Is XRP secretly a commodity dressed up as a security, just waiting for its grand reveal? Imagine if the crypto world were a high-stakes poker game, with XRP holding a wildcard that could change everything. This isn’t just idle speculation; it’s a growing conversation among crypto enthusiasts, investors, and legal experts alike. The question of whether XRP could be reclassified as a commodity instead of a security has huge implications for its future, and for the broader crypto market. But what’s fueling this debate, and what could it mean for your digital wallet?

Enter the Commodity Futures Trading Commission (CFTC), the financial world’s guardian of all things commodity-related. Could XRP’s future be tied to this regulatory body instead of the SEC, which has long kept a watchful eye on its every move? The CFTC oversees everything from agricultural products to metals, and yes, even certain cryptocurrencies. So, what makes XRP a potential candidate for this shift? Is it the way it facilitates cross-border payments with unparalleled speed? Or is it the way it’s integrated into the very fabric of blockchain technology and finance?

Let’s break it down. At its core, XRP is designed to be a bridge currency, providing liquidity for cross-border transactions with lightning speed. It’s a digital asset that’s been making waves in the financial sector, and not just for its price volatility. With its unique consensus algorithm, XRP stands out in a sea of cryptocurrencies, like a high-performance sports car at a go-kart race. But does this make it a commodity, a utility token, or something else entirely?

Here’s the kicker: classifying XRP as a commodity could potentially sidestep some of the legal challenges it currently faces as a security. It’s like discovering a secret passage in a labyrinthine legal maze. The implications for XRP investors are profound. A commodity classification might mean less regulatory red tape and more room for growth and innovation. But, as always, the devil is in the details. How would this shift impact XRP’s trading dynamics and its role in the broader financial ecosystem?

One could argue that XRP’s intrinsic value, determined by its utility in facilitating seamless transactions, aligns more closely with commodities than traditional securities. But, let’s not get ahead of ourselves. This isn’t just a legal debate; it’s a philosophical one. What truly defines a commodity or a security in the digital age? Is it the use case, the market behavior, or something else entirely? Perhaps it’s time to redefine these terms altogether.

In the world of crypto, where change is the only constant, XRP’s potential reclassification could herald a new chapter. For investors and traders, this is not merely a speculative endeavor; it’s a potential game-changer. Could this move pave the way for other cryptocurrencies to follow suit, challenging the status quo and reshaping the regulatory landscape? The stakes are high, and the potential rewards even higher.

At XRP Authority, we’re more than just bystanders in this unfolding narrative. We’re your trusted guide through the intricacies of XRP and the crypto market. With insights that blend technical expertise and market-savvy wit, we’re here to help you navigate these turbulent waters. Whether you’re a seasoned investor or a crypto curious newcomer, our mission is to provide you with the knowledge and confidence you need to make informed decisions.

So, what’s the next move on XRP’s chessboard? Stay tuned to XRP Authority, your go-to source for cutting-edge insights and analysis. As the story of XRP and its potential reclassification unfolds, count on us to keep you in the loop with all the juicy details, insightful commentary, and yes, a dash of humor. Because in the wild world of crypto, a little levity goes a long way.

Understanding Could XRP Be Reclassified as a Commodity Instead of a Security? and Its Impact on XRP

Legal background of XRP’s classification

To understand whether XRP could be reclassified as a commodity, it’s crucial to unpack its legal journey thus far. XRP, the native digital asset of the XRP Ledger, has been at the center of a high-profile legal battle that has brought its regulatory status into question—specifically, whether it should be considered a security under U.S. law. This classification has significant implications for how XRP is regulated, traded, and perceived by investors.

The debate over XRP’s status intensified in December 2020 when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, the company behind XRP. The SEC alleged that Ripple conducted an unregistered securities offering by selling XRP tokens to investors. According to the SEC, XRP met the criteria of the Howey Test, a legal benchmark derived from a 1946 Supreme Court case used to determine whether a transaction qualifies as an “investment contract,” and thus a security.

