Are you ready to explore the fascinating world of XRP and its role in revolutionizing cross-border transactions? As the witty and insightful owner of XRPAuthority.com, I’ve been navigating the crypto space since 2011 and have been an avid XRP investor since 2018. Today, we’re diving into the intriguing question: What countries are rolling out the red carpet for XRP-powered remittances? In a world where borders seem to blur in the digital realm, understanding which nations embrace XRP for cross-border transactions is crucial for investors and crypto enthusiasts alike.

First, let’s set the stage. Why is XRP making waves in the blockchain and finance sectors? Well, it’s not just because XRP sounds like the name of a futuristic spaceship—though that certainly adds to the allure. XRP is designed to facilitate fast, cost-effective international payments. Imagine sending money across the globe at the speed of a text message, minus the hefty fees. Sounds like sci-fi, right? But no, it’s just XRP doing its thing.

Now, you might be wondering, which countries are savvy enough to leverage this blockchain marvel for cross-border transactions? Spoiler alert: It’s not just countries with a penchant for innovation. Some nations are jumping on the XRP bandwagon because they understand the economic benefits of reducing transaction costs and increasing transparency. But which ones? Keep reading, and we’ll explore.

Before we delve into the specifics, let’s have a moment of levity. Why did the banker switch to XRP? Because he heard it was the “ripplest” way to move money! Jokes aside, XRP’s design does offer compelling advantages that are hard to ignore, especially in regions where traditional banking systems are more of a hurdle than a help.

Now, back to the meat of the matter: the countries themselves. From economic powerhouses to emerging markets, XRP is finding its way into the financial fabric of nations worldwide. The likes of Japan, Mexico, and the Philippines have been early adopters, driven by high remittance flows and the need for efficient payment systems. But don’t just take my word for it—these countries are seeing tangible benefits.

In Japan, for instance, Ripple’s collaboration with SBI Holdings has paved the way for XRP integration, making cross-border transactions as smooth as sushi rice. Meanwhile, in Mexico and the Philippines, where remittances form a significant part of the GDP, XRP is proving to be a game-changer by reducing costs and speeding up transactions. Who knew cryptocurrency could be such a hero?

As we continue to explore which countries support XRP, let’s not forget the importance of staying informed. The crypto landscape is ever-evolving, and keeping up with the latest developments is crucial for investors and enthusiasts. Countries that currently embrace XRP might inspire others to follow suit, potentially impacting XRP’s value and utility.

Finally, if you’re looking for the most insightful and timely information on XRP and its global adoption, XRP Authority is your go-to source. With a blend of technical depth and engaging wit, we’re here to keep you informed and entertained. Whether you’re a seasoned trader or a curious fintech professional, join our community and stay ahead of the curve in the dynamic world of cryptocurrency. After all, in the land of digital assets, knowledge is your best currency!

Understanding What Countries Support XRP for Cross-Border Transactions? Examining which nations allow XRP-powered remittances. and Its Impact on XRP

Global adoption of XRP in remittances

Global Adoption of XRP in Remittances

In the ever-evolving world of cross-border payments, few digital assets have made as significant a mark as XRP. Designed for speed, scalability, and low transaction costs, XRP has become a go-to solution for financial institutions looking to streamline remittances. Its utility, particularly through RippleNet—the decentralized global payment network powered by Ripple—has positioned XRP as a key player in transforming how money moves across borders. But what does global adoption actually look like?

Let’s dive into the countries and corridors where XRP is not just a buzzword, but a real-world financial instrument reshaping remittance flows.

- Asia-Pacific (APAC): This region is arguably the most fertile ground for XRP adoption. Countries like the Philippines, Japan, and Thailand are leveraging XRP for faster and cheaper cross-border payments. In the Philippines, for example, companies like Coins.ph and SendFriend have integrated XRP to enable low-cost remittances, especially from OFWs (Overseas Filipino Workers) in the U.S. and Middle East. Japan’s SBI Holdings, a major Ripple partner, has even launched its own crypto exchange, SBI VC Trade, with XRP as a featured asset.

