Welcome to the thrilling world of cryptocurrency, where the only thing more unpredictable than the price of Bitcoin is the legal rollercoaster that is the SEC lawsuit against Ripple. Imagine waking up one morning as a Ripple executive, only to find that the U.S. Securities and Exchange Commission (SEC) has decided to crash your party, claiming that XRP, the digital currency you’d been championing, is an unregistered security. If you think that sounds like the plot twist of a financial drama, you’re not wrong. But this is no Netflix series—it’s the real deal, and it has significant implications for XRP investors, blockchain enthusiasts, and the future of digital finance.

So, how did this all start? Picture this: in December 2020, as holiday cheer was settling in, the SEC dropped its bombshell lawsuit against Ripple Labs, stating that Ripple had conducted a .3 billion unregistered securities offering through the sale of XRP. Yes, you heard it right—.3 billion. If you’re wondering whether the SEC was simply playing Scrooge or had a legitimate case, you’re not alone. Legal intricacies aside, this lawsuit has raised critical questions about regulatory clarity in the ever-evolving crypto landscape.

But what does it mean for XRP, the digital asset that once promised to revolutionize cross-border payments with lightning-fast speed and minimal transaction fees? XRP had been lauded for its utility and efficiency, drawing in fintech companies, financial institutions, and crypto investors alike. However, this lawsuit threw a wrench in the works, leaving many asking: Is XRP a security, or merely a misunderstood token caught in the crossfire of regulatory zeal?

For the uninitiated, XRP isn’t just another cryptocurrency; it’s a bridge currency designed to facilitate seamless international transactions. It has been a game-changer in blockchain and finance, offering a compelling alternative to traditional systems bogged down by inefficiencies and high costs. Yet, the SEC’s lawsuit has put XRP’s future in a precarious position, prompting investors and traders to scrutinize its legal standing and market potential.

Now, let’s address the elephant in the room: why did the SEC target Ripple when there are countless cryptocurrencies floating around the digital ether? Some argue that Ripple’s transparency and cooperation with financial institutions made it an easy target. Others suggest that the SEC aimed to set a precedent, clarifying the murky waters of cryptocurrency regulation. Regardless of the motive, the lawsuit has sparked a broader debate about how digital assets should be classified and regulated.

Is it possible that the SEC’s action could stifle innovation in a sector brimming with potential? Or could it pave the way for a more structured and secure crypto environment? Such questions continue to swirl among investors, fueling both anxiety and hope. As the drama unfolds, XRP holders find themselves on tenterhooks, pondering the potential ramifications of a legal battle that could redefine the crypto landscape.

In this high-stakes saga, staying informed is crucial. The SEC vs. Ripple case is not just about legal definitions; it’s a pivotal moment that could shape the future of digital finance. Whether you’re an investor navigating the tumultuous waters of crypto or a fintech professional keen on understanding regulatory impacts, this lawsuit is a case study in the intersection of innovation and law.

For those seeking a reliable compass in this storm, XRP Authority stands ready, offering insightful analysis and updates. As your go-to source for everything XRP, we provide expert insights, breaking news, and a community of like-minded enthusiasts eager to explore the ever-shifting terrain of cryptocurrency. Stay tuned as we unravel the complexities of the SEC lawsuit and its potential to transform the crypto world as we know it.

Understanding How the SEC Lawsuit Against Ripple Started and Its Impact on XRP

Background on Ripple and XRP

To understand how the SEC lawsuit against Ripple began, it’s essential to first grasp what Ripple and XRP actually are—and more importantly, how they differ. While often used interchangeably in headlines, Ripple and XRP are not the same entity, and that distinction lies at the heart of the legal drama that has captured the crypto world’s attention.

Ripple Labs Inc. is a San Francisco-based fintech company founded in 2012 with a mission to revolutionize cross-border payments. The company developed RippleNet, a decentralized financial network that connects banks, payment providers, and digital asset exchanges. RippleNet enables fast, low-cost international transactions, a stark contrast to the sluggish and expensive SWIFT system most banks still rely on.

XRP, on the other hand, is the native digital asset that powers RippleNet’s On-Demand Liquidity (ODL) service. Unlike Bitcoin or Ethereum, which are mined, all 100 billion XRP tokens were pre-mined at launch. Ripple Labs initially held a significant portion of these tokens, distributing the rest to early investors and partners. This pre-mined model and Ripple’s large XRP holdings are key elements that later raised red flags with regulators.

