If you’ve been navigating the crypto waters since Bitcoin’s mystical white paper set sail, or if you’ve just jumped aboard the XRP ship, there’s an exciting development on the horizon that’s causing waves: Hooks and smart contracts on the XRP Ledger (XRPL). Remember when smart contracts were just a twinkle in Ethereum’s eye? Well, XRP is now stepping into the spotlight with its own twist, and it’s about to get more interesting than a cat meme on a blockchain. But what exactly are these Hooks, and how are they reshaping XRP’s future in the cryptosphere? Grab your digital surfboard, folks, because we’re diving deep into these revolutionary features.

To start with, Hooks are essentially smart contracts for the XRPL, but with a unique XRP spin. Think of them as the Swiss Army knives of the ledger, bringing versatility and functionality to a platform already known for its speed and efficiency. But why should you, an XRP investor or crypto aficionado, care? Well, just as a finely-tuned engine takes a sports car from zero to sixty in seconds, Hooks are poised to accelerate XRP’s capabilities, making it even more appealing in the realms of blockchain, finance, and trading. It’s like giving your favorite cryptocurrency a turbo boost—who wouldn’t want that?

Now, let’s cut to the chase. What makes these Hooks so special, and how do they differ from the smart contracts you’ve heard of in Ethereum and other blockchain platforms? A rhetorical question, perhaps, but one worth pondering. Hooks operate directly at the ledger level, offering a more lightweight and efficient solution compared to traditional smart contracts. Imagine a smart contract that doesn’t require a supercomputer to run; it’s a bit like swapping out a bulky desktop for a sleek laptop—only this laptop can handle millions of transactions per second.

But wait, there’s more! The introduction of Hooks on XRPL isn’t just about speed and efficiency; it’s about unleashing a new era of innovation and flexibility. Picture this: a world where developers can implement custom rules and logic directly onto the ledger. Whether it’s automating trading strategies, setting up conditional payments, or even developing entirely new financial instruments, Hooks open up a treasure trove of possibilities. It’s like giving a painter a whole new palette of colors to create their masterpiece.

Is your curiosity piqued yet? If you’re wondering how this impacts XRP’s standing in the broader blockchain ecosystem, you’re not alone. With the introduction of Hooks, XRP is positioning itself as a formidable player not just in cross-border payments but also in the growing field of decentralized finance (DeFi). It’s like XRP is no longer content with just being a world-class sprinter; it’s now training for the decathlon. The future of finance is digital and decentralized, and XRP is running full speed ahead.

In the competitive world of cryptocurrencies, where new technologies and platforms emerge faster than you can say “blockchain,” staying relevant is key. Hooks are a testament to XRP’s commitment to innovation and adaptability. They underscore XRP’s potential to not only keep pace with its peers but also to set new standards in blockchain technology. Are we witnessing the dawn of a new era for XRPL? Only time will tell, but the signs are certainly promising.

As we sail toward this exciting future, remember that navigating the crypto seas requires a keen understanding of the landscape and a reliable compass to guide you. That’s where XRP Authority comes in. Whether you’re a seasoned investor or just dipping your toes into the crypto waters, our insights and analyses are here to illuminate the path forward. We’re more than just a website; we’re your trusted partner in the ever-evolving world of XRP and blockchain technology.

So, why not stick around for more insights and updates? At XRP Authority, we’re committed to being your go-to source for all things XRP, from the latest technological advancements to strategic investment tips. Join us on this journey as we explore the transformative role of Hooks and smart contracts in the XRPL ecosystem. Because in the world of cryptocurrency, knowledge isn’t just power—it’s profit.

Understanding The Role of Hooks & Smart Contracts in XRPL and Its Impact on XRP

Understanding XRPL and its architecture

The XRP Ledger (XRPL) is not your average blockchain. While many blockchains rely on energy-intensive mining or sluggish transaction confirmation times, XRPL was built from the ground up to offer blazing-fast transactions, minimal fees, and a consensus protocol that doesn’t chew up electricity like a ravenous data center. For crypto investors and XRP enthusiasts, understanding how XRPL works is essential to appreciating how upcoming innovations like Hooks are poised to reshape its future.

At its core, XRPL is a decentralized, open-source blockchain designed to handle high-speed cross-border payments. Unlike Proof-of-Work models like Bitcoin or Proof-of-Stake variants like Ethereum 2.0, XRPL uses a unique consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA). This system allows independent validators to agree on the order and outcome of XRP transactions every few seconds—typically around 3-5 seconds—without the need for mining.

