Welcome to the world of XRP, where digital finance meets innovation, and where the future of blockchain technology is being sculpted one transaction at a time. If you’ve ever wondered how the marriage of smart contracts and NFTs is reshaping the landscape of digital asset trading, you’re in the right place. At XRPAuthority.com, we’re about to dive deep into the exciting realm of smart contracts on the XRP Ledger (XRPL) and explore how Hooks are revolutionizing automated NFT royalties and digital asset trading. But first, let’s set the stage. Have you ever thought about how smart contracts could simplify your crypto life? Or how the XRPL is not just another blockchain, but a game-changer in the financial world? Well, buckle up, because we’re about to unravel these mysteries with a touch of wit and a sprinkle of insight.

Picture this: you’re an artist, a creator, a visionary. You’ve just minted your masterpiece as an NFT, and it’s out there in the digital cosmos, ready to be snatched up by collectors. But wait, what happens when your NFT changes hands for the tenth time? Do you get a slice of that transaction pie, or do you just watch from the sidelines, metaphorically twiddling your thumbs? Enter smart contracts on the XRPL, stage left, equipped with Hooks! They are here to ensure that every time your NFT is sold, a neat little royalty heads your way. It’s like having a financial guardian angel, minus the wings and the harp.

Now, before we get too carried away, let’s talk about Hooks. What are they, you ask? Imagine them as tiny but mighty code snippets that attach to your transactions, like barnacles to a ship. But instead of weighing you down, they propel you forward, automating processes and ensuring smooth sailing in the vast ocean of digital finance. Hooks are the secret sauce that empowers smart contracts to handle NFT transactions with the grace and precision of a ballet dancer on the blockchain stage. And yes, you might say they “hook” you up with those much-deserved royalties. See what I did there?

The XRPL, with its lightning-fast settlement times and energy-efficient consensus mechanism, provides the perfect backdrop for this technological ballet. It’s not just a ledger; it’s the Michelangelo of blockchains, chiseling out the future of finance with every transaction. As XRP continues to prove its worth in the world of digital currencies and global transactions, the integration of smart contracts via Hooks adds another feather to its already well-adorned cap. Who knew blockchain could be so stylish?

But why should you, the savvy investor or crypto enthusiast, care about these developments? Well, in the ever-evolving world of digital assets, staying ahead of the curve is not just advantageous; it’s essential. Smart contracts on the XRPL bring transparency, efficiency, and automation to NFT transactions, making them a crucial tool for anyone looking to thrive in the digital economy. It’s like having a Swiss Army knife of blockchain tools at your disposal—minus the actual knife, of course.

Moreover, the potential for automated NFT royalties opens up new revenue streams for creators and investors alike. Imagine investing in a collection of NFTs and knowing that every subsequent sale could bring in a passive income stream. It’s like having your cake and eating it too, without the calories. Now, who wouldn’t want a slice of that action?

As we navigate these uncharted waters, it’s clear that the XRPL is more than just a ledger; it’s a beacon of innovation in the world of blockchain. With its robust infrastructure and forward-thinking features like Hooks, the XRPL is poised to redefine how we interact with digital assets and smart contracts. Whether you’re an artist, an investor, or just a curious observer, the ripple effect of these developments is undeniable.

At XRPAuthority.com, we pride ourselves on being your go-to source for all things XRP and beyond. Whether you’re seeking insights into the latest blockchain trends, a deep dive into crypto technology, or just a good laugh at the expense of financial jargon, we’ve got you covered. So, stick with us as we continue to explore the fascinating intersections of technology, finance, and innovation. After all, who better to guide you through the crypto cosmos than the authority on all things XRP?

Understanding The Role of Smart Contracts in NFT Transactions on XRPL and Its Impact on XRP

Smart contracts and their function on XRPL

Smart contracts are the programmable powerhouses behind decentralized ecosystems, and on the XRP Ledger (XRPL), they’re undergoing a transformative evolution. Traditionally, XRPL wasn’t built with native smart contract support like Ethereum, but with the introduction of Hooks—a lightweight and efficient smart contract layer—XRPL has entered the smart contract arena with a unique, performance-optimized approach. This opens up thrilling new possibilities for NFT transactions, automated royalties, and digital asset trading directly on the ledger.

At their core, smart contracts are self-executing code snippets stored on the blockchain, which automatically enforce the terms of an agreement. On XRPL, this functionality is being realized through Hooks, which are embedded directly into the ledger’s transaction processing logic. Unlike heavyweight virtual machines (think Ethereum’s EVM), Hooks are designed to be ultralight, fast, and cost-efficient—perfect for a network that prides itself on speed, scalability, and low transaction fees.