The Howey Test evaluates whether:

- There is an investment of money

- In a common enterprise

- With an expectation of profits

- Derived from the efforts of others

The SEC argued that XRP purchasers expected profits based on Ripple’s marketing and efforts to increase the token’s value. Ripple, on the other hand, maintained that XRP is not a security but rather a digital asset with utility—used for cross-border payments and liquidity provisioning within the XRP Ledger ecosystem. Moreover, Ripple contended that XRP had already been traded for years before the lawsuit, with the SEC previously offering no clear guidance on its status.

In July 2023, a partial summary judgment by Judge Analisa Torres in the Southern District of New York added nuance to the debate. The court ruled that XRP itself is not inherently a security. However, it specified that Ripple’s institutional sales of XRP did constitute securities offerings, while programmatic sales and other distributions (like those to developers and employees) did not. This ruling was a mixed bag: it neither fully exonerated Ripple nor did it classify XRP definitively as a security across the board.

What makes this case particularly compelling is the broader regulatory ambiguity surrounding digital assets in the U.S. The SEC and the Commodity Futures Trading Commission (CFTC) have been engaged in a quiet turf war over who should regulate which assets. While the SEC has leaned into classifying a wide range of crypto tokens as securities, the CFTC has argued that many digital assets—especially those with decentralized governance and utility—should fall under its purview as commodities.

In fact, the CFTC has previously labeled Bitcoin and Ethereum as commodities, setting a precedent for other cryptocurrencies. Given XRP’s decentralized nature and its use case in facilitating liquidity and real-time settlement for cross-border transactions, proponents argue that XRP aligns more closely with the characteristics of a commodity than a security. This opens the door to potential reclassification under the CFTC’s regulatory framework, which emphasizes market integrity, trading oversight, and investor protection without the stringent disclosure requirements imposed by the SEC.

If XRP were to be reclassified as a commodity, it would be subject to a different set of regulations—primarily focused on derivative trading and market manipulation, rather than corporate governance and investor disclosures. This shift could significantly impact how XRP is traded on exchanges, its appeal to institutional investors, and the broader adoption of the XRP Ledger in real-world applications like banking, remittances, and decentralized finance (DeFi).

In this evolving legal landscape, XRP’s classification remains a pivotal issue—not just for Ripple, but for the entire crypto industry. The resolution of this debate could set a precedent for how other digital assets are regulated and could influence the strategic direction of crypto projects navigating the complex U.S. regulatory environment.

Key arguments for XRP as a commodity

Now that we’ve unpacked the legal maze surrounding XRP, let’s dive into the core arguments for why XRP might be more appropriately classified as a commodity rather than a security. Spoiler alert: it’s not just semantics—it’s about how digital assets function, how they’re used, and who’s really pulling the strings. For crypto investors, this distinction could redefine how XRP is traded, taxed, and regulated. So, let’s break down the case for XRP falling under the Commodity Futures Trading Commission (CFTC)’s jurisdiction.

First, at the heart of the commodity argument is XRP’s utility and decentralized nature. Unlike traditional securities, which derive value from the performance of a company or the efforts of its management team, XRP operates as a medium of exchange and a bridge currency. It’s designed to facilitate fast, low-cost, cross-border transactions—think SWIFT on steroids. This functional role aligns more with how commodities like oil or gold are used in the real world: as assets with intrinsic utility, not merely investment vehicles.

Let’s consider a few key traits that bolster XRP’s commodity classification:

- Decentralization of the XRP Ledger: The XRP Ledger is open-source and maintained by a global community of validators. Ripple, while a major contributor, does not control the network. This decentralization mirrors the characteristics of other CFTC-recognized commodities like Bitcoin and Ethereum, which are similarly not tied to a single entity.

- Use case beyond investment: XRP’s primary function is to provide liquidity for cross-border payments. Financial institutions and payment providers aren’t buying XRP to “get rich”—they’re using it to settle transactions in seconds, with minimal fees. This real-world utility distances XRP from the speculative nature of securities.