Ripple positioned XRP as a bridge currency that facilitates real-time currency conversion during international transfers. For example, if a bank in Mexico wants to send money to a bank in Japan, XRP can be used to instantly convert Mexican pesos to Japanese yen, reducing the need for intermediary banks and slashing transaction times from several days to mere seconds. This practical utility has made XRP attractive to financial institutions looking to modernize their payment infrastructure.

Despite its utility, XRP has long been viewed with skepticism by some in the crypto community and regulators due to its centralized distribution and Ripple’s control over a large portion of the supply. Ripple has tried to counter these concerns by placing its XRP holdings in escrow accounts and releasing them in monthly increments, but critics argue this still gives Ripple too much influence over the asset’s price and availability.

From an investment perspective, XRP has had a rollercoaster journey. It reached an all-time high near .84 during the 2017 bull run before plummeting, and has since struggled to regain its former glory. Still, XRP remains one of the largest cryptocurrencies by market capitalization, buoyed by its real-world use cases and loyal investor base. Many see it as a long-term bet on the future of cross-border payments, especially if regulatory clarity can finally be achieved.

Understanding the distinction between Ripple (the company) and XRP (the digital asset), along with its centralized origins and use cases, sets the stage for the regulatory showdown that followed. The SEC’s scrutiny didn’t come out of the blue—it was rooted in these very complexities surrounding XRP’s classification and Ripple’s business model.

SEC’s allegations and legal basis

When the U.S. Securities and Exchange Commission (SEC) dropped its bombshell lawsuit against Ripple Labs in December 2020, it didn’t just shake XRP holders—it sent tremors through the entire crypto market. The crux of the SEC’s case? The agency alleged that Ripple had conducted an unregistered securities offering by selling XRP tokens, raising over .3 billion in the process. But this wasn’t your average securities case; it was a high-stakes battle over how digital assets should be classified in the eyes of the law.

At the heart of the lawsuit was the Howey Test, a legal standard derived from a 1946 Supreme Court case that determines whether a transaction qualifies as an “investment contract”—and therefore a security. According to the SEC, Ripple’s sales of XRP met all three prongs of the Howey Test:

- Investment of money: Investors bought XRP using fiat or other digital assets, satisfying the monetary investment requirement.

- Common enterprise: The SEC argued that buyers of XRP were tied together by Ripple’s efforts, with the success of their investments depending on the company’s performance and strategy.

- Expectation of profits from the efforts of others: Ripple’s marketing and public messaging allegedly led investors to expect that the value of XRP would increase based on the company’s actions.

Ripple, of course, pushed back hard. The company contended that XRP is a digital currency, not a security, and therefore falls outside the SEC’s jurisdiction. They emphasized that XRP has real-world utility as a bridge currency in international payments, a use case that aligns more closely with commodities than with securities.

Moreover, Ripple’s defense raised serious questions about regulatory clarity. For years, the SEC had remained ambiguous about how it viewed XRP, even as Ripple continued to operate and sign partnerships with financial institutions. Ripple argued that it had been blindsided and that the SEC failed to provide fair notice that XRP would be treated as a security—an argument that would later gain traction in court proceedings.

The legal battle also highlighted inconsistencies in how different digital assets were being treated by U.S. regulators. Bitcoin and Ethereum had both been declared non-securities by senior SEC officials, largely due to their decentralized structures. Ripple’s legal team argued that XRP was being unfairly singled out, despite its widespread distribution and functional role in payment systems.

Another key point of contention was Ripple’s sale of XRP to institutional investors versus retail buyers. The SEC claimed that Ripple had made strategic sales of XRP to hedge funds and other entities, often at discounted rates, without registering those offerings. These private placements, the SEC alleged, further supported the argument that Ripple was engaging in a securities offering without following the necessary disclosure rules.

From an enforcement perspective, the SEC’s lawsuit marked a bold move to assert its authority over the rapidly growing and often murky crypto landscape. It signaled that the agency was willing to crack down on what it saw as noncompliance with existing securities laws, even if that meant taking on one of the industry’s most prominent players.

For XRP investors, the lawsuit created a whirlwind of uncertainty. The token was delisted from major U.S. exchanges like Coinbase, its price plummeted below the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].25 level, and Ripple’s future seemed precarious. Yet, the case also sparked a broader conversation about the need for updated regulatory frameworks that reflect the unique nature of digital assets.