What makes XRPL’s approach stand out is its focus on minimalism and performance. Hooks aren’t trying to be all things to all people—they’re custom logic modules that trigger on ledger events and can perform validations, enforce rules, or initiate other transactions automatically. This makes them ideal for NFT use cases, where actions like royalty payments, ownership transfers, and market listings can be automated with precision and speed.

Here’s how smart contracts—via Hooks—are shaping the NFT experience on XRPL:

- Automated Royalty Distribution: With Hooks, creators can code in their royalty preferences directly into the NFT logic. Every time a secondary sale happens, the Hook ensures that a percentage of the sale is routed to the original creator, no middlemen or manual tracking required.

- Secure and Transparent Transactions: Smart contracts on XRPL enforce rules without bias. Whether it’s ensuring a buyer has sufficient funds or verifying that a digital collectible hasn’t been tampered with, Hooks make the process trustless and verifiable.

- Efficient Tokenized Asset Management: From art and music to tokenized real estate, Hooks can manage how a token behaves over time—such as locking it during disputes, splitting ownership, or even burning it after a set date.

For XRP investors and enthusiasts, this is more than just a technical upgrade—it’s a strategic leap. With XRPL’s low fees and near-instant settlement times, integrating smart contracts means the network can now compete with Ethereum-based NFT platforms, but without the gas fee headaches. This positions XRPL as a serious contender in the growing market of blockchain collectibles and tokenized assets.

Moreover, the programmable nature of Hooks enables real-time, dynamic behavior. Imagine an NFT that changes its metadata based on external inputs—like a digital trading card that evolves with a player’s performance, or a virtual art piece that reflects live weather data. These kinds of innovations are now possible on XRPL without compromising speed or cost-efficiency.

With the NFT market maturing and investors looking for sustainable, scalable solutions, XRPL’s smart contract capabilities offer a refreshing alternative. The built-in trust, deterministic execution, and low operational overhead make it an attractive environment for creators, collectors, and traders alike. And as Hooks continue to evolve, expect even more sophisticated logic and interoperability across the XRP ecosystem, paving the way for a vibrant digital asset marketplace where creativity meets code, and royalties are paid on autopilot.

Integration of NFTs within the XRPL ecosystem

Non-Fungible Tokens (NFTs) are no longer just niche digital art pieces—they’ve become a cornerstone of blockchain innovation, representing everything from collectibles and music rights to tokenized real estate and gaming assets. As the NFT landscape matures, the XRP Ledger (XRPL) is carving out its own unique space in this ecosystem, offering a fast, cost-effective, and eco-friendly platform for NFT creation, trading, and ownership. The integration of NFTs into XRPL is not only a technical milestone but also a strategic move that positions the ledger as a serious player in the digital asset revolution.

With the introduction of native NFT support through XLS-20, XRPL now offers a standardized protocol for minting, transacting, and managing NFTs natively on the ledger—no need for sidechains, bridges, or third-party protocols. This means NFTs on XRPL benefit from the same blazing-fast transaction speeds and minimal fees that XRP is known for. For investors and creators alike, this translates into a smoother, cheaper, and more secure user experience.

Here’s how NFTs are making waves within the XRPL ecosystem:

- Native NFT Minting: The XLS-20 standard allows users to mint NFTs directly on XRPL without relying on external platforms. This reduces complexity and risk, while enabling direct interaction with the ledger’s robust infrastructure.

- Built-in Royalty Support: One of the standout features of XRPL’s NFT integration is native support for creator royalties. Artists and developers can embed royalty parameters directly into the NFT metadata, ensuring they receive a share of all future secondary sales.

- Seamless Interoperability with Hooks: Hooks enhance the capabilities of NFTs by allowing smart logic to be executed during transactions. This enables automated royalty payments, dynamic asset behavior, and conditional transfers—all within a lightweight and efficient framework.

- Eco-friendly Blockchain: Unlike energy-intensive proof-of-work chains, XRPL uses a consensus protocol that is significantly more energy-efficient. This makes it an ideal choice for environmentally conscious NFT creators and investors.

The integration of NFTs into XRPL isn’t just a technical upgrade—it’s a catalyst for new business models and market opportunities. For example, a music artist can mint a limited edition album as NFTs, bake in a 10% royalty on all resales, and use Hooks to distribute royalties instantly each time a sale occurs. Or imagine a real estate developer tokenizing fractional ownership of a property, with smart contracts managing dividends and ownership transfers in real time. These aren’t futuristic concepts—they’re practical applications being made possible by XRPL’s NFT and smart contract synergy.

