Are you ready to dive into the intricate yet exhilarating world of XRP and its unique blockchain architecture? Have you ever wondered why XRP Ledger (XRPL) opted for a lightweight smart contract model, embracing Hooks instead of the full-blown Turing-complete contracts? Well, strap in, because we’re about to embark on a journey through the strategic brilliance of XRPL’s design choices—a tale as compelling as any thrilling crypto roller coaster, minus the nausea.

First, let’s set the stage. In the vast universe of blockchain, where complexity often reigns supreme, XRPL stands out like a lighthouse. It’s a beacon of efficiency and speed, primarily designed for seamless and cost-effective cross-border transactions. But hold on, why not follow the crowd and go for those all-encompassing, Turing-complete smart contracts, you ask? Ah, my inquisitive friend, the answer lies in XRPL’s wisdom in choosing simplicity and specialization over bloated complexity. It’s like deciding whether to bring a Swiss army knife to a butter-spreading contest.

Now, let’s talk Hooks. Picture this: a nimble, lightweight solution that allows developers to customize transaction behavior on the ledger without the hefty baggage of a complex smart contract language. Hooks are to XRPL what a perfectly tailored suit is to James Bond—sharp, efficient, and just the right fit for the mission. They provide the necessary functionality without compromising on XRPL’s core values of speed, cost-effectiveness, and reliability.

By now, you might be wondering, “But aren’t smart contracts the cornerstone of blockchain innovation?” Indeed, they are, but not every blockchain needs to be a jack-of-all-trades. XRPL’s strategy is akin to a finely-tuned sports car; it doesn’t need to double as a moving van. It focuses on doing a few things exceptionally well, not everything under the sun. This specialization is precisely what makes XRPL a powerhouse in finance and trading circles, where efficiency and speed can mean the difference between profit and loss.

Moreover, XRPL’s choice to implement Hooks reflects its commitment to practicality and usability. Why burden developers with learning a new, complex programming language when they can leverage the existing XRPL scripting capabilities? It’s like offering a gourmet burger instead of a convoluted 12-course meal when all you need is a quick, delicious bite. The result? A developer-friendly environment that encourages innovation without unnecessary hurdles.

In the broader context of blockchain finance, XRPL’s lightweight model is a game-changer. It aligns perfectly with the needs of traders and financial institutions who require swift, secure, and low-cost transactions. It’s like having a high-speed train on a track precisely engineered for rapid, frictionless travel. XRPL’s approach ensures that it remains a formidable player in the ever-evolving landscape of digital finance.

But wait, there’s more! The lightweight smart contract model doesn’t just benefit developers and traders; it also enhances the overall security of the XRPL ecosystem. By reducing complexity, XRPL minimizes potential vulnerabilities, making it a robust fortress in a digital world often fraught with security challenges. It’s like having a top-notch security system without the hassle of remembering a 20-character password.

As you can see, the reasoning behind XRPL’s choice to implement Hooks is as strategic as a game of 4D chess. It’s a decision that underscores XRPL’s commitment to efficiency, security, and practicality, ensuring it remains at the forefront of blockchain innovation. So, if you’re an XRP investor or a crypto enthusiast keen on understanding the nuances of this fascinating technology, look no further than XRP Authority. Your go-to source for insights, we blend expertise with a dash of humor to guide you through the ever-thrilling world of XRP and beyond. Stay tuned for more enlightening content that keeps you ahead of the curve!

Understanding Why XRPL Chose a Lightweight Smart Contract Model and Its Impact on XRP

Balancing performance and flexibility

When it comes to designing blockchain infrastructure, the tug-of-war between performance and flexibility is very real. The XRP Ledger (XRPL) made a deliberate, strategic choice to prioritize high-speed, low-cost transactions while still enabling a degree of programmability. Instead of adopting full-blown, Turing-complete smart contracts like those seen on Ethereum, XRPL opted for a lightweight smart contract model using Hooks—a decision that reflects its commitment to efficient scalability, transaction throughput, and investment-grade reliability.