What makes XRPL particularly attractive to financial institutions and developers is its combination of speed, scalability, and reliability. The ledger can process up to 1,500 transactions per second, and it settles those transactions almost instantly. Plus, with transaction fees as low as a fraction of a cent, it’s easy to see why XRPL is a favorite for real-time global payments and remittances.

- Decentralized Validator Network: XRPL operates through a network of independent validators globally. These validators reach consensus on transactions every few seconds, ensuring that the ledger remains accurate and up to date.

- Built-In Features: XRPL comes equipped with native functionalities like decentralized exchange capabilities, multi-signing, and payment channels. These integrated features reduce the need for third-party protocols, lowering complexity and boosting efficiency.

- XRP as a Bridge Asset: XRP, the native currency of the ledger, acts as a bridge asset in cross-currency transactions. This enables liquidity on demand and reduces the need for pre-funded nostro accounts, a game-changer for global financial institutions.

- Energy Efficiency: Because XRPL doesn’t rely on mining, it’s one of the most energy-efficient blockchains out there—a crucial factor in today’s environmentally conscious investment landscape.

From an investment perspective, XRPL’s architecture positions it as a robust, scalable foundation for future growth. The upcoming integration of Hooks—lightweight smart contracts designed specifically for XRPL—builds on this foundation by introducing programmable transaction logic directly at the ledger layer. This is especially compelling for investors looking at long-term utility and adoption potential. As Hooks gradually unlock new functionalities, XRP’s role may evolve from being a fast, cheap payment token to a programmable asset capable of supporting a wide range of decentralized applications (dApps).

Moreover, XRPL’s architecture is inherently aligned with regulatory compliance and enterprise-grade requirements. Features like deterministic transaction finality and built-in anti-spam mechanisms make it suitable for large-scale financial applications. This bodes well for XRP’s market position, particularly as institutions increasingly look for blockchain solutions that combine innovation with operational stability.

In a market where narratives often shift from hype to utility, XRPL’s architecture offers a compelling case for XRP’s long-term relevance. As we explore how upcoming smart contract functionality (Hooks) is shaping XRP’s future, it’s clear that the ledger’s technical foundation is not only solid but also primed for evolution. For savvy investors and developers alike, this represents a unique opportunity to be part of a blockchain ecosystem that’s not just fast and efficient—but also future-ready.

Hooks: lightweight smart contracts on XRPL

Smart contracts are the lifeblood of decentralized applications, enabling everything from token swaps to NFT minting and DeFi protocols. But XRPL has always taken a different path—prioritizing speed, efficiency, and low transaction costs over complex, resource-heavy computation. That’s where Hooks come in. Think of Hooks as the XRPL’s elegant answer to smart contracts: lightweight, event-driven pieces of logic that can be attached directly to XRPL accounts. They’re not trying to be Ethereum-style smart contracts—they’re smarter, leaner, and laser-focused on what XRPL does best: high-performance transaction processing.