From an investment standpoint, XRPL’s NFT integration opens up a new frontier of tokenized assets with real-world value. Blockchain collectibles are no longer just speculative JPEGs—they’re evolving into programmable, utility-driven assets that can generate ongoing revenue through royalties, access rights, or even staking rewards. For XRP holders, this means the token now has greater utility as the native currency for NFT transactions, minting fees, and smart contract execution—potentially increasing transactional volume and long-term demand.

Moreover, XRPL’s low transaction costs and rapid settlement times give it a competitive edge over platforms like Ethereum, where high gas fees can eat into profits and deter casual traders. On XRPL, minting an NFT or executing a Hook-enabled transaction can cost just fractions of a cent, making it accessible to creators and collectors around the world.

We’re also seeing a growing number of marketplaces and tools built specifically for XRPL NFTs, such as onXRP and xMart, which are helping build a vibrant, creator-friendly ecosystem. These platforms are integrating Hook functionalities to offer automated royalty enforcement, dynamic pricing models, and advanced trading features—all without compromising the speed and efficiency that XRPL is famed for.

In short, the XRPL ecosystem isn’t just catching up to the NFT trend—it’s redefining it. By combining native NFT support with the programmable power of Hooks, XRPL offers a streamlined, intelligent, and low-cost environment for digital ownership and asset trading. As more creators and investors flock to this ecosystem, the possibilities for innovation—and profit—are only just beginning to unfold.

Use cases and benefits of smart contracts in NFT transactions

As NFTs continue to evolve from digital novelties into serious investment vehicles and programmable assets, smart contracts are becoming the backbone of this transformation—especially on the XRP Ledger. Through the innovative use of Hooks, smart contracts on XRPL enable a wide variety of use cases that go far beyond simple ownership transfers. These micro-programs empower NFTs to become dynamic, revenue-generating assets that benefit creators, collectors, and investors alike.

Let’s break down the tangible use cases and benefits of smart contracts in XRPL-based NFT transactions, and why they matter for the future of digital asset trading and blockchain-based ownership.

- Automated Creator Royalties: One of the most celebrated use cases of smart contracts in the NFT space is the automation of royalty payments. With XRPL Hooks, creators can embed royalty logic directly into the NFT’s lifecycle. Each time the NFT is resold on a secondary marketplace, a predetermined percentage—say, 7%—is instantly routed to the creator’s wallet. No need for third-party enforcement or manual tracking. This ensures that artists, musicians, and developers continue to benefit from the ongoing success of their work long after the initial sale.

- Programmable Rights and Access: NFTs on XRPL can be programmed to grant special access rights using Hooks. Think of concert tickets, exclusive livestreams, or gated digital experiences. A smart contract can verify NFT ownership before granting access, creating a seamless, frictionless experience. This opens up new monetization channels for creators and provides NFT holders with real, tangible benefits beyond simple ownership.

- Dynamic Asset Behavior: Thanks to Hooks, NFTs on XRPL can evolve over time. For example, a game developer could create an in-game character NFT that levels up based on the user’s activity. Or a collectible card could change its stats based on real-world events. These dynamic capabilities turn static NFTs into living assets, increasing their desirability and long-term value in the eyes of collectors and investors.

- Trustless Escrow and Conditional Transfers: Smart contracts on XRPL can act as decentralized escrow agents. For instance, a buyer’s XRP can be held in a Hook-enabled transaction that only executes once the NFT has been verified and transferred. This eliminates the need for intermediaries, reduces counterparty risk, and ensures that both parties are protected in the transaction.

- Fractional Ownership and Revenue Sharing: With smart contracts, NFTs representing high-value assets—like tokenized real estate or rare art—can be split into fractional shares. Each share can entitle the holder to a portion of the revenue the asset generates, such as rental income or streaming royalties. Hooks can automate these distributions, turning NFTs into passive income streams for investors.

- Automated Market Listings and Auctions: NFTs can be listed on decentralized marketplaces with Hooks managing the auction logic. These contracts can automatically extend bidding windows, reject low bids, or even trigger flash sales based on market conditions. This level of automation enhances liquidity and creates a more dynamic trading environment.

For XRP investors, the implications are profound. By enabling these advanced functionalities, XRPL becomes more than just a fast and cheap ledger—it becomes a programmable, monetizable ecosystem for digital assets. This increases utility for the XRP token itself, as it’s used for minting, trading, and executing smart contracts, potentially driving up demand and market activity.

Moreover, the performance benefits of XRPL—sub-second transaction finality and ultra-low fees—mean that these smart contract use cases can scale without the bottlenecks seen on other chains. On Ethereum, for example, executing complex NFT functionality can cost tens of dollars due to gas fees. On XRPL, the same functionality can be executed for a fraction of a cent, making it viable for microtransactions, rapid trading, and global accessibility.