- Middle East and North Africa (MENA): With a high remittance-to-GDP ratio and a large expatriate workforce, MENA countries are actively exploring blockchain-based solutions. Ripple has partnered with several banks in the UAE and Saudi Arabia, including the Saudi British Bank (SABB) and National Commercial Bank (NCB), to enable XRP-powered remittances. These collaborations aim to reduce friction in high-volume corridors like UAE–India and Saudi Arabia–Pakistan.

- Latin America: XRP is gaining traction in countries like Mexico and Brazil, where remittance inflows are a major economic factor. Ripple’s partnership with Bitso—a leading crypto exchange in Mexico—has turned XRP into a bridge currency for U.S.–Mexico transactions. This has significantly reduced transfer times and costs, making it a game-changer for migrant workers sending money home.

- Europe: While regulatory environments vary, parts of Europe are warming up to XRP for cross-border use. Ripple has established a strong presence in the UK and Luxembourg, and financial institutions such as Santander have piloted RippleNet to explore XRP’s potential in improving payment rails between Europe and Latin America.

- South Asia: India and Bangladesh are emerging markets for XRP-powered remittances. Though regulatory uncertainty remains a hurdle, financial tech firms are showing interest in RippleNet’s On-Demand Liquidity (ODL) service, which uses XRP to eliminate the need for pre-funded accounts in destination currencies.

What makes XRP particularly attractive in these regions is its ability to settle transactions in just 3–5 seconds, with fees often less than a fraction of a cent. In contrast to traditional remittance services that can take days and cost upwards of 7% in fees, XRP offers a compelling alternative that’s both faster and more affordable.

Moreover, the integration of XRP into existing financial systems through RippleNet’s ODL product is not just theoretical—it’s already in motion. Ripple has reported that ODL transactions now account for a growing percentage of the network’s volume, proving that XRP is not just a speculative asset but a functional currency with real-world utility.

For investors and XRP enthusiasts, this global adoption signals more than just technological validation. It positions XRP as a cornerstone in the future of international finance—especially in emerging markets where the need for efficient remittance solutions is most urgent.

So, while Bitcoin may be the digital gold and Ethereum the decentralized backbone of smart contracts, XRP is quietly becoming the oil that greases the gears of cross-border finance. As adoption accelerates and more corridors open up, XRP’s role as a bridge asset is only set to expand.

Countries actively supporting XRP transactions

Countries Actively Supporting XRP Transactions

As XRP continues to carve out its niche in the global financial ecosystem, several countries have moved beyond experimentation and are actively supporting XRP transactions in real-world remittance and liquidity corridors. These nations are not only integrating Ripple’s On-Demand Liquidity (ODL) solution but also creating regulatory frameworks that allow for the seamless use of XRP in cross-border payments. Let’s take a closer look at some of the key players championing XRP adoption today and what that means for investors and the broader crypto landscape.

- Japan: Arguably the most XRP-friendly country on the planet, Japan has been a trailblazer in legitimizing XRP as both a utility token and a financial instrument. SBI Holdings, one of Ripple’s largest partners, has integrated XRP into multiple financial services, including SBI Remit and SBI VC Trade. The Japanese Financial Services Agency (FSA) has classified XRP as a cryptocurrency rather than a security, providing regulatory clarity that has accelerated adoption. The Japan–Philippines corridor, powered by RippleNet, is already handling significant remittance volume through XRP.

- Philippines: As a top remittance-receiving country, the Philippines has embraced XRP as a solution to reduce high transfer fees and long processing times. Licensed platforms like Coins.ph and partnered institutions such as UnionBank have integrated XRP to facilitate real-time settlements. The U.S.–Philippines remittance corridor, in particular, has become one of the most active routes utilizing Ripple’s ODL service.

- Mexico: Ripple’s partnership with Bitso, the largest crypto exchange in Latin America, has turned Mexico into a key hub for XRP-powered remittances. Bitso acts as a liquidity provider in the U.S.–Mexico corridor, using XRP to convert USD to MXN in seconds. This has drastically lowered costs for Mexican families receiving money from relatives abroad. With Bitso processing billions in volume via RippleNet, Mexico remains a flagship case study for XRP’s real-world impact.