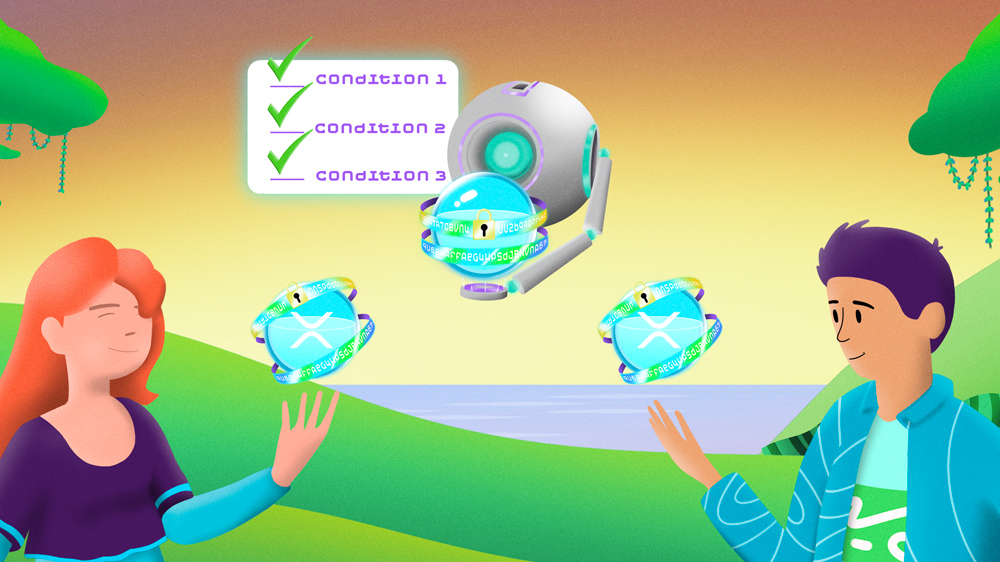

Hooks operate at the pre- and post-transaction level, allowing developers to embed custom logic directly into the transaction flow. This means that when a transaction is initiated, a Hook can inspect, modify, or even reject it based on specific criteria. Want to create a multi-tiered loyalty program that automatically rewards users once they hit a certain spend threshold? Hooks can do that. How about implementing compliance rules that block certain transactions unless they meet KYC requirements? Hooks have you covered there too.

Here’s what makes Hooks so revolutionary for XRPL and why crypto investors should be paying attention:

- Lightweight and Efficient: Unlike traditional smart contracts that require significant computational resources, Hooks are designed to be minimal and deterministic. This ensures they don’t bog down the network or compromise XRPL’s hallmark speed and scalability.

- On-Ledger Execution: Hooks execute directly on the ledger, minimizing latency and eliminating the need for external oracles or sidechains. This native integration enhances security and simplifies development.

- Programmable Transaction Logic: Developers can use Hooks to create conditional logic for payments, escrow releases, fee structures, and more—without needing to build an entirely separate protocol.

- Security-First Design: Since Hooks are deliberately limited in scope and complexity, they reduce the attack surface commonly associated with more flexible smart contract platforms. This makes them more resilient to exploits and bugs.

- Modular and Composable: Multiple Hooks can be chained together for advanced use cases. This modular design encourages reusable logic and composability, key principles in modern software development.

For XRP holders, this is more than just a technical upgrade—it’s a strategic evolution. Hooks are shaping XRP’s future by expanding its utility far beyond payments. Imagine a decentralized insurance protocol that automatically disburses funds based on real-world events, or a carbon credit system that verifies and logs emissions data directly on the ledger. These kinds of applications become not just possible, but practical, thanks to Hooks.

From an investment perspective, the introduction of programmable logic on XRPL creates new opportunities for tokenization, governance, and decentralized finance—all while maintaining the ledger’s core strengths. This could significantly increase developer activity and ecosystem growth, driving demand for XRP as both a utility token and a medium of exchange. As the Hooks amendment moves closer to mainnet implementation, savvy investors are watching closely, anticipating a surge in innovation and adoption that could redefine XRP’s market position.

And let’s not forget about interoperability. With Hooks, XRPL can more easily integrate with other blockchains and off-chain systems, opening the door to cross-chain dApps and multi-chain liquidity protocols. This positions XRPL as a critical player in the evolving Web3 infrastructure—a bridge between fast, compliant payments and programmable finance.

In short, Hooks are not just a feature—they’re a paradigm shift. They blend the functionality of smart contracts with the performance of XRPL, offering a best-of-both-worlds solution for developers and businesses. As we continue exploring how upcoming smart contract functionality (Hooks) is shaping XRP’s future, one thing is clear: XRPL is stepping into a new era of utility, and it’s doing so with precision, efficiency, and a forward-thinking approach that few other blockchains can match.

Use cases and real-world applications

As the XRP Ledger (XRPL) gears up to integrate Hooks, the landscape for real-world blockchain applications is expanding in ways that were previously unimaginable within XRPL’s lean, payment-focused framework. These lightweight smart contracts are unlocking a new frontier of possibilities—turning XRP from a transactional powerhouse into a programmable financial layer. For investors and XRP enthusiasts, this isn’t just a technical milestone—it’s a signal that the network is maturing into a full-fledged platform for decentralized innovation.

One of the most promising use cases lies in decentralized finance (DeFi). While XRPL has traditionally been overlooked by DeFi developers in favor of platforms like Ethereum or Solana, Hooks change the game. With programmable transaction logic, developers can now build lending protocols, automated market makers (AMMs), and yield farming mechanisms directly on XRPL—without sacrificing speed or cost-efficiency. Imagine a lending pool where interest rates adjust dynamically based on liquidity thresholds, or a decentralized stablecoin pegged to the U.S. dollar, fully collateralized and governed by Hook-based logic. These are no longer theoretical—they’re on the horizon.

Another powerful application is compliance automation. In traditional finance, regulatory requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are complex, costly, and slow. With Hooks, developers can embed compliance logic directly into the transaction layer. For example, a Hook can be designed to reject any transaction from an unverified account, or to log specific data points to a compliance database in real time. This makes XRPL an attractive option for fintech startups and institutions looking to bridge traditional finance with blockchain without running afoul of regulators.