Real-world examples are already emerging. Imagine a decentralized music platform built on XRPL where each song is an NFT, and every stream triggers a royalty payment via a Hook. Or a digital art gallery where pieces are auctioned in real-time, and the winning bid executes a smart contract that not only transfers ownership but also unlocks exclusive content for the buyer. These aren’t science fiction—they’re happening now, and they’re powered by XRPL’s smart contract capabilities.

For creators, the benefit is direct control over their digital works and compensation models. For investors, it’s the ability to engage with NFTs as programmable financial instruments. And for traders, it’s access to a fast, low-cost, and trustless environment for buying and selling digital assets.

As the NFT market matures, the demand for programmable, scalable, and cost-effective infrastructure will only grow. XRPL—with Hooks at its core—is uniquely positioned to meet that demand. By combining smart contract functionality with the ledger’s inherent speed and efficiency, XRPL is enabling a new generation of NFTs that are smarter, fairer, and more profitable for everyone involved.

Challenges and future developments in XRPL smart contracts

Despite the exciting progress XRPL has made with Hooks and native NFT support, the journey to fully unlocking the potential of smart contracts on the XRP Ledger is not without its hurdles. While Hooks introduce powerful programmability, they are still in active development and face a number of technical, adoption, and interoperability challenges that must be addressed to realize a truly frictionless NFT and digital asset trading environment.