The SEC’s allegations weren’t just about XRP—they were a referendum on how crypto should be regulated and who gets to draw the lines. As the legal proceedings unfolded, the case became a landmark in the ongoing battle between innovation and oversight, with implications that extend far beyond Ripple and its token.

Timeline of the lawsuit’s initiation

The sequence of events leading up to the SEC’s lawsuit against Ripple didn’t happen overnight—it was a slow burn that culminated in a regulatory firestorm. Understanding the timeline of how this legal saga began provides crucial insight into the evolving relationship between crypto projects and U.S. financial regulators. It also helps investors gauge just how long regulatory uncertainty can simmer before boiling over into enforcement action.

Ripple had been operating in the crypto space for nearly a decade before the lawsuit hit. From the early days of XRP’s distribution to major partnerships with financial institutions, Ripple was no secret to regulators. In fact, the company had engaged in ongoing discussions with the SEC and other agencies for years. However, the SEC’s silence on XRP’s regulatory status persisted—until it didn’t.

- 2013–2017: Early XRP distribution and growing scrutiny

Ripple began distributing XRP tokens in 2013, initially to early adopters, developers, and institutional partners. By 2015, Ripple Labs had settled with the U.S. Department of Justice and the Financial Crimes Enforcement Network (FinCEN) over allegations related to violations of the Bank Secrecy Act. As part of that settlement, Ripple agreed to implement an AML program, but notably, XRP was not classified as a security by these agencies. This gave Ripple some breathing room, but it also signaled that regulators were watching. - 2018: SEC clarifies stance on Bitcoin and Ethereum—but not XRP

In a pivotal moment for the crypto industry, SEC Director of Corporation Finance William Hinman declared in June 2018 that Bitcoin and Ethereum were not securities. The rationale? Their decentralized nature. But conspicuously absent from this declaration was any mention of XRP. Ripple executives began to grow concerned, especially as questions swirled around XRP’s classification. Internally, the company sought legal opinions and even lobbied for regulatory clarity, but the SEC remained tight-lipped. - 2019–2020: Mounting tension and internal SEC debate

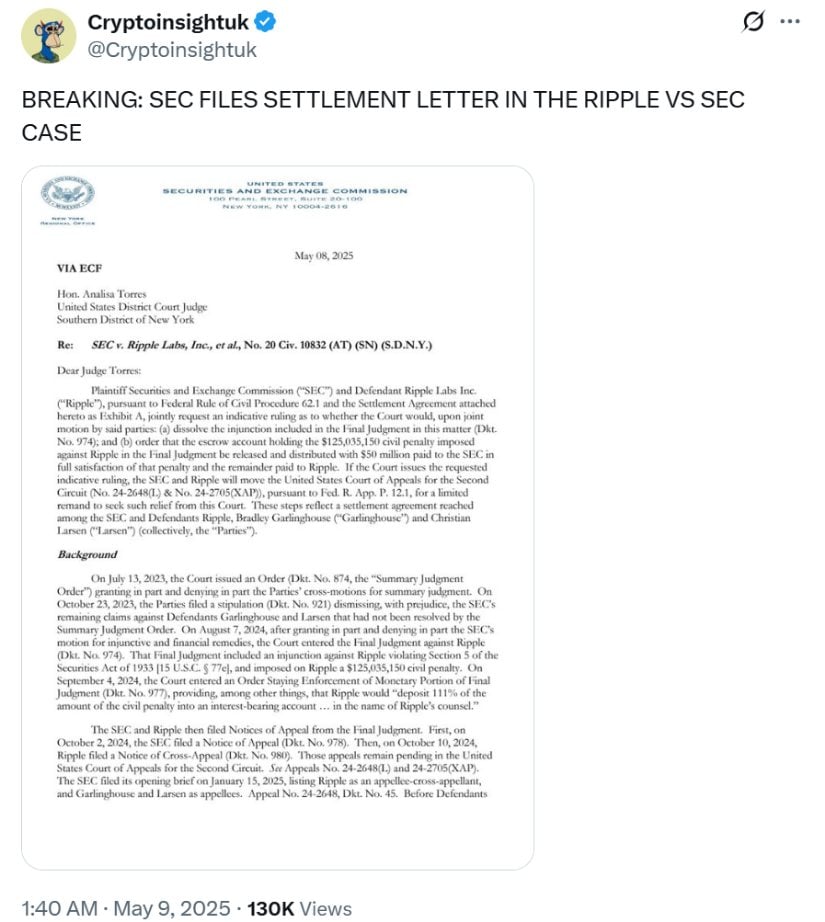

During this period, Ripple continued to expand its ODL product and signed partnerships with MoneyGram and other payment providers. Simultaneously, the company sold hundreds of millions of dollars worth of XRP to institutional investors, reportedly at negotiated discounts. These sales drew scrutiny from within the SEC, where internal discussions reportedly intensified. Some officials believed that XRP met the criteria of a security under the Howey Test, while others urged caution, citing the lack of clear guidance for digital assets. - December 21, 2020: Ripple receives a Wells notice