- United Arab Emirates (UAE): The UAE is positioning itself as a blockchain innovation hub, and XRP is playing a central role in that vision. Banks like the National Bank of Fujairah and the Saudi British Bank (in neighboring Saudi Arabia) are actively using RippleNet to facilitate cross-border payments. The corridor between the UAE and South Asia, particularly India and Pakistan, is benefiting from XRP’s speed and cost-efficiency, making the region a strategic growth area for Ripple’s ODL services.

- Brazil: Ripple has been expanding its footprint in Brazil, a country with a rapidly growing fintech ecosystem and strong demand for faster remittance services. Ripple’s local operations are working with Brazilian financial institutions to integrate XRP into payment flows, especially for remittances to and from the U.S. and Spain. Brazil’s central bank has also been exploring blockchain-based payment solutions, giving XRP a potential edge in the long-term regulatory landscape.

- Thailand: Siam Commercial Bank (SCB), one of the largest banks in Thailand, has partnered with Ripple to explore blockchain solutions for remittances. While SCB initially piloted RippleNet without XRP, there is growing momentum to integrate ODL for greater liquidity efficiency. Thailand’s strategic location and strong ties with countries like Japan make it a natural candidate for expanded XRP use.

- United Kingdom: The UK serves as Ripple’s European headquarters and is a focal point for XRP adoption in the region. Financial institutions such as Santander and TransferGo have tested XRP in cross-border pilot programs to improve settlement speed and reduce costs. The UK’s relatively open stance toward digital assets, combined with Ripple’s regulatory engagement, makes it one of the more promising European markets for XRP integration.

These countries are not just testing XRP—they are actively integrating it into their financial infrastructure. The common denominator across these markets? A strong need for faster, cheaper, and more transparent cross-border payment solutions. Whether it’s remittance-heavy nations like the Philippines and Mexico, or fintech-forward economies like Japan and the UAE, each is leveraging XRP’s unique strengths to solve longstanding inefficiencies in global finance.

For crypto investors, this active support translates into more than just headlines. It signals liquidity depth, network effect, and growing transactional utility—factors that can influence long-term valuation. As XRP continues to establish itself as a bridge currency across high-volume corridors, its relevance in the global payment stack becomes harder to ignore.

Moreover, Ripple’s strategy of aligning with regulators and financial institutions in these regions ensures that XRP adoption is not just technically sound, but also legally sustainable. With RippleNet’s On-Demand Liquidity volume growing year over year, these partnerships are already bearing fruit. And as new corridors open up, XRP’s role in enabling real-time, cost-effective payments is only set to expand.

So for those tracking XRP’s utility narrative—or looking for strong fundamentals beyond speculative price swings—these actively supportive countries offer a glimpse into a future where digital assets are not alternatives, but integral components of the financial ecosystem.

Regulatory challenges and regional restrictions

Regulatory Challenges and Regional Restrictions

While XRP has found champions in markets like Japan, the Philippines, and Mexico, its global journey hasn’t been without turbulence. Regulatory headwinds continue to shape where and how XRP can be used for cross-border transactions. From outright bans to legal gray zones, understanding the regulatory landscape is crucial for investors and institutions eyeing XRP’s potential in international payments.

Let’s unpack the key regulatory challenges and regional restrictions that XRP faces, and what they mean for the asset’s long-term viability in the global remittance game.

- United States: No discussion about XRP’s regulatory struggles is complete without mentioning the legal battle with the U.S. Securities and Exchange Commission (SEC). The SEC’s 2020 lawsuit alleging that XRP is an unregistered security sent shockwaves through the crypto world. Although recent court rulings have offered partial clarity—stating that XRP is not a security when sold on public exchanges—the case has created lingering uncertainty. As a result, many U.S.-based exchanges like Coinbase and Kraken temporarily suspended XRP trading, and Ripple’s U.S. operations have taken a more cautious tone. This legal ambiguity makes the U.S. a challenging environment for XRP-powered remittances, despite its massive remittance outflows to countries like Mexico and the Philippines.