Unlike other blockchains that allow developers to write complex, open-ended code, XRPL’s Hooks are small, efficient WebAssembly (WASM) modules that attach directly to accounts and execute logic during transaction processing. This model offers just enough flexibility for automated workflows without sacrificing the performance that XRP is known for. For investors and developers alike, this means fewer bottlenecks, lower fees, and reduced risks—all critical for mainstream adoption and real-world integration.

The XRPL processes transactions in around 3–5 seconds with finality, and its lightweight model ensures that this performance metric remains consistent even as more users and decentralized applications join the network. In contrast, full Turing-complete smart contracts can slow down blockchains, increase transaction costs, and introduce complex vulnerabilities. XRPL’s design philosophy is that not every use case needs the power of a full virtual machine—especially when most DeFi, NFT, and payment logic can be accomplished with simpler, more secure constructs.

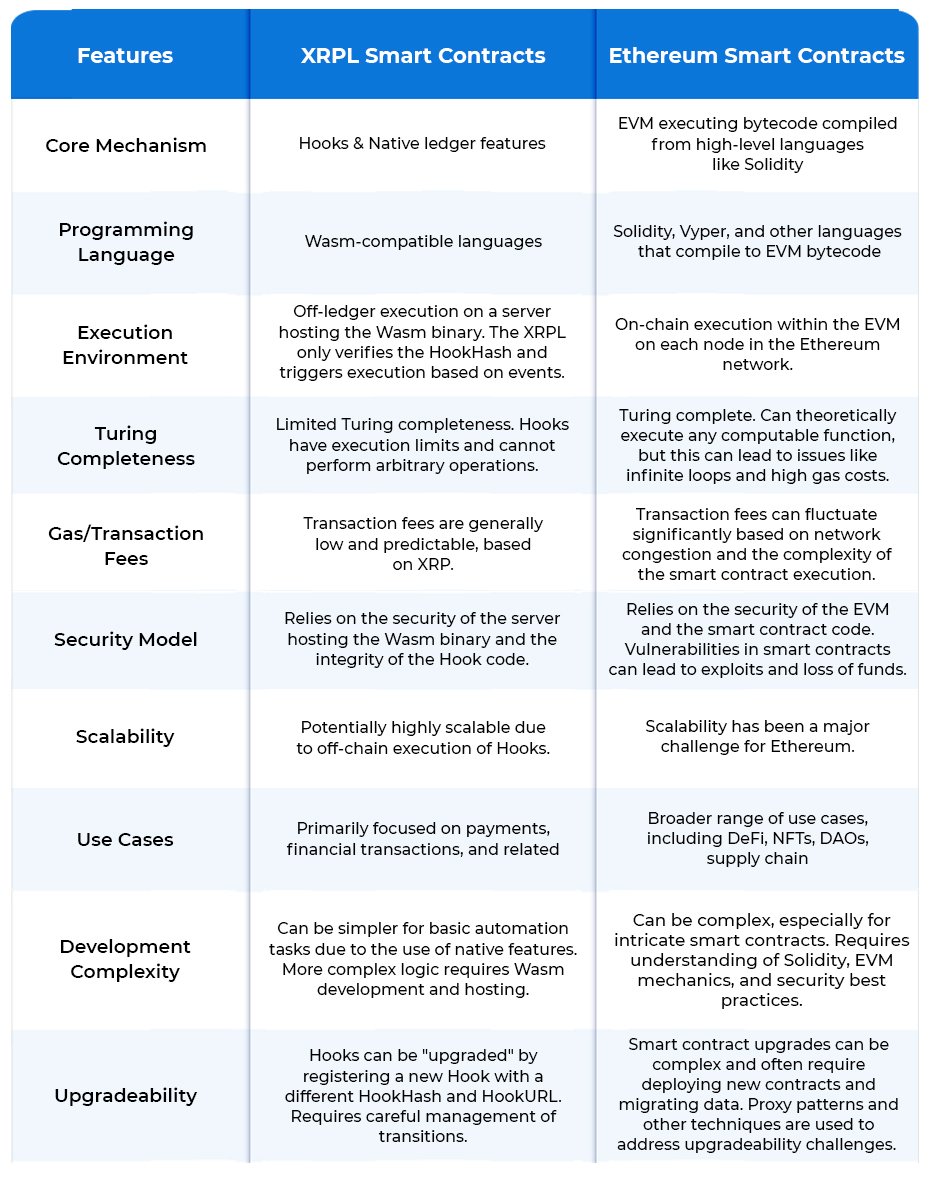

Here’s how XRPL’s approach stacks up in terms of performance and flexibility:

- Resource Efficiency: Hooks are lightweight by design, consuming minimal computational and storage resources. This keeps transaction costs consistently low—an essential trait for both retail and institutional investors looking to move capital efficiently.

- On-Ledger Execution: Hooks are executed natively on the ledger, eliminating the need for external oracles or off-chain computation. This ensures deterministic behavior and enhances trust in the network’s state transitions.

- Streamlined Automation: Hooks allow for conditional logic, such as triggering an action when a payment is received or rejecting transactions that don’t meet predefined criteria. This level of automation supports programmable finance without bloating the network.

- Transaction Cost Stability: By avoiding the overhead of full smart contract execution, XRPL maintains one of the lowest transaction fee environments in the industry—often fractions of a cent. This cost predictability is a major advantage for enterprises and cross-border payment providers.

From an investment standpoint, this architecture positions XRP as a high-throughput, low-latency asset tailored for utility and real-world adoption. As regulatory clarity improves and enterprise adoption accelerates, the network’s ability to offer flexible programmability without compromising on speed or cost becomes a key differentiator. The lightweight smart contract model isn’t a compromise—it’s a calculated evolution that aligns with XRPL’s long-term vision of being the backbone for global financial applications.