- No ownership claim: Holding XRP doesn’t give investors equity in Ripple Labs or any rights to dividends, voting, or governance. It’s a digital asset you own outright, much like holding a barrel of oil or an ounce of gold. This lack of ownership interest is a key factor distinguishing commodities from securities.

- Secondary market behavior: XRP trades on numerous global exchanges, often independently of Ripple’s actions or announcements. Its price movements are driven by broader market forces, not just company performance—another hallmark of commodity-like behavior.

From a regulatory perspective, the CFTC’s framework is arguably a better fit for assets like XRP. The agency focuses on ensuring market integrity and preventing fraud and manipulation in the trading of commodities and derivatives. This approach is less about scrutinizing the issuer’s disclosures and more about safeguarding transparent and fair trading practices. For investors, this could mean fewer bureaucratic hurdles and more predictable rules of engagement.

It’s also worth noting that the CFTC has been increasingly vocal about its desire to regulate a broader swath of the crypto market. In past statements, CFTC officials have acknowledged that many digital assets exhibit traits of commodities and should be overseen accordingly. In fact, the agency has already taken enforcement actions involving digital assets it considers to be commodities, reinforcing its claim to jurisdiction.

Here’s where things get especially interesting for XRP enthusiasts: if XRP were officially reclassified as a commodity, it could open the doors to more robust futures and derivatives trading under CFTC oversight. This would likely boost liquidity, attract institutional players, and enhance price discovery—all positive signals for long-term investors. Imagine XRP futures contracts trading alongside Bitcoin and Ethereum on major platforms like the CME. That’s not just regulatory clarity—that’s mainstream financial integration.

Additionally, a commodity classification could reduce legal uncertainty for exchanges and custodians, who often hesitate to list or support assets that might be deemed securities. With XRP comfortably under the CFTC’s wing, more platforms might list it, increasing accessibility and driving broader adoption. For retail investors, this translates to more trading options, tighter spreads, and better price execution.

Of course, none of this is just wishful thinking. The precedent is there. Bitcoin and Ethereum have already been acknowledged as commodities by the CFTC, primarily due to their decentralized governance and non-reliance on a central issuer. XRP shares many of these characteristics, and the partial legal victory Ripple scored in 2023 further supports the argument that the token itself is not a security in all contexts.

So, where does this leave XRP? Squarely in the crosshairs of regulatory evolution. The argument for classifying XRP as a commodity is gaining traction, not just among legal experts, but also within the wider crypto community and even some lawmakers. It’s a narrative that aligns with technological realities, market behaviors, and the need for a regulatory framework that fosters innovation without compromising investor protection.

In a nutshell, XRP isn’t just a digital token—it’s a tool for financial infrastructure. And tools, like commodities, serve practical purposes rather than speculative ones. That utility-driven perspective is at the core of the argument for why XRP may ultimately find its regulatory home with the CFTC.

Implications of reclassification for investors and markets

If XRP were to be officially reclassified as a commodity under the jurisdiction of the Commodity Futures Trading Commission (CFTC), the ripple effects—pun intended—would be felt across the broader financial landscape. For crypto investors, exchanges, institutional players, and even fintech innovators, this shift would mark a strategic turning point in how XRP is perceived, traded, and integrated into mainstream finance.

Let’s start with the immediate impact on investor confidence. One of the biggest hurdles XRP has faced is regulatory uncertainty. The SEC’s lawsuit, while partially resolved, left a lingering cloud over the asset. A definitive reclassification as a commodity would provide much-needed clarity and legal stability. This could embolden both retail and institutional investors, who have historically been wary of assets caught in regulatory limbo. With the CFTC’s lighter-touch oversight, investors could operate with clearer expectations and reduced risk of sudden enforcement actions.

From a market infrastructure standpoint, the reclassification could open the door to a broader range of financial products. Think beyond spot trading—futures, options, ETFs, and structured products based on XRP could become more viable. Under the CFTC’s regulatory framework, exchanges like the Chicago Mercantile Exchange (CME) could list XRP derivatives, just as they have with Bitcoin and Ethereum. This would not only deepen liquidity but also enhance price discovery, benefiting everyone from day traders to long-term holders.