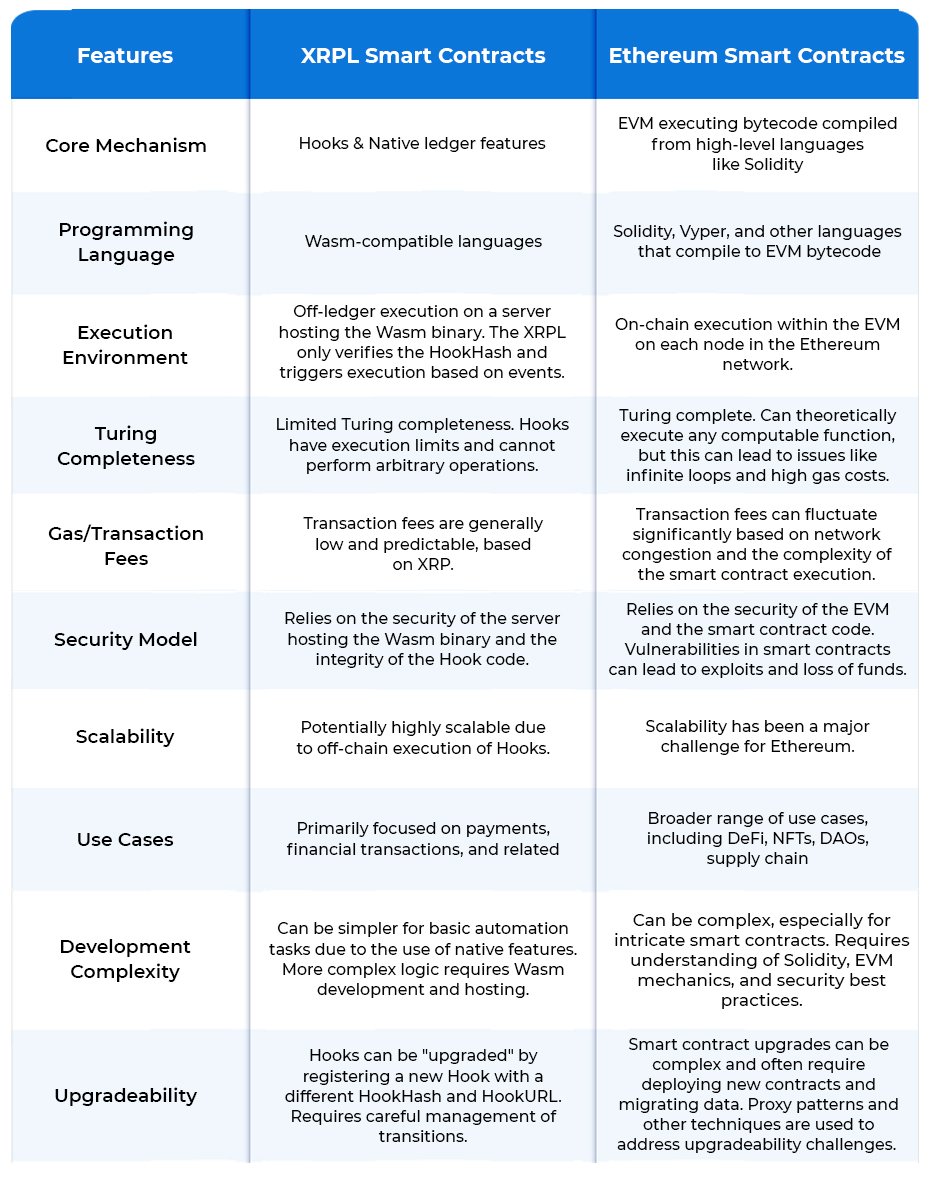

One of the primary challenges lies in the limited scope of Hooks compared to full-fledged smart contract platforms like Ethereum. Hooks are intentionally lightweight and designed to execute minimal logic within a transaction context. This keeps the ledger lean and efficient, but it also means that complex decentralized applications (dApps) requiring stateful logic or external data inputs (like oracles) are currently out of reach. For example, implementing a fully autonomous NFT lending protocol or a multi-chain NFT bridge would require functionality beyond Hooks’ current capabilities.

Moreover, developer tooling and documentation for XRPL smart contracts are still catching up. While the XRPL community is growing and enthusiastic, the ecosystem lacks the extensive libraries, IDE integrations, and third-party infrastructure that Ethereum and Solana developers enjoy. This can slow down adoption and make it more difficult for new developers to enter the space and build sophisticated NFT applications on XRPL. However, this is being actively addressed by the RippleX team and community-led initiatives, signaling a promising trajectory.

Security is another critical consideration. While Hooks are designed to be deterministic and lightweight—thereby reducing the attack surface—smart contract bugs or logic errors can still occur. As Hooks become more widely used for automating royalty payments, conditional transfers, and dynamic NFT behavior, ensuring the correctness and safety of this code will be paramount. Formal verification tools, audit frameworks, and best practices tailored to Hooks will be essential to support secure, scalable adoption.

On the interoperability front, XRPL currently operates as a siloed ecosystem. While this ensures speed and security, it limits the composability and cross-chain interactions that are increasingly common in the Web3 world. NFT traders and creators often want to move assets between Ethereum, Solana, and XRPL, or tap into liquidity pools across chains. Future developments may include cross-chain bridges, wrapped assets, or interoperability layers that enable XRPL-based NFTs and smart contracts to interact with other blockchains seamlessly.

Looking ahead, the roadmap for XRPL smart contracts is filled with potential. Here are some of the most anticipated developments that could reshape the landscape:

- Expanded Hook Functionality: Future iterations of Hooks may support more complex operations, multi-step workflows, and external data inputs. This would open the door to more advanced NFT use cases like dynamic pricing models, gamified collectibles, or decentralized governance mechanisms tied to digital assets.

- Integration with Oracle Networks: By enabling safe and verifiable access to off-chain data, XRPL smart contracts could power NFTs that respond to real-world events—such as sports scores, weather conditions, or financial metrics—making them more interactive and valuable.

- Improved Developer Tooling: As the ecosystem matures, expect to see robust development environments, simulation tools, and user-friendly SDKs that lower the barrier to entry and accelerate innovation within the XRPL smart contract space.

- Decentralized Marketplaces with Hook Integration: Future NFT platforms built natively on XRPL could offer fully automated listing, bidding, and royalty distribution mechanisms powered by Hooks, providing a seamless experience for creators and traders alike.

- Regulatory Compliance Features: As NFTs and digital assets enter mainstream finance, smart contracts on XRPL may evolve to include compliance-friendly features like KYC/AML verification, tax tracking, and jurisdictional logic—all programmable via Hooks.

For XRP investors, these developments hint at a broader utility and demand for the XRP token. As more smart contract-powered applications emerge, the transactional volume on XRPL will likely increase, driving liquidity and reinforcing XRP’s role as a bridge currency and fuel for the ecosystem. Moreover, the network’s low fees and high speed make it an attractive destination for institutional and retail participants seeking scalable digital asset infrastructure.

In the NFT space, the ability to automate royalties, enforce programmable ownership rights, and enable dynamic asset behavior—all at a fraction of the cost of Ethereum—could position XRPL as a hub for next-gen digital collectibles and tokenized assets. As the market matures and creators look for platforms that offer both performance and profitability, XRPL’s smart contract ecosystem is poised to shine.

Ultimately, the evolution of smart contracts on XRPL—especially through the continued refinement of Hooks—represents a critical step toward making blockchain-based digital ownership mainstream. While challenges remain, the direction is clear: a fast, secure, and programmable ledger where NFTs and tokenized assets can thrive, and where creators and investors alike can unlock new value through automation, transparency, and innovation.