Just days before filing the lawsuit, the SEC sent Ripple a Wells notice—a formal indication that the agency intended to bring an enforcement action. This notice gave Ripple one last chance to respond and potentially dissuade the SEC from suing. Ripple’s leadership, including CEO Brad Garlinghouse and Executive Chairman Chris Larsen, chose to fight back, arguing that the SEC’s sudden shift in stance was unfair and lacked legal merit. - December 22, 2020: SEC files the lawsuit

The SEC officially filed its complaint in the U.S. District Court for the Southern District of New York. The lawsuit named Ripple Labs, Garlinghouse, and Larsen as defendants, alleging they had raised over .3 billion through the unregistered sale of XRP. The timing was controversial—then-SEC Chairman Jay Clayton filed the suit on his last full day in office, sparking criticism that the move was politically motivated or rushed.

The timing and circumstances of the lawsuit’s initiation raised eyebrows across the crypto community and Wall Street alike. Why now, after years of apparent regulatory inaction? Why target Ripple when other projects had arguably similar token distribution models? These questions fueled speculation and conspiracy theories, but they also highlighted the urgent need for regulatory reform. Ripple’s legal team quickly went on the offensive, asserting that the SEC’s case lacked consistency and transparency.

In the days following the lawsuit, XRP’s market value took a beating, dropping below the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].25 support level as panic selling took hold. Major exchanges, including Coinbase, suspended XRP trading to avoid regulatory exposure. The token’s delisting triggered a liquidity crunch, and Ripple’s high-profile partnerships began to unravel. MoneyGram, for instance, paused its collaboration with Ripple, citing the legal uncertainty.

Despite the chaos, Ripple didn’t back down. The company vowed to fight the lawsuit in court and launched a public relations campaign to rally support. XRP enthusiasts and crypto legal experts began dissecting the SEC’s claims, with many arguing that the lawsuit could set a dangerous precedent for the entire industry. The case quickly evolved from a single enforcement action into a landmark legal battle with implications for how digital assets are classified, traded, and regulated in the U.S.

From an investment standpoint, the lawsuit’s initiation marked a turning point. While the immediate reaction was bearish, with XRP plummeting from the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 range to under [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].25, savvy investors began to recognize a potential opportunity. If Ripple could successfully defend itself, the case could pave the way for regulatory clarity—something the crypto market desperately needs. In fact, some speculators began re-entering XRP positions, betting on a favorable outcome and a rebound to key resistance levels like the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 mark or even the .00 psychological level.

Ultimately, the timeline of the SEC’s lawsuit against Ripple reveals more than just a sequence of legal events—it underscores the tension between innovation and regulation, the need for clear rules in the digital asset space, and the resilience of the XRP community. As the case progressed, it became a bellwether for how regulators would treat crypto projects going forward, influencing market behavior, investor sentiment, and policy discussions worldwide.

Market reaction and industry impact

When the SEC dropped its enforcement hammer on Ripple in December 2020, the crypto market didn’t just flinch—it convulsed. XRP, once a top-three cryptocurrency by market capitalization, was thrust into regulatory limbo, triggering a cascade of delistings, price collapses, and investor anxiety. But beyond the immediate chaos, the lawsuit had far-reaching implications for the broader crypto ecosystem, regulatory policy, and the future of digital asset classification in the United States.

Within hours of the lawsuit’s announcement, major U.S.-based exchanges like Coinbase, Binance.US, and Bitstamp began suspending or delisting XRP trading. The token’s price nosedived from the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].60 level to well below the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].25 mark, wiping out billions in market value almost overnight. Liquidity dried up, and XRP’s market cap plummeted, causing it to fall out of the top five cryptocurrencies for the first time in years. Retail investors who had long held XRP as a speculative play or utility token were suddenly left scrambling, unsure if their holdings were now considered unregistered securities.