- India: India remains a paradox for crypto adoption. On one hand, its remittance market is the largest in the world, making it a prime candidate for efficient blockchain solutions like XRP. On the other, regulatory ambiguity has stifled innovation. While the Reserve Bank of India (RBI) has not explicitly banned cryptocurrencies, it has discouraged their use in the banking sector. Ripple has expressed interest in expanding its footprint in India, but until there is a clear framework, XRP adoption in the country remains limited. Investors should keep a close eye on India’s evolving crypto legislation, as a regulatory green light could unlock significant demand for XRP-powered remittances.

- China: China has maintained a hardline stance on cryptocurrencies, banning crypto exchanges and Initial Coin Offerings (ICOs) altogether. While the country is advancing its own central bank digital currency (CBDC), the digital yuan, it has shown little interest in allowing decentralized digital assets like XRP. Thus, XRP adoption in mainland China is effectively non-existent, and Ripple has shifted its focus to more crypto-friendly Asian markets like Japan and Singapore.

- European Union (EU): The EU has taken a more measured approach to crypto regulation, but the lack of uniformity across member states creates a complex environment. While countries like the UK (pre-Brexit) and Luxembourg have welcomed XRP and RippleNet, others like Germany and France have been more cautious. The upcoming Markets in Crypto-Assets (MiCA) regulation aims to provide a standardized legal framework across the EU, which could either facilitate or hinder XRP’s adoption depending on how the legislation is interpreted. For now, XRP usage in Europe remains fragmented and largely dependent on individual country policies.

- South Korea: Known for its vibrant crypto trading culture, South Korea has strict regulations when it comes to digital assets. While XRP is widely traded on Korean exchanges like Bithumb and Upbit, its use in cross-border remittances is limited due to regulatory constraints. The Korean government requires financial institutions to adhere to stringent anti-money laundering (AML) and know-your-customer (KYC) protocols, which can complicate the integration of XRP into traditional banking systems. However, ongoing efforts to modernize the regulatory environment could pave the way for broader XRP adoption in the future.

These regional restrictions don’t just impact current utility—they also affect investor sentiment and institutional participation. For example, the uncertainty in the U.S. may deter American financial institutions from fully embracing RippleNet’s On-Demand Liquidity product, even though the technology clearly offers efficiency gains. Likewise, in India and China, regulatory opacity limits XRP’s reach in two of the world’s largest remittance markets.

But it’s not all doom and gloom. Ripple has demonstrated a strong commitment to regulatory compliance, often working alongside central banks and financial watchdogs to ensure that XRP can be used safely and legally. This proactive approach has paid off in regions like the UAE and Japan, where clear regulations have allowed Ripple and XRP to flourish.

For crypto investors, these regulatory dynamics present both risks and opportunities. On the one hand, jurisdictions with hostile or unclear stances can suppress XRP’s price and utility in the short term. On the other, any shift toward clarity—especially in large markets like the U.S. or India—could serve as a powerful catalyst for renewed adoption and price appreciation. Think of it as coiled potential waiting to spring once the regulatory fog lifts.

Moreover, Ripple’s legal victory—partial though it may be—in the U.S. court system is already influencing how other countries perceive and regulate XRP. As more jurisdictions begin to distinguish between XRP’s utility as a payment token and its speculative uses, we could see a domino effect of positive regulatory developments across the globe.

In the meantime, XRP investors and enthusiasts should stay informed, not just about price charts and technical indicators, but also about the evolving legal frameworks that govern its global use. Because in the world of cross-border payments, compliance is just as critical as speed and cost-efficiency.

Future outlook for XRP in cross-border payments

Future Outlook for XRP in Cross-Border Payments

As we peer into the crystal ball of cross-border finance, XRP’s trajectory looks increasingly intertwined with the future of global payments. While regulatory hurdles and market volatility have tested its resilience, XRP continues to gain traction in corridors where efficiency, speed, and liquidity are paramount. For investors and crypto enthusiasts alike, the evolving landscape presents not just a narrative of survival, but one of strategic resurgence.