Here’s how this could play out in practical terms:

- Increased institutional participation: With regulatory clarity and access to derivatives markets, hedge funds, asset managers, and even corporate treasuries might view XRP as a more attractive asset for portfolio diversification and hedging strategies.

- Expanded exchange listings: Some U.S.-based exchanges have delisted or limited XRP trading due to concerns over its security status. A CFTC designation could reverse this trend, leading to relistings and new listings on global platforms.

- Improved custody solutions: Institutional-grade custodians often require regulatory certainty before supporting an asset. A commodity classification could spur more custodial offerings and insurance coverage, bolstering investor protection.

But it’s not just about Wall Street. For the average XRP enthusiast or crypto startup, this reclassification could fuel innovation and adoption. Developers building on the XRP Ledger would no longer need to navigate the murky waters of securities compliance. That means faster time-to-market for new decentralized apps, payment solutions, and DeFi protocols using XRP as a liquidity layer. Cross-border payment corridors could be expanded without fear of regulatory backlash, making XRP a more dependable bridge currency for international remittances and B2B transactions.

Moreover, a CFTC-regulated XRP ecosystem would likely benefit from more transparent and robust trading practices. The CFTC emphasizes market surveillance, anti-manipulation rules, and fair access to trading venues. While it doesn’t impose the same disclosure requirements as the SEC, it still enforces strict standards to ensure market integrity. For XRP holders, this could mean fewer pump-and-dump schemes and more trust in price movements driven by actual market demand.

Let’s also talk about taxation and compliance. While the IRS hasn’t yet drawn a clear line between securities and commodities for crypto tax purposes, a CFTC classification could influence future guidance. Commodities are generally subject to different tax treatments than securities, especially when it comes to capital gains and derivatives trading. For savvy investors, this could present new optimization strategies during tax season.

However, it’s important to recognize that a shift to CFTC oversight won’t be a regulatory free-for-all. The CFTC still enforces rules around wash trading, insider trading, and fraud. But unlike the SEC’s focus on initial offerings and corporate disclosures, the CFTC’s approach is more aligned with how decentralized assets actually function in the wild. This regulatory fit could foster a healthier, more dynamic market for XRP without stifling innovation or overburdening ecosystem participants.

In essence, reclassification would transform XRP from a legal grey area into a fully-fledged, regulated commodity asset. That change would not only clear the fog of uncertainty but also unlock new avenues for growth, liquidity, and technological advancement. As the crypto industry matures, assets like XRP will need regulatory frameworks that reflect their real-world utility and market behavior—something the CFTC may be uniquely positioned to provide.

Regulatory perspectives and future outlook

As the legal dust begins to settle around XRP, the regulatory lens through which it is viewed becomes increasingly significant. The SEC and the CFTC, two powerhouse regulators in the U.S. financial ecosystem, continue to jostle for jurisdiction over digital assets. This turf war isn’t just bureaucratic posturing—it’s a fundamental debate over how to categorize and govern the rapidly evolving world of cryptocurrencies. For XRP, this battle could determine its future trajectory in the global financial system.

The SEC has traditionally taken a more conservative stance, asserting that many digital tokens, including XRP in certain contexts, meet the criteria of investment contracts under the Howey Test. This perspective subjects issuers and platforms to extensive disclosure requirements, compliance audits, and enforcement risks. But recent legal developments, including the partial summary judgment in favor of Ripple, have exposed the limitations of the SEC’s one-size-fits-all approach to crypto regulation.

Meanwhile, the CFTC has adopted a more functional and market-oriented view. It recognizes that not all digital assets are created equal, and some—like XRP—may better align with the characteristics of commodities. The CFTC’s regulatory framework emphasizes the fairness and transparency of trading markets, rather than the issuer’s intent or investor expectations. This approach could offer a more flexible and innovation-friendly environment for digital assets with practical use cases.