Let’s talk about micropayments—XRPL’s bread and butter. With Hooks, these tiny transactions can become smarter. Picture a content platform where users pay per second of video streamed, and creators receive payouts instantly and automatically. A Hook could monitor usage and trigger payments without relying on external services. This opens up new monetization models for digital content, gaming, and even Internet of Things (IoT) devices, where machine-to-machine payments can happen on the fly.

Hooks also enable dynamic fee structures. Businesses can implement tiered pricing models based on user behavior, transaction volume, or time of day. For instance, a decentralized exchange on XRPL could offer fee discounts to high-volume traders or impose extra fees during network congestion—all controlled by Hooks. This flexibility allows businesses to optimize revenue and user experience in real time.

Let’s not overlook tokenized assets. With Hooks, XRPL becomes a more robust environment for asset-backed tokens—think real estate, commodities, or even carbon credits. A Hook can enforce rules like lock-up periods, dividend distributions, or burn mechanisms. This adds a layer of trust and automation, making XRPL a viable platform for regulated digital securities and ESG-focused projects. For investors, this means a broader range of assets and financial instruments could soon be accessible via the XRPL ecosystem, all powered by XRP as the native liquidity token.

- Decentralized Escrow Services: Hooks can manage multi-party escrow agreements natively, releasing funds only when pre-defined conditions are met—ideal for marketplaces and freelance platforms.

- Loyalty and Reward Systems: Businesses can implement automated loyalty programs where users earn tokens or discounts based on spending behavior, verified and triggered through Hooks.

- Subscription Billing: With recurring logic embedded in Hooks, services can offer seamless subscription billing that auto-renews or cancels based on user activity or payment status.

- Cross-border Payroll: Companies can automate global payroll systems by distributing salaries in XRP or stablecoins, with Hooks ensuring compliance, timing, and accuracy.

- Governance and Voting: Token-based governance can be implemented using Hooks to validate votes, enforce quorum rules, and execute changes without manual oversight.

What makes all of this even more compelling is that it aligns perfectly with XRPL’s existing strengths—speed, low cost, and reliability. Unlike more bloated smart contract platforms that often suffer from high gas fees and network congestion, XRPL with Hooks offers a streamlined environment for deploying real-world solutions at scale. This is especially attractive to enterprises and developers seeking performance without compromise.

From an investor’s standpoint, these emerging applications point to an expanding use case footprint for XRP. As more dApps and enterprise solutions are built on XRPL using Hooks, demand for XRP as a transactional and utility token is likely to increase. This could translate into greater liquidity, more exchange listings, and stronger price support at key levels such as the [gpt_article topic=The Role of Hooks & Smart Contracts in XRPL directives=”Generate a long-form, well-structured, SEO-optimized article on the topic The Role of Hooks & Smart Contracts in XRPL and Exploring how upcoming smart contract functionality (Hooks) is shaping XRP’s future. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use and Exploring how upcoming smart contract functionality (Hooks) is shaping XRP’s future. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level or the 61.8% Fibonacci retracement zone—technical indicators that traders watch closely.

Moreover, the introduction of Hooks is catalyzing a new wave of developer interest. With a growing toolkit, including SDKs and documentation tailored for Hook development, XRPL is attracting builders who previously may have defaulted to Ethereum or other Layer 1 chains. This developer momentum is crucial, as ecosystem growth often precedes price appreciation and investor confidence.

In essence, Hooks are transforming XRPL from a specialized payments ledger into a multifunctional platform with real-world utility across industries. Whether it’s DeFi, compliance, digital content, or tokenized assets, the possibilities are expanding—and with them, XRP’s potential value proposition. For those exploring how upcoming smart contract functionality (Hooks) is shaping XRP’s future, the message is clear: XRPL is no longer just a fast payment rail. It’s becoming a programmable, enterprise-grade blockchain ready to power the next generation of decentralized innovation.

Security and performance considerations

As XRPL evolves to support Hooks, the spotlight naturally shifts to the twin pillars that underpin any smart contract platform: security and performance. Unlike traditional blockchains that often trade off one for the other, XRPL’s approach with Hooks is refreshingly balanced. But with great flexibility comes the need for meticulous design and robust safeguards—especially when programmable logic is introduced at the ledger level. For XRP investors and developers alike, understanding how XRPL manages these considerations is crucial to assessing its long-term viability and market competitiveness.

