper ways to move money, Ripple’s technology is increasingly seen as a viable solution. XRP’s role as a bridge currency in on-demand liquidity (ODL) services continues to gain traction, especially in regions where traditional banking systems are fragmented or inefficient.

Looking at the market, XRP has shown remarkable resilience. Even during periods of volatility and uncertainty, it has maintained a strong presence in the top tier of cryptocurrencies by market capitalization. Technical analysts often point to key levels—such as the [gpt_article topic=How Chris Larsen Co-Founded Ripple directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How Chris Larsen Co-Founded Ripple and The origins of Ripple and Larsen’s role in shaping the company. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use blockchain startups, financial disruption, OpenCoin, early investors, fintech growth and The origins of Ripple and Larsen’s role in shaping the company. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level and the 61.8% Fibonacci retracement—as indicators of XRP’s momentum. These metrics, combined with Ripple’s expanding use cases, suggest that XRP is more than just a speculative asset—it’s a cornerstone of a growing fintech ecosystem.

What sets Ripple apart, and what Chris Larsen helped instill from the beginning, is a relentless focus on solving real problems. Whether it’s reducing remittance costs for migrant workers or enabling just-in-time liquidity for multinational banks, Ripple’s technology delivers measurable value. And that value is what continues to attract partners, investors, and developers alike.

In the ever-evolving world of crypto, where projects come and go with the tide, Ripple’s journey offers a blueprint for sustainable growth. By embracing regulation, investing in infrastructure, and focusing on utility, Larsen and his team built a company that can weather storms and seize opportunities. For XRP holders and crypto investors looking for assets with staying power, Ripple’s track record of overcoming challenges and scaling globally is more than reassuring—it’s a signal of what’s possible when vision meets execution.