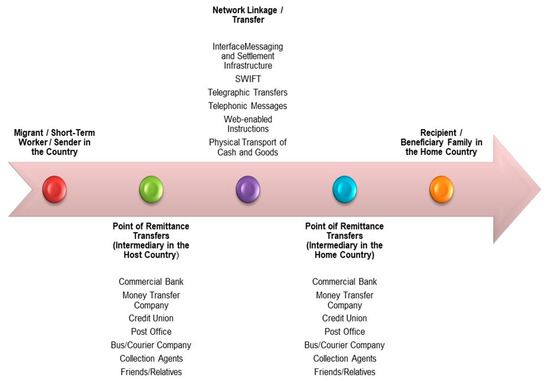

Ripple’s On-Demand Liquidity (ODL) product, which uses XRP to eliminate the need for pre-funded nostro accounts, is already redefining how international transfers are settled. With traditional systems like SWIFT facing criticism for being slow, opaque, and expensive, XRP is emerging as a viable alternative—not just in theory, but in practice. And the numbers tell the story: ODL volumes have grown year over year, with billions of dollars now moving through RippleNet corridors powered by XRP.

Looking ahead, several macroeconomic and technological trends are likely to accelerate XRP’s adoption in the cross-border space:

- Tokenization of Assets and CBDCs: As central banks explore the development of Central Bank Digital Currencies (CBDCs), interoperability becomes a key concern. XRP, with its ability to act as a neutral bridge asset between fiat currencies and digital tokens, is well-positioned to facilitate this transition. Ripple’s recent collaborations with countries exploring CBDCs, such as Palau and Bhutan, hint at a broader strategic role for XRP in the tokenized economy of the future.

- Rise of Fintech Partnerships: Ripple’s approach of partnering with regulated financial institutions rather than disrupting them is paying dividends. As more banks and payment providers seek to modernize their infrastructure, XRP’s low-cost, high-speed capabilities offer a compelling value proposition. Expect to see expanded use cases beyond remittances—such as B2B payments and treasury operations—especially in fintech-forward regions like Southeast Asia and Latin America.

- Regulatory Clarity on the Horizon: The partial legal victory in the U.S. has already begun to shift sentiment. As jurisdictions like the European Union roll out comprehensive crypto regulations (e.g., MiCA), XRP stands to benefit from increased legal certainty. In the U.S., a favorable outcome in Ripple’s ongoing legal saga could act as a catalyst for renewed adoption by American financial institutions, unlocking massive corridors previously sidelined due to compliance concerns.

- Institutional Interest and Liquidity Expansion: As institutional investors seek exposure to utility-driven crypto assets, XRP’s real-world use case offers a strong narrative. The growing network of ODL partners and liquidity providers ensures that XRP can scale with demand—something that many other digital assets still struggle with. This liquidity expansion also reduces slippage and volatility, making XRP more attractive for high-volume remittance corridors.

From an investment standpoint, XRP’s future in cross-border payments presents an asymmetric opportunity. While short-term price action may be influenced by broader crypto market trends and regulatory developments, the long-term fundamentals are increasingly robust. XRP is not merely a speculative token riding the crypto hype cycle—it’s an asset with a defined utility, proven technology, and a growing list of enterprise-grade partners.

Moreover, Ripple’s continued expansion into emerging markets—where traditional financial infrastructure is either outdated or inaccessible—adds a layer of social impact to XRP’s growth story. By enabling faster and cheaper remittances, XRP is helping families receive more of their hard-earned money, businesses reduce operational costs, and economies benefit from improved capital flow.

Technologically, XRP is also evolving. With the introduction of sidechains, smart contracts via Hooks, and interoperability features, the XRP Ledger is becoming more versatile. This opens up opportunities for decentralized finance (DeFi), microtransactions, and even NFTs—all of which could further drive demand for XRP and increase its utility beyond remittances.

In essence, the future of XRP in cross-border payments is not just a continuation of its current trajectory—it’s a launchpad for broader financial innovation. As the global economy becomes increasingly digitized, and as demand for real-time, low-cost international payments grows, XRP is uniquely positioned to be a foundational layer in this new financial architecture.

For XRP investors and enthusiasts, staying informed and engaged is key. Watch for new corridor launches, regulatory shifts, and institutional partnerships, as these will be the signposts of XRP’s continued evolution. While challenges remain, the groundwork has been laid—and the bridge is already being built.