By focusing on core strengths—speed, efficiency, and reliability—while still enabling programmable logic via Hooks, XRPL offers a compelling alternative to bloated, gas-heavy ecosystems. As the market matures and users demand more predictable, secure, and scalable platforms, this balanced approach could propel XRP past the [gpt_article topic=Why XRPL Chose a Lightweight Smart Contract Model directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Why XRPL Chose a Lightweight Smart Contract Model and The reasoning behind using Hooks instead of full Turing-complete smart contracts. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.

💡 Article Requirements:

✅ Use

for main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use resource efficiency, security risks, on-ledger execution, streamlined automation, transaction cost and The reasoning behind using Hooks instead of full Turing-complete smart contracts. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level and toward broader mainstream integration.

Addressing scalability concerns

Scalability isn’t just a buzzword—it’s the lifeblood of any blockchain hoping to thrive in real-world, high-volume environments. For the XRP Ledger, scalability isn’t an afterthought; it’s a foundational principle. The decision to implement a lightweight smart contract model using Hooks instead of embracing full Turing-complete functionality was driven largely by the need to scale efficiently without compromising the network’s blistering speed or rock-bottom transaction fees.

Let’s face it: full-featured smart contract platforms, while powerful, often come with baggage. Think bloated state sizes, skyrocketing gas fees, and endless congestion during periods of high demand. Ethereum’s struggles during NFT booms or DeFi frenzies are prime examples. XRPL’s creators understood early on that if the goal was to support enterprise-grade applications and global finance use cases, the network had to remain lean and lightning-fast—even as adoption scales exponentially.

Hooks offer a clever middle ground. They enable developers to embed custom logic directly into accounts without introducing the complexity and overhead of a full virtual machine. This means the ledger can support tens of thousands of transactions per second, even as more users interact with smart logic. For investors, this translates into a blockchain that doesn’t buckle under pressure—ideal for high-frequency trading, cross-border payments, and real-time settlement systems.