From a policy perspective, several lawmakers and industry leaders are advocating for clearer, more nuanced regulation. Bipartisan efforts in Congress, such as the Digital Commodity Exchange Act (DCEA) and the Responsible Financial Innovation Act, aim to delineate responsibilities between the SEC and the CFTC. These proposals often suggest that tokens with sufficient decentralization and utility—like XRP—should fall under the CFTC’s purview. If passed, such legislation could provide the regulatory clarity that the crypto industry has long demanded.

Looking ahead, the path toward XRP’s reclassification as a commodity may depend on several key developments:

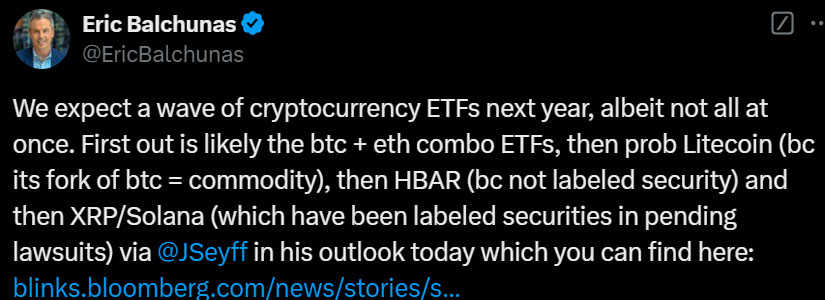

- Legislative action: Congress has the power to definitively assign regulatory authority. If upcoming bills favor the CFTC’s role in overseeing certain types of digital assets, XRP could be one of the primary beneficiaries.

- Judicial precedent: As more court cases involving digital assets unfold, legal interpretations will shape how regulators apply existing laws. The Ripple case already introduced a precedent that XRP is not inherently a security, setting the stage for further judicial clarification.

- Regulatory collaboration: Although the SEC and CFTC have historically clashed, there are signs of increasing cooperation. Joint regulatory frameworks or task forces could lead to a more harmonized approach, reducing friction and uncertainty for projects like XRP.

For investors and developers, this evolving regulatory landscape presents both risks and opportunities. On one hand, continued ambiguity could stall innovation and deter institutional capital. On the other, a shift toward CFTC oversight could unlock new growth channels, particularly in derivatives markets and enterprise adoption. XRP’s use case in cross-border payments, combined with its decentralized infrastructure, makes it a strong candidate for integration into regulated financial products and services.

Furthermore, global regulatory trends may also influence XRP’s classification in the U.S. Jurisdictions like the European Union, Singapore, and Japan have adopted more progressive frameworks that distinguish between utility tokens, payment tokens, and security tokens. These models could serve as blueprints for U.S. regulators seeking to modernize their approach. If the U.S. wants to maintain its leadership in financial innovation, it may need to follow suit—and XRP could be the test case that drives that evolution.

There’s also a growing recognition that digital assets are here to stay, and the regulatory infrastructure must adapt accordingly. The CFTC, with its focus on market integrity and trading oversight, is well-positioned to manage the unique challenges posed by assets like XRP. Unlike traditional securities, which are tied to corporate disclosures and shareholder rights, XRP functions more like a digital commodity—used in real-time settlement, liquidity provisioning, and interoperability between financial networks.

In the end, the future of XRP’s regulatory classification may hinge on a pragmatic understanding of its role in the digital economy. As policymakers, courts, and regulators continue to grapple with the crypto conundrum, one thing is clear: the status quo is unsustainable. Whether through legislative reform, judicial rulings, or regulatory consensus, the industry is moving toward a clearer framework—and XRP is poised to be at the forefront of that transformation.

For investors, this means staying informed, agile, and ready to capitalize on the shifts. XRP’s potential reclassification as a commodity isn’t just a legal footnote—it’s a signal of where the crypto market is heading. And for those who believe in the long-term utility and vision of the XRP Ledger, the future is looking increasingly bright, with regulatory clarity on the horizon and mainstream adoption within reach.