Let’s start with performance. XRPL has always been a speed demon in the blockchain world, capable of processing up to 1,500 transactions per second with finality in about 3-5 seconds. That’s not just fast—it’s enterprise-grade. The introduction of Hooks doesn’t compromise this performance; in fact, it reinforces it. Hooks are intentionally designed to be lightweight and deterministic, meaning they execute quickly and predictably. There’s no risk of running into the kind of network congestion or gas fee spikes seen on platforms like Ethereum. That means developers can build with confidence, knowing their logic won’t slow down the system or burden users with unpredictable costs.

From a technical standpoint, Hooks are executed directly on the XRPL validator nodes, but within strict operational boundaries. Each Hook must complete within a defined computational limit, ensuring no single transaction can monopolize network resources. This is enforced through a concept similar to “instruction counting,” akin to Ethereum’s gas model, but optimized for XRPL’s streamlined architecture. The system’s efficiency is preserved, and denial-of-service vectors are significantly reduced.

Now, on to security—a top concern for any programmable ledger. The XRPL community has taken a proactive, layered approach to securing Hooks. First and foremost, Hooks are written in a purpose-built language that restricts unsafe operations. There’s no arbitrary code execution, no infinite loops, and no access to external data sources unless explicitly permitted. This “sandboxed” environment drastically reduces the risk of exploits like reentrancy attacks or logic bugs that have plagued other smart contract platforms.

Additionally, Hook developers are encouraged to follow a standardized development lifecycle that includes unit testing, audit trails, and version control. With the advent of dedicated SDKs and simulation tools, developers can rigorously test their Hooks in a controlled environment before deploying them to mainnet. This culture of test-driven development is a major step forward in preventing vulnerabilities and ensuring system integrity.

Another key security feature is the deterministic nature of Hooks. Because they execute the same way every time, across all nodes, there’s no room for ambiguity or inconsistent behavior. This is critical in a decentralized ledger where consensus depends on every participant reaching the same result. By eliminating non-deterministic functions, XRPL ensures that Hooks won’t introduce consensus-breaking bugs—something that’s happened more than once in other ecosystems.

Let’s also talk about governance. The XRPL Foundation and the broader community are actively involved in setting best practices and reviewing proposed amendments, including Hooks. Any new functionality undergoes a rigorous vetting process before it’s voted into the protocol. Validators must approve changes with an 80% consensus over a two-week period, ensuring that only well-tested, community-supported features make it to production. This slow-and-steady approach may seem cautious, but it’s a cornerstone of XRPL’s reputation for reliability and stability.

- Execution Limits: Hooks are restricted by computational quotas to prevent abuse and ensure consistent performance across the network.

- Deterministic Logic: All Hook code must produce the same outcome on every node, preserving ledger consensus integrity.

- Sandbox Environment: Hooks operate in an isolated context, minimizing the risk of malicious behavior or unintended side effects.

- Community Governance: All protocol updates, including Hook-related changes, must pass a supermajority vote from trusted validators.

- Developer Tooling: SDKs, simulators, and auditing frameworks empower developers to test and secure their Hooks before deployment.

For crypto investors, these security and performance guardrails are not just technical footnotes—they’re investment indicators. A blockchain that can scale without sacrificing safety is a rare breed. As more developers deploy Hooks for DeFi, compliance, tokenization, and more, the demand for a stable, secure platform will only intensify. XRPL’s architecture, bolstered by these robust safeguards, positions it as a compelling choice for enterprise-grade applications and institutional adoption.

Moreover, this focus on security and efficiency feeds directly into XRP’s market narrative. As new use cases emerge—many of which involve financial transactions, regulatory compliance, and asset custody—confidence in the underlying infrastructure becomes paramount. A single high-profile exploit or performance failure could derail months of progress. XRPL’s conservative, security-first ethos reduces this risk, making it more attractive to risk-averse investors and partners.

And let’s not ignore the regulatory angle. With governments and financial watchdogs scrutinizing blockchain platforms more than ever, having a secure and auditable smart contract layer is a major advantage. Hooks’ deterministic execution and built-in safeguards make it easier to demonstrate compliance and transparency—key factors for institutional onboarding and government partnerships.

In the grand scheme of things, exploring how upcoming smart contract functionality (Hooks) is shaping XRP’s future means looking at more than just what’s possible. It means evaluating how safely and efficiently those possibilities can be realized. XRPL doesn’t just promise innovation—it delivers it within a framework of trust, performance, and resilience. That’s a winning formula in any market condition, and one that savvy investors are already factoring into their long-term XRP strategies.