Here’s why XRPL’s approach to scalability stands out in a crowded crypto landscape:

- Predictable Performance: Unlike blockchains that slow down with increased smart contract complexity, XRPL maintains consistent transaction speeds around 3–5 seconds. This ensures that even at scale, the network remains responsive and reliable.

- Low Resource Overhead: By avoiding the heavy computational load of Turing-complete contracts, XRPL minimizes memory and CPU usage across the network. Nodes can operate more efficiently, which incentivizes decentralization and lowers operational costs for validators.

- Linear Scalability: The architecture allows for the network to scale linearly with demand. As more transactions are processed, the lightweight Hooks model ensures that throughput remains stable without introducing bottlenecks or requiring major protocol changes.

- Network Integrity: Fewer moving parts mean fewer attack vectors. By limiting the scope of what smart contracts can do, XRPL reduces the risk of exploits that could cripple the network or compromise user funds—an essential consideration for enterprise partners and financial institutions.

It’s also worth noting that scalability isn’t just a technical metric—it has real implications for XRP’s position in the market. As the network scales without degradation, XRP becomes increasingly attractive to institutional players looking for a blockchain that can handle real-world workloads. Whether it’s processing thousands of microtransactions in emerging markets or settling multi-million-dollar trades between financial institutions, XRPL’s architecture ensures that it can scale gracefully, without the drama.

In investment terms, this robust scalability model gives XRP a long-term competitive edge. As regulatory clarity emerges and tokenized assets gain traction, networks that can handle high throughput with low latency will dominate. XRPL’s decision to sidestep Turing-complete complexity in favor of scalable, lightweight logic positions it as a frontrunner in the race for blockchain-based financial infrastructure. If adoption continues to rise, we could see XRP push past the [gpt_article topic=Why XRPL Chose a Lightweight Smart Contract Model directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Why XRPL Chose a Lightweight Smart Contract Model and The reasoning behind using Hooks instead of full Turing-complete smart contracts. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use resource efficiency, security risks, on-ledger execution, streamlined automation, transaction cost and The reasoning behind using Hooks instead of full Turing-complete smart contracts. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level and establish new support zones aligned with broader institutional interest.

Ultimately, XRPL’s choice to prioritize scalability through simplicity isn’t just smart—it’s strategic. It reflects a deep understanding of what the blockchain ecosystem needs to mature: fast, efficient, and secure platforms that can scale with demand. And in that arena, XRPL—with its Hooks-based smart contract model—is playing chess while others are still figuring out checkers.

Enhancing security through simplicity

When it comes to blockchain, complexity is often the enemy of security. Every additional line of code, every new function, and every layer of abstraction increases the potential for vulnerabilities. The XRP Ledger (XRPL) takes a radically different approach by embracing simplicity as a core security principle. Instead of implementing full Turing-complete smart contracts—which, while powerful, are notoriously difficult to audit and secure—XRPL introduces Hooks, a streamlined, lightweight mechanism for embedding logic directly into transactions.

Hooks are designed to be small, deterministic, and purpose-built. By limiting what they can do and how they can interact with the ledger, XRPL drastically reduces the attack surface typically associated with smart contract platforms. There are no infinite loops, no complex recursive calls, and no room for gas-related exploits. In short, the XRPL team has said “no” to the smart contract sprawl that has plagued other ecosystems, opting instead for a leaner, more predictable model that’s tailor-made for secure on-ledger execution.

This simplicity isn’t a limitation—it’s a feature. For investors and developers alike, predictable behavior is a cornerstone of trust. The last thing any institutional player wants is to wake up to a headline about a 0 million exploit due to a smart contract bug. XRPL’s Hooks minimize this risk by enforcing strict execution limits and validation rules, ensuring that even user-defined logic remains within safe, auditable bounds.