But the reaction wasn’t just limited to XRP holders. The entire industry took notice, and the lawsuit sent a chilling message: the SEC was willing to pursue enforcement actions against established crypto companies, even those with years of operational history and partnerships with traditional financial institutions. This created a domino effect of caution throughout the sector:

- Exchanges tightened listing policies: Platforms became more conservative in listing new assets, often requiring additional legal reviews to avoid regulatory blowback.

- Token issuers paused or modified offerings: Projects began reevaluating their fundraising models, with many shifting away from U.S. investors or adopting more compliant frameworks like Reg D or Reg A+ exemptions.

- Venture capital slowed in the U.S. crypto space: Investors grew wary of backing projects without clear legal guidance, especially those with pre-mined tokens or centralized control structures.

From a macro perspective, the Ripple lawsuit accelerated the conversation around the classification of digital assets. The SEC’s position—that XRP constituted a security due to its centralized issuance and Ripple’s promotional efforts—sparked debates about the application of the Howey Test and whether it was suitable for 21st-century blockchain technologies. Legal scholars, blockchain associations, and even former regulators weighed in, with many calling for a new framework that reflects the unique characteristics of crypto assets.

Interestingly, the case also galvanized the XRP community. Far from retreating, many XRP holders doubled down, organizing petitions, social media campaigns, and even submitting amicus briefs in support of Ripple. The “XRP Army,” as they’re known online, became one of the most vocal and mobilized crypto communities, arguing that the SEC’s actions harmed retail investors more than they protected them. This grassroots support not only kept XRP in the spotlight but also helped sustain its trading activity on non-U.S. platforms, where it remained accessible.

In the months following the lawsuit, XRP began to rebound, both in price and sentiment. The token clawed its way back above the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].50 level, even briefly testing the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level during favorable court rulings or market-wide rallies. Investors grew more optimistic as Ripple scored procedural victories, such as gaining access to internal SEC communications or having key motions granted by the court. Each legal win was seen not just as a step forward for Ripple, but as a potential precedent for other crypto projects facing regulatory scrutiny.

Meanwhile, the lawsuit’s impact extended beyond market charts and courtroom drama. It influenced policymaking at the highest levels. U.S. lawmakers began introducing bills aimed at clarifying the regulatory status of digital assets, such as the Token Taxonomy Act and the Digital Commodity Exchange Act. The case became a talking point in Congressional hearings, with lawmakers pressing the SEC for greater transparency and consistency in its approach to crypto regulation.

Ripple itself didn’t just survive the storm—it adapted. The company continued expanding its operations overseas, particularly in crypto-friendly jurisdictions like the United Arab Emirates, Japan, and the European Union. RippleNet’s adoption grew, and the company even hinted at a potential IPO once the legal dust settled. From a business continuity standpoint, Ripple demonstrated remarkable resilience, leveraging its global footprint to sidestep domestic regulatory hurdles while maintaining its mission of transforming cross-border payments.

For investors and market analysts, the Ripple case served as a cautionary tale and a strategic signal. Tokens with unclear regulatory status or centralized control structures faced increased scrutiny, while those with decentralized models and strong utility narratives gained favor. The legal battle also reinforced the importance of due diligence—not just in technology and team, but in regulatory positioning and compliance strategies.

In terms of market forecasting, XRP’s future remains intertwined with the lawsuit’s outcome. A favorable ruling could propel the token past the .00 psychological level and potentially toward the .50 mark, especially if it coincides with a broader crypto bull market. Conversely, an unfavorable decision could lead to renewed delistings and a retest of lower support levels, possibly near the [gpt_article topic=How the SEC Lawsuit Against Ripple Started directives=”Generate a long-form, well-structured, SEO-optimized article on the topic How the SEC Lawsuit Against Ripple Started and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use securities classification, XRP lawsuit, financial enforcement, legal battle, regulatory disputes and A breakdown of why the U.S. Securities and Exchange Commission sued Ripple. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].30 zone. But perhaps more importantly, the case will likely set a precedent that shapes how regulators approach digital assets for years to come.

In the grander scheme, the SEC’s lawsuit against Ripple was more than a legal action—it was a catalyst. It forced the industry to confront its regulatory growing pains, brought investor protection into sharper focus, and highlighted the urgent need for a clear, modern framework that balances innovation with oversight. Whether you’re an XRP investor, a DeFi enthusiast, or a blockchain entrepreneur, the ripple effects of this case will be felt across the crypto landscape for the foreseeable future.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- for key points.

- 2013–2017: Early XRP distribution and growing scrutiny