- Deterministic Execution: Every Hook must behave predictably and consistently across all nodes. This eliminates the race conditions and fork risks that can arise from non-deterministic smart contract behavior on other platforms.

- No Gas, No Exploits: Traditional smart contracts often rely on gas to limit execution. But gas manipulation can lead to denial-of-service attacks or failed transactions. XRPL’s model avoids gas entirely, relying instead on execution constraints that are enforced at the protocol level.

- Reduced Attack Surface: By offering only the necessary functionality for common use cases—like payment triggers, multi-signature enforcement, or transaction filtering—Hooks leave little room for malicious actors to exploit.

- On-Ledger Validation: Hooks are executed directly on the ledger and validated by consensus. There’s no need for off-chain computation or third-party oracles, which are frequent sources of hacks and inconsistencies in other ecosystems.

From a market perspective, this security-first approach is a major selling point. As regulatory frameworks tighten and institutional investors demand greater assurances, networks that can offer both programmability and provable safety will stand out. XRPL’s architecture aligns perfectly with this shift, offering a platform where developers can build confidently and investors can allocate capital without fear of catastrophic smart contract failures.

Consider the broader implications for XRP’s valuation. A secure and reliable network lowers systemic risk, making XRP more attractive as a long-term asset. It also increases its utility in high-stakes environments, such as international remittances, tokenized real estate, or central bank digital currencies (CBDCs). These use cases require not just speed and scalability, but bulletproof security—exactly what XRPL’s Hooks deliver.

Moreover, by avoiding the overhead of generalized smart contracts, XRPL keeps its transaction fees among the lowest in the industry—often just fractions of a cent. This cost-efficiency, combined with heightened security, makes the network an ideal candidate for everything from microtransactions in emerging markets to enterprise-grade financial infrastructure. As adoption grows and developers build more applications using Hooks, the network’s security model will continue to be a key differentiator.

In a world where one misconfigured contract can lead to millions in losses, XRPL’s decision to keep things simple isn’t just prudent—it’s visionary. It’s a reminder that sometimes, less really is more. And for XRP holders, that translates into a more stable, secure, and investable ecosystem—one that could help propel the asset beyond the [gpt_article topic=Why XRPL Chose a Lightweight Smart Contract Model directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Why XRPL Chose a Lightweight Smart Contract Model and The reasoning behind using Hooks instead of full Turing-complete smart contracts. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use resource efficiency, security risks, on-ledger execution, streamlined automation, transaction cost and The reasoning behind using Hooks instead of full Turing-complete smart contracts. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level as confidence in its infrastructure grows.

Supporting real-world use cases

At the heart of XRPL’s lightweight smart contract model lies a simple yet powerful motivation: real-world utility. While many blockchain platforms chase theoretical maximums with Turing-complete smart contracts, the XRP Ledger takes a grounded, pragmatic approach. Instead of offering infinite possibilities with infinite complexity, XRPL focuses on delivering concrete, scalable solutions for real-world problems—especially in areas like payments, compliance, tokenization, and enterprise automation.

This is where Hooks shine. Hooks are not designed to reinvent the wheel or simulate decentralized operating systems. Instead, they provide developers and businesses with the tools they actually need—compact, efficient logic that operates directly on the ledger, without the overhead and unpredictability of traditional smart contracts. The result? A blockchain that’s not just fast and secure, but useful in everyday financial operations.

- Payments and Micropayments: With Hooks, developers can implement logic like “reject payments below a certain threshold” or “split incoming payments automatically between multiple accounts.” This is particularly valuable for content creators, gaming platforms, or pay-per-use API services where micropayments are essential. And thanks to XRPL’s ultra-low fees—often a fraction of a cent—these payments remain economically viable.

- Compliance and Regulation: One of the most compelling use cases for on-ledger logic is regulatory compliance. Hooks can enforce KYC/AML rules, restrict fund flows based on jurisdiction, or flag suspicious transactions—all without relying on off-chain systems. This is a game-changer for financial institutions and enterprises operating in tightly regulated environments.

- Escrow and Conditional Transfers: Hooks enable sophisticated escrow mechanisms, such as releasing funds only when certain criteria are met. This is ideal for real estate deals, freelance contracts, or even peer-to-peer lending platforms. The logic executes directly on the XRPL, eliminating the need for intermediaries or third-party dispute resolution.

- Tokenization and NFTs: While XRPL is not primarily an NFT platform, its support for native tokens and Hooks allows for basic NFT functionality and token management. For example, Hooks can enforce royalty payments, cap token supply, or automate transfer conditions. This opens the door for creators and businesses to explore tokenized assets without migrating to congested, high-fee ecosystems.

From an investment perspective, this focus on real-world use cases makes XRP more than just a speculative asset. It becomes a utility token with genuine demand, driven by tangible applications. As more developers build on XRPL and more enterprises integrate its technology, the utility-driven demand could serve as a strong catalyst for price appreciation—potentially pushing XRP past the [gpt_article topic=Why XRPL Chose a Lightweight Smart Contract Model directives=”Generate a long-form, well-structured, SEO-optimized article on the topic Why XRPL Chose a Lightweight Smart Contract Model and The reasoning behind using Hooks instead of full Turing-complete smart contracts. for embedding into a WordPress post.

The content must be engaging, insightful, and easy to read, targeting crypto investors and XRP enthusiasts.💡 Article Requirements:

✅ Usefor main sections,

for content, and

- ,

- for key points.

✅ Provide clear explanations but maintain a conversational, witty tone.

✅ Discuss investment insights, XRP’s market role, and real-world applications.

✅ Use resource efficiency, security risks, on-ledger execution, streamlined automation, transaction cost and The reasoning behind using Hooks instead of full Turing-complete smart contracts. to enrich the content.

✅ When referencing decimal values (e.g., Fibonacci levels or price points), always format them as complete phrases like ‘the $0.75 resistance level’ or ‘61.8% Fibonacci retracement’ to prevent shortcode or template errors.

✅ Avoid generic fluff and ensure technical accuracy.

✅ Maintain a forward-thinking and optimistic tone.The article should be highly informative while keeping the reader engaged with strategic analysis and market predictions.” max_tokens=”10000″ temperature=”0.6″].75 resistance level and into new territory as adoption scales.

Moreover, the Hooks model aligns with the broader trend of modular blockchain development. Rather than forcing developers to navigate the complexity of a general-purpose virtual machine, XRPL offers a streamlined toolkit tailored to high-impact, low-risk automation. This encourages faster development cycles, easier debugging, and a lower barrier to entry for businesses new to blockchain technology.

Consider the implications for industries like cross-border remittances, where speed, cost, and compliance are non-negotiable. XRPL’s architecture allows a remittance provider to embed compliance checks directly into the payment flow via Hooks—no need for third-party middleware or complex off-chain integrations. This not only reduces friction but also ensures transparency and trust, which are critical in financial ecosystems.

And let’s not forget about central bank digital currencies (CBDCs) and stablecoins. As governments and institutions explore digital asset issuance, they require platforms that are secure, scalable, and regulation-ready. XRPL’s lightweight smart contract model offers just enough programmability to support these initiatives—without opening the door to the vulnerabilities and inefficiencies that plague more complex systems.

Ultimately, XRPL’s choice to use Hooks instead of full smart contracts isn’t a limitation—it’s a strategic pivot toward purpose-built utility. This is why XRP continues to gain traction in enterprise corridors, why it remains a favorite among payment providers, and why investors should keep a close eye on its evolving ecosystem. As real-world adoption accelerates, the demand for predictable, efficient, and secure blockchain logic will only grow—and XRPL is already ahead of the curve.